What Does A W-2 Form Tell You Everfi

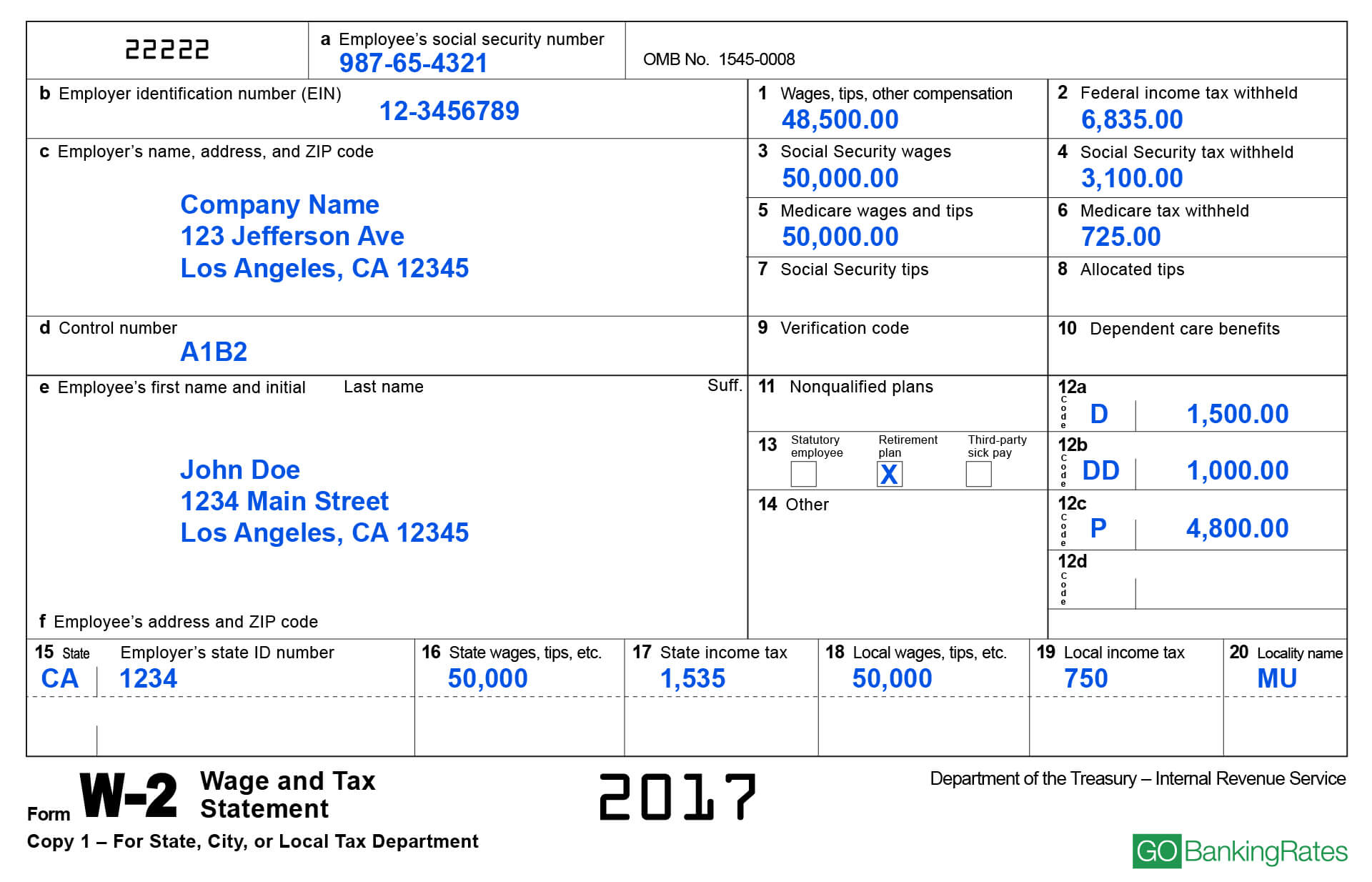

What Does A W-2 Form Tell You Everfi - How much taxes to withhold from. Which of the following statements is true about. Copy a goes to the social security administration copy 1 is for the city, state, or locality copy b is for filing. How much taxes you've paid in the last year based on how much you've earned. Web according to investopedia, a w2 form is defined as a “document an employer is required to send to each employee and the internal revenue service (irs). The document also details what you have paid in. How much taxes you've paid in the last year. Web how much you've earned and how much taxes you've paid in the last year. The w2 form reports an employee’s annual wages and. How much taxes you owe to the federal government.

How much taxes you owe to the federal government. How much taxes you've paid in the last year. Web how much you've earned and how much taxes you've paid in the last year. How often you will be paid. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. How much taxes you've paid in the last year based on how much you've earned. How often you will be paid. This form is given to you by your employer to send to the irs. Web purpose of the form. How much taxes to withhold from.

Which of the following statements is true about. This form is given to you by your employer to send to the irs. The w2 form reports an employee’s annual wages and. How often you will be paid. How much taxes you've paid in the last year based on how much you've earned. How often you will be paid. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. How much taxes to withhold from. This shows the income you earned for the previous year and the taxes withheld from those earnings. Web according to investopedia, a w2 form is defined as a “document an employer is required to send to each employee and the internal revenue service (irs).

What Does W2 Form Tell You Armando Friend's Template

Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. This shows the income you earned for the previous year and the taxes withheld from those earnings. Web how much you've earned and how much taxes you've paid in the last year. Web according.

Understanding Your Tax Forms The W2

Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. The w2 form reports an employee’s annual wages and. Web according to investopedia, a w2 form is defined as a “document an employer is required to send to each employee and the internal revenue.

W2 Form Form Resume Examples QBD3QJMOXn

Which of the following statements is true about. The w2 form reports an employee’s annual wages and. The document also details what you have paid in. This form is given to you by your employer to send to the irs. How often you will be paid.

How Do You Get Your W2 Form? It's The Easiest Thing You'll Do All Month

This form is given to you by your employer to send to the irs. Web purpose of the form. Which of the following statements is true about. How often you will be paid. How often you will be paid.

What Is a W2 Form? GOBankingRates

Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. Copy a goes to the social security administration copy 1 is for the city, state, or locality copy b is for filing. How much taxes you owe to the federal government. How much taxes.

Everfi

How much taxes you've paid in the last year based on how much you've earned. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. This form is given to you by your employer to send to the irs. Web according to investopedia, a.

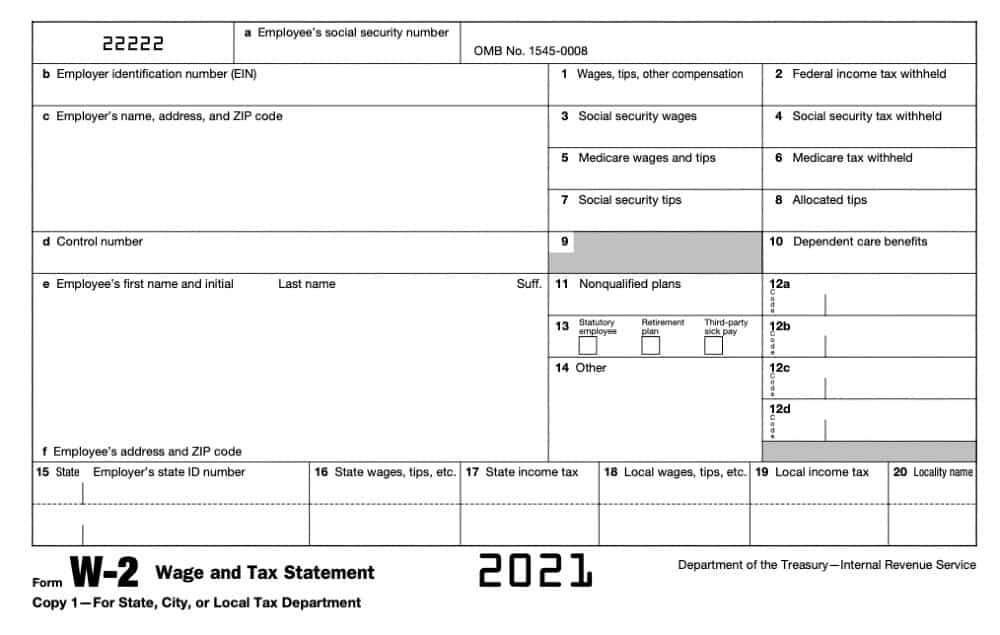

Printable W2 Form 2022 Printable Form, Templates and Letter

How much taxes you've paid in the last year based on how much you've earned. This shows the income you earned for the previous year and the taxes withheld from those earnings. The w2 form reports an employee’s annual wages and. Web how much you've earned and how much taxes you've paid in the last year. How much taxes you've.

EVERFI Venture Entrepreneurial Expedition Answers » Quizzma

How much taxes you've paid in the last year. Web purpose of the form. How much taxes you owe to the federal government. How much taxes you owe to the federal government. The w2 form reports an employee’s annual wages and.

What is an IRS Form W2 Federal W2 Form for 2022 Tax Year

How much taxes you've paid in the last year based on how much you've earned. How much taxes you owe to the federal government. Web purpose of the form. How much taxes to withhold from. This form is given to you by your employer to send to the irs.

How to Fill Out a W2 Form

Copy a goes to the social security administration copy 1 is for the city, state, or locality copy b is for filing. How much taxes you owe to the federal government. This shows the income you earned for the previous year and the taxes withheld from those earnings. How often you will be paid. The w2 form reports an employee’s.

Web According To Investopedia, A W2 Form Is Defined As A “Document An Employer Is Required To Send To Each Employee And The Internal Revenue Service (Irs).

How much taxes you've paid in the last year. The w2 form reports an employee’s annual wages and. How often you will be paid. The document also details what you have paid in.

How Much Taxes You Owe To The Federal Government.

How much taxes you've paid in the last year based on how much you've earned. Web how much you've earned and how much taxes you've paid in the last year. How much taxes to withhold from. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees.

This Form Is Given To You By Your Employer To Send To The Irs.

How much taxes you owe to the federal government. This shows the income you earned for the previous year and the taxes withheld from those earnings. Which of the following statements is true about. How often you will be paid.

Web Purpose Of The Form.

Copy a goes to the social security administration copy 1 is for the city, state, or locality copy b is for filing.