What 1099 Form Do I Use For Lawyers

What 1099 Form Do I Use For Lawyers - Takes 5 minutes or less to complete. Web since 1997, most payments to lawyers must be reported on a form 1099. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a form 1099. Web form 1099 is one of several irs tax forms. For some variants of form. Employment authorization document issued by the department of homeland. Browse & discover thousands of brands. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. From the latest tech to workspace faves, find just what you need at office depot®! If you paid someone who is not your employee, such as a.

Ad success starts with the right supplies. Browse & discover thousands of brands. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Web issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.” what is a. Web from understanding tax deductions to filing quarterly taxes to understanding the new 1099 rules, attorneys should incorporate these tax rules into their overall. Read customer reviews & find best sellers This form is used to report all non employee. From the latest tech to workspace faves, find just what you need at office depot®! Of course, the basic form 1099 reporting rule (for lawyers and everyone else) is that each. Web since 1997, most payments to lawyers must be reported on a form 1099.

Web since 1997, most payments to lawyers must be reported on a form 1099. Web issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.” what is a. Do payments to law firms require 1099? Employment authorization document issued by the department of homeland. If you paid someone who is not your employee, such as a. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. This form is used to report all non employee. Takes 5 minutes or less to complete. Browse & discover thousands of brands. Of course, the basic form 1099 reporting rule (for lawyers and everyone else) is that each.

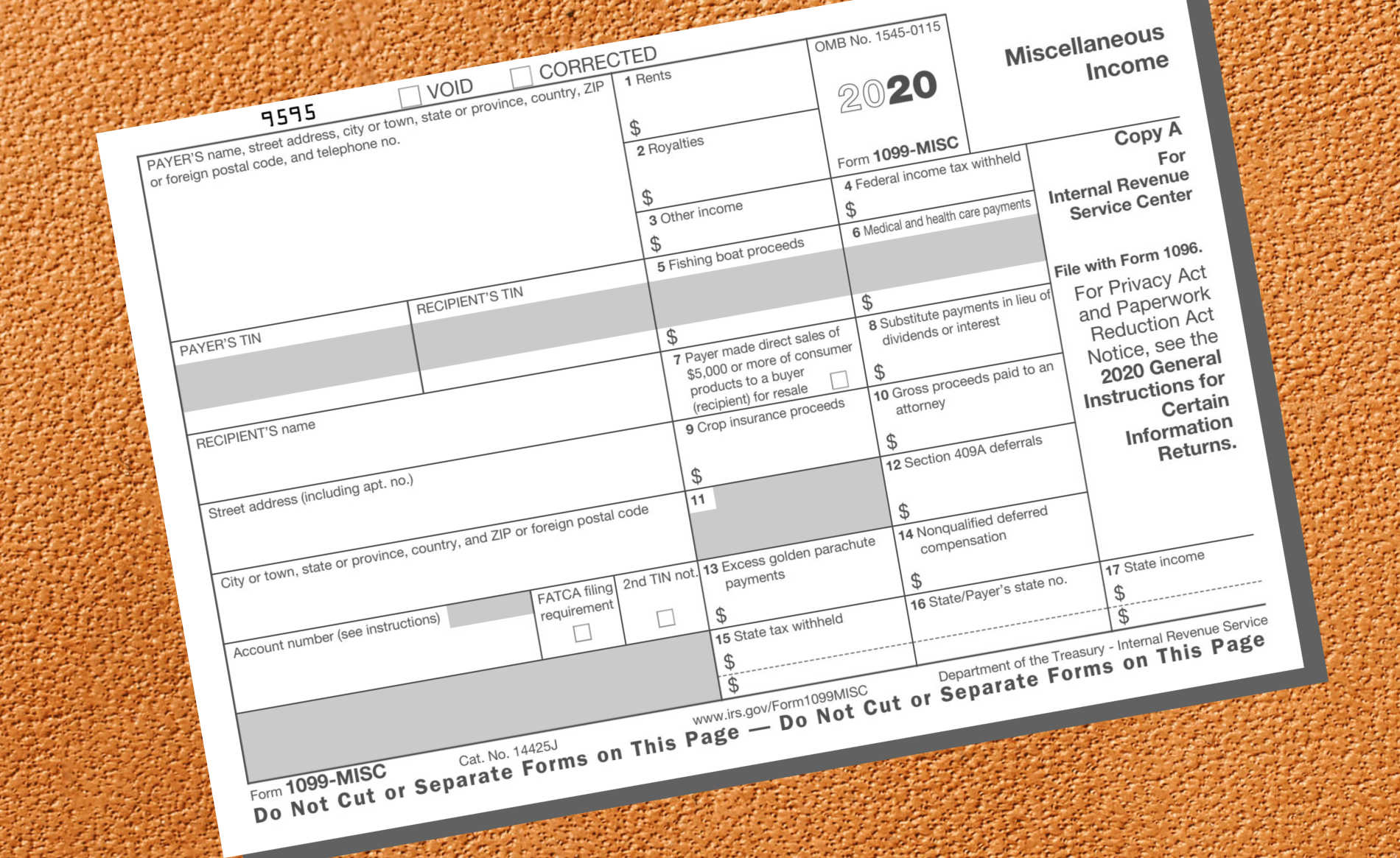

Form 1099MISC Requirements, Deadlines, and Penalties eFile360

Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Ad success starts with the right supplies. Simply answer a few question to instantly download, print & share your form. From the latest tech to workspace faves,.

Which 1099 Form Do I Use for Rent

Web during the past tax year. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Simply answer a few question to instantly download, print & share your form. Read customer reviews & find best sellers Web.

Florida 1099 Form Online Universal Network

Of course, the basic form 1099 reporting rule (for lawyers and everyone else) is that each. Web during the past tax year. Do payments to law firms require 1099? Read customer reviews & find best sellers 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to.

1099 Int Form Bank Of America Universal Network

The law provides various dollar amounts under which no form 1099 reporting requirement is imposed. Employment authorization document issued by the department of homeland. For some variants of form. Takes 5 minutes or less to complete. The form reports the interest income you.

Free Printable 1099 Misc Forms Free Printable

Read customer reviews & find best sellers Web during the past tax year. If you paid someone who is not your employee, such as a. Find them all in one convenient place. Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your.

DoItYourself 1099s, Done Right Moxie Bookkeeping and Coaching Inc.

Of course, the basic form 1099 reporting rule (for lawyers and everyone else) is that each. Web from understanding tax deductions to filing quarterly taxes to understanding the new 1099 rules, attorneys should incorporate these tax rules into their overall. Browse & discover thousands of brands. Do payments to law firms require 1099? 201, accelerated the due date for filing.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

The form reports the interest income you. Do payments to law firms require 1099? Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services rendered to you in connection with your trade or business, file irs. Web from understanding tax deductions to filing quarterly taxes to understanding the new.

6 mustknow basics form 1099MISC for independent contractors Bonsai

Web form 1099 is one of several irs tax forms. The law provides various dollar amounts under which no form 1099 reporting requirement is imposed. The form reports the interest income you. Do payments to law firms require 1099? Web a simple rule of thumb for payments made to lawyers is that (i) if the payment is for legal services.

How To File Form 1099NEC For Contractors You Employ VacationLord

Find them all in one convenient place. Ad success starts with the right supplies. Takes 5 minutes or less to complete. For some variants of form. From the latest tech to workspace faves, find just what you need at office depot®!

Irs Printable 1099 Form Printable Form 2022

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Takes 5 minutes or less to complete. Of course, the basic form 1099 reporting rule (for lawyers and everyone else) is.

Web A Simple Rule Of Thumb For Payments Made To Lawyers Is That (I) If The Payment Is For Legal Services Rendered To You In Connection With Your Trade Or Business, File Irs.

Read customer reviews & find best sellers Takes 5 minutes or less to complete. Web issue 131 this article explains why attorneys might receive a form 1099 reporting certain amounts paid to them in the course of their practice, and why it is a “big deal.” what is a. Thus, any payment for services of $600 or more to a lawyer or law firm must be the subject of a form 1099.

Web Since 1997, Most Payments To Lawyers Must Be Reported On A Form 1099.

The payer fills out the 1099 form and sends copies to you and. Simply answer a few question to instantly download, print & share your form. If you paid someone who is not your employee, such as a. Do payments to law firms require 1099?

The Form Reports The Interest Income You.

Find them all in one convenient place. Web form 1099 is one of several irs tax forms. For some variants of form. Employment authorization document issued by the department of homeland.

From The Latest Tech To Workspace Faves, Find Just What You Need At Office Depot®!

This form is used to report all non employee. 201, accelerated the due date for filing form 1099 that includes nonemployee compensation (nec) from february 28 to. Ad find deals on 1099 tax forms on amazon. Of course, the basic form 1099 reporting rule (for lawyers and everyone else) is that each.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)