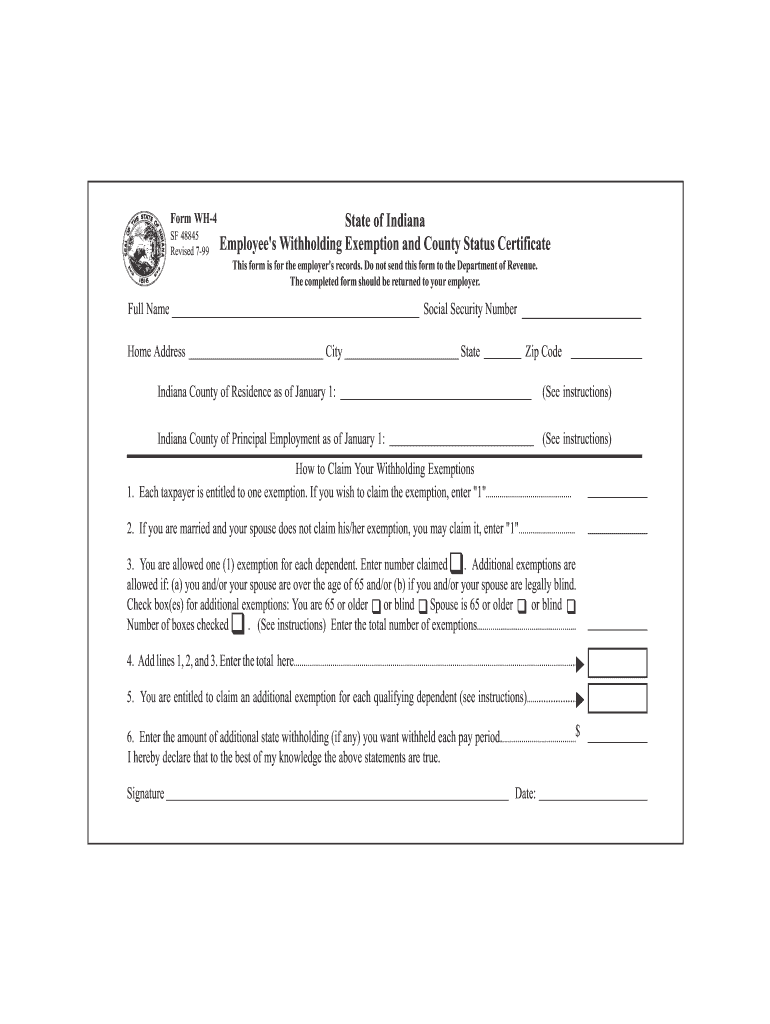

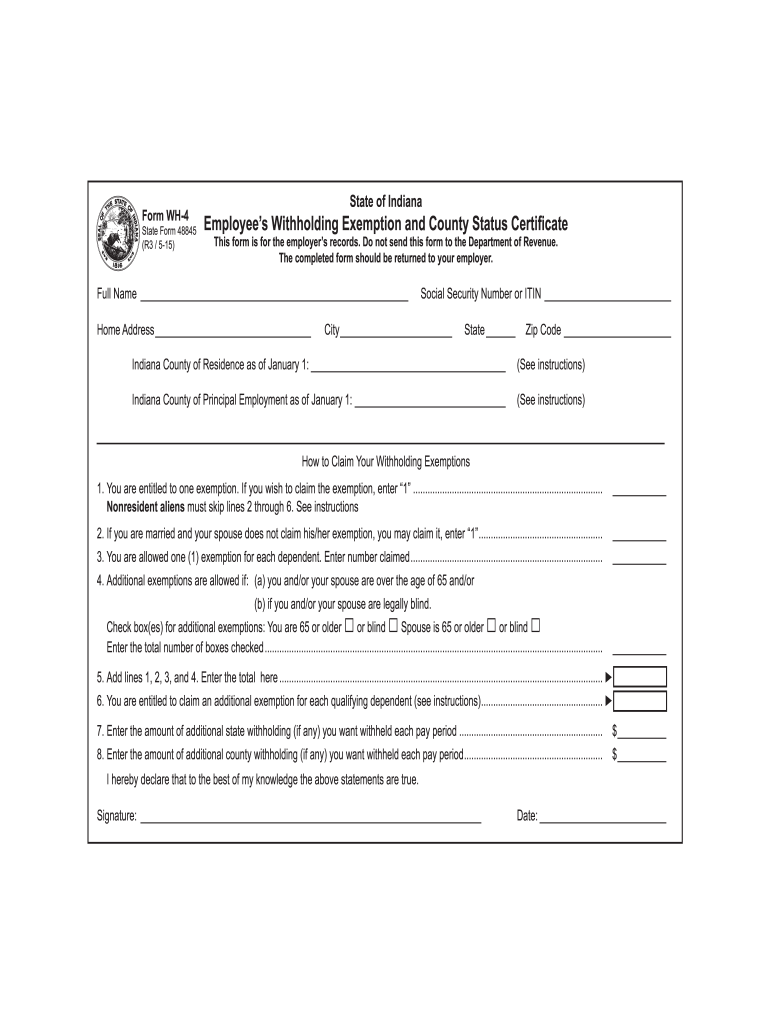

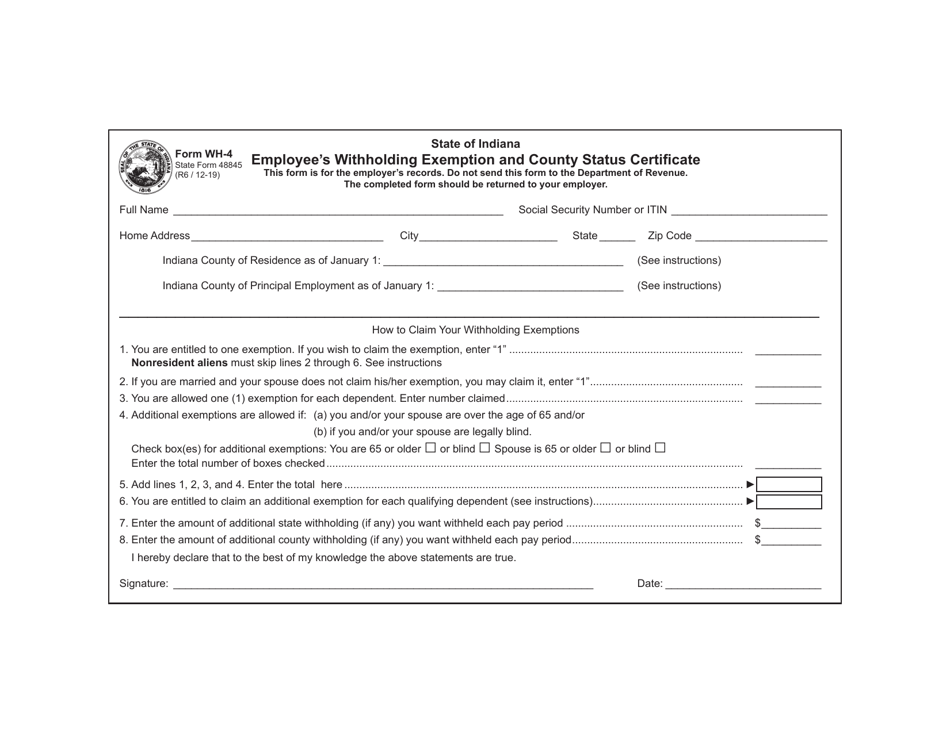

Wh-4 Form Indiana

Wh-4 Form Indiana - Registration for withholding tax is necessary if the business has: Underpayment of indiana withholding filing register and file this tax online via intime. If you have employees working at your business, you’ll need to collect withholding taxes. Generally, employers are required to withhold both state and county taxes from employees’ wages. This forms part of indiana’s state. 48845 employee's withholding exemption & county status certificate fill. Annual withholding tax form register and file this tax online via intime. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Print or type your full name, social security number or itin and home address. Web employees withholding exemption & county status certificate:

Do not send this form to the department of revenue. Do not send this form to the department of revenue. Print or type your full name, social security number or itin and home address. Generally, employers are required to withhold both state and county taxes from employees’ wages. Enter your indiana county of residence and county of principal employment as of january If you wish to claim the exemption, enter “1” if i don't claim one exemption this year do i lose the exemption or can i claim that next year. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Web employees withholding exemption & county status certificate: If you have employees working at your business, you’ll need to collect withholding taxes. You are entitled to one exemption.

Registration for withholding tax is necessary if the business has: 48845 employee's withholding exemption & county status certificate fill. Enter your indiana county of residence and county of principal employment as of january If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Do not send this form to the department of revenue. These are state and county taxes that are withheld from your employees’ wages. If you wish to claim the exemption, enter “1” if i don't claim one exemption this year do i lose the exemption or can i claim that next year. Do not send this form to the department of revenue. You are entitled to one exemption. If you have employees working at your business, you’ll need to collect withholding taxes.

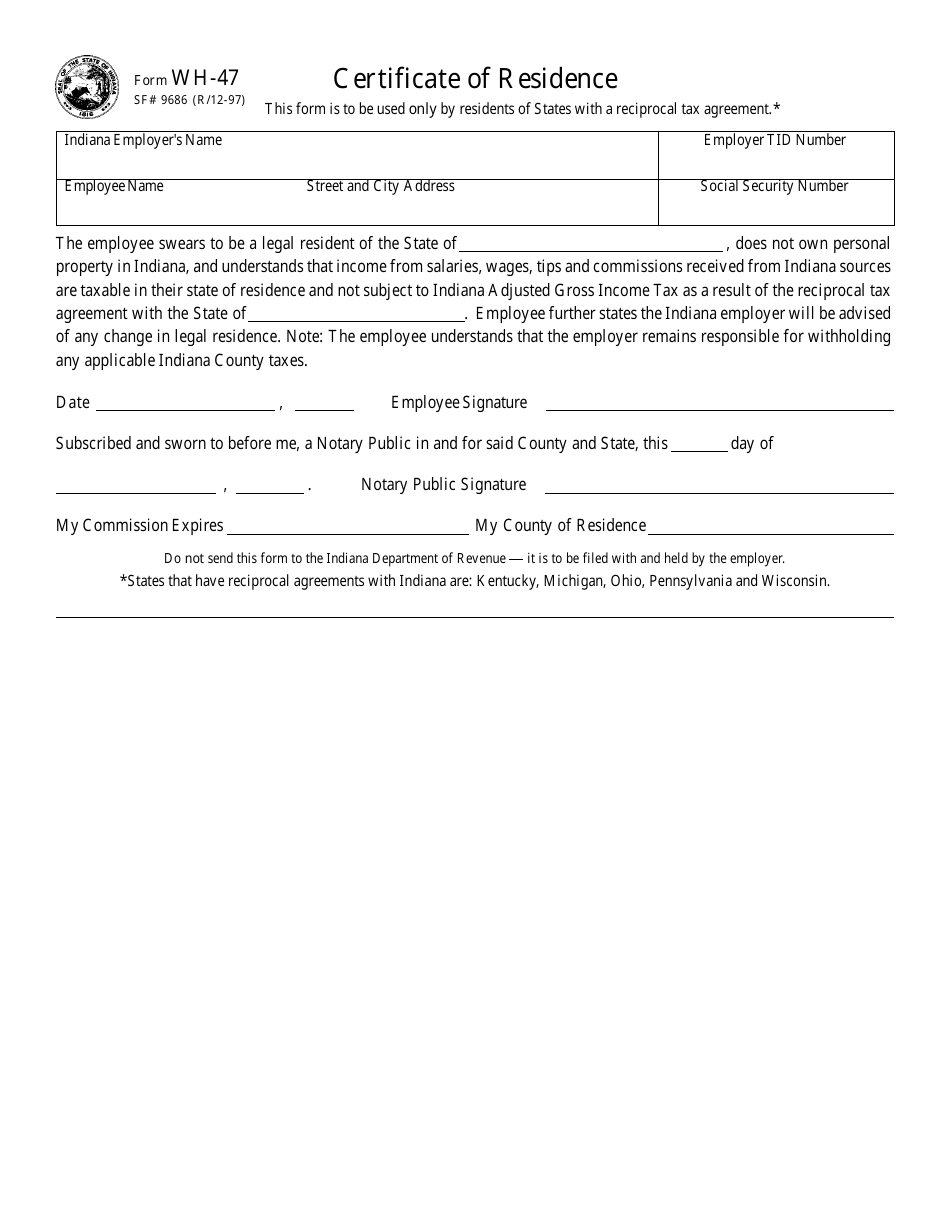

Form SF9686 (WH47) Download Printable PDF or Fill Online Certificate

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If you wish to claim the exemption, enter “1” if i don't claim one exemption this year do i lose the exemption or can i claim that next year. Print or type your full name, social security number or.

Form WH4 Edit, Fill, Sign Online Handypdf

If too much is withheld, you will generally be due a refund. If you have employees working at your business, you’ll need to collect withholding taxes. This forms part of indiana’s state. Registration for withholding tax is necessary if the business has: Print or type your full name, social security number or itin and home address.

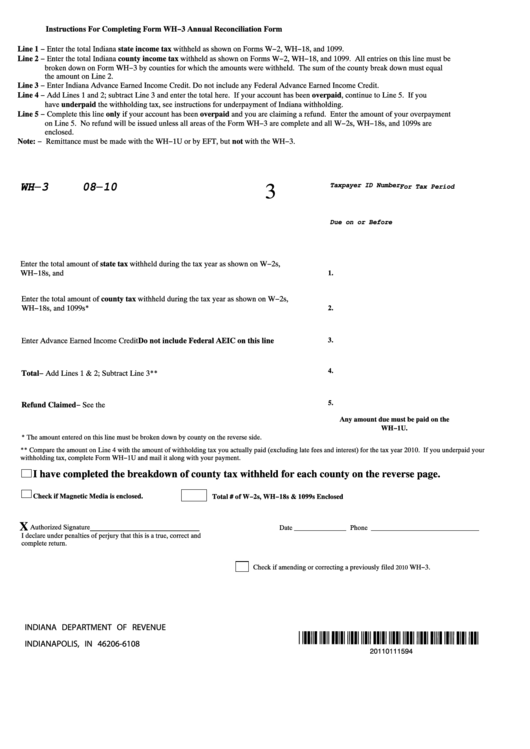

Indiana Withholding Tax Form Wh3

However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Registration for withholding tax is necessary if the business has: If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Enter your indiana county of residence and.

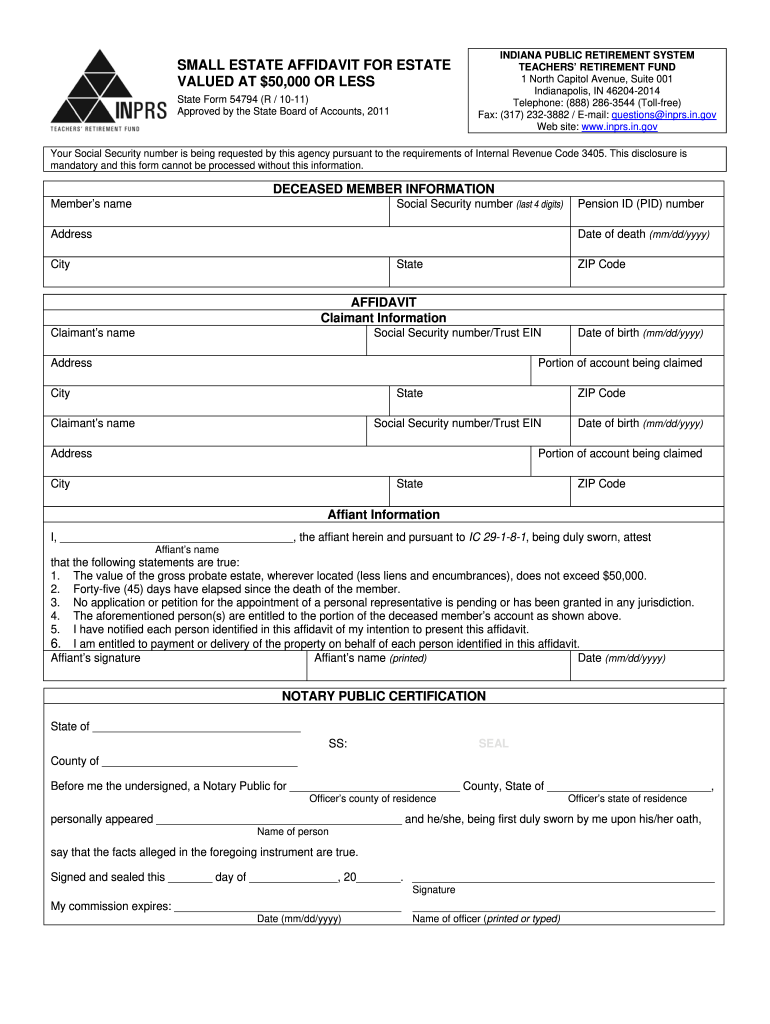

State Of Indiana Form 54794 Fill Online, Printable, Fillable, Blank

If too much is withheld, you will generally be due a refund. This forms part of indiana’s state. Underpayment of indiana withholding filing register and file this tax online via intime. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If you wish to claim the exemption, enter.

Indiana Wh 4 Form Fill Out and Sign Printable PDF Template signNow

Print or type your full name, social security number or itin and home address. Registration for withholding tax is necessary if the business has: If you have employees working at your business, you’ll need to collect withholding taxes. Web employees withholding exemption & county status certificate: However, they have to register to withhold tax in indiana but must have an.

Form wh 4 2019 indiana Fill Out and Sign Printable PDF Template SignNow

The completed form should be returned to your employer. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. The first question is 1. You are entitled to one exemption. Print or type your full name, social security number or itin and home address.

Free Vermont Vermont Child Labor Labor Law Poster 2021

You are entitled to one exemption. Web employees withholding exemption & county status certificate: If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If you have employees working at your business, you’ll need to collect withholding taxes. Underpayment of indiana withholding filing register and file this tax online.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Underpayment of indiana withholding filing register and file this tax online via intime. Do not send this form to the department of revenue. Print or type your full name, social security number or itin and home address. The completed form should be returned to your employer. If you wish to claim the exemption, enter “1” if i don't claim one.

Form WH4 Edit, Fill, Sign Online Handypdf

You are entitled to one exemption. Registration for withholding tax is necessary if the business has: The completed form should be returned to your employer. Print or type your full name, social security number or itin and home address. Annual withholding tax form register and file this tax online via intime.

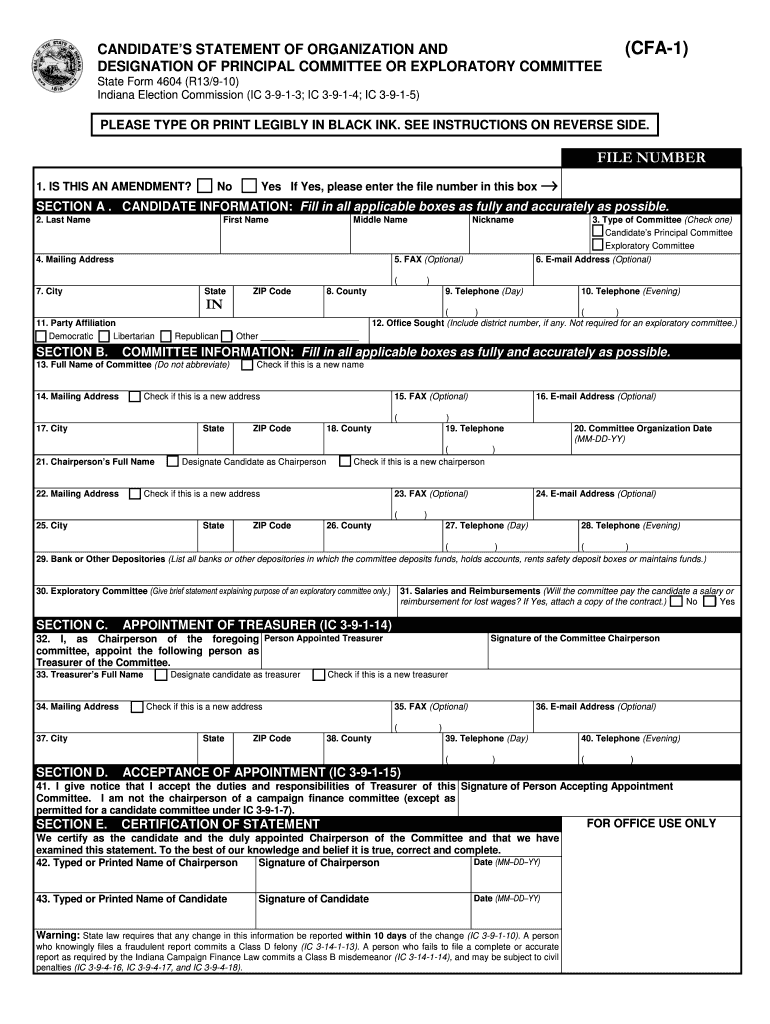

Indiana Cfa 1 Fill Online, Printable, Fillable, Blank pdfFiller

The first question is 1. Do not send this form to the department of revenue. Do not send this form to the department of revenue. If you have employees working at your business, you’ll need to collect withholding taxes. Print or type your full name, social security number or itin and home address.

If You Have Employees Working At Your Business, You’ll Need To Collect Withholding Taxes.

These are state and county taxes that are withheld from your employees’ wages. 48845 employee's withholding exemption & county status certificate fill. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Underpayment of indiana withholding filing register and file this tax online via intime.

Web Employees Withholding Exemption & County Status Certificate:

Registration for withholding tax is necessary if the business has: If you wish to claim the exemption, enter “1” if i don't claim one exemption this year do i lose the exemption or can i claim that next year. Do not send this form to the department of revenue. This forms part of indiana’s state.

Annual Withholding Tax Form Register And File This Tax Online Via Intime.

The completed form should be returned to your employer. Enter your indiana county of residence and county of principal employment as of january Generally, employers are required to withhold both state and county taxes from employees’ wages. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Do Not Send This Form To The Department Of Revenue.

Print or type your full name, social security number or itin and home address. Print or type your full name, social security number or itin and home address. If too much is withheld, you will generally be due a refund. You are entitled to one exemption.