Weak Form Emh

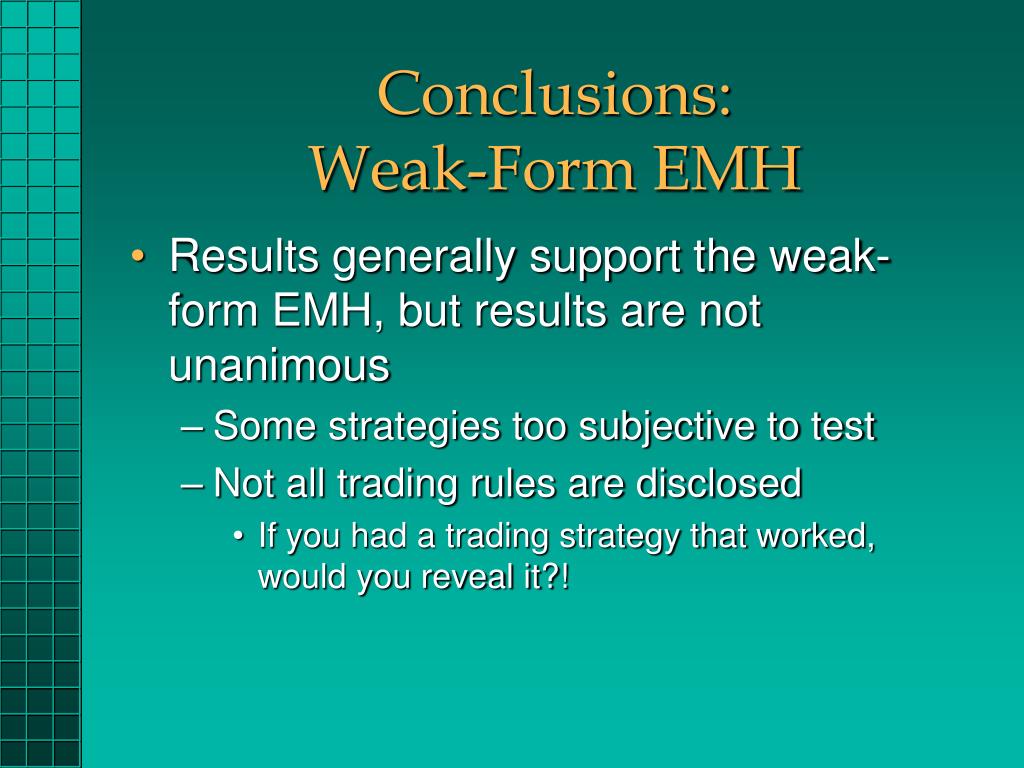

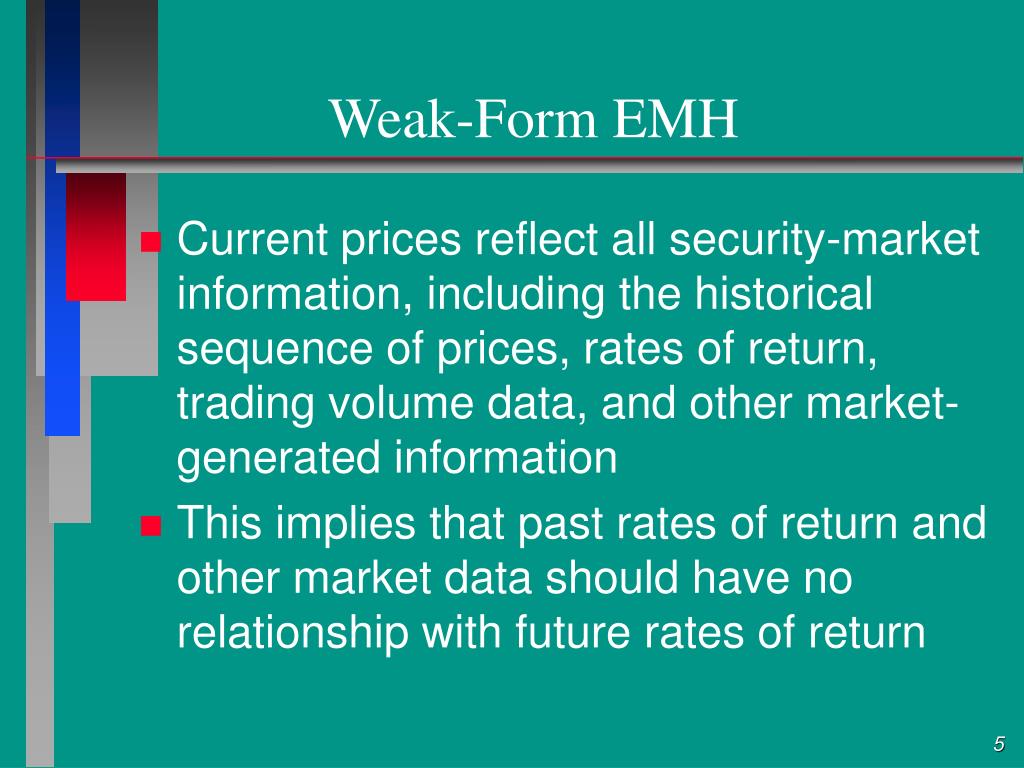

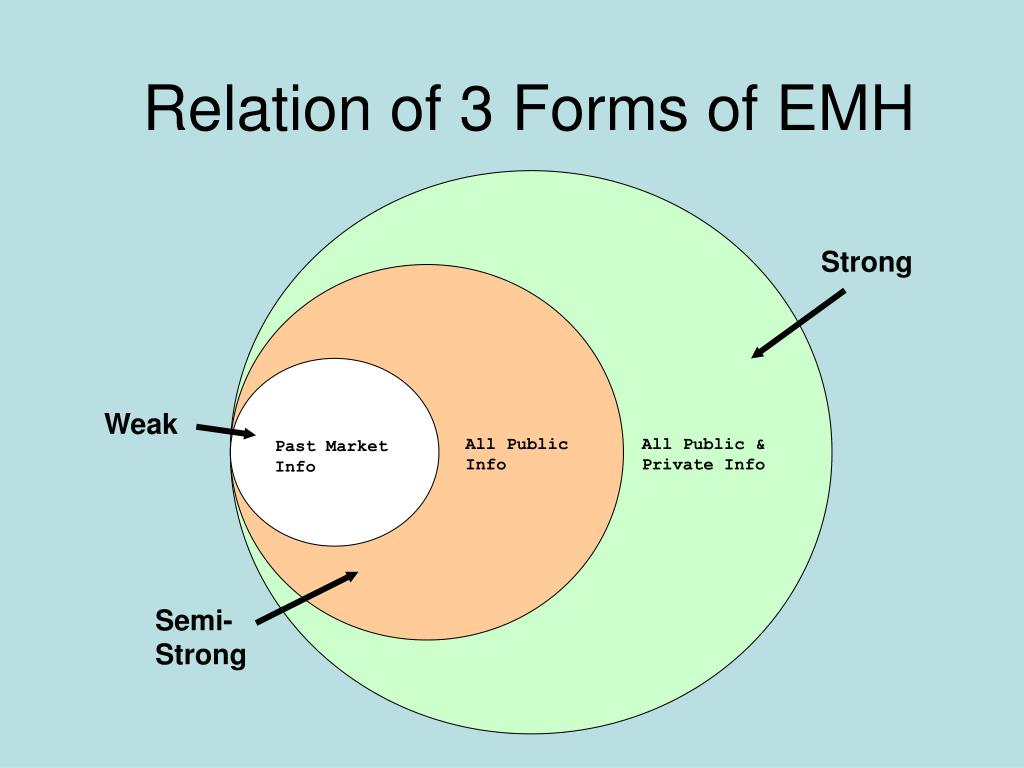

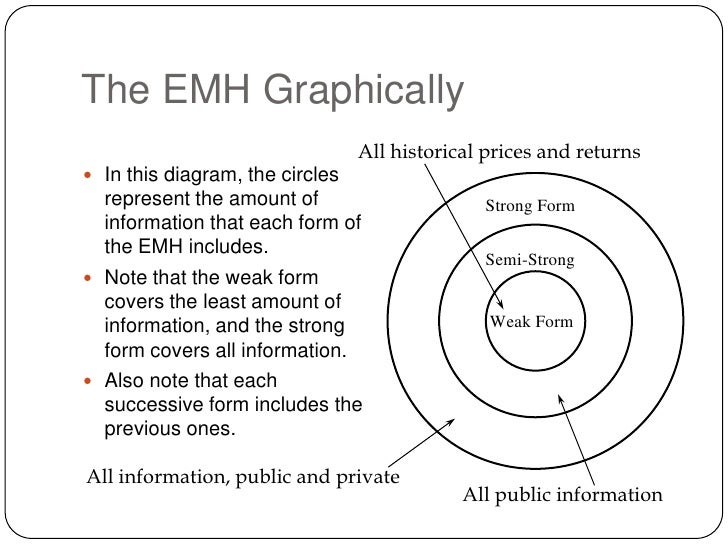

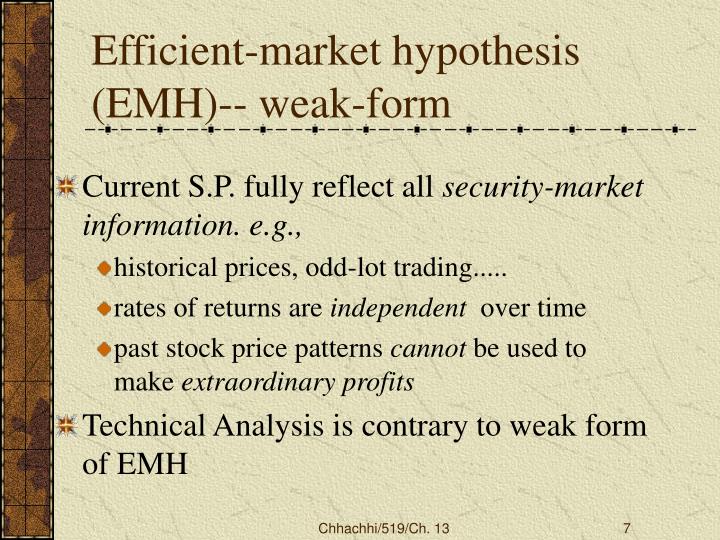

Weak Form Emh - All past information like historical trading prices and volume data is reflected in the market prices. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less than $2 trillion in 1995 to $5 trillion in 2006 (nally, 2010). The weak form of market efficiency is the weakest form of this hypothesis model. Weak form emh suggests that all past information is priced into securities. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. There are three beliefs or views: The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. All publicly available information is reflected in the current market prices. It additionally assumes that past information regarding price, volume, and returns is independent of future prices.

The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Weak form emh suggests that all past information is priced into securities. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. Web weak form emh: The weak form of market efficiency is the weakest form of this hypothesis model. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: All past information like historical trading prices and volume data is reflected in the market prices. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. All public and private information, inclusive of insider information, is reflected in market prices. There are three beliefs or views:

Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. All public and private information, inclusive of insider information, is reflected in market prices. All past information like historical trading prices and volume data is reflected in the market prices. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. The weak form of market efficiency is the weakest form of this hypothesis model. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less than $2 trillion in 1995 to $5 trillion in 2006 (nally, 2010). All publicly available information is reflected in the current market prices. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: There are three beliefs or views: It additionally assumes that past information regarding price, volume, and returns is independent of future prices.

CHAPTER 8 Stocks and Their Valuation n n

There are three beliefs or views: The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less.

PPT Chapter 10 PowerPoint Presentation, free download ID395356

It additionally assumes that past information regarding price, volume, and returns is independent of future prices. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. All public and private information, inclusive of insider information, is reflected in market prices. The weak form of the emh assumes that the prices of.

What does Warren Buffett tell me about EMH on his winning bet?

Web weak form emh: Web weak form efficiency is one of the three different degrees of efficient market hypothesis (emh). Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. All public and private information, inclusive of insider information, is reflected in market prices. It additionally assumes that past information regarding.

PPT Efficient Market Theory PowerPoint Presentation, free download

The weak form of market efficiency is the weakest form of this hypothesis model. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less than $2 trillion in 1995 to $5 trillion in 2006 (nally, 2010). Web weak form efficiency is one of the three different.

PPT Market Efficiency and Empirical Evidence PowerPoint Presentation

Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: All public and private information, inclusive of insider information, is reflected in market prices. Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled,.

Efficient market hypothesis

Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. It additionally assumes that past information regarding price, volume, and returns is independent of future prices. All public and private information, inclusive of insider information, is reflected in market prices. The efficient market hypothesis concerns the extent to which outside information.

Efficient market hypothesis

All past information like historical trading prices and volume data is reflected in the market prices. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three.

Weak form efficiency indian stock markets make money with meghan system

Weak form emh suggests that all past information is priced into securities. There are three beliefs or views: All publicly available information is reflected in the current market prices. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. Web.

What is the Efficient Market Hypothesis (EMH)? IG Bank Switzerland

All publicly available information is reflected in the current market prices. Web weak form market efficiency, also known as he random walk theory is part of the efficient market hypothesis. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available..

Weak Form of EMH (T39) YouTube

Key takeaways weak form efficiency states that past prices, historical values, and. The weak form of market efficiency is the weakest form of this hypothesis model. All past information like historical trading prices and volume data is reflected in the market prices. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the.

Web Weak Form Efficiency Is One Of The Three Different Degrees Of Efficient Market Hypothesis (Emh).

All publicly available information is reflected in the current market prices. The efficient market hypothesis concerns the extent to which outside information has an effect upon the market price of a security. Web the efficient market hypothesis (emh), as a whole, theorizes that the market is generally efficient, but the theory is offered in three different versions: The weak form of market efficiency is the weakest form of this hypothesis model.

Web Weak Form Market Efficiency, Also Known As He Random Walk Theory Is Part Of The Efficient Market Hypothesis.

Web the market capitalization of emerging market economies accounts for twelve percent of world market capitalization and has more than doubled, growing from less than $2 trillion in 1995 to $5 trillion in 2006 (nally, 2010). Weak form emh suggests that all past information is priced into securities. Web weak form emh: There are three beliefs or views:

All Past Information Like Historical Trading Prices And Volume Data Is Reflected In The Market Prices.

It additionally assumes that past information regarding price, volume, and returns is independent of future prices. The weak form of the emh assumes that the prices of securities reflect all available public market information but may not reflect new information that is not yet publicly available. Key takeaways weak form efficiency states that past prices, historical values, and. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term.