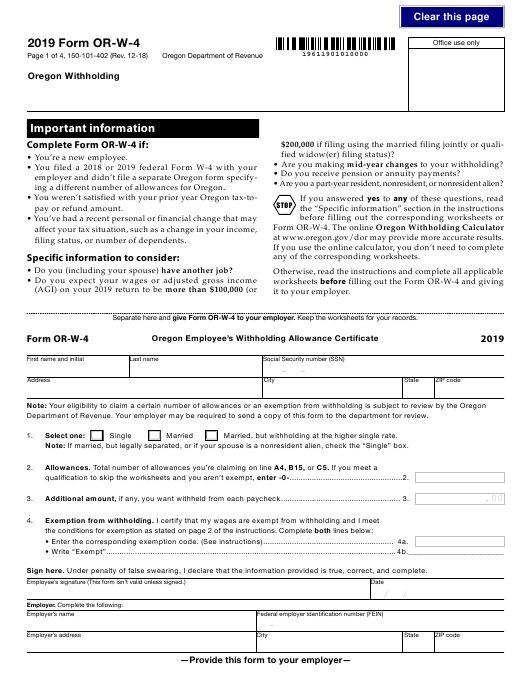

W-4 Form Oregon

W-4 Form Oregon - Select a heading to view its forms, then u se the search feature to locate a form or publication. Single married married, but withholding. Web oregon department of revenue. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate. This form tells your employer how much. Your employer may be required to send a copy of this form to the department for review. Web (a) other income (not from jobs). 01) office use only oregon department of revenue 19612201010000 oregon withholding statement and. Web open the oregon w4 and follow the instructions easily sign the or w 4 form with your finger send filled & signed oregon w 4 form or save rate the oregon withholding 4.7 satisfied. Your 2020 tax return may still result in a tax due or refund.

Single married married, but withholding. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Your 2020 tax return may still result in a tax due or refund. Web oregon department of revenue. Web (a) other income (not from jobs). Web making a voluntary meter request. If too little is withheld, you will generally owe tax when you file your tax return. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate. Select a heading to view its forms, then u se the search feature to locate a form or publication. 01) office use only oregon department of revenue 19612201010000 oregon withholding statement and.

01) office use only oregon department of revenue 19612201010000 oregon withholding statement and. Your employer may be required to send a copy of this form to the department for review. If too little is withheld, you will generally owe tax when you file your tax return. Web making a voluntary meter request. Select a heading to view its forms, then u se the search feature to locate a form or publication. This form tells your employer how much. Web (a) other income (not from jobs). 01) oregon department of revenue office use only oregon withholding statement and exemption certificate. Your 2020 tax return may still result in a tax due or refund. If too little is withheld, you will generally owe tax when you file your tax return.

What Is A Power Of Attorney Federal

Web oregon department of revenue. Web open the oregon w4 and follow the instructions easily sign the or w 4 form with your finger send filled & signed oregon w 4 form or save rate the oregon withholding 4.7 satisfied. Single married married, but withholding. If too little is withheld, you will generally owe tax when you file your tax.

Michigan W4 Form and Instructions for Nonresident Aliens University

This form tells your employer how much. Single married married, but withholding. If too little is withheld, you will generally owe tax when you file your tax return. Web (a) other income (not from jobs). Web view all of the current year's forms and publications by popularity or program area.

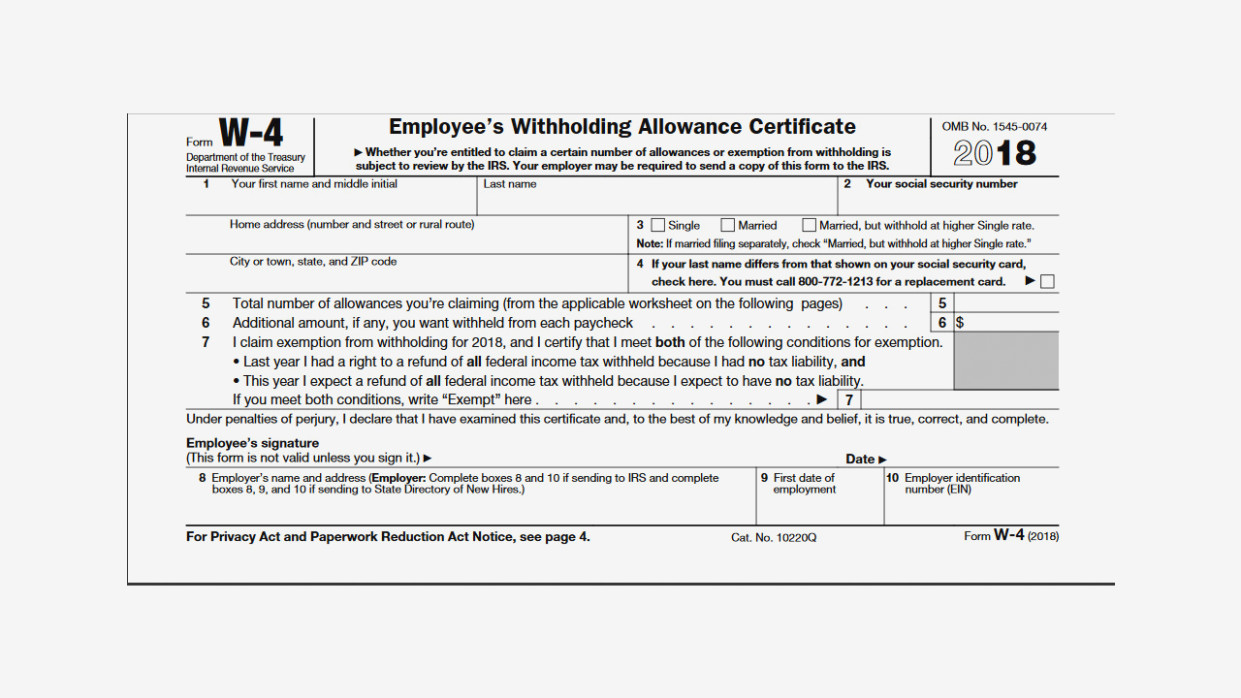

Tweak Your Withholding Taxes Filing a New W4 Form with Your Employer

This form tells your employer how much. Your 2020 tax return may still result in a tax due or refund. Select a heading to view its forms, then u se the search feature to locate a form or publication. Web making a voluntary meter request. If too little is withheld, you will generally owe tax when you file your tax.

W 4 Form Help Examples and Forms

Web open the oregon w4 and follow the instructions easily sign the or w 4 form with your finger send filled & signed oregon w 4 form or save rate the oregon withholding 4.7 satisfied. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate. Your employer may be required to send a copy of this.

Oregon W 4 Form Printable 2022 W4 Form

If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Select a heading to view its forms, then u se the search feature to locate a form or publication. Web one ticket in california matched all five numbers and the powerball. If too little is withheld, you.

Download Oregon Form W4 (2013) for Free FormTemplate

Web one ticket in california matched all five numbers and the powerball. Web making a voluntary meter request. If too little is withheld, you will generally owe tax when you file your tax return. 01) office use only oregon department of revenue 19612201010000 oregon withholding statement and. Web view all of the current year's forms and publications by popularity or.

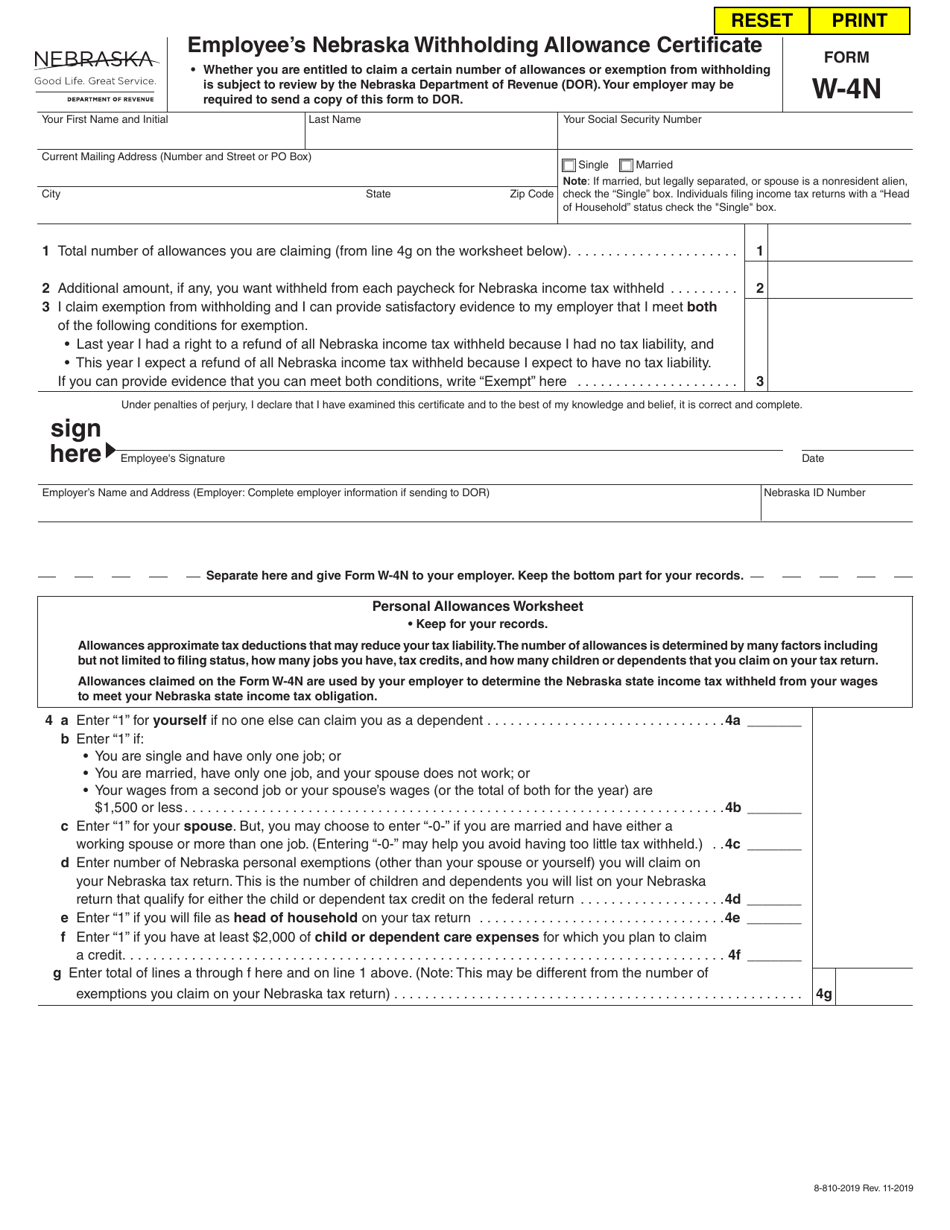

Form W4N Download Fillable PDF or Fill Online Employee's Nebraska

If too little is withheld, you will generally owe tax when you file your tax return. Web view all of the current year's forms and publications by popularity or program area. Web one ticket in california matched all five numbers and the powerball. Web making a voluntary meter request. Your employer may be required to send a copy of this.

How To Correctly Fill Out Your W4 Form Youtube Free Printable W 4

Your 2020 tax return may still result in a tax due or refund. Your employer may be required to send a copy of this form to the department for review. This form tells your employer how much. If too little is withheld, you will generally owe tax when you file your tax return. If you want tax withheld for other.

How to Fill Out a W4 Form GoCo.io

Web (a) other income (not from jobs). If too little is withheld, you will generally owe tax when you file your tax return. Web open the oregon w4 and follow the instructions easily sign the or w 4 form with your finger send filled & signed oregon w 4 form or save rate the oregon withholding 4.7 satisfied. If too.

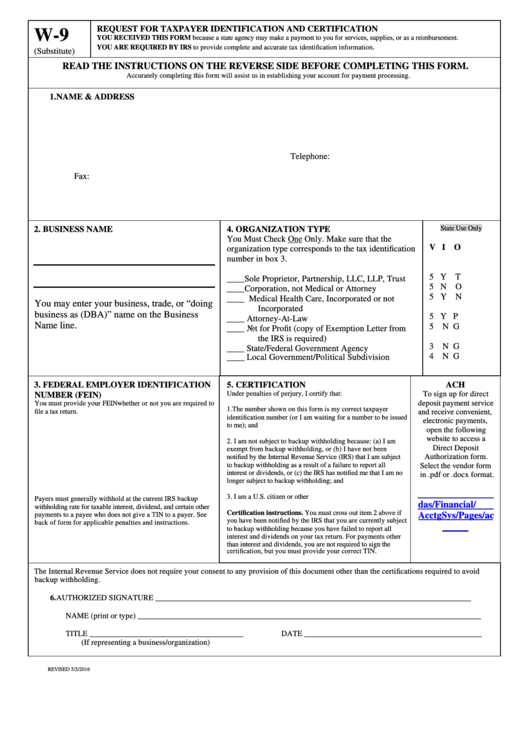

Form W9 (Substitute) Request For Taxpayer Identification And

Your employer may be required to send a copy of this form to the department for review. Web (a) other income (not from jobs). Web view all of the current year's forms and publications by popularity or program area. Web making a voluntary meter request. 01) oregon department of revenue office use only oregon withholding statement and exemption certificate.

Your Employer May Be Required To Send A Copy Of This Form To The Department For Review.

Web open the oregon w4 and follow the instructions easily sign the or w 4 form with your finger send filled & signed oregon w 4 form or save rate the oregon withholding 4.7 satisfied. Web one ticket in california matched all five numbers and the powerball. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return.

Web View All Of The Current Year's Forms And Publications By Popularity Or Program Area.

Web making a voluntary meter request. Web oregon department of revenue. Select a heading to view its forms, then u se the search feature to locate a form or publication. Your 2020 tax return may still result in a tax due or refund.

This Form Tells Your Employer How Much.

Single married married, but withholding. Web (a) other income (not from jobs). 01) oregon department of revenue office use only oregon withholding statement and exemption certificate. 01) office use only oregon department of revenue 19612201010000 oregon withholding statement and.