Va State Tax Refund Calendar

Va State Tax Refund Calendar - Web general refund processing times during filing season: Up to 8 weeks returns sent by certified mail: Web for immediate releasejan. Up to 4 weeks paper filed returns: Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. To check your status, visit www.tax.virginia.gov or.

Up to 4 weeks paper filed returns: To check your status, visit www.tax.virginia.gov or. Up to 8 weeks returns sent by certified mail: Web for immediate releasejan. Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Web general refund processing times during filing season:

Web for immediate releasejan. Web general refund processing times during filing season: Up to 8 weeks returns sent by certified mail: Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Up to 4 weeks paper filed returns: To check your status, visit www.tax.virginia.gov or.

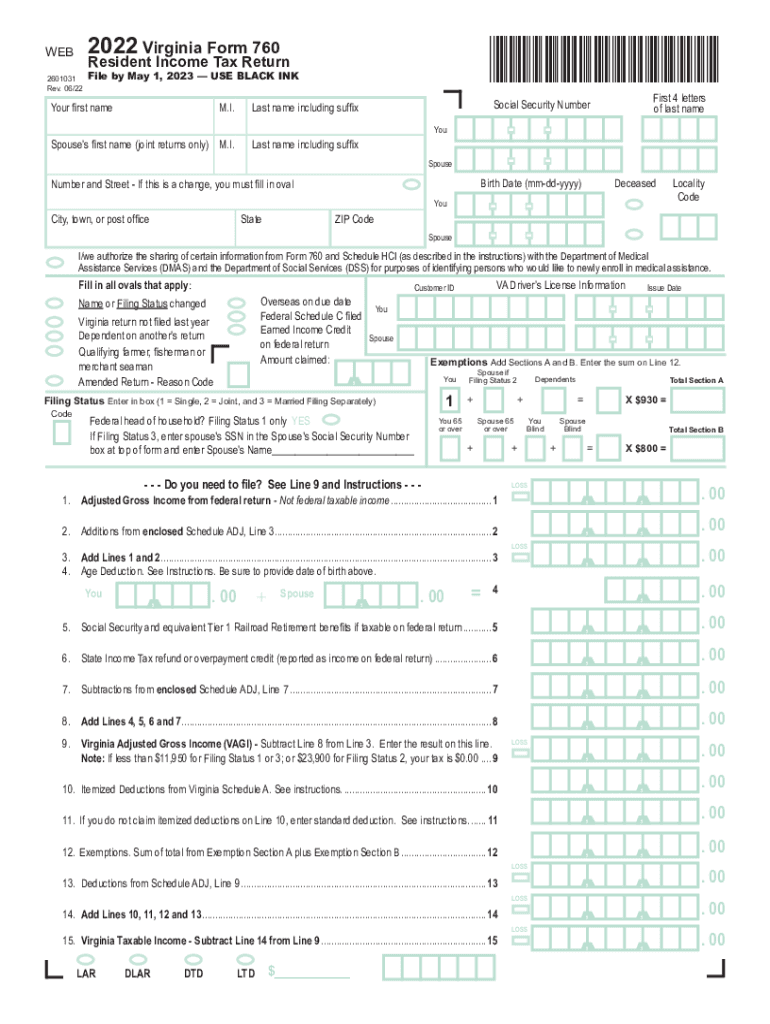

2022 Form VA DoT 760 Fill Online, Printable, Fillable, Blank pdfFiller

Web for immediate releasejan. Web general refund processing times during filing season: Up to 8 weeks returns sent by certified mail: To check your status, visit www.tax.virginia.gov or. Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486.

20192020 Tax Season Average IRS and State Tax Refund and Processing

Up to 8 weeks returns sent by certified mail: Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Up to 4 weeks paper filed returns: Web for immediate releasejan. Web general refund processing times during filing season:

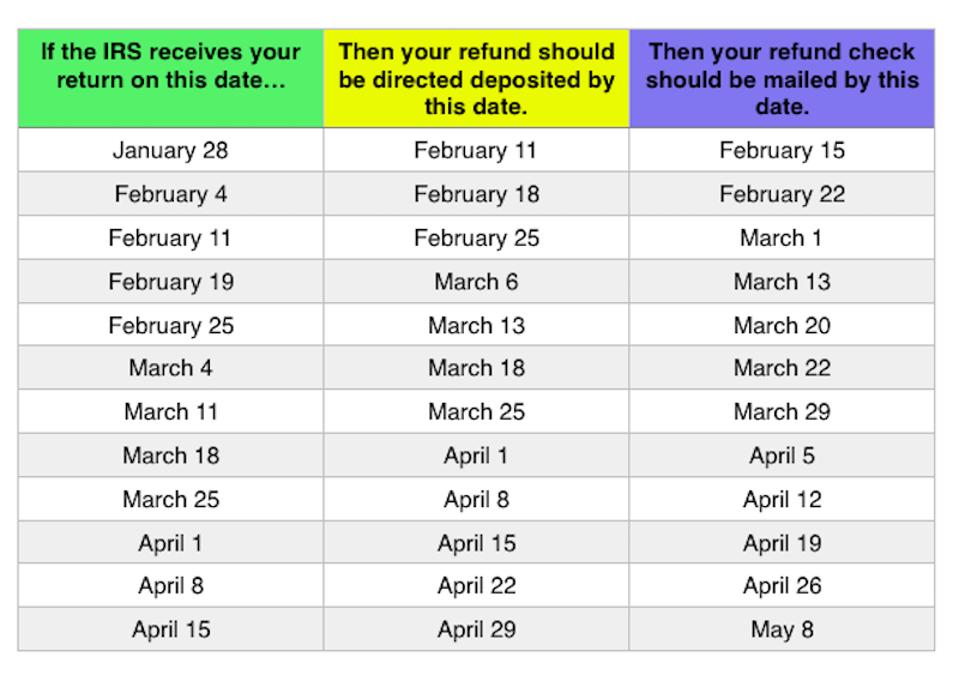

Refund Cycle Chart Online Refund Status

Up to 4 weeks paper filed returns: Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Web for immediate releasejan. Up to 8 weeks returns sent by certified mail: Web general refund processing times during filing season:

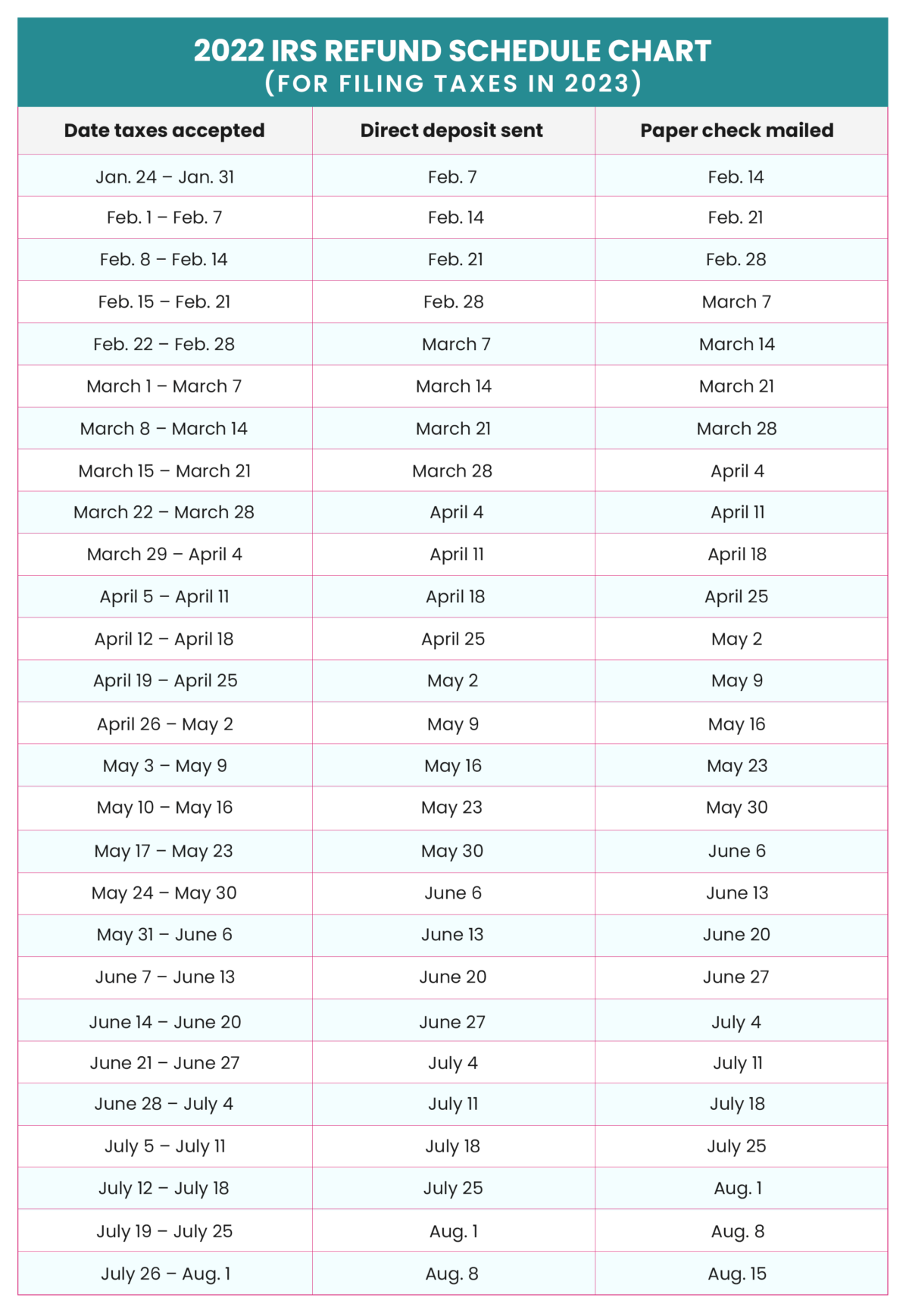

The IRS Tax Refund Schedule 2023 Where's My Refund?

Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. Web for immediate releasejan. Web general refund processing times during filing season: Up to 4 weeks paper filed returns: Up to 8 weeks returns sent by certified mail:

Here Are The States With The Highest (And Lowest) Tax Refunds Austin

To check your status, visit www.tax.virginia.gov or. Web for immediate releasejan. Up to 4 weeks paper filed returns: Up to 8 weeks returns sent by certified mail: Web general refund processing times during filing season:

The IRS Tax Refund Schedule 2023 Where's My Refund?

Up to 8 weeks returns sent by certified mail: Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. To check your status, visit www.tax.virginia.gov or. Web for immediate releasejan. Up to 4 weeks paper filed returns:

2023 Tax Refund Date Chart Printable Forms Free Online

Web to check your refund status, go to our where’s my refund online tool or call our automated phone system at 804.367.2486. To check your status, visit www.tax.virginia.gov or. Up to 8 weeks returns sent by certified mail: Up to 4 weeks paper filed returns: Web for immediate releasejan.

This Map Shows The Average Tax Refund In Every State ValueWalk Premium

To check your status, visit www.tax.virginia.gov or. Up to 8 weeks returns sent by certified mail: Web general refund processing times during filing season: Up to 4 weeks paper filed returns: Web for immediate releasejan.

2023 Tax Refund Chart Printable Forms Free Online

To check your status, visit www.tax.virginia.gov or. Web general refund processing times during filing season: Up to 8 weeks returns sent by certified mail: Web for immediate releasejan. Up to 4 weeks paper filed returns:

Web To Check Your Refund Status, Go To Our Where’s My Refund Online Tool Or Call Our Automated Phone System At 804.367.2486.

Up to 4 weeks paper filed returns: Web for immediate releasejan. Web general refund processing times during filing season: Up to 8 weeks returns sent by certified mail: