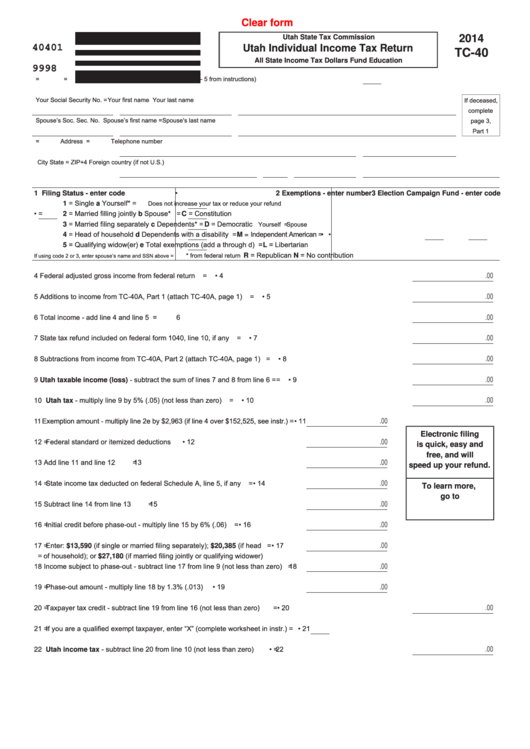

Utah State Tax Form Tc 40

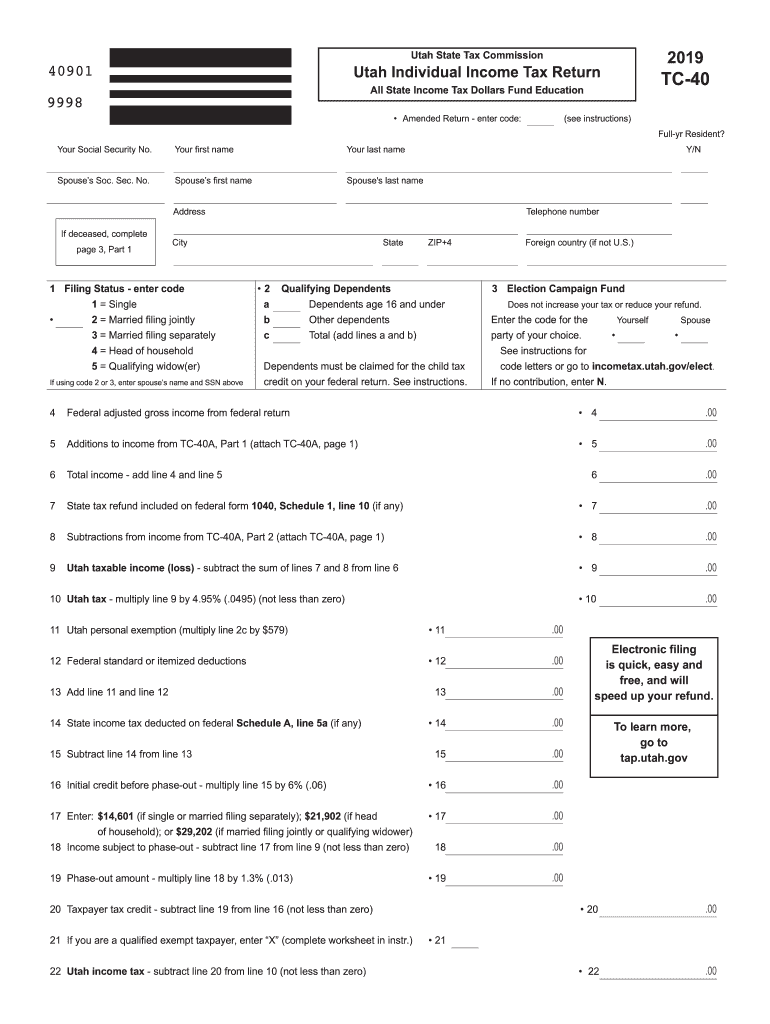

Utah State Tax Form Tc 40 - Try it for free now! Y/n telephone number if deceased, complete page 3, part 1city state zip+4 foreign country (if not u.s.) filing. Attach completed schedule to your utah income tax return. Election campaign fund line 4. Upload, modify or create forms. Submit page only if data entered. Attach completed schedule to your utah. • • if you are using credit 18 (retirement credit), enter your birth date(s): Additions to income line 7. Silver lake, big cottonwood canyon, by colton matheson instructions

Instructions for married couples line 2. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Attach completed schedule to your utah. Web follow these steps to calculate your utah tax: Y/n telephone number if deceased, complete page 3, part 1city state zip+4 foreign country (if not u.s.) filing. If you claim the retirement tax credit, be. Attach completed schedule to your utah income tax return. Upload, modify or create forms. Silver lake, big cottonwood canyon, by colton matheson instructions .00 submit page only if data entered.

Additions to income line 7. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Y/n telephone number if deceased, complete page 3, part 1city state zip+4 foreign country (if not u.s.) filing. Election campaign fund line 4. Submit page only if data entered. Try it for free now! If you claim the retirement tax credit, be. • • if you are using credit 18 (retirement credit), enter your birth date(s): Attach completed schedule to your utah income tax return. You • spouse • • mm/dd/yy mm/dd/yy.00•.00 • total.

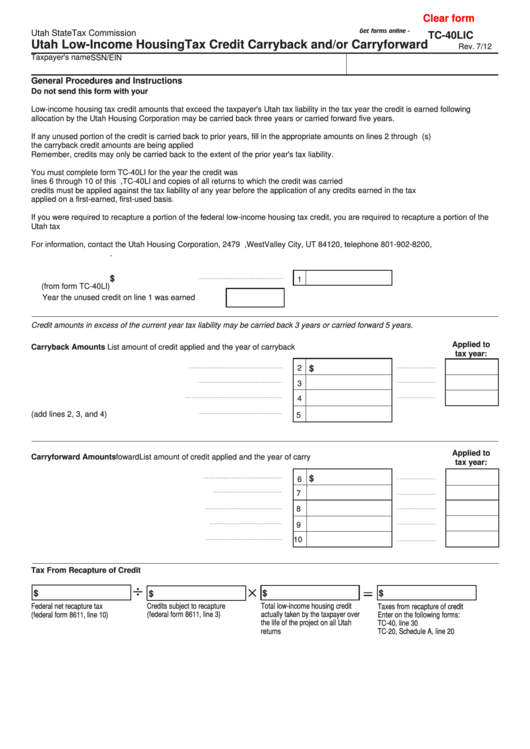

Fillable Form Tc40lic Utah Housing Tax Credit Carryback

Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Silver lake, big cottonwood canyon, by colton matheson instructions Web follow these steps to calculate your utah tax: .00 submit page only if data entered. Attach completed schedule to your utah income tax return.

Fillable Form Tc40 Utah Individual Tax Return printable pdf

Submit page only if data entered. Election campaign fund line 4. Y/n telephone number if deceased, complete page 3, part 1city state zip+4 foreign country (if not u.s.) filing. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Instructions for married couples line 2.

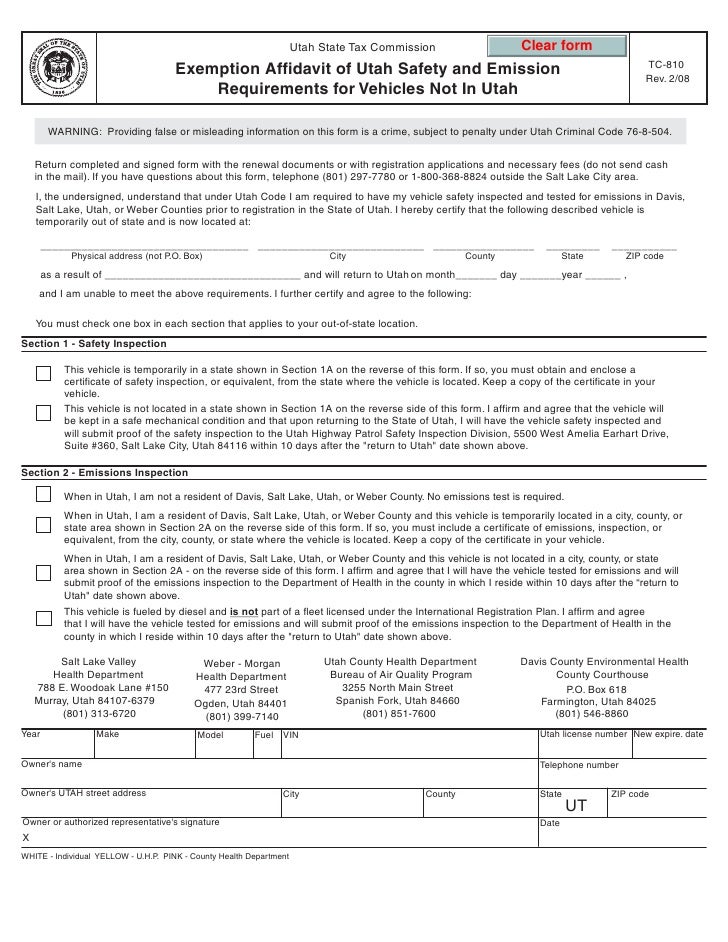

tax.utah.gov forms current tc tc810

Election campaign fund line 4. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. If you claim the retirement tax credit, be. Upload, modify or create forms. Additions to income line 7.

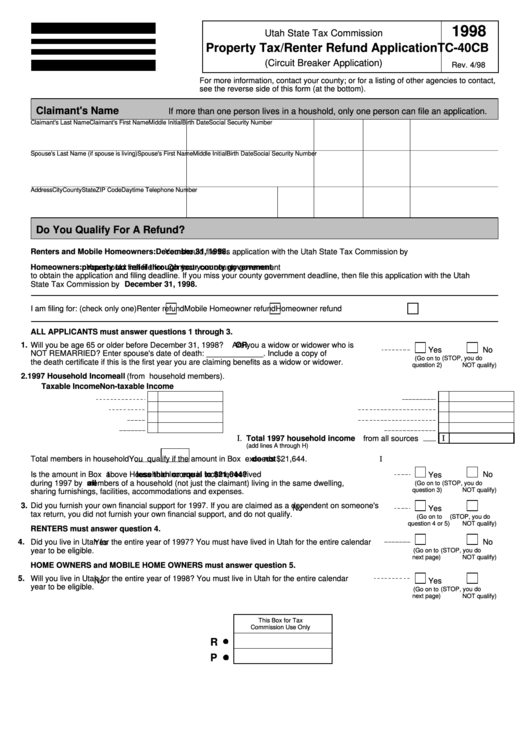

Fillable Form Tc40cb Property Tax/renter Refund Application Utah

Attach completed schedule to your utah. .00 submit page only if data entered. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. If you claim the retirement tax credit, be. Silver lake, big cottonwood canyon, by colton matheson instructions

Utah State Tax Form 2015 amulette

Attach completed schedule to your utah income tax return. You • spouse • • mm/dd/yy mm/dd/yy.00•.00 • total. Election campaign fund line 4. Web 1 enter federal adjusted gross income taxed by both utah and state of: Upload, modify or create forms.

tax.utah.gov forms current tc tc40hd

If you claim the retirement tax credit, be. Attach completed schedule to your utah income tax return. Web 1 enter federal adjusted gross income taxed by both utah and state of: Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Attach completed schedule to.

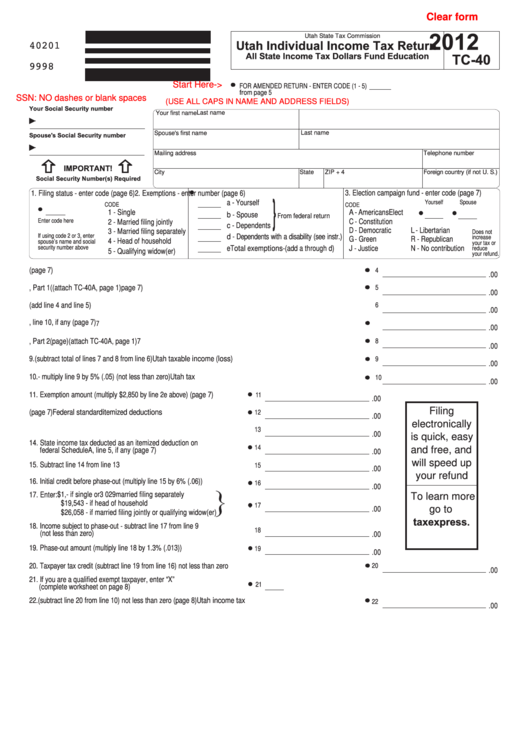

Fillable Form Tc40 Utah Individual Tax Return 2012

Instructions for married couples line 2. Attach completed schedule to your utah. You • spouse • • mm/dd/yy mm/dd/yy.00•.00 • total. .00 submit page only if data entered. Additions to income line 7.

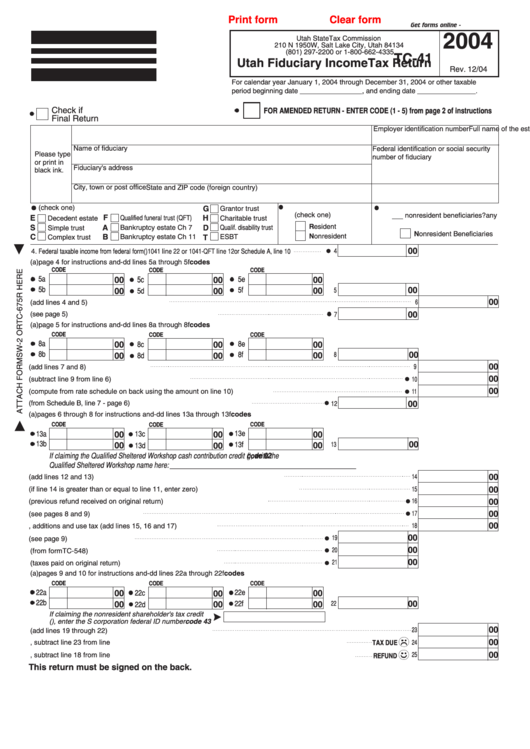

Fillable Form Tc41 Utah Fiduciary Tax Return 2004 printable

Web see instructions or incometax.utah.gov for codes. Silver lake, big cottonwood canyon, by colton matheson instructions .00 submit page only if data entered. Election campaign fund line 4. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities.

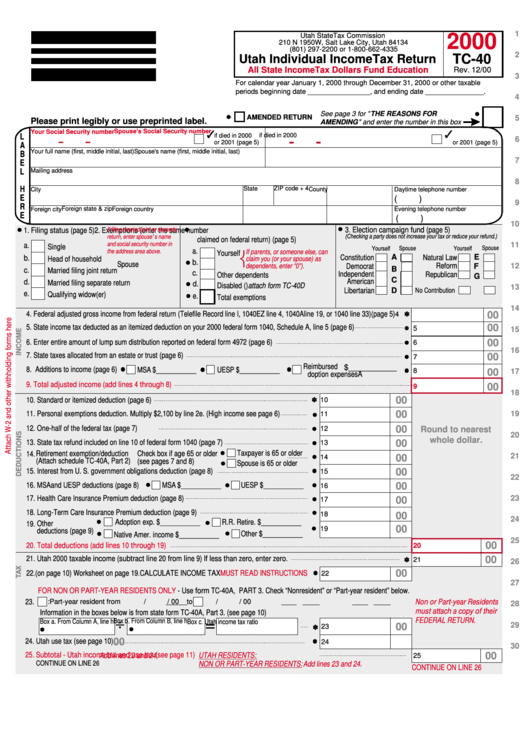

Form Tc40 Utah Individual Tax Return 2000 printable pdf

.00 submit page only if data entered. Election campaign fund line 4. Get ready for tax season deadlines by completing any required fields today. Try it for free now! Web follow these steps to calculate your utah tax:

Get Ready For Tax Season Deadlines By Completing Any Required Fields Today.

Additions to income line 7. Submit page only if data entered. Silver lake, big cottonwood canyon, by colton matheson instructions If you claim the retirement tax credit, be.

Y/N Telephone Number If Deceased, Complete Page 3, Part 1City State Zip+4 Foreign Country (If Not U.s.) Filing.

Instructions for married couples line 2. Attach completed schedule to your utah income tax return. Web 1 enter federal adjusted gross income taxed by both utah and state of: .00 submit page only if data entered.

Election Campaign Fund Line 4.

Web see instructions or incometax.utah.gov for codes. You • spouse • • mm/dd/yy mm/dd/yy.00•.00 • total. Web follow these steps to calculate your utah tax: Upload, modify or create forms.

Try It For Free Now!

• • if you are using credit 18 (retirement credit), enter your birth date(s): Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Attach completed schedule to your utah.