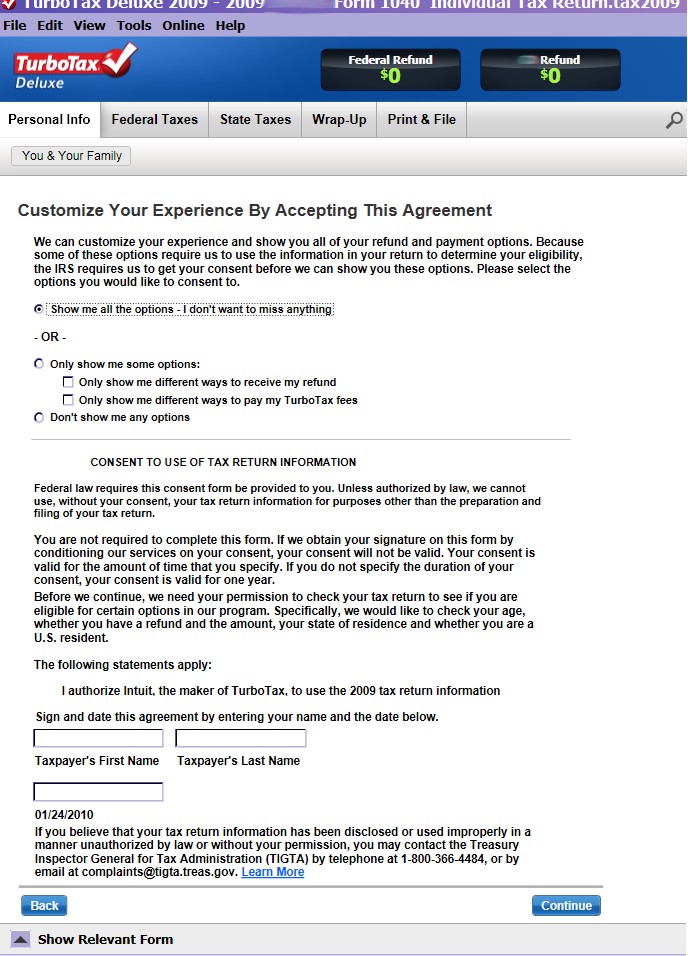

Turbotax Consent Form

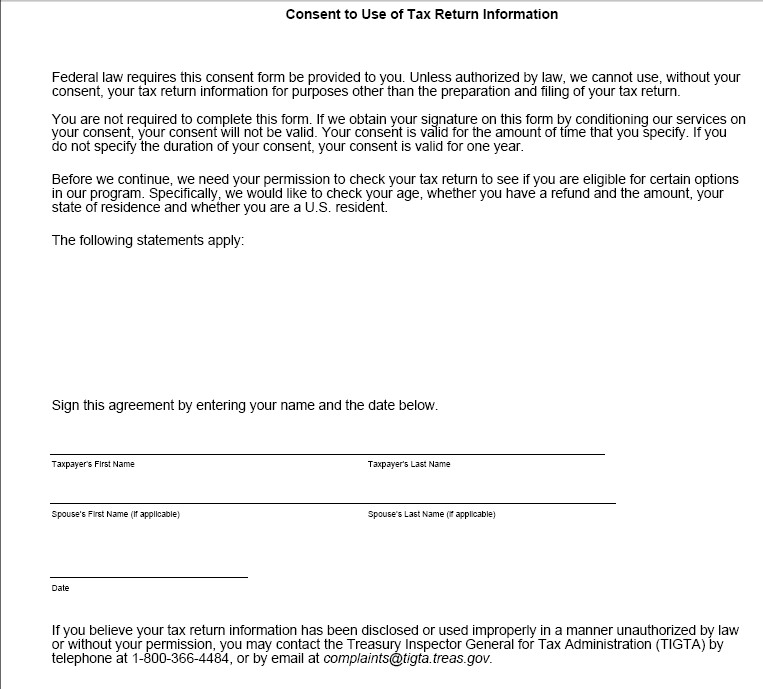

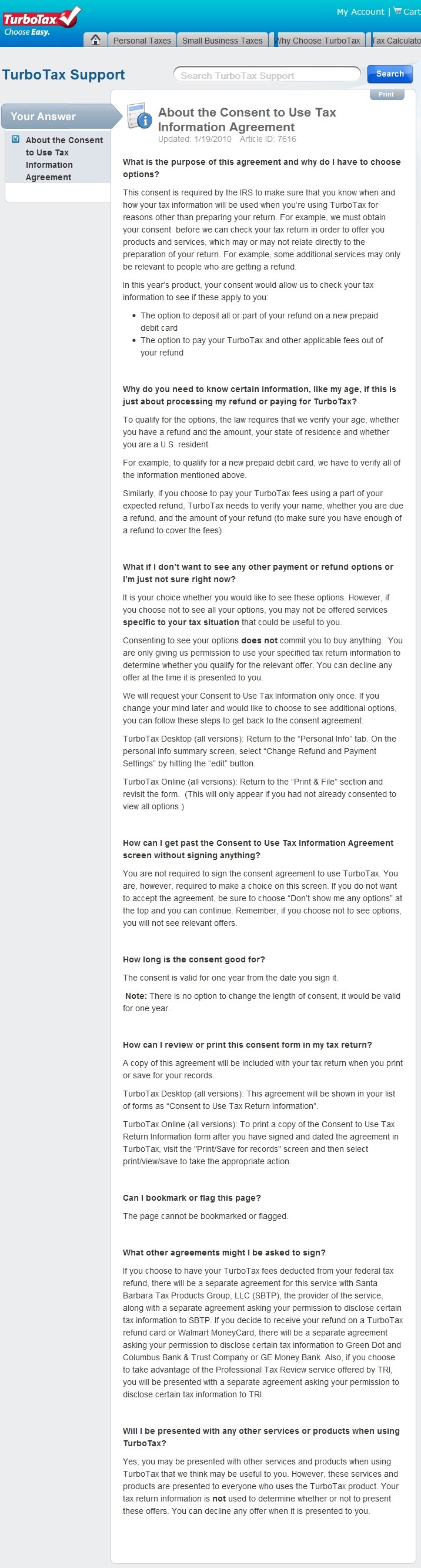

Turbotax Consent Form - Web i'm a little confused by the consent to disclosure form. Unless authorized by law, we cannot use, without your consent, your. Do most people agree and consent? Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one). When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Web can someone explain consent required for paying turbo tax with my federal refund? Web preparation, to obtain taxpayer consent and provide taxpayers with specific information. This consent form is not to sell or market your information. Web what is the consent to use of tax return information? Web the consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund.

This includes who will receive their tax return information and the particular items of tax. Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one). When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Make changes to your 2022 tax. Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing. Web for turbotax, you have to email privacy@intuit.com. Web preparation, to obtain taxpayer consent and provide taxpayers with specific information. What are the pluses and minuses? Unless authorized by law, we cannot use, without your consent, your. This consent form is not to sell or market your information.

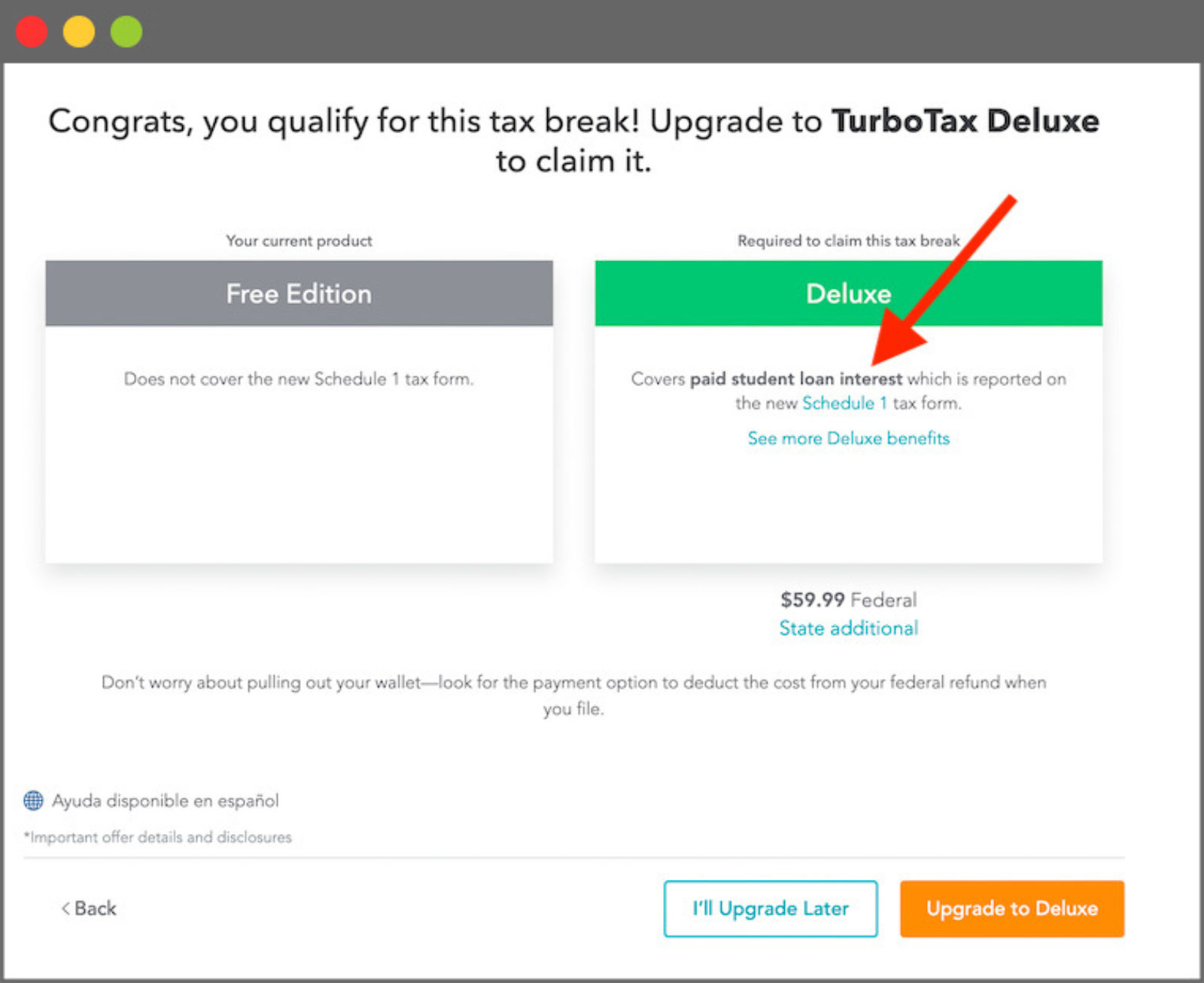

Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing. Web 2.1k views 1 year ago. Web can someone explain consent required for paying turbo tax with my federal refund? Web for turbotax, you have to email privacy@intuit.com. Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your refund to pay. Taxpayer must sign and date this form on line 6. Ad get your taxes done right & maximize your refund with turbotax®. This consent form is not to sell or market your information. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Web federal law requires this consent form be provided to you (“you” refers to each taxpayer, if more than one).

Trump’s tax law threatened TurboTax profits. So the company started

Be sure to mention that you’d like to revoke your “consent for use of tax return information.” Web for irs use only. Ad get your taxes done right & maximize your refund with turbotax®. Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your.

TurboTax 2016 Deluxe Home and Business + All States Fix Free Download

Web preparation, to obtain taxpayer consent and provide taxpayers with specific information. Web for irs use only. Web can someone explain consent required for paying turbo tax with my federal refund? We have thousands of employers on file to help you easily import your tax forms. What are the pluses and minuses?

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web file form 8821 to: It may seem silly, but turbotax can't offer you. We have thousands of employers on file to help you easily import your tax forms. Web for turbotax, you have to email privacy@intuit.com. Web can someone explain consent required for paying turbo tax with my federal refund?

TurboTax Restores Forms to Desktop Software The TurboTax Blog

Do most people agree and consent? Web for irs use only. Ad get your taxes done right & maximize your refund with turbotax®. Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your refund to pay. Web what is the consent to use of.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Web what is the consent to use of tax return information? Web for turbotax, you have to email privacy@intuit.com. Ad get your taxes done right & maximize your refund with turbotax®. Web curious30 new member i'm being asked for consent to disclosure of your tax return information. i want to decline but i can't go past this screen w/o entering.

Adoptive Child Worksheet Turbotax Worksheet Resume Examples

Web curious30 new member i'm being asked for consent to disclosure of your tax return information. i want to decline but i can't go past this screen w/o entering my. What are the pluses and minuses? Ad get your taxes done right & maximize your refund with turbotax®. Web what is the consent to use of tax return information? Web.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing. Do most people agree and consent? Web preparation, to obtain taxpayer consent and provide taxpayers with specific information. Web curious30 new member i'm being asked for consent to disclosure of your tax return information. i want to decline but.

What is the TurboTax consent form? YouTube

Web i'm a little confused by the consent to disclosure form. What are the pluses and minuses? Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing. Make changes to your 2022 tax. Web what is the consent to use of tax return information?

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

This includes who will receive their tax return information and the particular items of tax. Web for turbotax, you have to email privacy@intuit.com. This consent form is not to sell or market your information. Ad get your taxes done right & maximize your refund with turbotax®. Web 2.1k views 1 year ago.

form 2106 turbotax Fill Online, Printable, Fillable Blank

We have thousands of employers on file to help you easily import your tax forms. Web can someone explain consent required for paying turbo tax with my federal refund? Web for turbotax, you have to email privacy@intuit.com. This consent form is not to sell or market your information. Web 2.1k views 1 year ago.

Web Preparation, To Obtain Taxpayer Consent And Provide Taxpayers With Specific Information.

Web can someone explain consent required for paying turbo tax with my federal refund? Unless authorized by law, we cannot use, without your consent, your. Taxpayer must sign and date this form on line 6. Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your refund to pay.

Do Most People Agree And Consent?

Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing. Be sure to mention that you’d like to revoke your “consent for use of tax return information.” Web i'm a little confused by the consent to disclosure form. Web the consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund.

When Setting Up Your Account, You Will Review A Page Titled Personalize Your Taxslayer Experience With Two Consents (For.

Web curious30 new member i'm being asked for consent to disclosure of your tax return information. i want to decline but i can't go past this screen w/o entering my. Web what is the consent to use of tax return information? This includes who will receive their tax return information and the particular items of tax. Web for turbotax, you have to email privacy@intuit.com.

Ad Get Your Taxes Done Right & Maximize Your Refund With Turbotax®.

It may seem silly, but turbotax can't offer you. Web for irs use only. Make changes to your 2022 tax. What are the pluses and minuses?