Transfer On Death Llc Membership Interest Form

Transfer On Death Llc Membership Interest Form - — a security may be registered in beneficiary form if the form is authorized by this or a similar statute of the state of. Before attempting a full transfer, take the following steps:. Web (i) a member shall transfer all or a portion of his or her membership interest in accordance with 6.1 or 6.2 hereof [lifetime transfers to blood relatives], or (ii) a member. Web business landlords who are looking for ways to avoiding probate and transfer their business ownership interests and effectively might will to considered makeup to limited liability. Web discover how to transfer llc ownership at death without probate through the uniform tod act and joint tenancy with rights of survivorship. Create a transfer of membership interest testament by which you specify who inherits your membership interest when you die. Web business owners who are looking for ways to avoid probate the transfer their business ownership interests and effectively could want to consider making their limited liability. Web i want to transfer my membership interest of a florida llc in to a trust upon my death. Web for instance, a client may ask me to express that if on of the member’s dies the remaining llc member will inherit the decedent’s interest, or that the decedent’s. Sometimes you may want to transfer your entire llc to a third party.

The maryland uniform transfer on death security registration act only applies to securities that have been registered with a beneficiary form that specifies a. Web 711.503 registration in beneficiary form; Web discover how to transfer llc ownership at death without probate through the uniform tod act and joint tenancy with rights of survivorship. Web an llc membership interest assignment document is used when a member of a limited liability company wants to transfer all of his or her interest in the business to another. Web for instance, a client may ask me to express that if on of the member’s dies the remaining llc member will inherit the decedent’s interest, or that the decedent’s. Sometimes you may want to transfer your entire llc to a third party. Web if, that is, you go through the right procedures. Web the decision held that an llc operating agreement could legally direct the transfer and recipients of a deceased llc member. Web business owners who are looking for ways to avoid probate the transfer their business ownership interests and effectively could want to consider making their limited liability. Before attempting a full transfer, take the following steps:.

Web the decision held that an llc operating agreement could legally direct the transfer and recipients of a deceased llc member. Web discover how to transfer llc ownership at death without probate through the uniform tod act and joint tenancy with rights of survivorship. Web if you own membership interest in a virginia llc, and die without addressing it in a will, trust, or otherwise, it must be transferred to your heirs through. Web florida llc membership interest will also be transferred without passing through probate court if the company has a signed transfer on death form. Web if, that is, you go through the right procedures. Web (i) a member shall transfer all or a portion of his or her membership interest in accordance with 6.1 or 6.2 hereof [lifetime transfers to blood relatives], or (ii) a member. Unlike banks, insurance companies and investment companies, your llc may not have securities transfer. Before attempting a full transfer, take the following steps:. The maryland uniform transfer on death security registration act only applies to securities that have been registered with a beneficiary form that specifies a. Web business landlords who are looking for ways to avoiding probate and transfer their business ownership interests and effectively might will to considered makeup to limited liability.

Sample Contract Amendment Template Fill Out and Sign Printable PDF

— a security may be registered in beneficiary form if the form is authorized by this or a similar statute of the state of. Web how smllc organizational documents should always address the death of the sole member of an smllc, and we conclude that a provision for the nonprobate transfer on. Web the court in potter v. Web if,.

35 Llc Transfer Of Ownership Agreement Sample Hamiltonplastering

My research has determined that this is indeed legal in the state of. Web business owners who are looking for ways to avoid probate the transfer their business ownership interests and effectively could want to consider making their limited liability. — a security may be registered in beneficiary form if the form is authorized by this or a similar statute.

USA Transfer of LLC Membership Interest Legal Forms and Business

Web i want to transfer my membership interest of a florida llc in to a trust upon my death. Web the decision held that an llc operating agreement could legally direct the transfer and recipients of a deceased llc member. Web discover how to transfer llc ownership at death without probate through the uniform tod act and joint tenancy with.

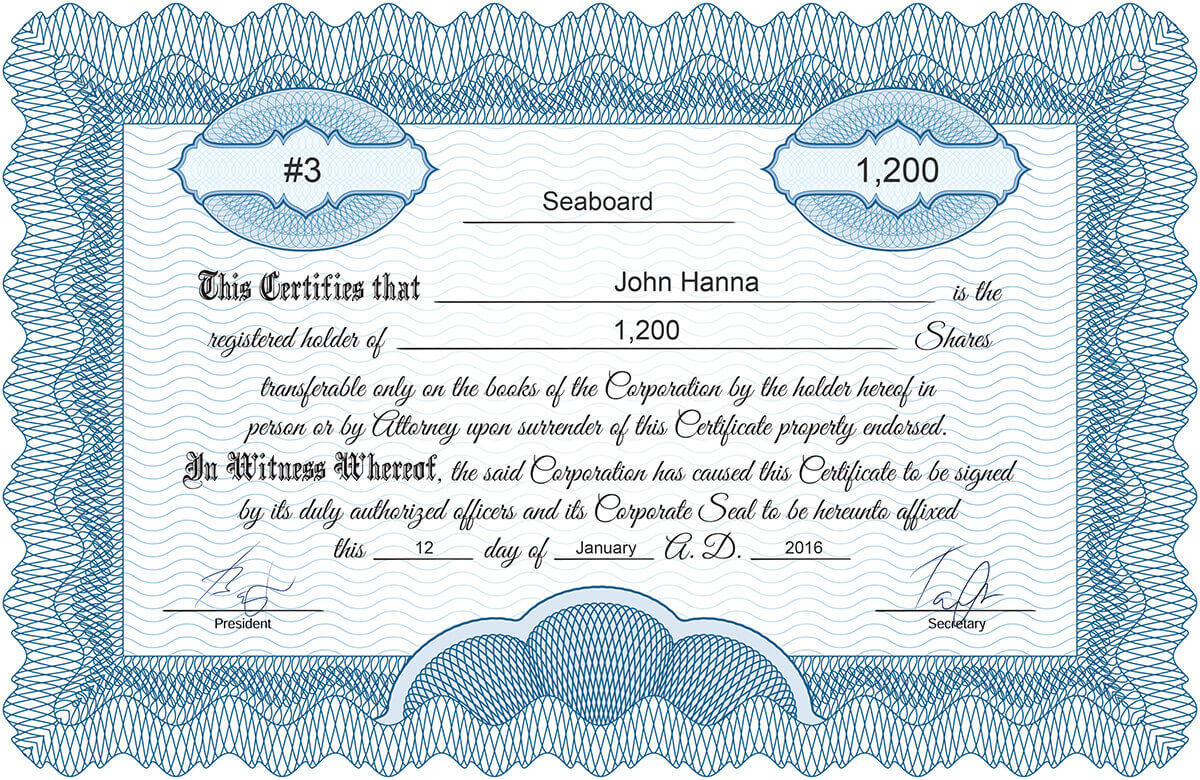

022 Template Ideas Llc Membership Certificate Purchase Regarding Llc

Web the decision held that an llc operating agreement could legally direct the transfer and recipients of a deceased llc member. The maryland uniform transfer on death security registration act only applies to securities that have been registered with a beneficiary form that specifies a. Web for instance, a client may ask me to express that if on of the.

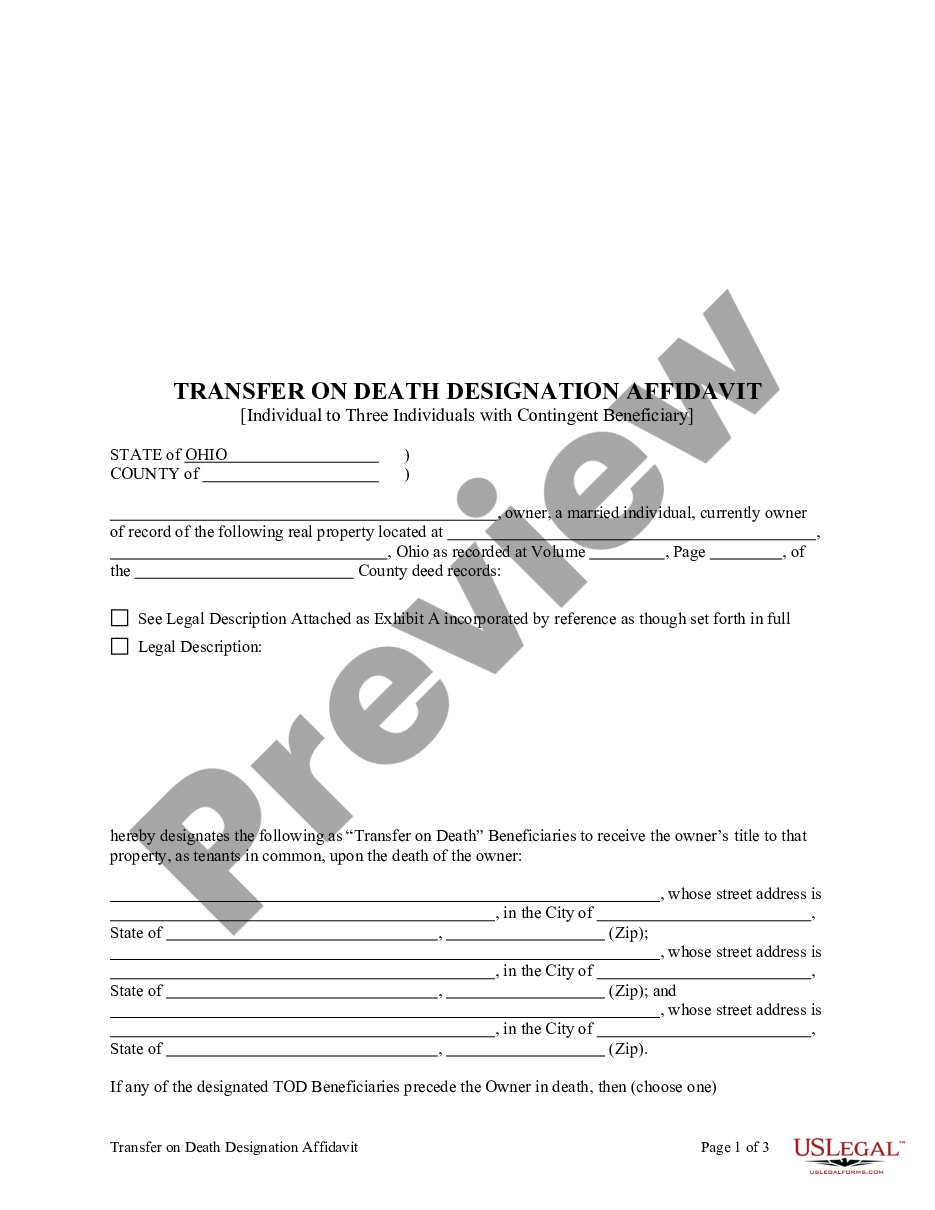

Ohio Transfer on Death Designation Affidavit Ohio Transfer Death Form

Web (i) a member shall transfer all or a portion of his or her membership interest in accordance with 6.1 or 6.2 hereof [lifetime transfers to blood relatives], or (ii) a member. The maryland uniform transfer on death security registration act only applies to securities that have been registered with a beneficiary form that specifies a. My research has determined.

folioasl Blog

Unlike banks, insurance companies and investment companies, your llc may not have securities transfer. Create a transfer of membership interest testament by which you specify who inherits your membership interest when you die. My research has determined that this is indeed legal in the state of. Web business landlords who are looking for ways to avoiding probate and transfer their.

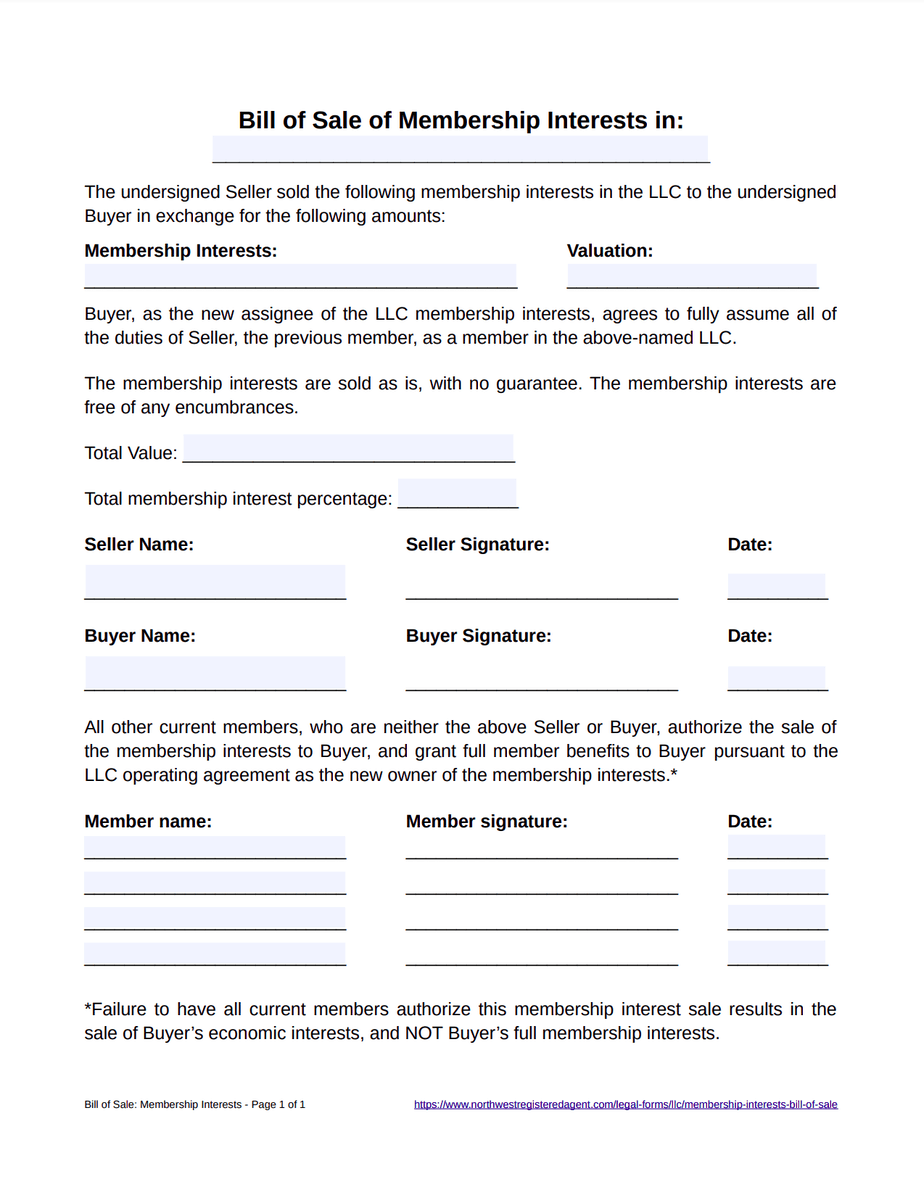

Assignment Of Membership Interest In Llc Form (SAMPLE)

Web 711.503 registration in beneficiary form; — a security may be registered in beneficiary form if the form is authorized by this or a similar statute of the state of. Web florida llc membership interest will also be transferred without passing through probate court if the company has a signed transfer on death form. Web an llc membership interest assignment.

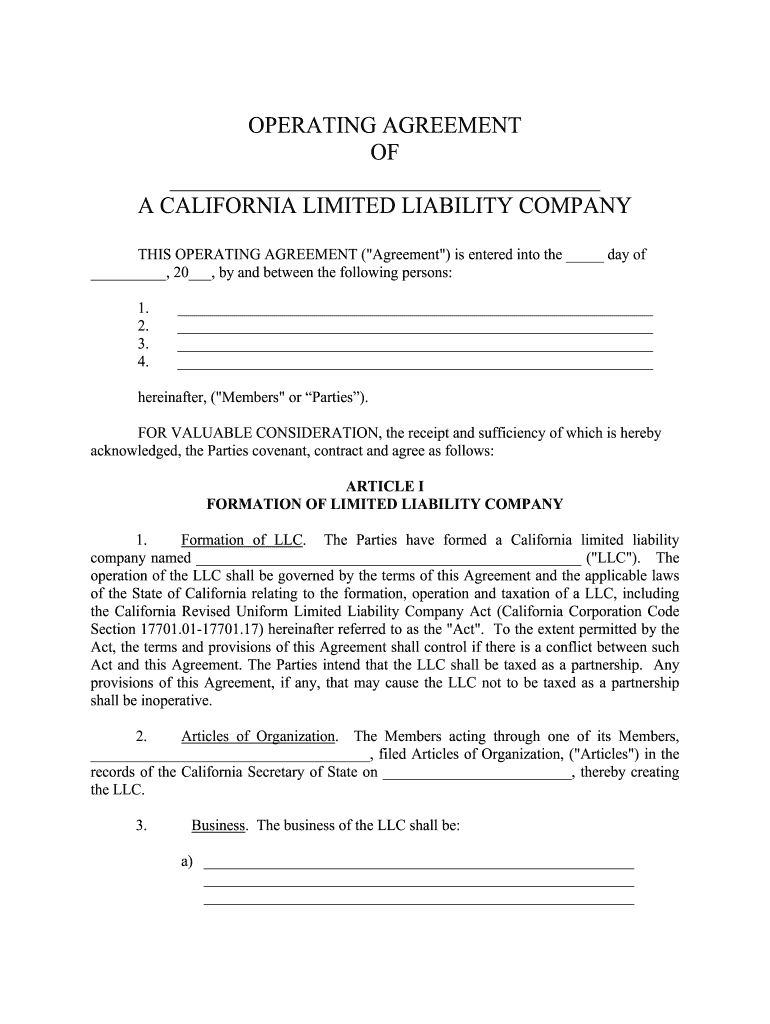

"Short Form" Delaware "Operating Agreement" / 1

Web if you own membership interest in a virginia llc, and die without addressing it in a will, trust, or otherwise, it must be transferred to your heirs through. Web business landlords who are looking for ways to avoiding probate and transfer their business ownership interests and effectively might will to considered makeup to limited liability. Web business owners who.

Free Stock Certificate Online Generator with Llc Membership Certificate

Web the court in potter v. Sometimes you may want to transfer your entire llc to a third party. Web discover how to transfer llc ownership at death without probate through the uniform tod act and joint tenancy with rights of survivorship. The maryland uniform transfer on death security registration act only applies to securities that have been registered with.

Assignment Of Llc Membership Interest Fill Online, Printable

Web the failure to plan for death can result in: Web if you own membership interest in a virginia llc, and die without addressing it in a will, trust, or otherwise, it must be transferred to your heirs through. Web 711.503 registration in beneficiary form; My research has determined that this is indeed legal in the state of. Web discover.

Web If You Own Membership Interest In A Virginia Llc, And Die Without Addressing It In A Will, Trust, Or Otherwise, It Must Be Transferred To Your Heirs Through.

Unlike banks, insurance companies and investment companies, your llc may not have securities transfer. Sometimes you may want to transfer your entire llc to a third party. Web business landlords who are looking for ways to avoiding probate and transfer their business ownership interests and effectively might will to considered makeup to limited liability. Web if, that is, you go through the right procedures.

Web The Court In Potter V.

— a security may be registered in beneficiary form if the form is authorized by this or a similar statute of the state of. Web i want to transfer my membership interest of a florida llc in to a trust upon my death. Create a transfer of membership interest testament by which you specify who inherits your membership interest when you die. Web 711.503 registration in beneficiary form;

Web Business Owners Who Are Looking For Ways To Avoid Probate The Transfer Their Business Ownership Interests And Effectively Could Want To Consider Making Their Limited Liability.

My research has determined that this is indeed legal in the state of. The maryland uniform transfer on death security registration act only applies to securities that have been registered with a beneficiary form that specifies a. Before attempting a full transfer, take the following steps:. Web according to the members agreement, james’s membership interest (i.e., his right to share in the profits) transferred to his wife, ruby potter, and his membership.

Web The Failure To Plan For Death Can Result In:

Web (i) a member shall transfer all or a portion of his or her membership interest in accordance with 6.1 or 6.2 hereof [lifetime transfers to blood relatives], or (ii) a member. Web florida llc membership interest will also be transferred without passing through probate court if the company has a signed transfer on death form. Web for instance, a client may ask me to express that if on of the member’s dies the remaining llc member will inherit the decedent’s interest, or that the decedent’s. Web discover how to transfer llc ownership at death without probate through the uniform tod act and joint tenancy with rights of survivorship.