Texas Form 801

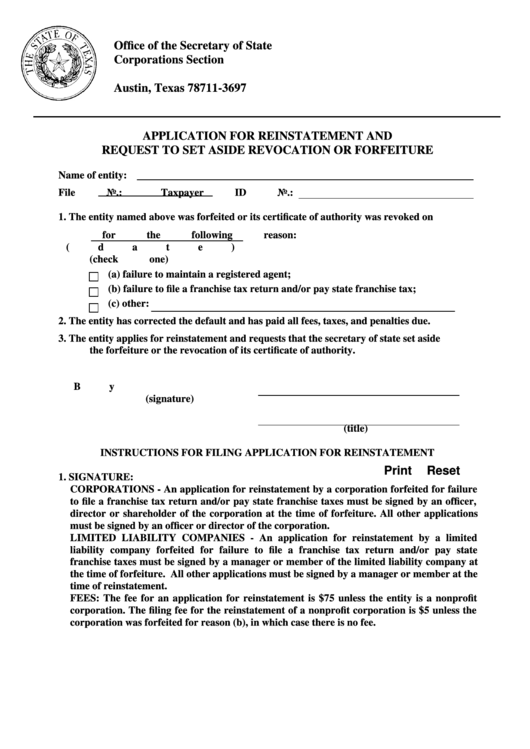

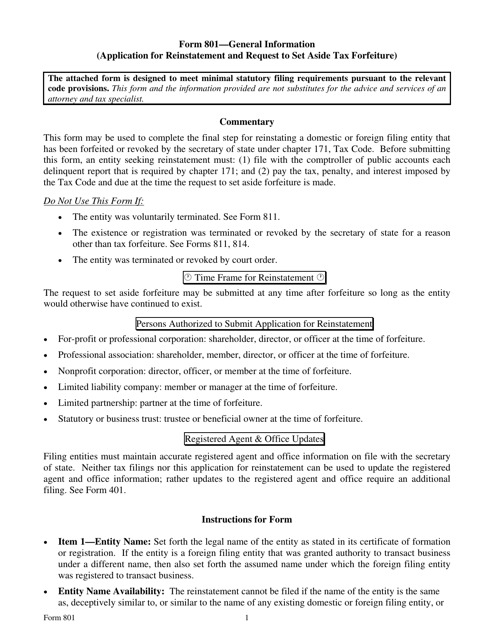

Texas Form 801 - Web texas form 801 is a state form that is used to report and remit sales and use tax. Web 10 rows index of report forms filed by professional. Web this form may be used to complete the final step for reinstating a domestic or foreign filing entity that has been forfeited or revoked by the secretary of state under chapter 171, tax. The office strongly encourages electronic filing through. Ad download or email tx form 801 & more fillable forms, register and subscribe now! Appointment of an agent by. (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171; Web this form, an entity seeking reinstatement must: If your address has changed, please. Web form 801—general information (application for reinstatement and request to set aside tax forfeiture) the attached form is designed to meet minimal statutory filing.

Web texas form 801 is a state form that is used to report and remit sales and use tax. Ad download or email tx form 801 & more fillable forms, register and subscribe now! Web if your llc was terminated for failing to pay the texas franchise tax, you’ll need to file the application for reinstatement and request to set aside tax forfeiture (form 801). Web this form, an entity seeking reinstatement must: Web form 801 requirements instructions for filing a reinstatement of a domestic or foreign filing entity following a tax forfeiture (form 801) Get everything done in minutes. The secretary of state is aware that many transactions in the business and financial world are time sensitive. Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code. The form may be mailed to p.o. Form to be used to file the annual report required by law of a texas partnership registered as a limited liability partnership.

Conversion domestic limited liability partnerships; Agreement for electronic delivery of tax bills. And (2) pay the tax,. Get everything done in minutes. The document has moved here. The office strongly encourages electronic filing through. (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171; The form may be mailed to p.o. Web termination of a domestic entity; Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code.

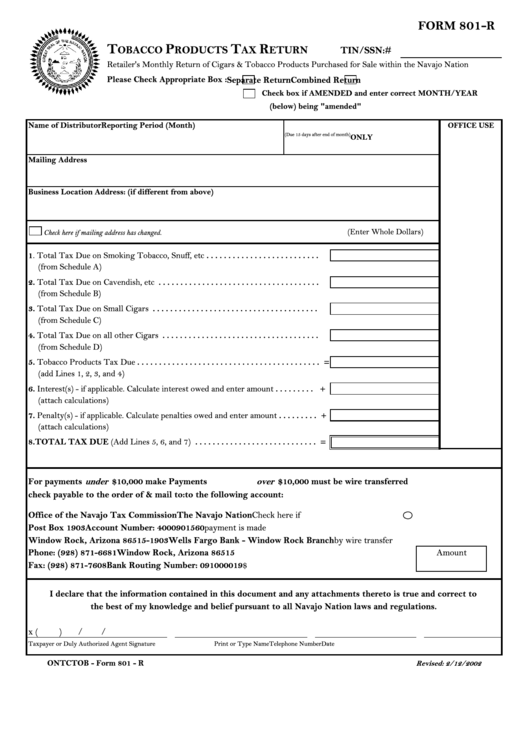

Form 801R Tobacco Products Tax Return Form printable pdf download

The form may be mailed to p.o. Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code. (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171; Web the way to fill out the 811 online: This form must be filed on a monthly basis, and the due.

Fillable Form 801 Application For Reinstatement And Request To Set

Agreement for electronic delivery of tax bills. Appointment of an agent by. The secretary of state is aware that many transactions in the business and financial world are time sensitive. Web texas comptroller of public accounts. Web texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible.

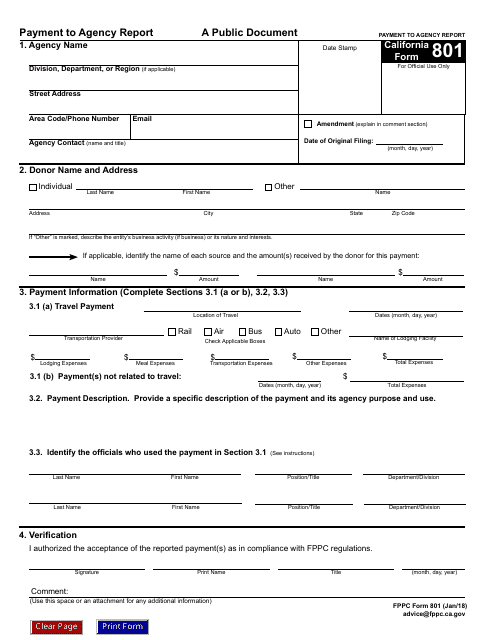

FPPC Form 801 Download Fillable PDF or Fill Online Payment to Agency

The document has moved here. This agreement is to provide for electronic delivery of tax bills pursuant to tax. The secretary of state is aware that many transactions in the business and financial world are time sensitive. Sign online button or tick the preview image of the document. Web form 801 requirements instructions for filing a reinstatement of a domestic.

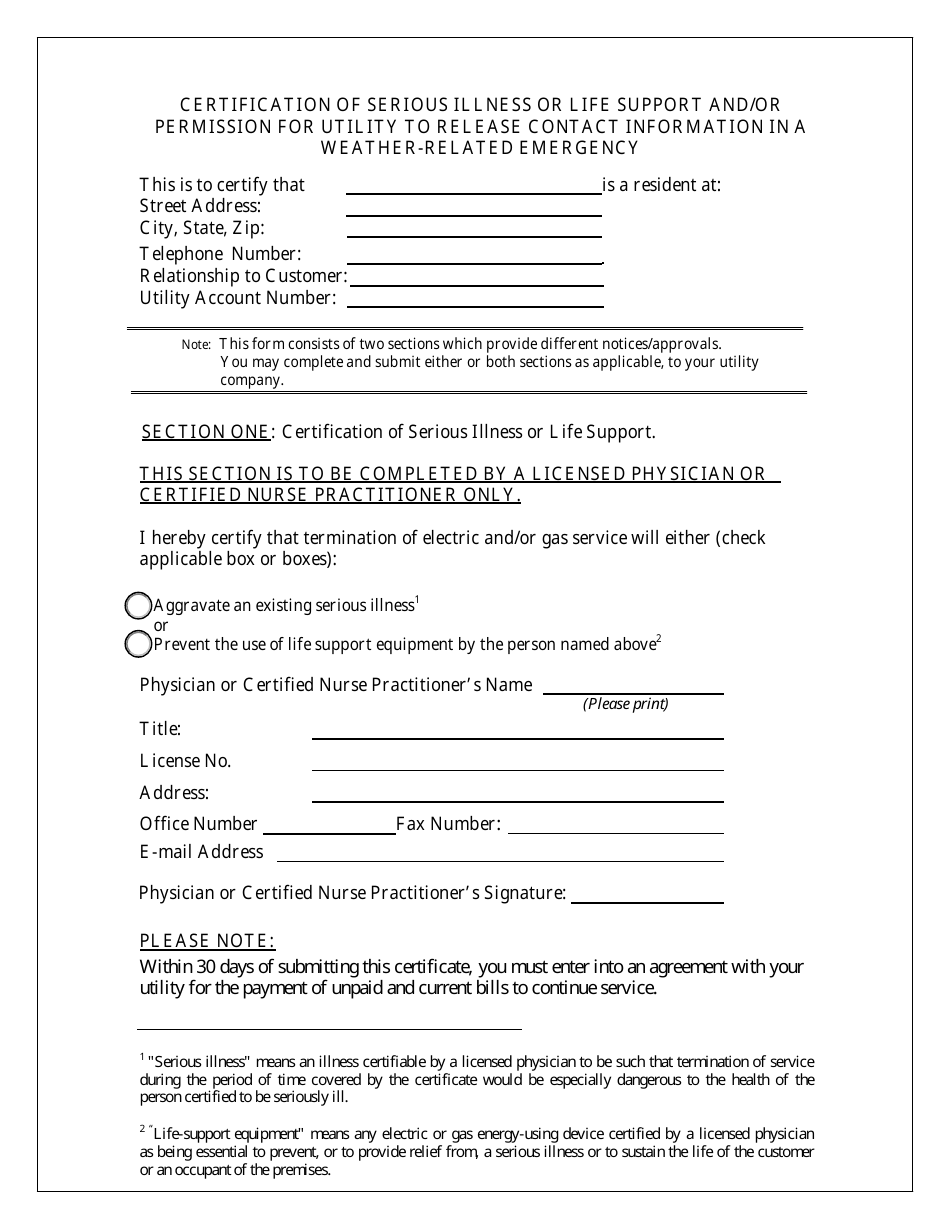

Form PSC801 Download Fillable PDF or Fill Online Certification of

Registration of a texas limited liability partnership. The document has moved here. Conversion domestic limited liability partnerships; This agreement is to provide for electronic delivery of tax bills pursuant to tax. Certificate of formation for a texas nonprofit corporation (form 202) or.

Disclaimer of inheritance form california Fill out & sign online DocHub

And (2) pay the tax,. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. To begin the document, utilize the fill camp; Web texas comptroller of public accounts. If your address has changed, please.

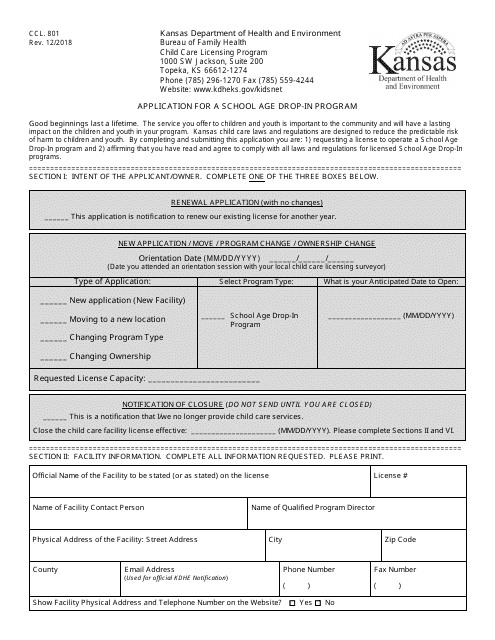

Form CCL.801 Download Printable PDF or Fill Online Application for a

The office strongly encourages electronic filing through. Appointment of an agent by. Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code. Web texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Get everything done in minutes.

Form 801 Download Fillable PDF or Fill Online Application for

The office strongly encourages electronic filing through. Conversion domestic limited liability partnerships; Web this form may be used to complete the final step for reinstating a domestic or foreign filing entity that has been forfeited or revoked by the secretary of state under chapter 171, tax. Get everything done in minutes. This form must be filed on a monthly basis,.

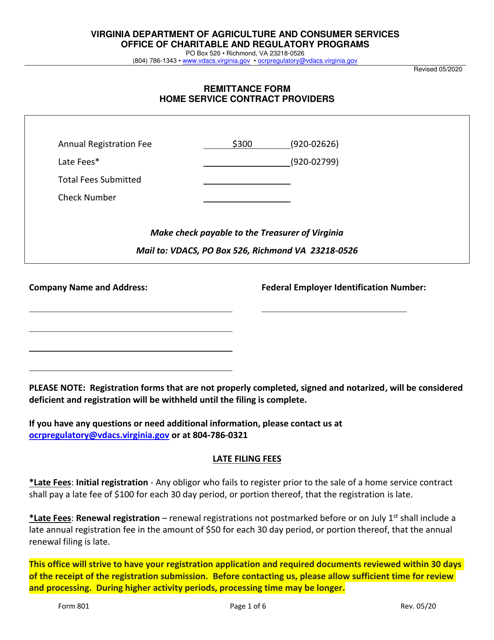

Form 801 Download Fillable PDF or Fill Online Home Service Contract

(1) file with the comptroller of public accounts each delinquent report that is required by chapter 171; The document has moved here. Ad download or email tx form 801 & more fillable forms, register and subscribe now! Registration of a texas limited liability partnership. Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code.

801_dtz_form online und überall Deutsch lernen

Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code. Web if your llc was terminated for failing to pay the texas franchise tax, you’ll need to file the application for reinstatement and request to set aside tax forfeiture (form 801). Web this form may be used to complete the final step for reinstating a.

2008 Form TX Comptroller 01339 Fill Online, Printable, Fillable, Blank

And (2) pay the tax,. Web termination of a domestic entity; Web texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. The form 801 texas is for residents who are receiving state assistance and need to apply for a new medicare card. Web the way to fill out.

Web This Form May Be Used To Complete The Final Step For Reinstating A Domestic Or Foreign Filing Entity That Has Been Forfeited Or Revoked By The Secretary Of State Under Chapter 171, Tax.

Web certificate of formation for a texas professional association or limited partnership (forms 204, 207) $750. Sign online button or tick the preview image of the document. Web termination of a domestic entity; The document has moved here.

Certificate Of Formation For A Texas Nonprofit Corporation (Form 202) Or.

Web form 801 requirements instructions for filing a reinstatement of a domestic or foreign filing entity following a tax forfeiture (form 801) Registration of a texas limited liability partnership. Web form 801—general information (application for reinstatement and request to set aside tax forfeiture) the attached form is designed to meet minimal statutory filing. To begin the document, utilize the fill camp;

This Form Must Be Filed On A Monthly Basis, And The Due Date For The Return Is The 20Th Day Of.

Web an entity forfeited under the tax code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all. Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code. Appointment of an agent by. The secretary of state is aware that many transactions in the business and financial world are time sensitive.

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

If your address has changed, please. Web if your llc was terminated for failing to pay the texas franchise tax, you’ll need to file the application for reinstatement and request to set aside tax forfeiture (form 801). Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code. (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171;