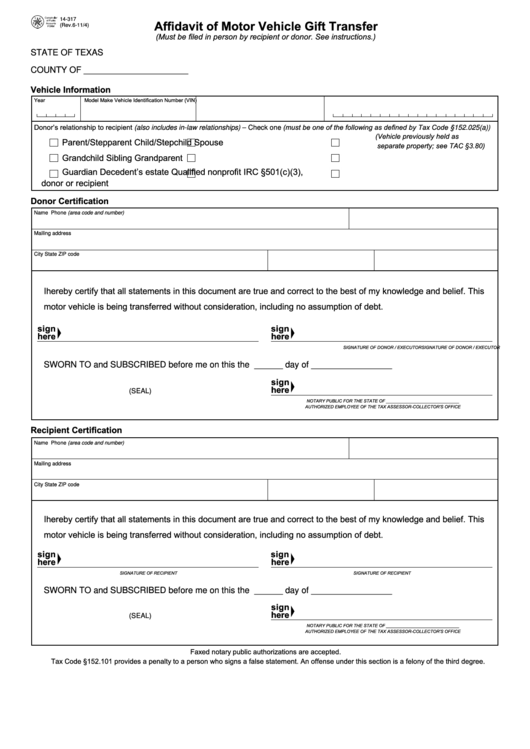

Texas Comptroller Form 14 317

Texas Comptroller Form 14 317 - We make sure it is very simple to work with this form. The gift tax is $10, and is paid in lieu of the motor vehicle sales tax. The affidavit nd the titl application must be submitted in person by ither the donor or recipient. A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift The donor or recipient filing the affidavit must file in person and must provide a valid form of identification. Effective june 19, 2011, sb 267: You can begin using your pdf file by only pressing the button down below. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web we would like to show you a description here but the site won’t allow us. Tax code section 152.101 provides a penalty.

Use the file number assigned by the texas secretary of state. Sexually oriented business fee forms. We are not affiliated with any brand or entity on this form. We make sure it is very simple to work with this form. The donor and recipient must both sign the affidavit and title application. Upload, modify or create forms. The gift tax is $10, and is paid in lieu of the motor vehicle sales tax. The affidavit nd the titl application must be submitted in person by ither the donor or recipient. Tax code section 152.101 provides a penalty. Web mixed beverage tax forms.

The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Sexually oriented business fee forms. Web we would like to show you a description here but the site won’t allow us. You can begin using your pdf file by only pressing the button down below. The donor and recipient must both sign the affidavit and title application. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required. Try it for free now! We make sure it is very simple to work with this form. Web the transfer of an unencumbered motor vehicle to a beneficiary of a testamentary trust or a revocable trust subject to the provisions of the trust instrument. Web mixed beverage tax forms.

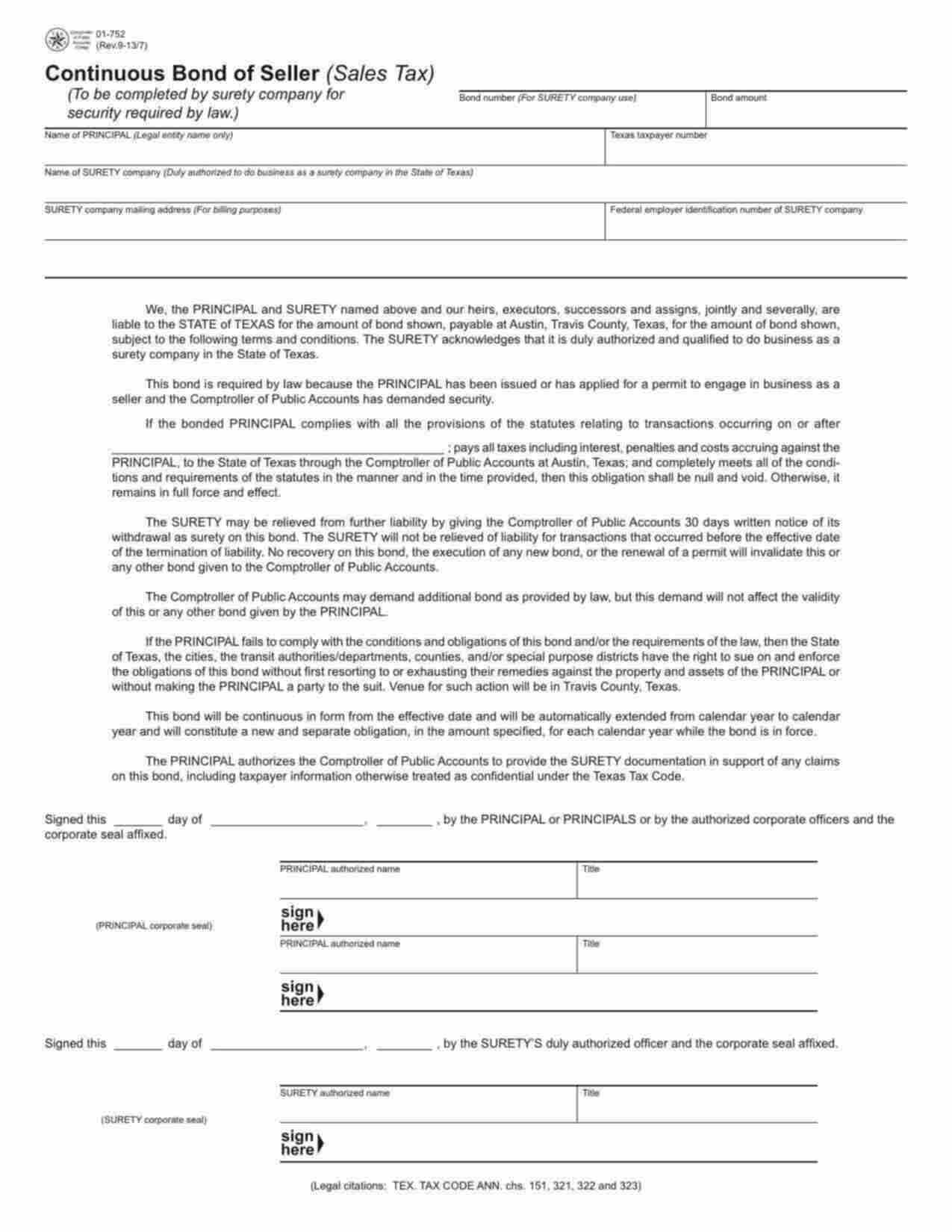

Surety Bond State of Texas Comptroller of Public Accounts Continuous

See rule 3.80.) do not send to the comptroller’s office. The affidavit nd the titl application must be submitted in person by ither the donor or recipient. Either the donor or recipient must submit all forms. Upload, modify or create forms. A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that.

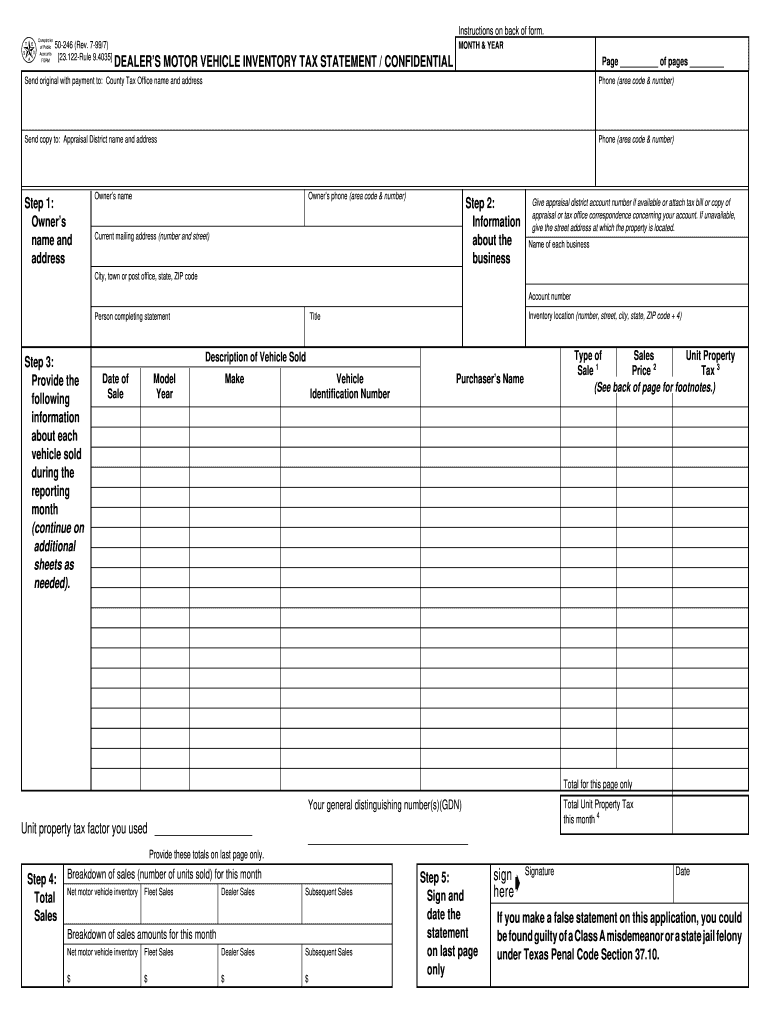

TX Comptroller 50246 1999 Fill out Tax Template Online US Legal Forms

The donor and recipient must both sign the affidavit and title application. Affidavit requires both the donor and recipient's signature to be notarized. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required. A transaction in which a motor vehicle is transferred to.

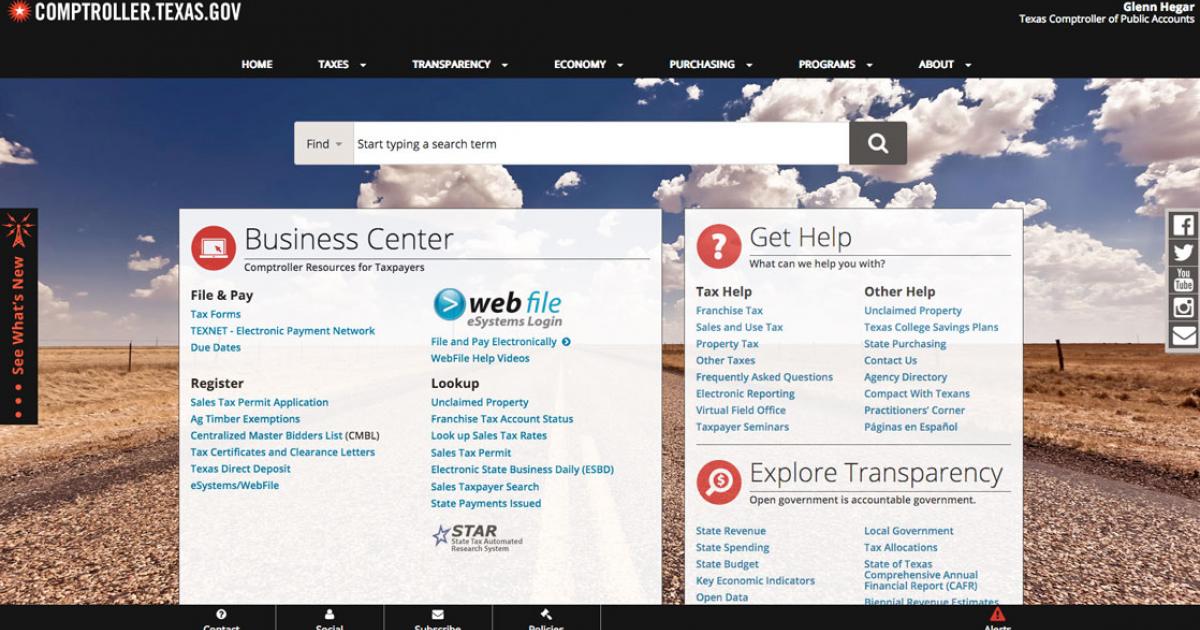

Texas Comptroller Launches New Website

The gift tax is $10, and is paid in lieu of the motor vehicle sales tax. Affidavit requires both the donor and recipient's signature to be notarized. Web we would like to show you a description here but the site won’t allow us. Web mixed beverage tax forms. Use the tx transfer 2015 template to automate your rmv workflows and.

COMPTROLLER FORM 14317 PDF

The donor and recipient must both sign the affidavit and title application. A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift Web mixed beverage tax forms. Either the donor or recipient must submit all forms. Tax code section 152.101 provides a penalty.

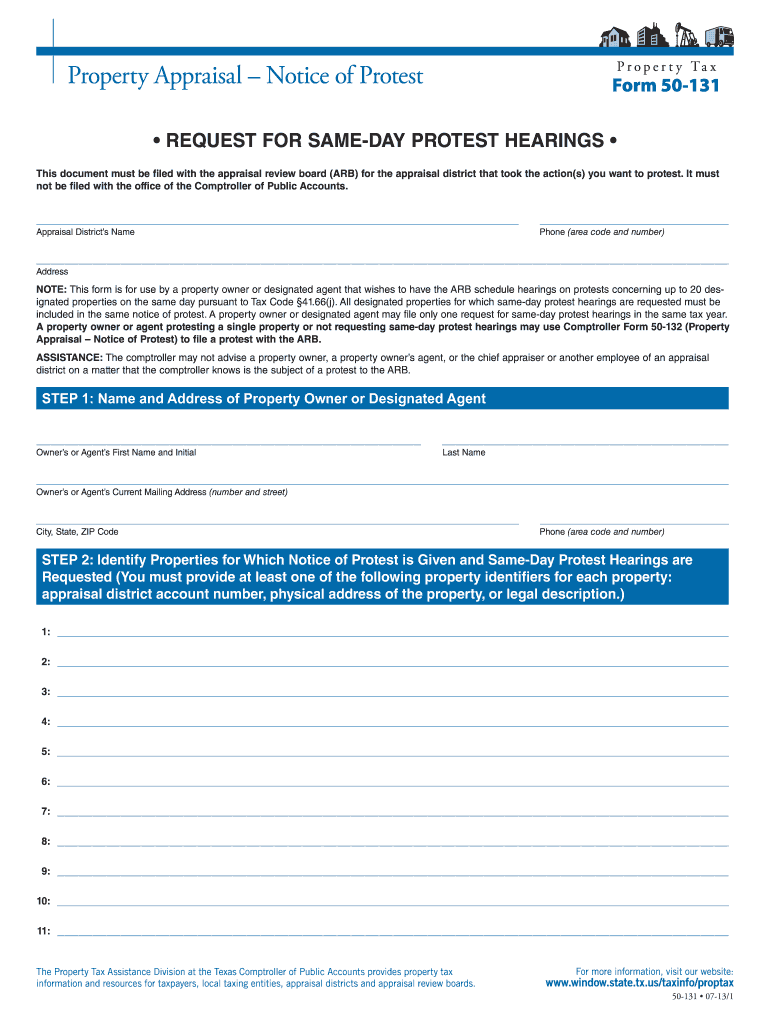

Comptroller Texas Gov Forms 50 131 Pdf Fill Out and Sign Printable

Either the donor or recipient must submit all forms. The donor and recipient must both sign the affidavit and title application. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. We make sure it is very simple to work with this.

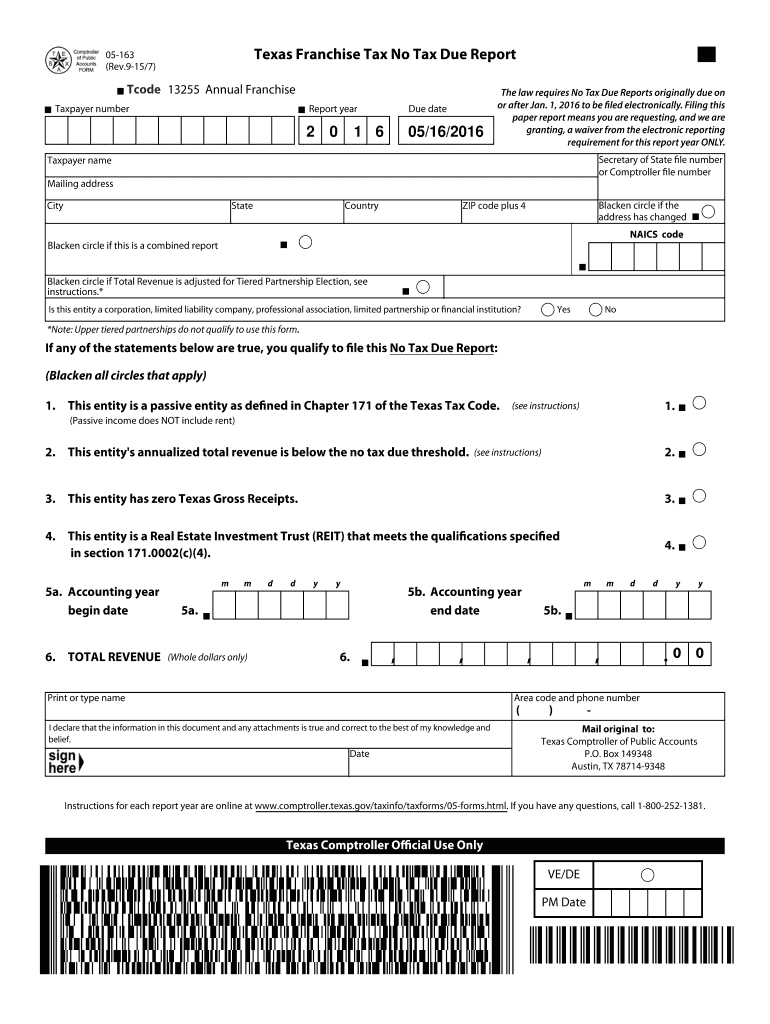

2015 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

The gift tax is $10, and is paid in lieu of the motor vehicle sales tax. Affidavit requires both the donor and recipient's signature to be notarized. Sexually oriented business fee forms. Use the file number assigned by the texas secretary of state. The donor and recipient must both sign the affidavit and title application.

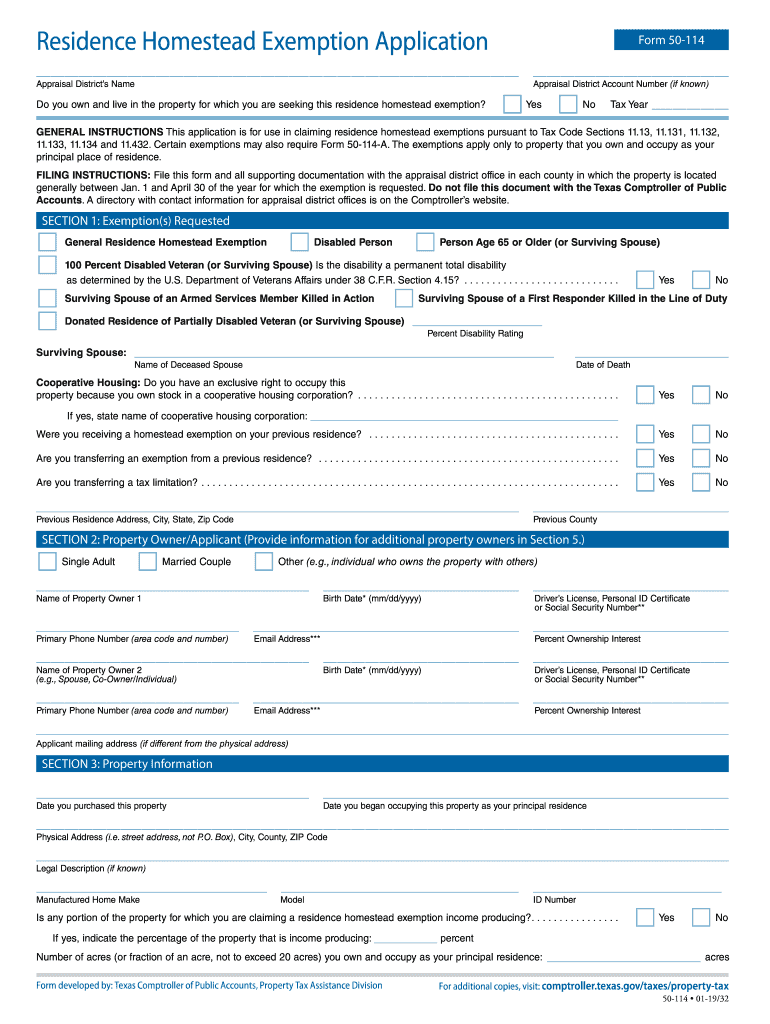

TX Comptroller 50114 2019 Fill out Tax Template Online US Legal Forms

Sexually oriented business fee forms. We make sure it is very simple to work with this form. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web mixed beverage tax forms. Upload, modify or create forms.

Form 14 312 Texas Fill Online, Printable, Fillable, Blank pdfFiller

The donor or recipient filing the affidavit must file in person and must provide a valid form of identification. Tax code section 152.101 provides a penalty. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required. Web we would like to show you.

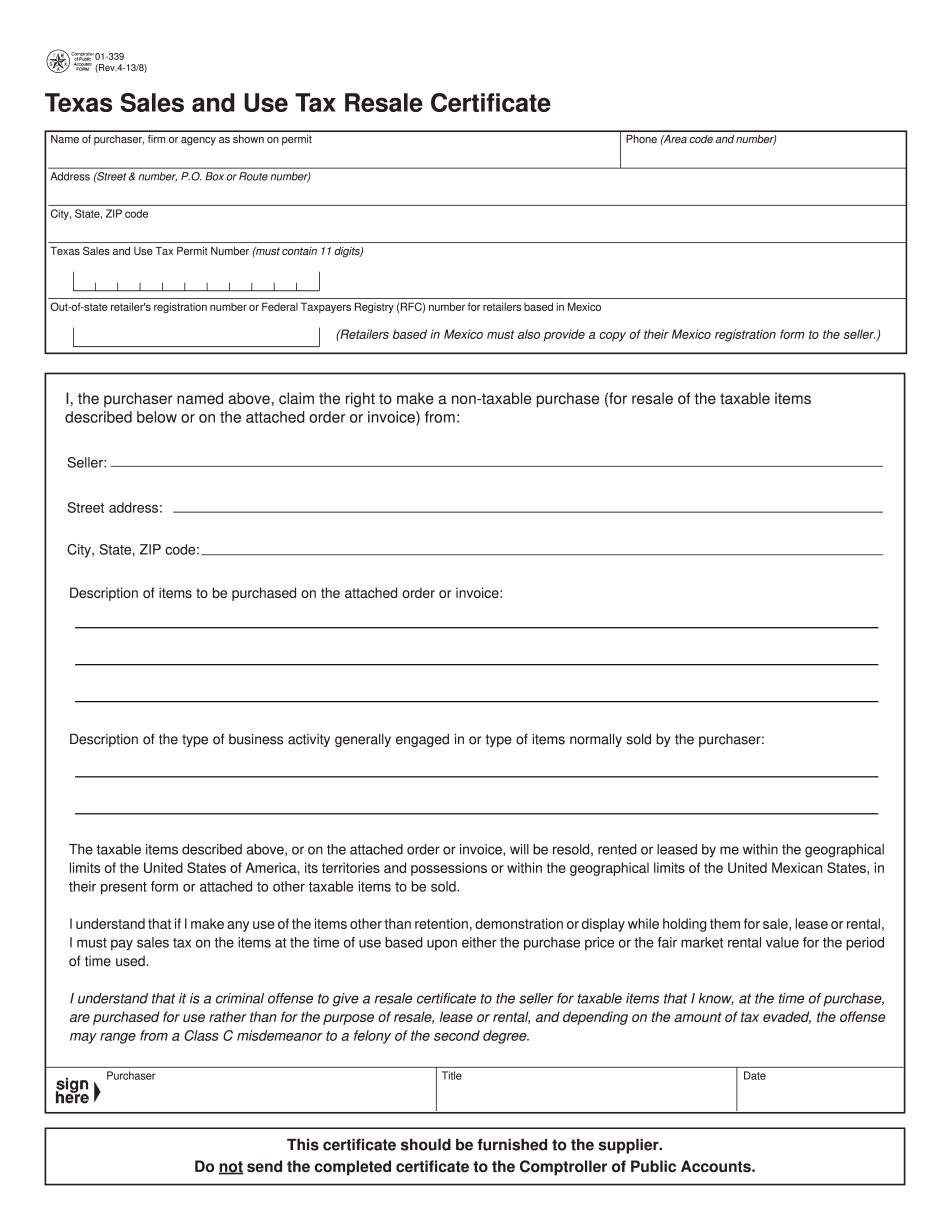

TX Comptroller 01339 2022 Form Printable Blank PDF Online

Use the tx transfer 2015 template to automate your rmv workflows and close deals faster. A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift Use the file number assigned by the texas secretary of state. Affidavit requires both the donor and recipient's signature to.

You Can Begin Using Your Pdf File By Only Pressing The Button Down Below.

Effective june 19, 2011, sb 267: A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift The donor and recipient must both sign the affidavit and title application. Web the transfer of an unencumbered motor vehicle to a beneficiary of a testamentary trust or a revocable trust subject to the provisions of the trust instrument.

We Make Sure It Is Very Simple To Work With This Form.

Try it for free now! We are not affiliated with any brand or entity on this form. The purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Either the donor or recipient must submit all forms.

The Gift Tax Is $10, And Is Paid In Lieu Of The Motor Vehicle Sales Tax.

The gift tax is $10, and is paid in lieu of the motor vehicle sales tax. The donor and recipient must both sign the affidavit and title application. The affidavit nd the titl application must be submitted in person by ither the donor or recipient. See rule 3.80.) do not send to the comptroller’s office.

The Purpose Of This Affidavit Is To Document The Gift Of A Motor Vehicle To An Eligible Recipient As Required By Texas Tax Code Section 152.062, Required.

Use the tx transfer 2015 template to automate your rmv workflows and close deals faster. Sexually oriented business fee forms. Tax code section 152.101 provides a penalty. Use the file number assigned by the texas secretary of state.