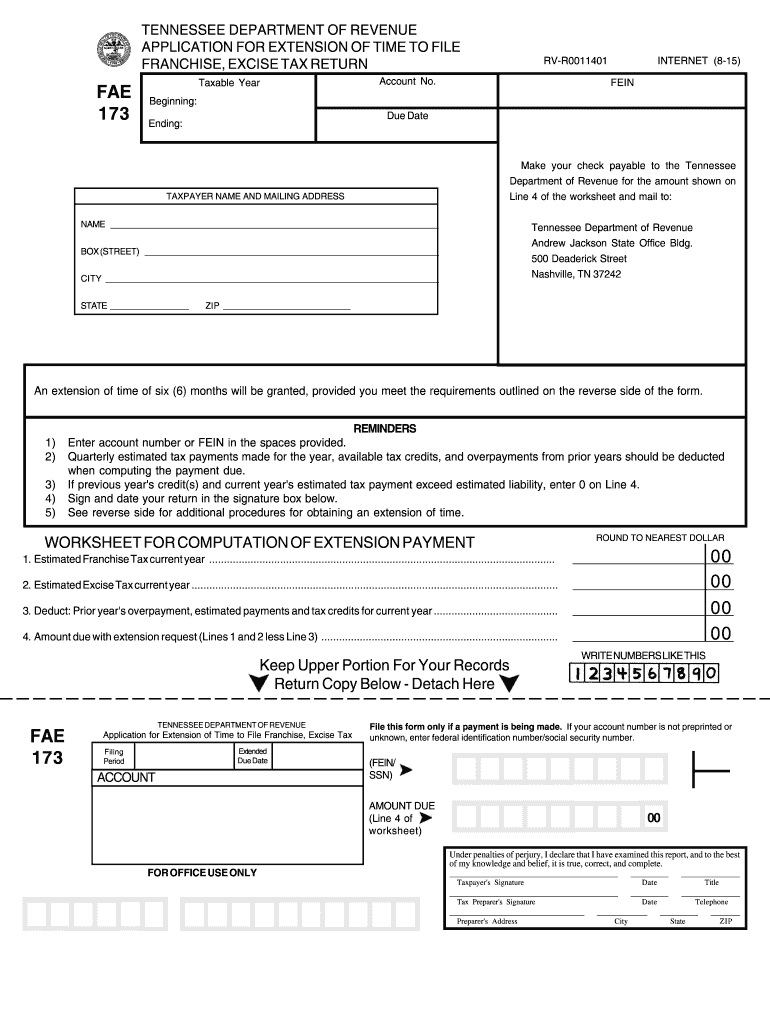

Tennessee Form Fae 173

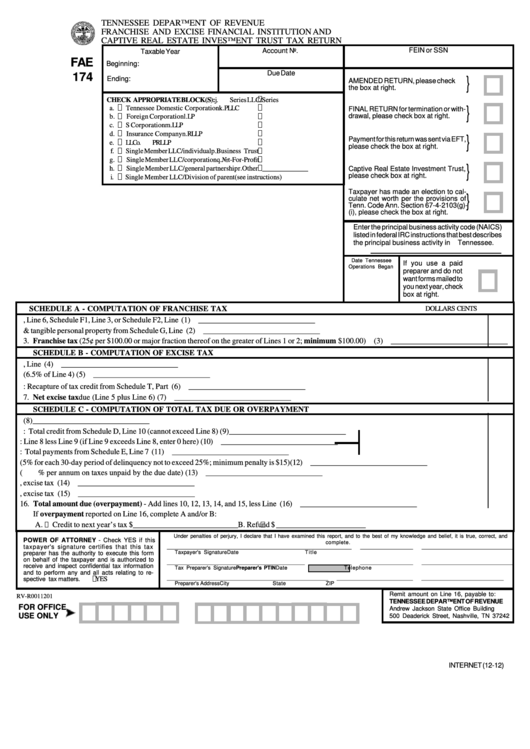

Tennessee Form Fae 173 - What form does the state require to file an extension? Web we've got more versions of the tennessee franchise excise form. This form is for income earned in tax year 2022, with tax. Select the right tennessee franchise excise version from the list and start editing it straight away! Web date tennessee operations began, whichever occurred first. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Deadline to file an extension with the. Does tennessee support tax extension for business income tax returns?

Deadline to file an extension with the. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or through a mail service to meet the payment. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. In taxslayer pro, this form is on the main menu of the tennessee franchise & excise tax return. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax. Web fae 173 tennessee department of revenue filing period account fae 173 application for extension of time to file franchise, excise tax an extension of time of. What form does the state require to file an extension? Form fae 173, application for extension of time to. Use get form or simply click on the template preview to open it in the editor. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets.

Web tennessee fae 173 form is a standardized test required to become licensed as a psychologist in the state of tennessee. Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Web the extension request is filed on form fae 173. Web we've got more versions of the tennessee franchise excise form. Does tennessee support tax extension for business income tax returns? Form fae 173, application for extension of time to. Web using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. The application for exemption should be completed by. Easily fill out pdf blank, edit, and sign them.

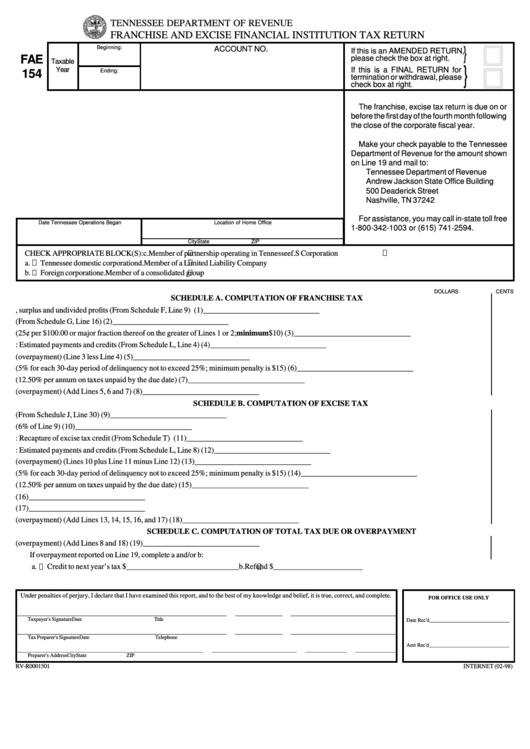

Fillable Form Fae 154 Franchise And Excise Financial Institution Tax

Web the extension request is filed on form fae 173. Web how do i generate the fae 173 for a tennessee corporation using worksheet view? • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or through a mail service to meet the payment. Easily fill out pdf.

TN DoR FAE 173 2017 Fill out Tax Template Online US Legal Forms

Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web tennessee fae 173 form is a standardized test required to become licensed as a psychologist in the state of tennessee. Go to the other > extensions worksheet. The application for exemption should be completed by. What form does the state require to file.

Dibujo digital de Lefty FNaF Amino [ Español ] Amino

Get form now download pdf tennessee fae. Deadline to file an extension with the. Web date tennessee operations began, whichever occurred first. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax. Web the extension request is filed on form fae 173.

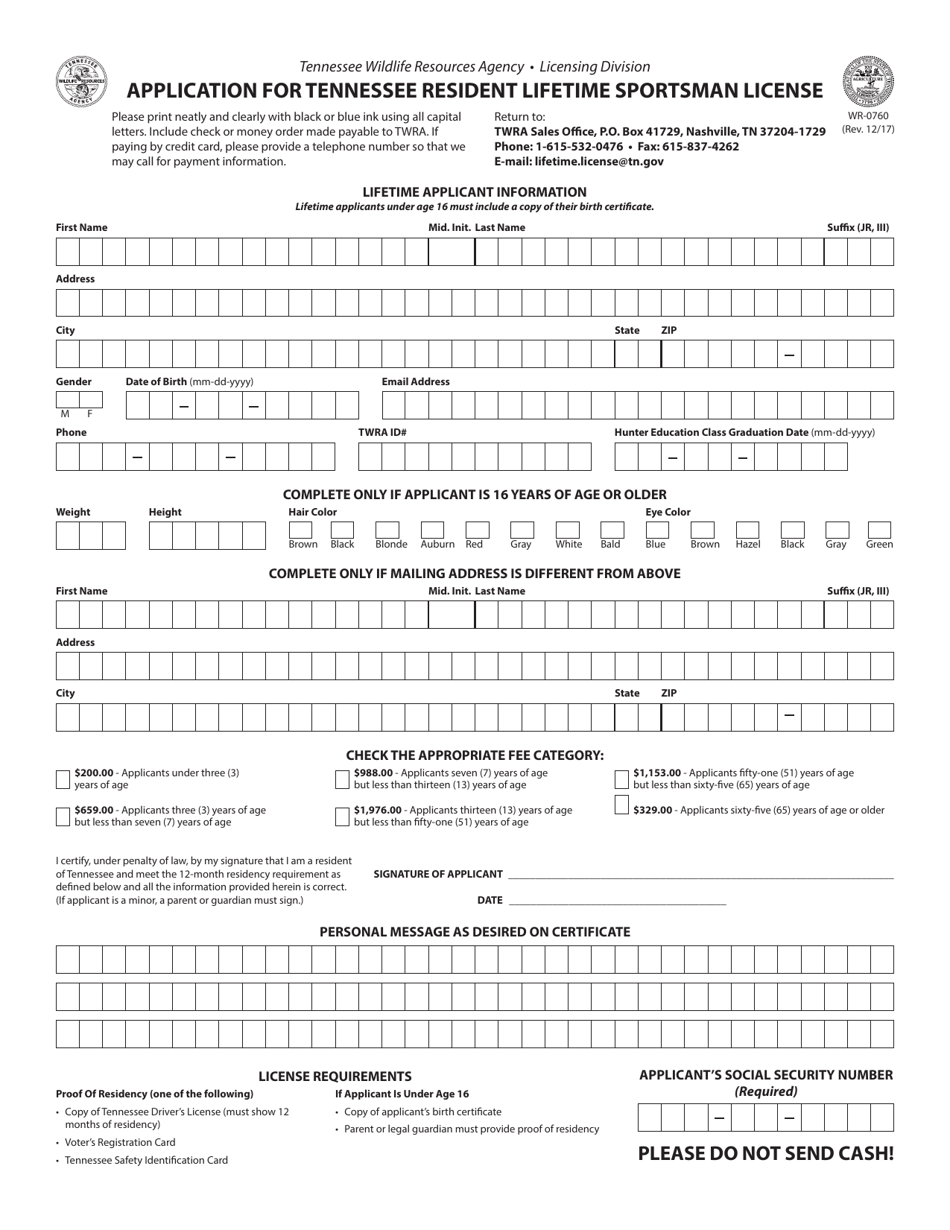

Form WR0760 Download Printable PDF or Fill Online Application for

In taxslayer pro, this form is on the main menu of the tennessee franchise & excise tax return. What form does the state require to file an extension? Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount shown on line 4 of the. Go to the.

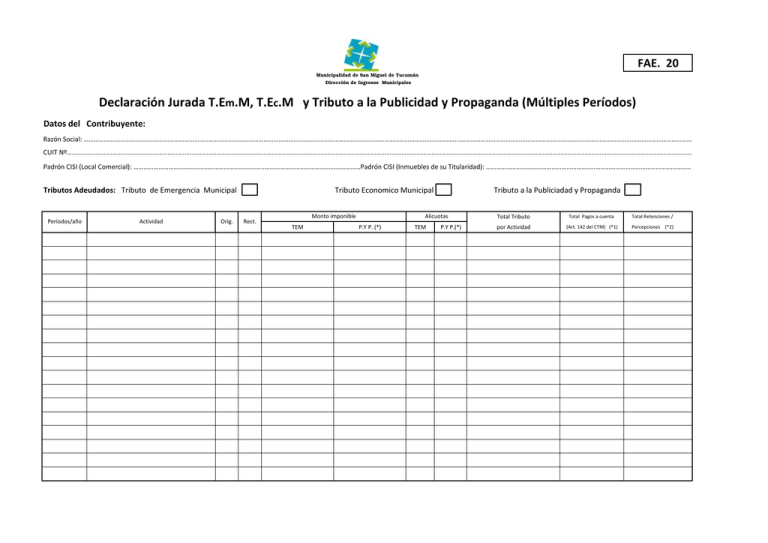

FORM. FAE.20.xlsx

Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Deadline to file an extension with the. In taxslayer pro, this form is on the main menu of the tennessee franchise & excise tax return. Unless otherwise specified,.

Tennessee Fae 172 Form ≡ Fill Out Printable PDF Forms Online

This form is for income earned in tax year 2022, with tax. In taxslayer pro, this form is on the main menu of the tennessee franchise & excise tax return. Web we've got more versions of the tennessee franchise excise form. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure.

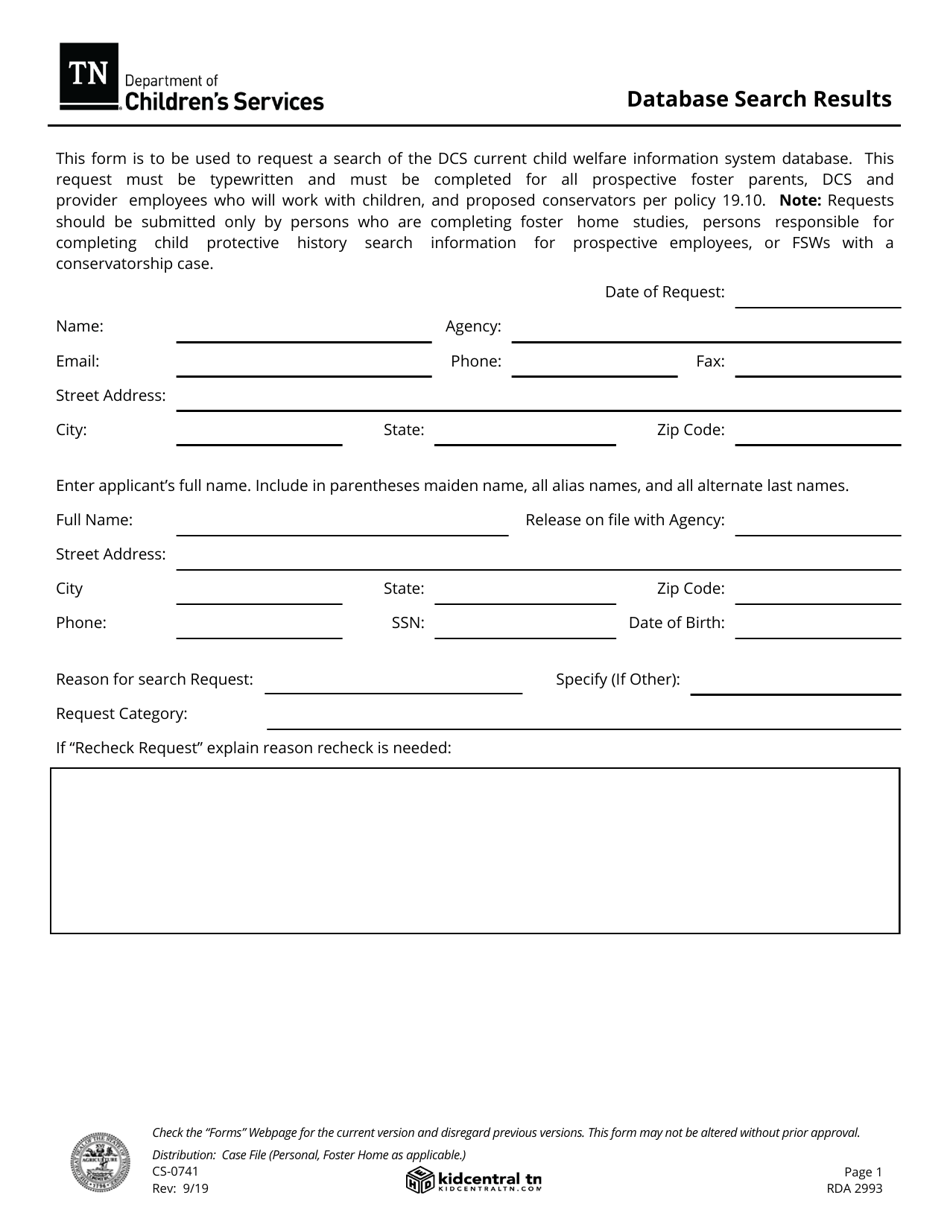

Form CS0741 Download Fillable PDF or Fill Online Database Search

The application for exemption should be completed by. Select the right tennessee franchise excise version from the list and start editing it straight away! Web we've got more versions of the tennessee franchise excise form. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information,.

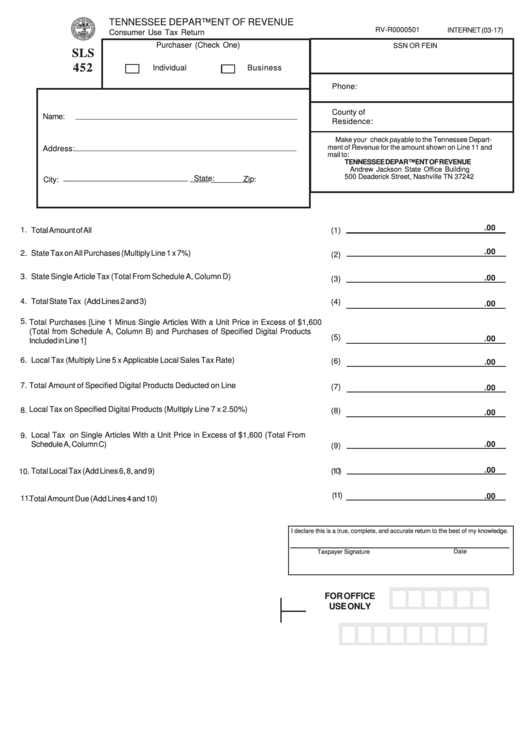

411 Tennessee Department Of Revenue Forms And Templates free to

Web tennessee fae 173 form is a standardized test required to become licensed as a psychologist in the state of tennessee. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax. Does tennessee support tax extension for business income tax returns? Unless otherwise.

2015 Form TN DoR FAE 173 Fill Online, Printable, Fillable, Blank

Web we've got more versions of the tennessee franchise excise form. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or.

Top 56 Tennessee Tax Exempt Form Templates free to download in PDF format

Use get form or simply click on the template preview to open it in the editor. Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount shown on line 4 of the. Deadline to file an extension with the. Save or instantly send your ready documents. In.

Save Or Instantly Send Your Ready Documents.

Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount shown on line 4 of the. Deadline to file an extension with the. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web the extension request is filed on form fae 173.

Taxpayers Incorporated Or Otherwise Formed Outside Tennessee Must Prorate The Franchise Tax On The Initial Return.

Form fae 173, application for extension of time to. What form does the state require to file an extension? Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Web how do i generate the fae 173 for a tennessee corporation using worksheet view?

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. Get form now download pdf tennessee fae. Use get form or simply click on the template preview to open it in the editor. Web date tennessee operations began, whichever occurred first.

Web Tennessee Fae 173 Form Is A Standardized Test Required To Become Licensed As A Psychologist In The State Of Tennessee.

Web fae 173 tennessee department of revenue filing period account fae 173 application for extension of time to file franchise, excise tax an extension of time of. Select the right tennessee franchise excise version from the list and start editing it straight away! Web we've got more versions of the tennessee franchise excise form. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or through a mail service to meet the payment.

![Dibujo digital de Lefty FNaF Amino [ Español ] Amino](https://pm1.narvii.com/7048/865ef5d5163cdb851d55b169ef1a2a08eed66828r1-800-1280v2_hq.jpg)