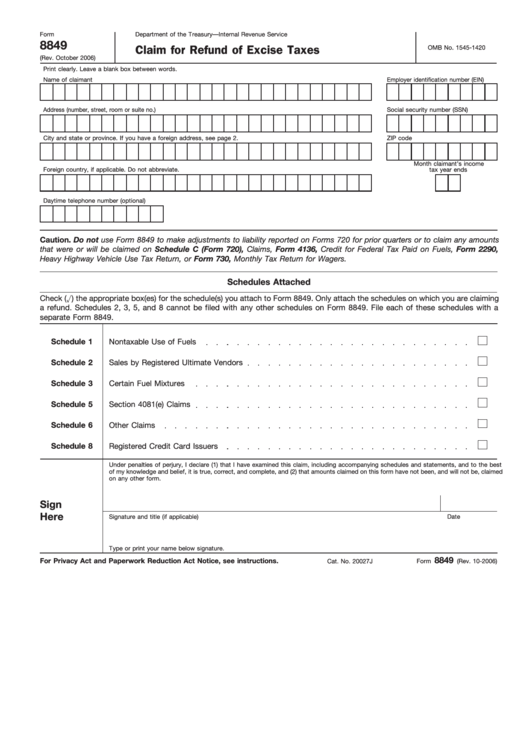

Tax Form 8849

Tax Form 8849 - If you checked the box on line 2, send form 8822 to:. File your irs 2290 form in just a few clicks. Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. They can also use this form to claim certain. Taxpayers can use the irs form 8849 to file a claim for acquiring refunds of the excise taxes. Web august 23, 2021. There is no deadline to file your form. This is a separate return from the individual tax return. Form 8849 lists the schedules by number and title. Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales.

Use schedule 6 for other claims, including refunds of excise taxes reported on: Form 8849 of the irs is used to claim a refund on the excise taxes. File your irs 2290 form in just a few clicks. Web form department of the treasury—internal revenue service 8849 (rev. Web form 8849 and its instructions or separate schedules, such as legislation enacted after they were published, go to www.irs.gov/form8849. Web august 23, 2021. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web what is form 8849? They can also use this form to claim certain. Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales.

Web form 8849 to claim for refund of excise taxes form 8849 is used to claim a refund of excise taxes reported on hvut form 2290. Web what is form 8849? January 2002) claim for refund of excise taxes omb no. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. If you are not a filer of form 720, 730, or 2290, file form 8849 with the service. Offering electronic filing of form 8849 satisfies the congressional. Taxpayers have to attach schedule 1,2,3,5 and 8 to claim relevant refunds. If you paid additional 2290 tax to the irs while filing a tax return, you can file the irs form 8849 to. If you checked the box on line 2, send form 8822 to:. Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely.

Instructions to Claim Credits Using Tax Form 8849

They can also use this form to claim certain. Taxpayers can use the irs form 8849 to file a claim for acquiring refunds of the excise taxes. Taxpayers also use the irs 8849 to claim certain. Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8.

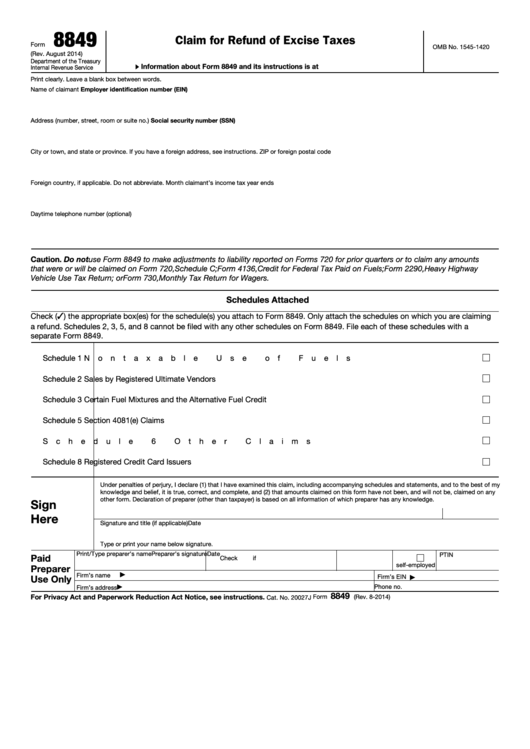

Form 8849 (Schedule 6) Other Claims of Taxes IRS Form (2014) Free

Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely. Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. This is.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. Form 8849 lists the schedules by number and title. Use schedule 6 for other claims, including refunds of excise taxes reported on: Effective july 30, 2021, you are required to file your sales and use tax returns.

Fill Free fillable Form 8849 2014 Claim for Refund of Excise Taxes

If you paid additional 2290 tax to the irs while filing a tax return, you can file the irs form 8849 to. Form 8849 is used to claim a refund of excise taxes. Web form 8849 to claim for refund of excise taxes form 8849 is used to claim a refund of excise taxes reported on hvut form 2290. Web.

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales. January 2002) claim for refund of excise taxes omb no. Web form department of the treasury—internal revenue service 8849 (rev. Web we last updated the claim for refund of excise taxes in february 2023, so this is the latest.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Use schedule 6 for other claims, including refunds of excise taxes reported on: They can also use this form to claim certain. There is no deadline to file your form. Get stamped schedule 1 in minutes.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Web file form 8849 with the internal revenue service center where you file form 720, 730, or 2290. If you checked the box on line 2, send form 8822 to:. What’s new changes are discussed. Get stamped schedule 1 in minutes. Web uses (or sales) of fuels.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web file form 8849 with the internal revenue service center where you file form 720, 730, or 2290. Web form department of the treasury—internal revenue service 8849 (rev. Taxpayers also use the irs 8849 to claim certain. Get stamped schedule 1 in minutes. Web uses (or sales) of fuels.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

If you paid additional 2290 tax to the irs while filing a tax return, you can file the irs form 8849 to. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Web form 8849 to claim for refund of excise taxes form 8849 is used to claim a refund of excise taxes reported.

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales. Web we last updated the claim for refund of excise taxes in february 2023, so this is the latest version of form 8849, fully updated for tax year 2022. Web august 23, 2021. Form 8849 of the irs is.

Web File Form 8849 With The Internal Revenue Service Center Where You File Form 720, 730, Or 2290.

Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely. Get stamped schedule 1 in minutes. Form 8849 is used to claim a refund of excise taxes. Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290.

Web Form 8849 To Claim For Refund Of Excise Taxes Form 8849 Is Used To Claim A Refund Of Excise Taxes Reported On Hvut Form 2290.

Taxpayers have to attach schedule 1,2,3,5 and 8 to claim relevant refunds. Web what is form 8849? Web uses (or sales) of fuels. Form 8849 of the irs is used to claim a refund on the excise taxes.

Form 8849 Lists The Schedules By Number And Title.

Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? They can also use this form to claim certain. If you paid additional 2290 tax to the irs while filing a tax return, you can file the irs form 8849 to. Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales.

Web The Following Replaces The “Where To File” Addresses On Page 2 Of Form 8822 (Rev.

Web form 8849 and its instructions or separate schedules, such as legislation enacted after they were published, go to www.irs.gov/form8849. What’s new changes are discussed. Web august 23, 2021. Taxpayers also use the irs 8849 to claim certain.