Tax Form 8453 Ol

Tax Form 8453 Ol - This form is for income earned in tax year 2022, with tax returns due in. File and pay your taxes online. Web if you received a request to submit form 8453 (u.s. Web form 843, claim for refund and request for abatement. Web part iii make estimated tax payments for taxable year 2023. Web do not mail this form to the ftb. Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card. Withdrawal date type of account: Web individual income tax forms. Find irs forms and answers to tax questions.

First payment due 4/15/2020 second. Web part iii make estimated tax payments for taxable year 2023. This form is for income earned in tax year 2022, with tax returns due in. Form 8027, employer’s annual information return of tip income and. Find irs forms and answers to tax questions. File and pay your taxes online. _____ _____ _____ _____ taxpayer’s. Web form 843, claim for refund and request for abatement. We help you understand and meet your federal tax responsibilities. These are not installment payments for the current amount you owe.

Find irs forms and answers to tax questions. If i’m only a collector, i’m. These are not installment payments for the current amount you owe. Part iv banking information (have you. First payment due 4/15/2020 second. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. Web do not mail this form to the ftb. Web part iii make estimated tax payments for taxable year 2023. By signing form ftb 8453. Web information about form 8453, u.s.

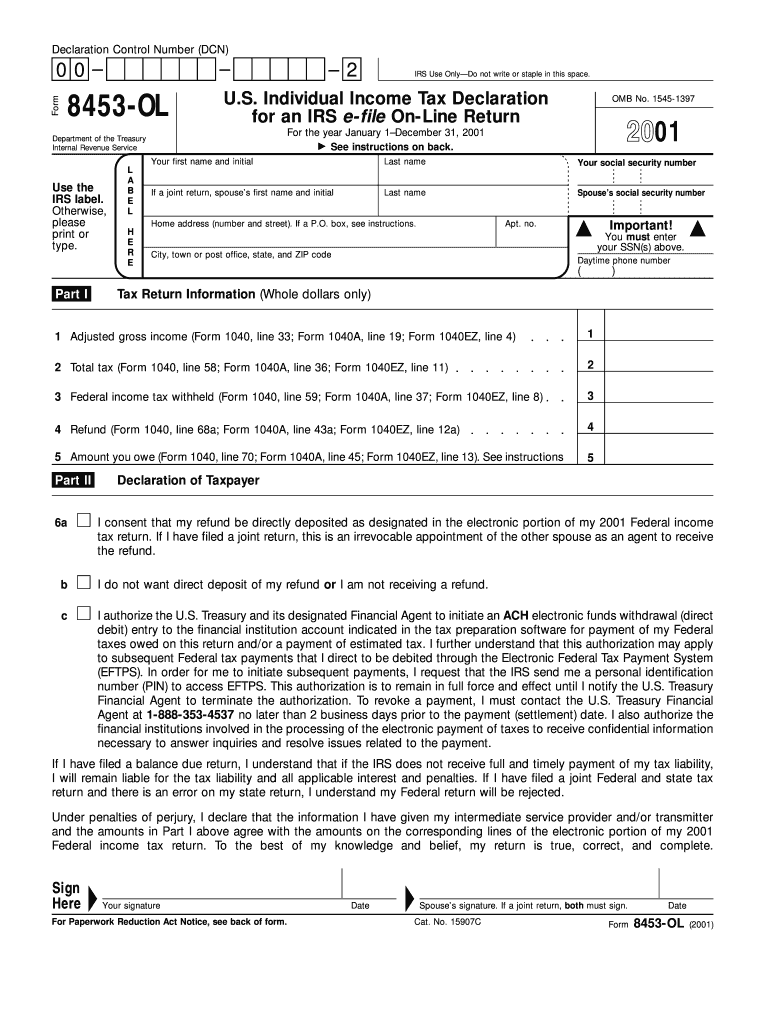

What Is IRS Form 8453OL? IRS Tax Attorney

We help you understand and meet your federal tax responsibilities. Withdrawal date type of account: Web individual income tax forms. Web part iii make estimated tax payments for taxable year 2020. Web if you received a request to submit form 8453 (u.s.

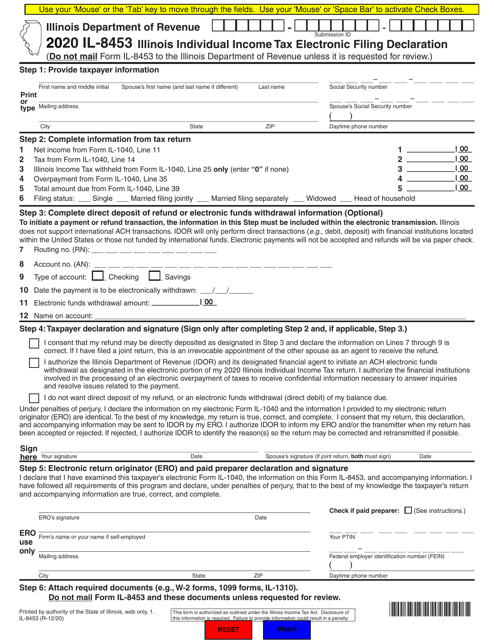

Form IL8453 Download Fillable PDF or Fill Online Illinois Individual

Part iv banking information (have you. Form 8027, employer’s annual information return of tip income and. Web if you received a request to submit form 8453 (u.s. Web do not mail this form to the ftb. These are not installment payments for the current amount you owe.

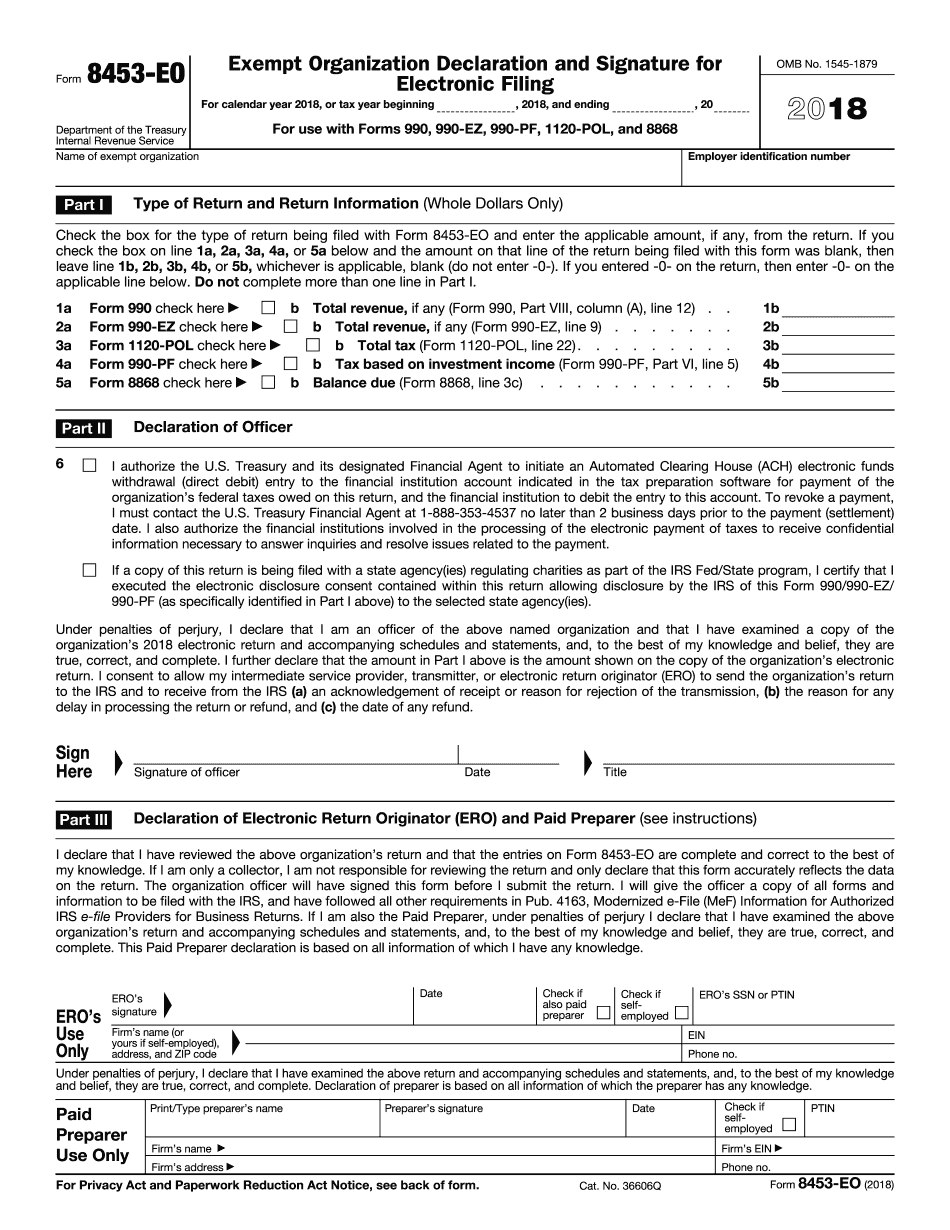

IRS Form 8453EO 2018 2019 Fill out and Edit Online PDF Template

By signing this form, you. This form is for income earned in tax year 2022, with tax returns due in. Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter,.

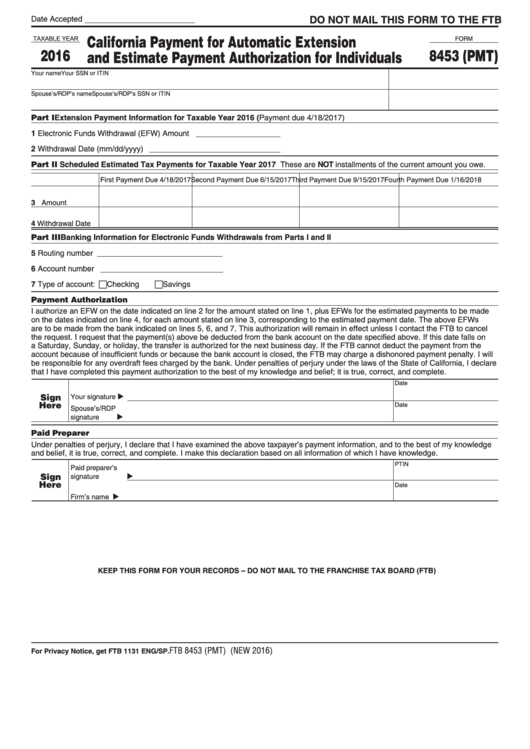

Form 8453 (Pmt) California Payment For Automatic Extension And

Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card. Web if you received a request to submit form 8453 (u.s. Part iv banking information (have you. Withdrawal date type of account: Web do not mail this form to the ftb.

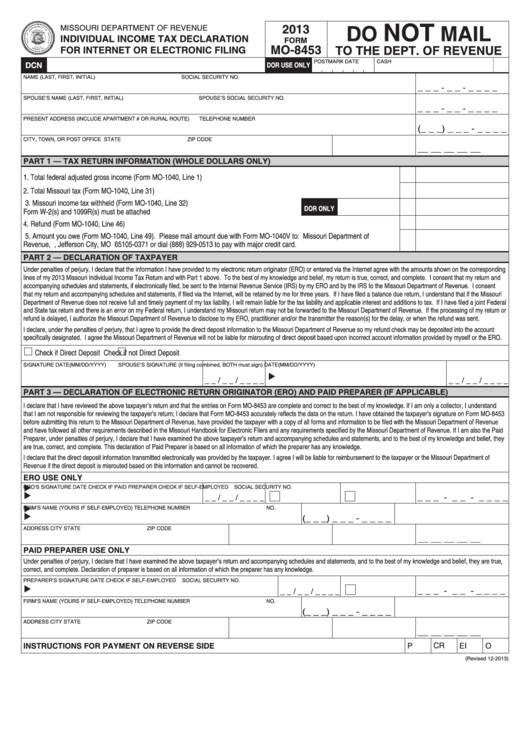

Form Mo8453 Individual Tax Declaration For Or

File and pay your taxes online. If i’m only a collector, i’m. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. Withdrawal date type of account: Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card.

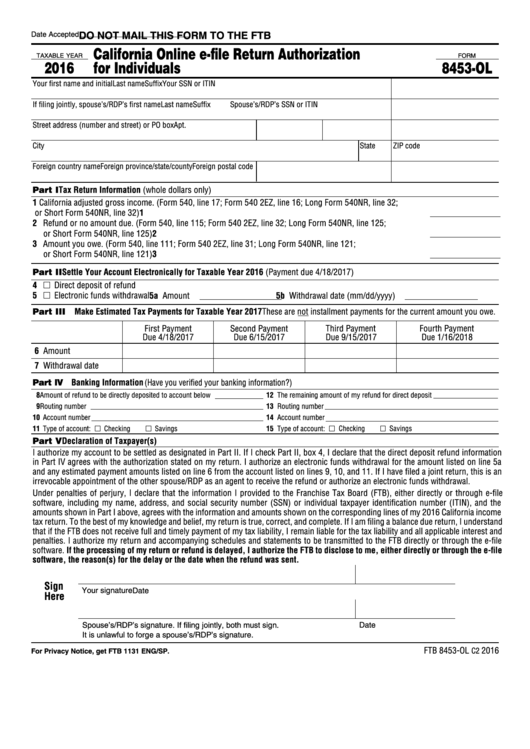

EFiling with Form FTB 8453OL H&R Block

Web part iii make estimated tax payments for taxable year 2023. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. Form 8027, employer’s annual information return of tip income and. These are not installment payments for the current amount you owe. File and pay your taxes.

Fillable Form 8453Ol California Online EFile Return Authorization

Web form 843, claim for refund and request for abatement. Web if you received a request to submit form 8453 (u.s. Web part iii make estimated tax payments for taxable year 2023. We help you understand and meet your federal tax responsibilities. Withdrawal date type of account:

Form 8453OL Fill out & sign online DocHub

These are not installment payments for the current amount you owe. First payment due 4/15/2020 second. This form is for income earned in tax year 2022, with tax returns due in. By signing this form, you. These are not installment payments for the current amount you owe.

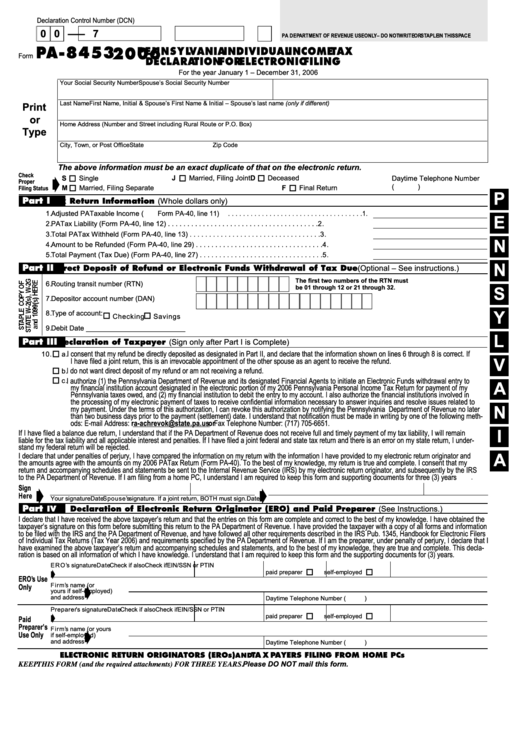

Form Pa 8453 Pennsylvania Individual Tax Declaration For

These are not installment payments for the current amount you owe. First payment due 4/15/2020 second. These are not installment payments for the current amount you owe. Withdrawal date type of account: Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card.

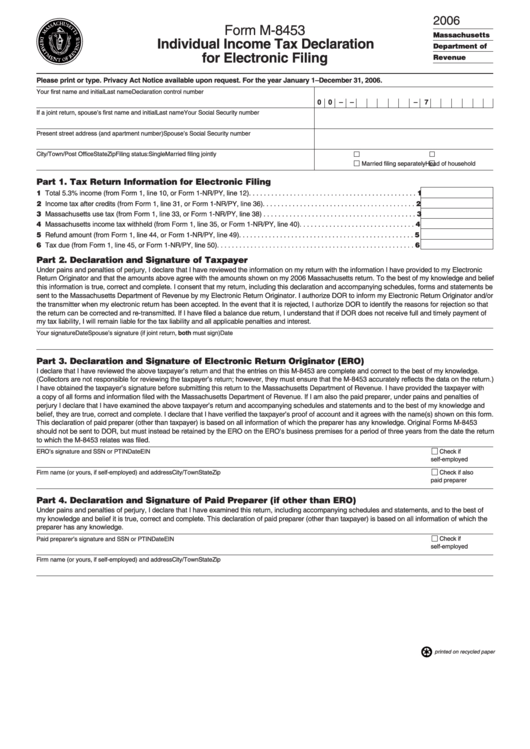

Form M8453 Individual Tax Declaration For Electronic Filing

By signing this form, you. These are not installment payments for the current amount you owe. These are not installment payments for the current amount you owe. Web part iii make estimated tax payments for taxable year 2020. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax.

Web Individual Income Tax Forms.

By signing this form, you. These are not installment payments for the current amount you owe. First payment due 4/15/2020 second. Find irs forms and answers to tax questions.

Form 8027, Employer’s Annual Information Return Of Tip Income And.

Web individual income tax declaration for electronic filing full payment partial payment payment made/will be made by credit card. Who must file if you are filing a 2000 form 1040, 1040a, or 1040ez through an intermediate service provider and/or transmitter, you must. This form is for income earned in tax year 2022, with tax returns due in. Web part iii make estimated tax payments for taxable year 2020.

We Help You Understand And Meet Your Federal Tax Responsibilities.

By signing this form, you. Web the dor of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. Web form 843, claim for refund and request for abatement. Withdrawal date type of account:

Web If You Received A Request To Submit Form 8453 (U.s.

File and pay your taxes online. Part iv banking information (have you. Web information about form 8453, u.s. _____ _____ _____ _____ taxpayer’s.