Ss4 Form Sample

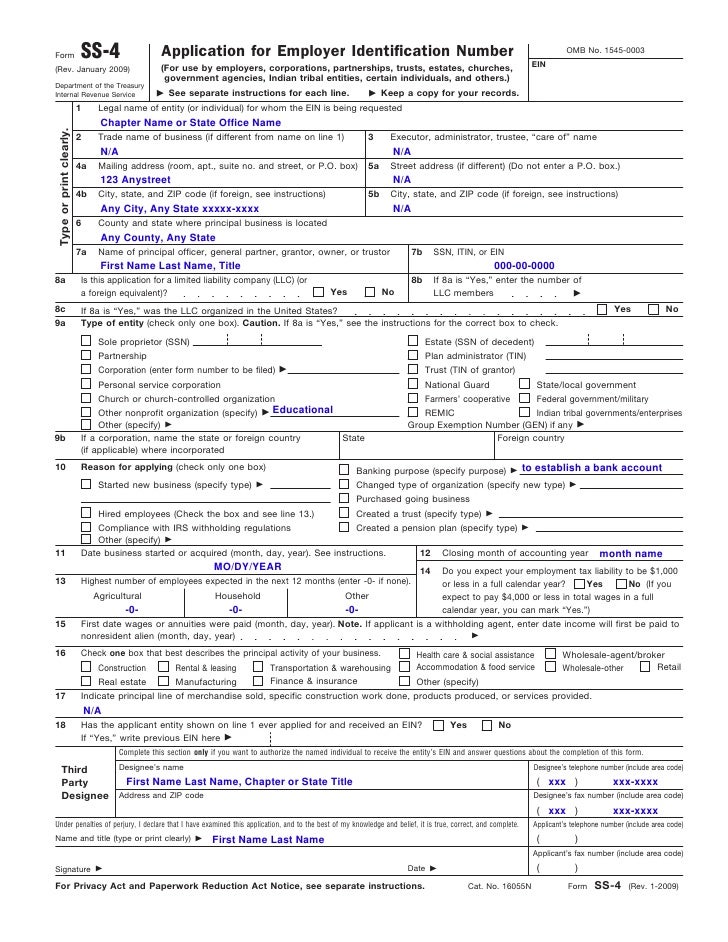

Ss4 Form Sample - The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any other usa taxpayer id. Make sure your business name is spelled correctly and that it looks the same on this line as it appears on your articles of incorporation or official business formation documents. Enter title as hhcsr (home healthcare service recipient). Enter c/o mcfi fiscal agent. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Web form ss4 is an application for the issuance of a taxpayer identification number (tin) under the individual tax identification number (itin) program. An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. What are examples of ss4 letter? Enter legal name of entity (or individual) for whom the ein is being requested; Legal name of entity (or individual) for whom the ein is being requested.

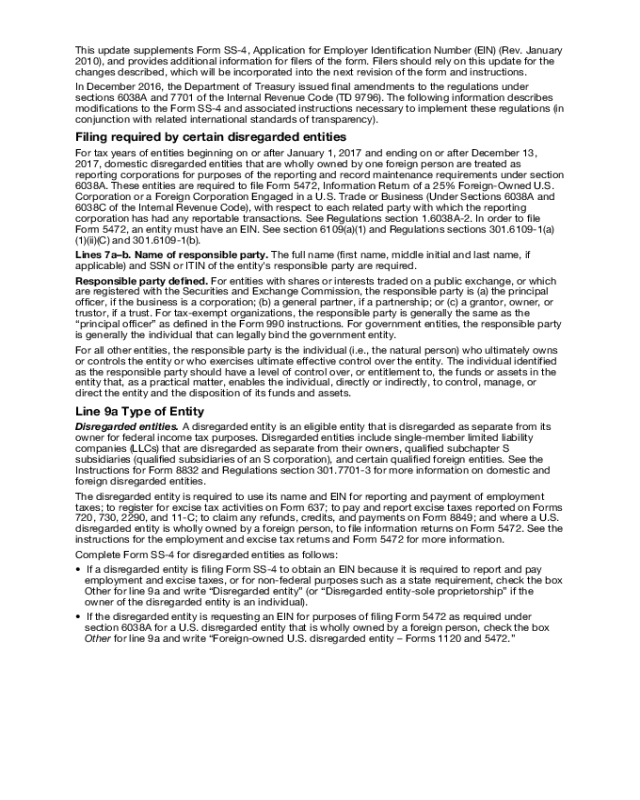

Some of the circumstances under which a new number may be required are as follows: An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? Web how to fill out and sign ss 4 letter sample online? What it is and how to find yours you can get the form online or. December 2019) department of the treasury internal revenue service. This includes obtaining an employer identification number (ein) from the irs. If you're required to report employment taxes or excise taxes or to give tax statements to employees or annuitants, you need an ein. Enter title as hhcsr (home healthcare service recipient). Web if you already have an ein, and the organization (entity) or ownership of your business changes, you may need to apply for a new number.

Enter legal name of entity (or individual) for whom the ein is being requested; On this fein form, you must provide information about your business, including your business’s legal name, address, type of business structure, and reasons for applying. Make sure your business name is spelled correctly and that it looks the same on this line as it appears on your articles of incorporation or official business formation documents. February 2006) government agencies, indian tribal entities, certain individuals, and others.) department of December 2019) department of the treasury internal revenue service. If approved, the irs will then issue an employer identification number (ein) that the business will use with their. The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any other usa taxpayer id. Enter c/o mcfi fiscal agent. Web form ss4 is an application for the issuance of a taxpayer identification number (tin) under the individual tax identification number (itin) program. If you're required to report employment taxes or excise taxes or to give tax statements to employees or annuitants, you need an ein.

Form SS4 Example Demo YouTube

On this fein form, you must provide information about your business, including your business’s legal name, address, type of business structure, and reasons for applying. An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. Web if you already have an ein, and the organization (entity) or ownership of your business changes, you.

Sample EIN SS4 Application Form 2009

An ein is your business’s taxpayer identification number (tin) and is assigned to you for business purposes only. If you're required to report employment taxes or excise taxes or to give tax statements to employees or annuitants, you need an ein. Web form ss4 is an application for the issuance of a taxpayer identification number (tin) under the individual tax.

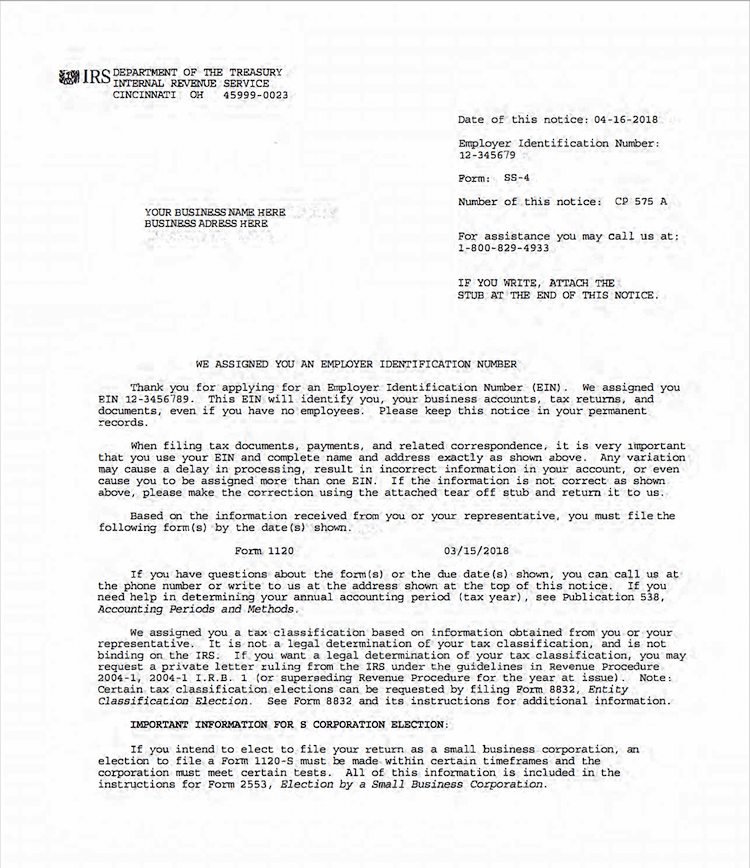

SS4 EIN Registration Letter ASAP Help Center

An ein is your business’s taxpayer identification number (tin) and is assigned to you for business purposes only. Enter c/o mcfi fiscal agent. Application for employer identification number (for use by employers, corporations, partnerships, trusts, estates, churches, government agencies, indian tribal entities, certain individuals, and others.). Some of the circumstances under which a new number may be required are as.

How to Get A Copy Of Your Form SS4 Letter Excel Capital

An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. What it is and how to find yours you can get the form online or. Web if you already have an ein, and the organization (entity) or ownership of your business changes, you may.

Form ss4 Edit, Fill, Sign Online Handypdf

February 2006) government agencies, indian tribal entities, certain individuals, and others.) department of The information you provide on this form will establish your business tax account. Web if you already have an ein, and the organization (entity) or ownership of your business changes, you may need to apply for a new number. Also, see do i need an ein? Web.

Ss4 Irs Form amulette

December 2019) department of the treasury internal revenue service. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)? Also, see do i need an ein? Federal tax reporting opening a business bank account An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a.

Irs Ss4 Form

An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. Enter c/o mcfi fiscal agent. Enter title as hhcsr (home healthcare service recipient). The itin, which is also known as ad hoc tax id or simply tax id,” allows individuals to file income taxes without having a usa social security number or any.

Instructions for the Form SS4 Limited Liability Company Irs Tax Forms

Get your online template and fill it in using progressive features. Some of the circumstances under which a new number may be required are as follows: The information you provide on this form will establish your business tax account. What it is and how to find yours you can get the form online or. The itin, which is also known.

Form ss4 Employer identification number, Online application, Business

Application for employer identification number (for use by employers, corporations, partnerships, trusts, estates, churches, government agencies, indian tribal entities, certain individuals, and others.). This is where you put your official business name. Enter title as hhcsr (home healthcare service recipient). What are examples of ss4 letter? Legal name of entity (or individual) for whom the ein is being requested.

denisewy's blog Decreased tax withholding rate on royalties for NonUS

Enter title as hhcsr (home healthcare service recipient). An ein is required for several reasons, including: Get your online template and fill it in using progressive features. Web how to fill out and sign ss 4 letter sample online? The information you provide on this form will establish your business tax account.

This Is Where You Put Your Official Business Name.

When completed, this form is submitted to the irs. Make sure your business name is spelled correctly and that it looks the same on this line as it appears on your articles of incorporation or official business formation documents. Legal name of entity (or individual) for whom the ein is being requested. Web does a small company that operates as a sole proprietorship need an employer identification number (ein)?

Web Primary Business Activity, Products And Services (I.e.

An ein is your business’s taxpayer identification number (tin) and is assigned to you for business purposes only. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Also, see do i need an ein? The information you provide on this form will establish your business tax account.

Web If You Already Have An Ein, And The Organization (Entity) Or Ownership Of Your Business Changes, You May Need To Apply For A New Number.

Application for employer identification number (for use by employers, corporations, partnerships, trusts, estates, churches, government agencies, indian tribal entities, certain individuals, and others.). Enjoy smart fillable fields and interactivity. Enter c/o mcfi fiscal agent. This includes obtaining an employer identification number (ein) from the irs.

What Are Examples Of Ss4 Letter?

Some of the circumstances under which a new number may be required are as follows: An existing business is purchased or inherited by an individual who'll operate it as a sole proprietorship. An ein is required for several reasons, including: Federal tax reporting opening a business bank account