Schedule Nec Form 1040-Nr

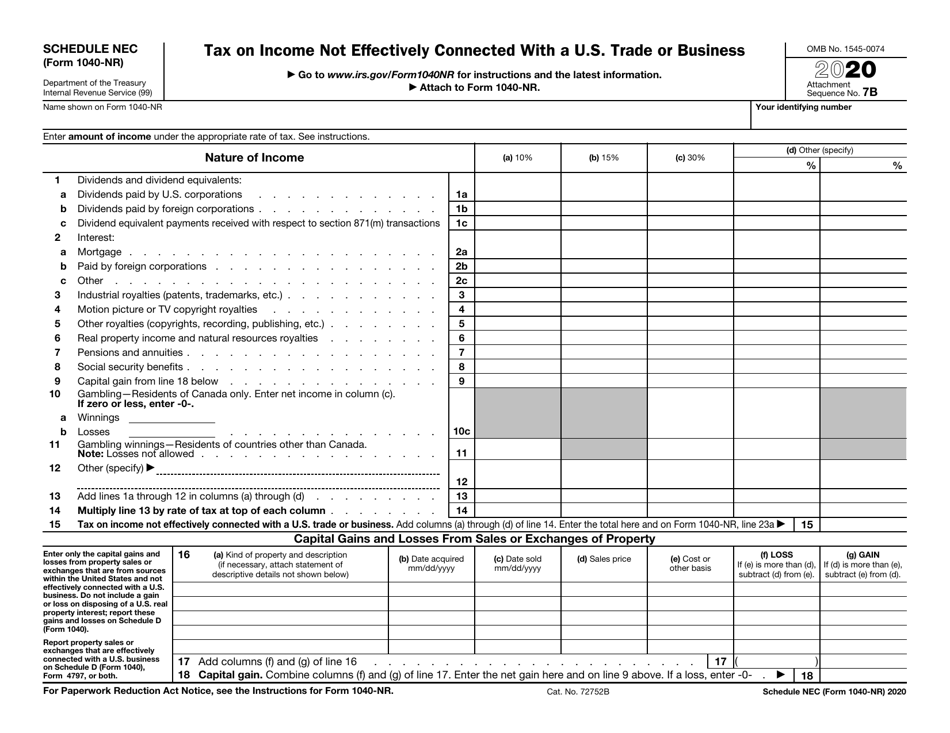

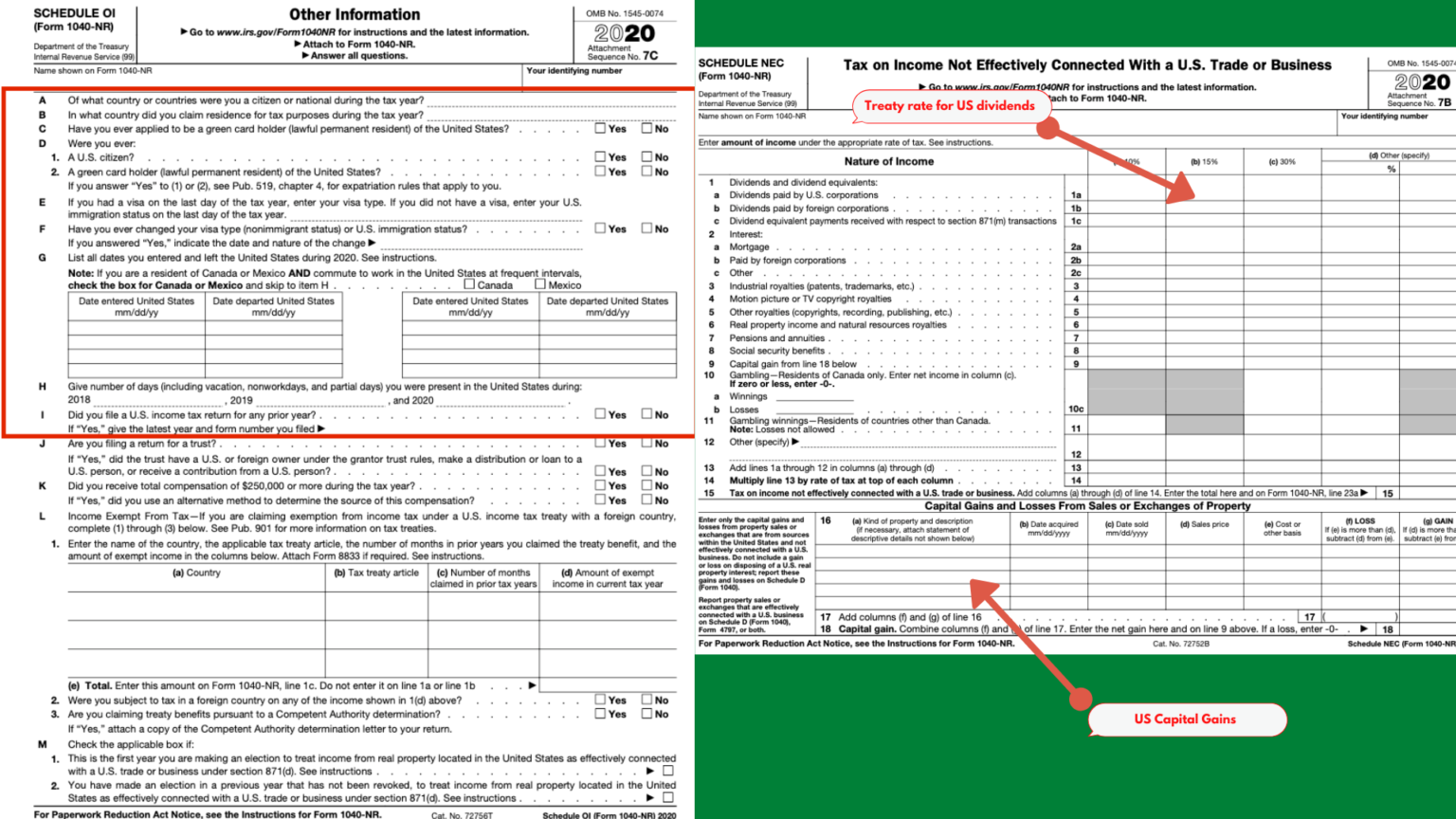

Schedule Nec Form 1040-Nr - 2540 noelle ct, racine, wi is a single family home that was built in 1998. The rent zestimate for this. The 10% and 15% rates commonly apply to various types of income eligible for treaty. In the client information section, select the filing status (ctrl+t) (mandatory). Trade or business and to figure your. Irs use only—do not write or. Only the schedules that ae right for you! It contains 3 bedrooms and 2.5 bathrooms. Join flightaware view more flight history purchase entire flight history for n1040r. Nonresident alien income tax return 2022 omb no.

Web go to screen 58.1, nonresident alien (1040nr). 2540 noelle ct, racine, wi is a single family home that was built in 1998. Join flightaware view more flight history purchase entire flight history for n1040r. Nonresident alien income tax return. Web income which is nec may include, but is not limited to, interest and dividends from businesses in which you are not engaged, income from real property, and gambling. In the client information section, select the filing status (ctrl+t) (mandatory). The 10% and 15% rates commonly apply to various types of income eligible for treaty. Only the schedules that ae right for you! Nonresident alien income tax return department of the treasury internal revenue service go to www.irs.gov/form1040nr for instructions and the latest. The rent zestimate for this.

The 10% and 15% rates commonly apply to various types of income eligible for treaty. The rent zestimate for this. Web basic users (becoming a basic user is free and easy!) view 3 months history. In the client information section, select the filing status (ctrl+t) (mandatory). 2540 noelle ct, racine, wi is a single family home that was built in 1998. This may include, but is not limited to, dividends, royalties,. Web income which is nec may include, but is not limited to, interest and dividends from businesses in which you are not engaged, income from real property, and gambling. Nonresident alien income tax return department of the treasury internal revenue service go to www.irs.gov/form1040nr for instructions and the latest. Nonresident alien income tax return 2022 omb no. Trade or business and to figure your.

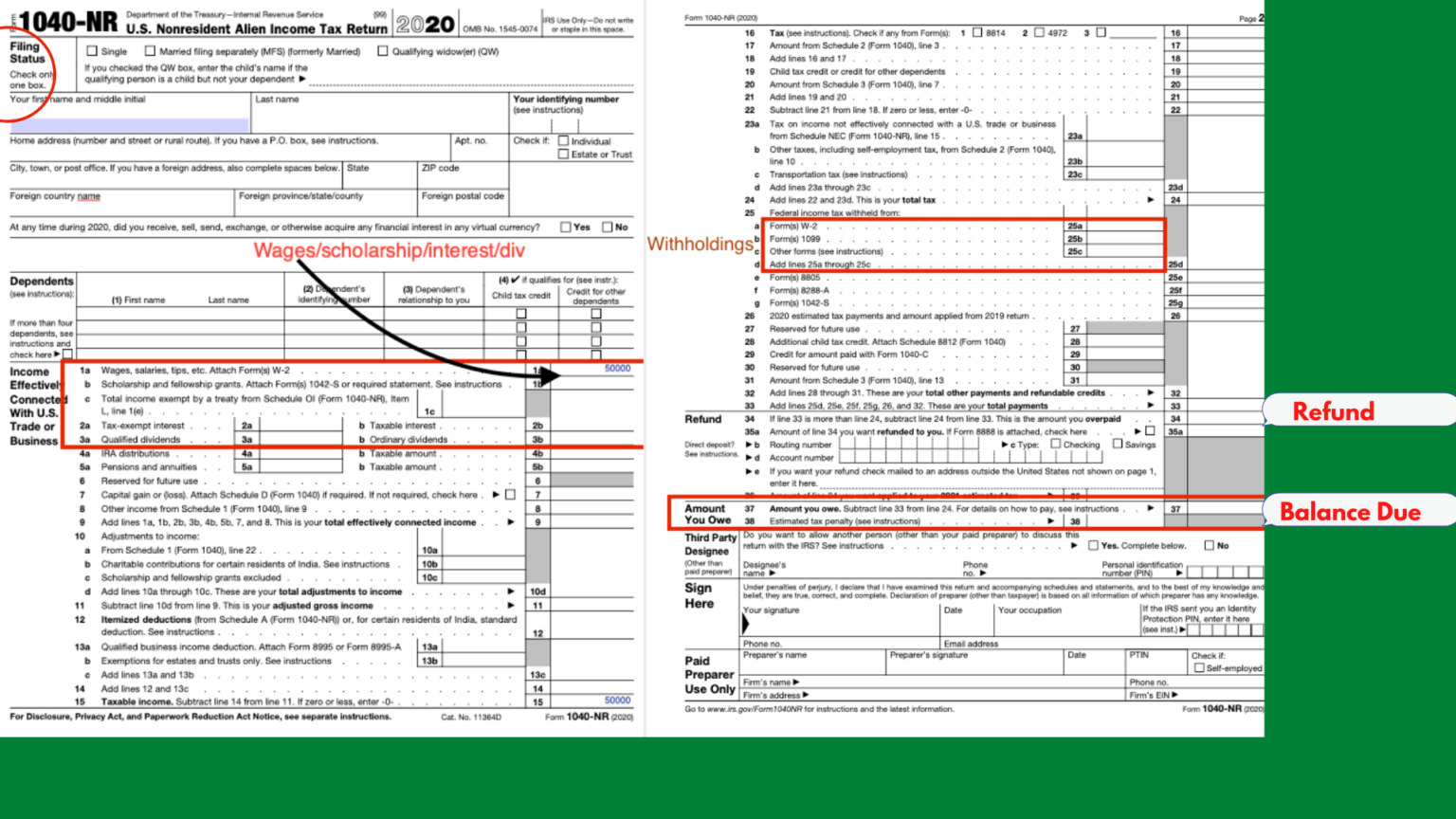

Form 1040NR U.S. Nonresident Alien Tax Return Form (2014

In the client information section, select the filing status (ctrl+t) (mandatory). 2540 noelle ct, racine, wi is a single family home that was built in 1998. This will generate the 1040nr. Nonresident alien income tax return. Web go to screen 58.1, nonresident alien (1040nr).

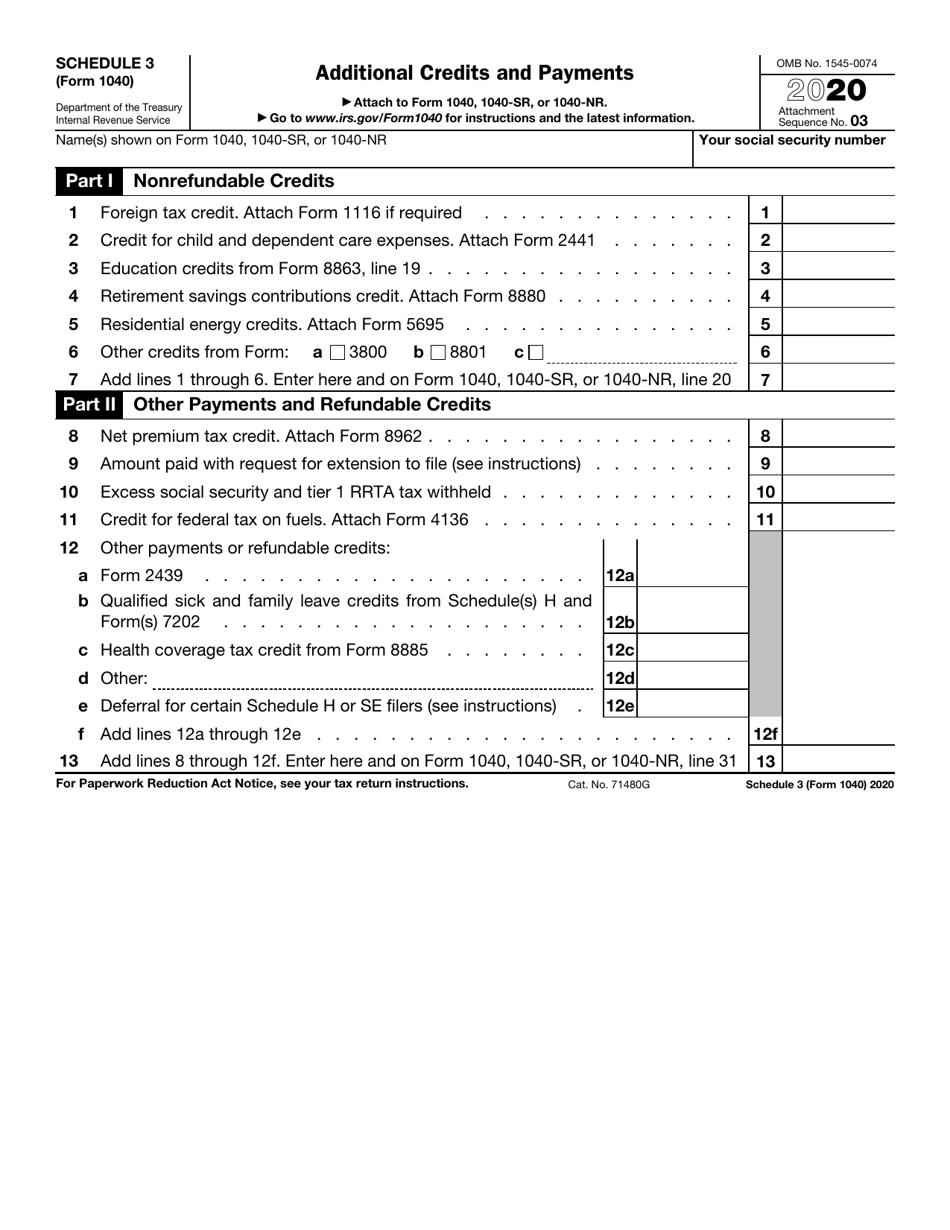

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

Web income which is nec may include, but is not limited to, interest and dividends from businesses in which you are not engaged, income from real property, and gambling. Web enter the amount of gambling winnings, federal withholding, and losses (if applicable) in the appropriate fields. 2540 noelle ct, racine, wi is a single family home that was built in.

Irs 1040 Nr Fill Online, Printable, Fillable, Blank pdfFiller

Web go to screen 58.1, nonresident alien (1040nr). Nonresident alien income tax return. Irs use only—do not write or. This may include, but is not limited to, dividends, royalties,. Trade or business and to figure your.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

This may include, but is not limited to, dividends, royalties,. This will generate the 1040nr. Only the schedules that ae right for you! In the client information section, select the filing status (ctrl+t) (mandatory). Web enter the amount of gambling winnings, federal withholding, and losses (if applicable) in the appropriate fields.

IRS 1040NR Schedule A 20212022 Fill and Sign Printable Template

This may include, but is not limited to, dividends, royalties,. Join flightaware view more flight history purchase entire flight history for n1040r. Only the schedules that ae right for you! Web enter the amount of gambling winnings, federal withholding, and losses (if applicable) in the appropriate fields. Web basic users (becoming a basic user is free and easy!) view 3.

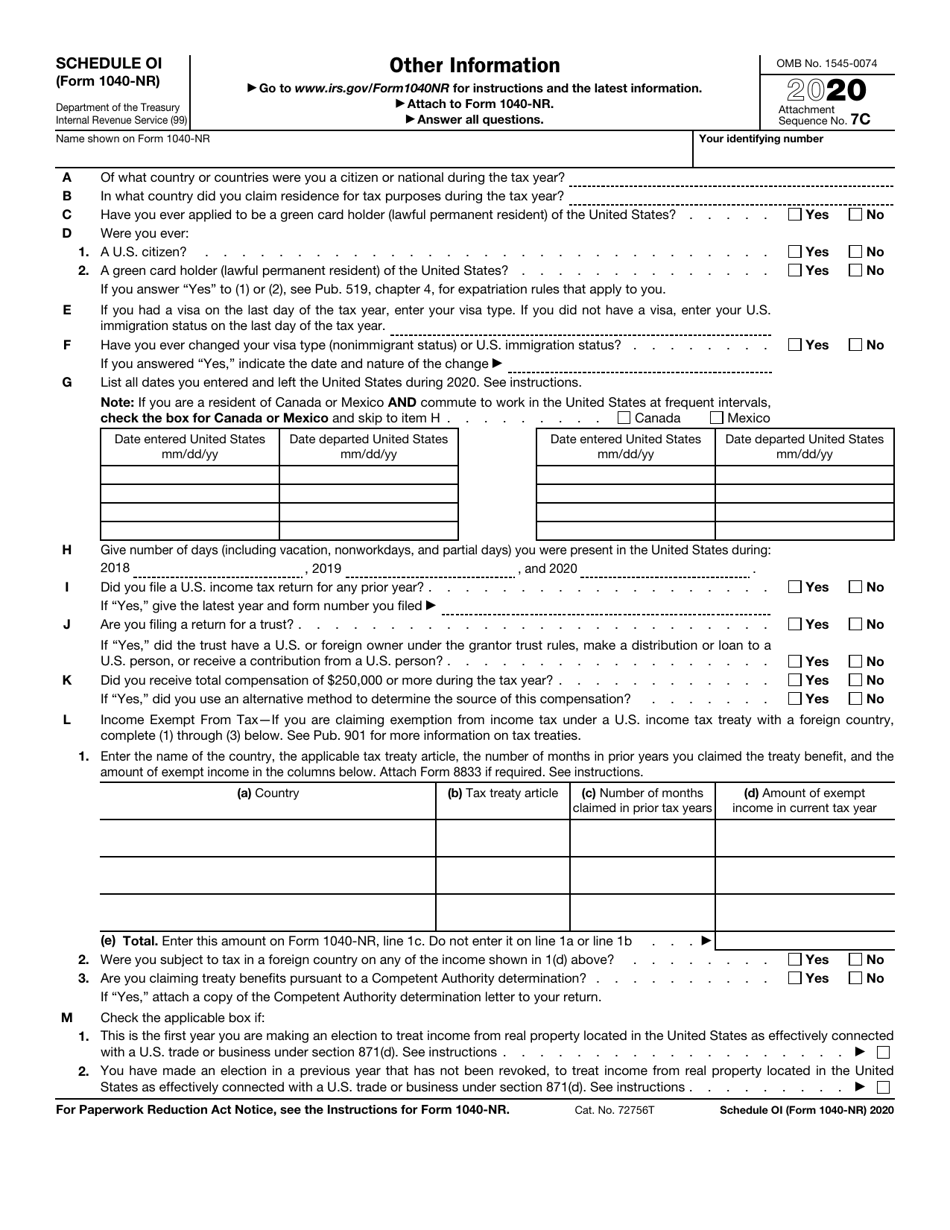

IRS Form 1040NR Schedule OI Download Fillable PDF or Fill Online Other

It contains 3 bedrooms and 2.5 bathrooms. 2540 noelle ct, racine, wi is a single family home that was built in 1998. This may include, but is not limited to, dividends, royalties,. Web enter the amount of gambling winnings, federal withholding, and losses (if applicable) in the appropriate fields. In the client information section, select the filing status (ctrl+t) (mandatory).

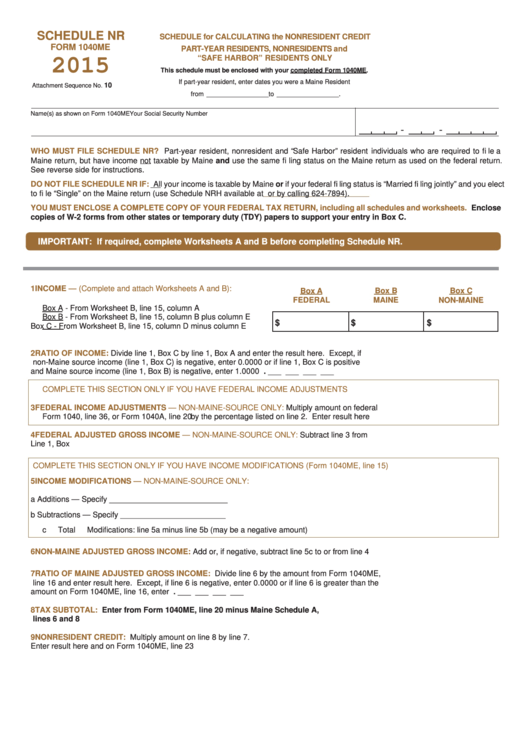

Fillable Schedule Nr (Form 1040me) Schedule For Calculating The

It contains 3 bedrooms and 2.5 bathrooms. Only the schedules that ae right for you! The rent zestimate for this. This will generate the 1040nr. Nonresident alien income tax return department of the treasury internal revenue service go to www.irs.gov/form1040nr for instructions and the latest.

IRS Form 1040NR Schedule NEC Download Fillable PDF or Fill Online Tax

Web basic users (becoming a basic user is free and easy!) view 3 months history. This may include, but is not limited to, dividends, royalties,. Nonresident alien income tax return. It contains 3 bedrooms and 2.5 bathrooms. Web go to screen 58.1, nonresident alien (1040nr).

NonResident US Tax Return Form 1040NR Things you must know

This may include, but is not limited to, dividends, royalties,. Nonresident alien income tax return department of the treasury internal revenue service go to www.irs.gov/form1040nr for instructions and the latest. This will generate the 1040nr. It contains 3 bedrooms and 2.5 bathrooms. 2540 noelle ct, racine, wi is a single family home that was built in 1998.

It Contains 3 Bedrooms And 2.5 Bathrooms.

Join flightaware view more flight history purchase entire flight history for n1040r. The rent zestimate for this. This may include, but is not limited to, dividends, royalties,. Nonresident alien income tax return.

Trade Or Business And To Figure Your.

Web income which is nec may include, but is not limited to, interest and dividends from businesses in which you are not engaged, income from real property, and gambling. This will generate the 1040nr. Nonresident alien income tax return department of the treasury internal revenue service go to www.irs.gov/form1040nr for instructions and the latest. 2540 noelle ct, racine, wi is a single family home that was built in 1998.

Only The Schedules That Ae Right For You!

In the client information section, select the filing status (ctrl+t) (mandatory). Nonresident alien income tax return 2022 omb no. The 10% and 15% rates commonly apply to various types of income eligible for treaty. Web basic users (becoming a basic user is free and easy!) view 3 months history.

Web Go To Screen 58.1, Nonresident Alien (1040Nr).

Irs use only—do not write or. Web enter the amount of gambling winnings, federal withholding, and losses (if applicable) in the appropriate fields.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://static.wixstatic.com/media/9fe6e6_c02527d741474d7e88dbd9fa3595b59f~mv2.png/v1/fit/w_1000%2Ch_853%2Cal_c%2Cq_80/file.jpg)