Sc State Tax Form

Sc State Tax Form - Notary public application [pdf] motor vehicle forms. Web south carolina has a state income tax that ranges between 0% and 7% , which is administered by the south carolina department of revenue. Web tax forms now available. Web sc fillable forms does not store your information from previous tax years. Web south carolina department of revenue Web the term state agency does not include any county, municipality, or local or regional governmental authority. Web we last updated the form sc1040 instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Web state of south carolina department of revenue. Previous logins no longer provide access to the program. Web income tax forms and instructions.

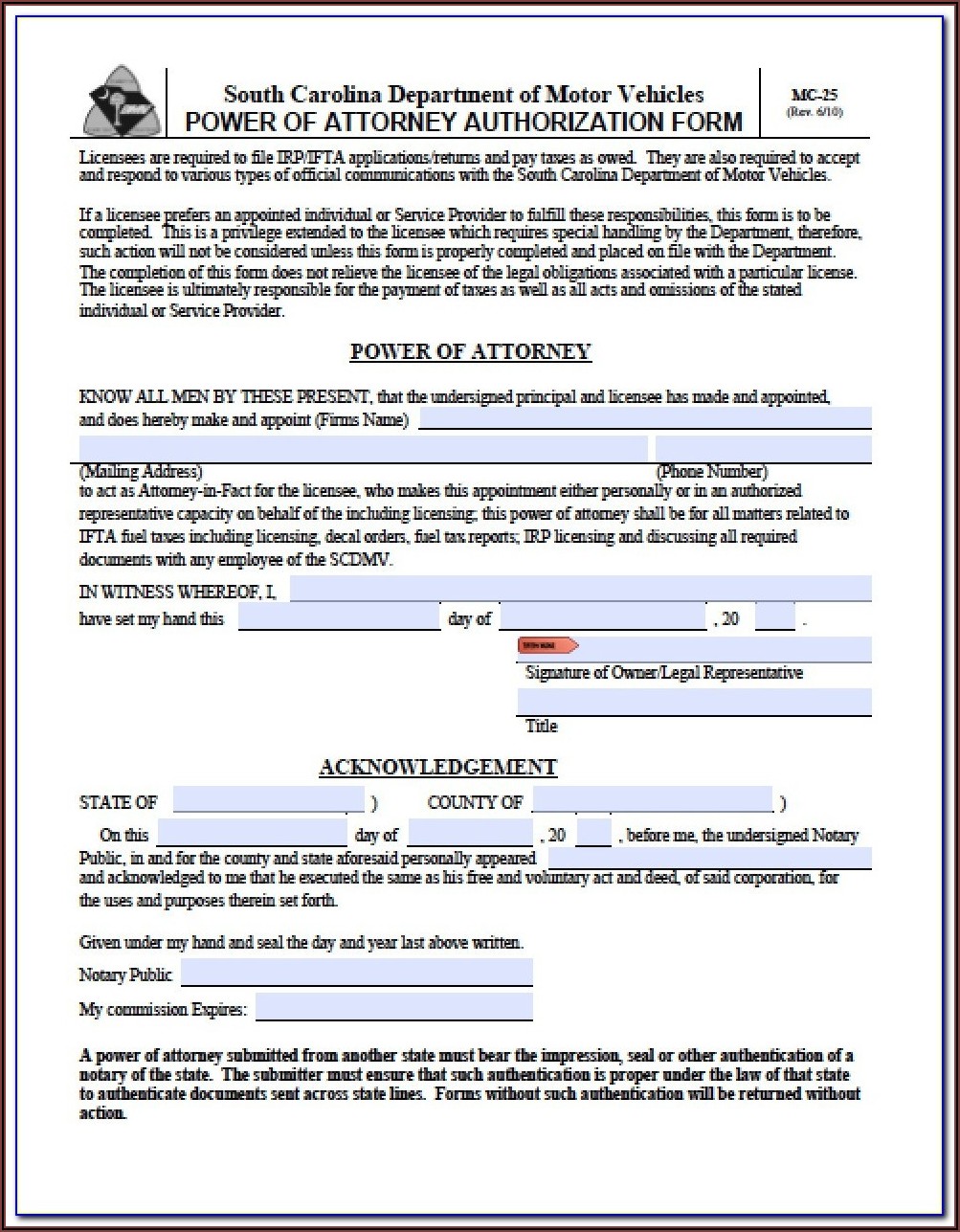

Notary public application [pdf] motor vehicle forms. If you do not qualify for free filing using one of. Web south carolina income tax forms for current and previous tax years. Web south carolina has a state income tax that ranges between 0% and 7% , which is administered by the south carolina department of revenue. These vendors must collect and. Web sc fillable forms does not store your information from previous tax years. Driver's license renewal [pdf] disabled. Web state of south carolina department of revenue. Previous logins no longer provide access to the program. Signnow allows users to edit, sign, fill and share all type of documents online.

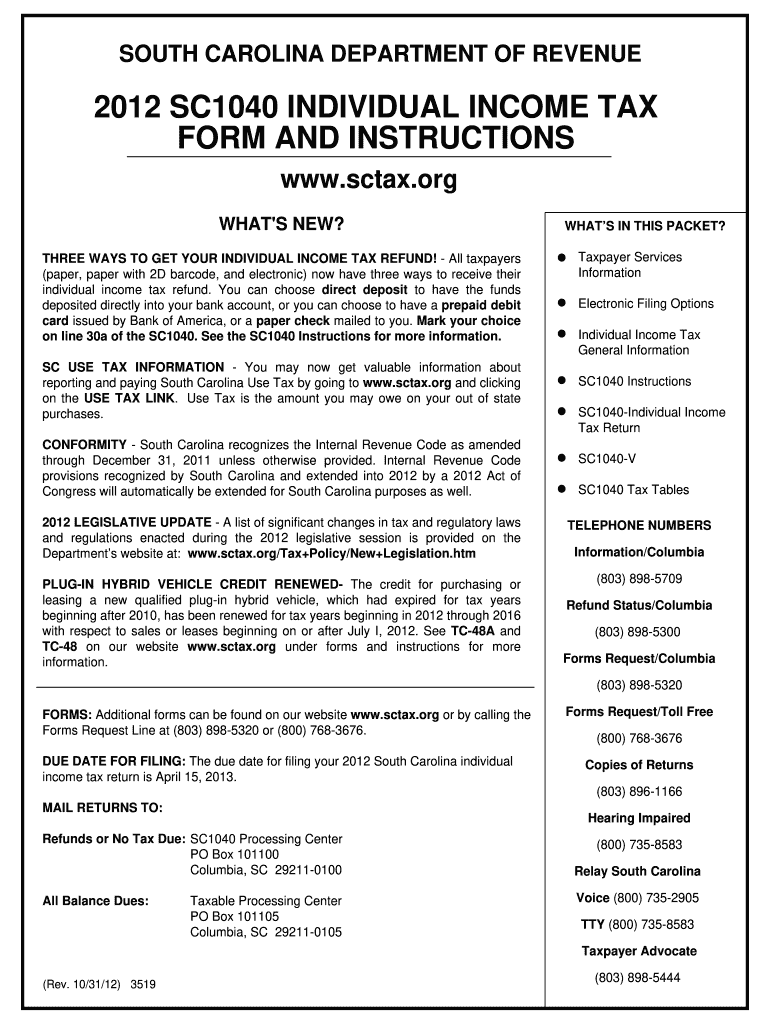

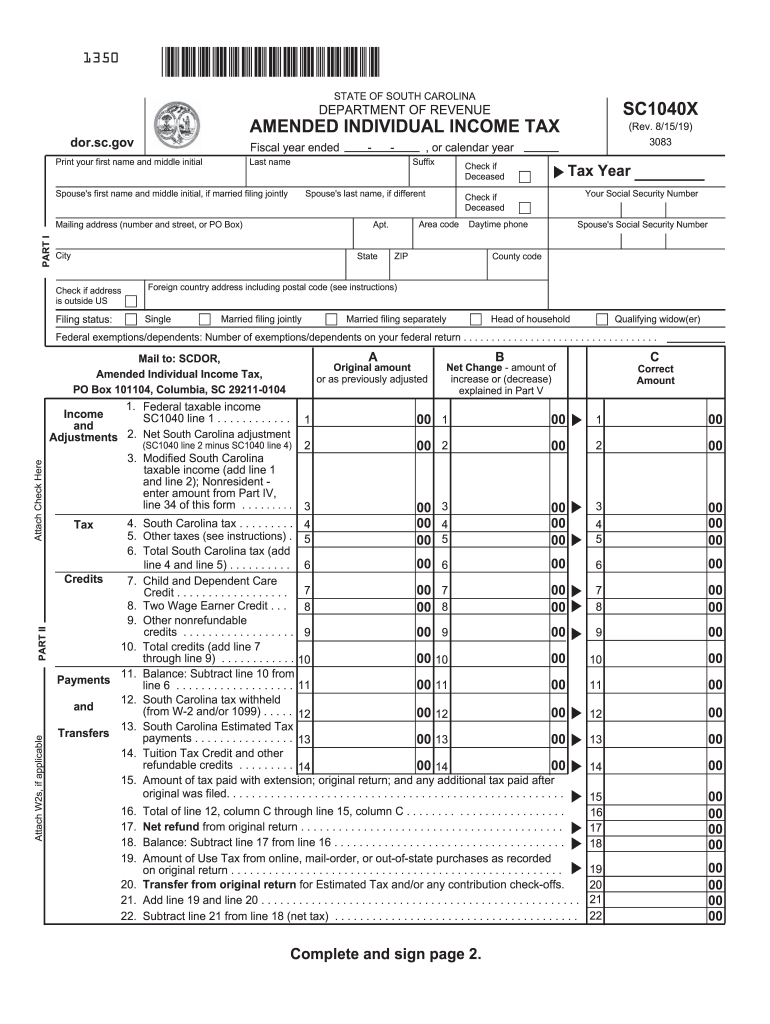

We last updated the individual income. Web state of south carolina c corporation income tax return (rev. Signnow allows users to edit, sign, fill and share all type of documents online. Web south carolina department of revenue Web state of south carolina department of revenue 2022 individual income tax return number of dependents claimed that were under the age of 6 years as of. Web south carolina income tax forms for current and previous tax years. Web south carolina has a state income tax that ranges between 0% and 7% , which is administered by the south carolina department of revenue. If you do not qualify for free filing using one of. Are you looking for printed state and federal tax forms? Web we last updated the form sc1040 instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022.

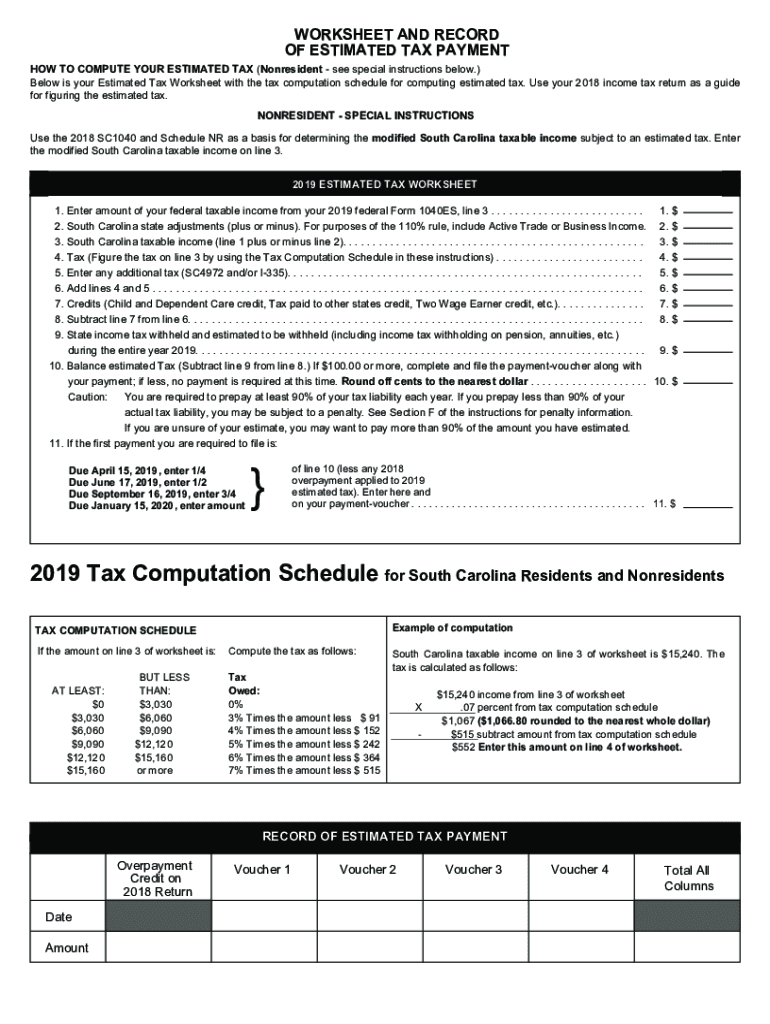

Estimated Taxes For 2019 Payment Slip For State Of South Carolina

Are you looking for printed state and federal tax forms? Web we last updated the form sc1040 instructional booklet in february 2023, so this is the latest version of income tax instructions, fully updated for tax year 2022. Web state of south carolina department of revenue 2022 individual income tax return number of dependents claimed that were under the age.

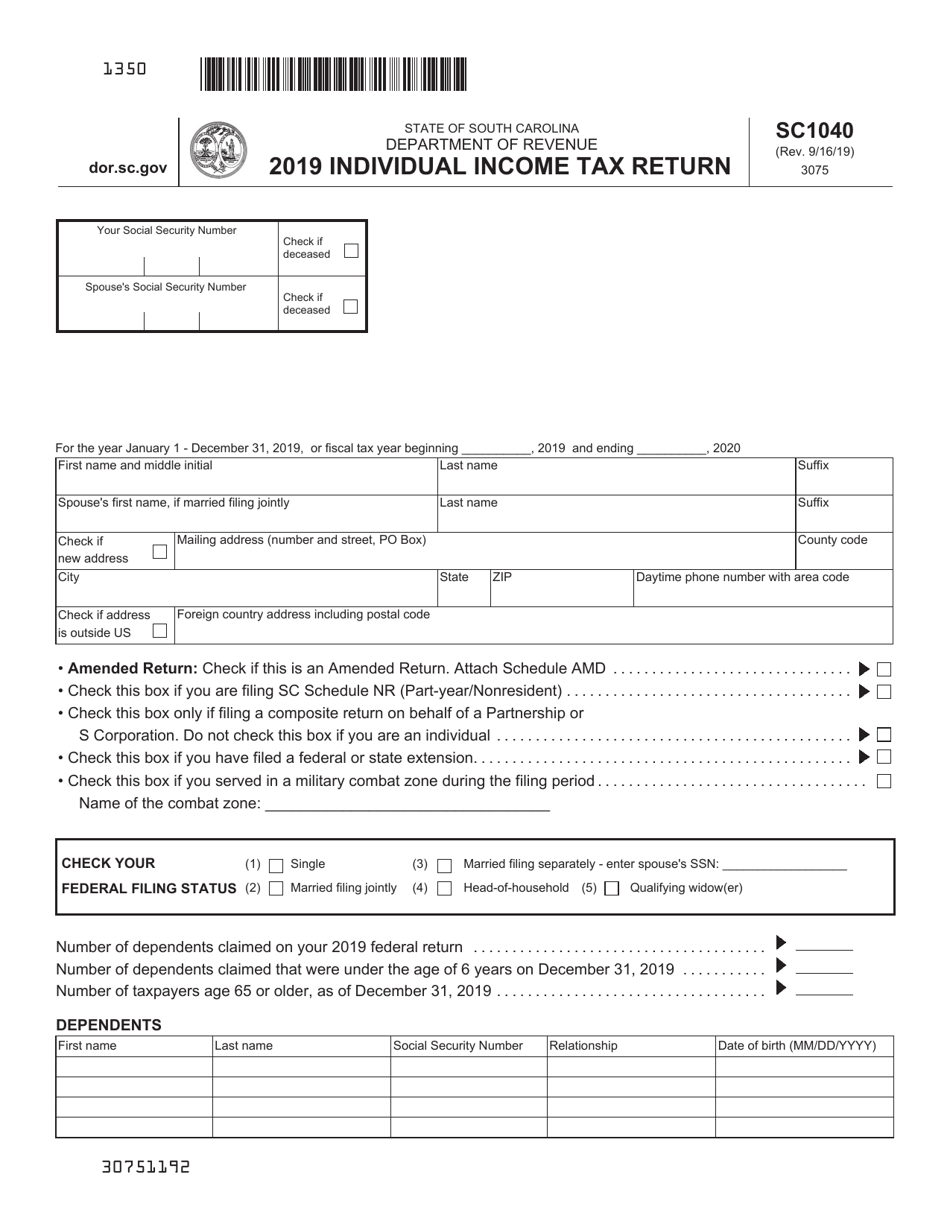

Form SC1040 Download Printable PDF or Fill Online Individual Tax

Web sc fillable forms does not store your information from previous tax years. If you do not qualify for free filing using one of. 44% of returns paid no income tax,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. 1 enter federal taxable income from your federal form.

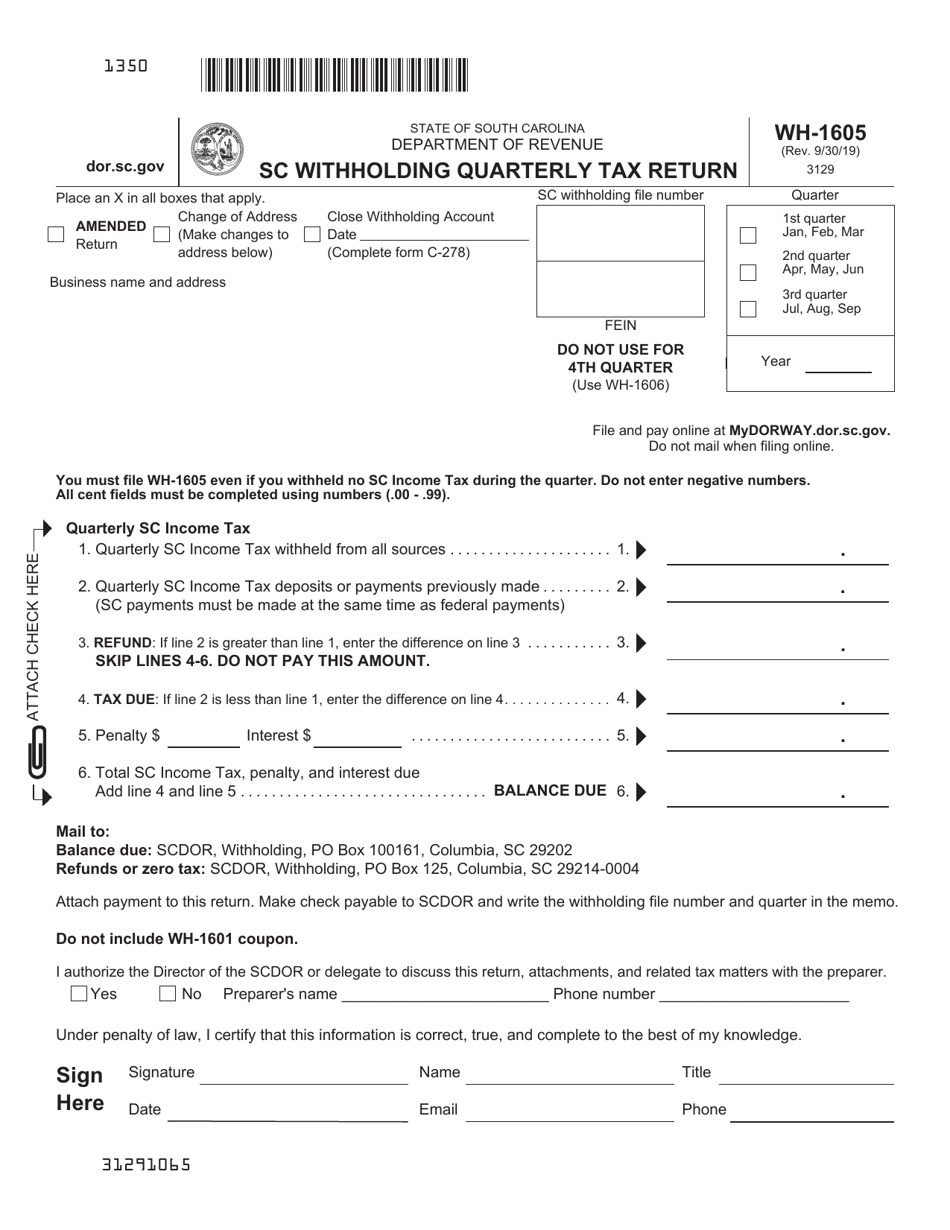

Form WH1605 Download Printable PDF or Fill Online Sc Withholding

1 enter federal taxable income from your federal form. Ad download or email sc 1120 & more fillable forms, register and subscribe now! Web form sc1040es is a south carolina individual income tax form. Web south carolina income tax forms for current and previous tax years. Web the term state agency does not include any county, municipality, or local or.

Sc Tax Form Printable Fill Out and Sign Printable PDF Template signNow

Web south carolina income tax forms for current and previous tax years. Web form sc1040es is a south carolina individual income tax form. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email sc 1120 & more fillable forms, register and subscribe now! If you do not qualify for free filing using one.

Sc State Tax Forms Form Resume Examples pv9wXxgaY7

If you do not qualify for free filing using one of. The south carolina state library has them available for pick up at 1500 senate street. Signnow allows users to edit, sign, fill and share all type of documents online. Securely file, pay, and register most south carolina taxes using the scdor’s free online tax portal, mydorway. Previous logins no.

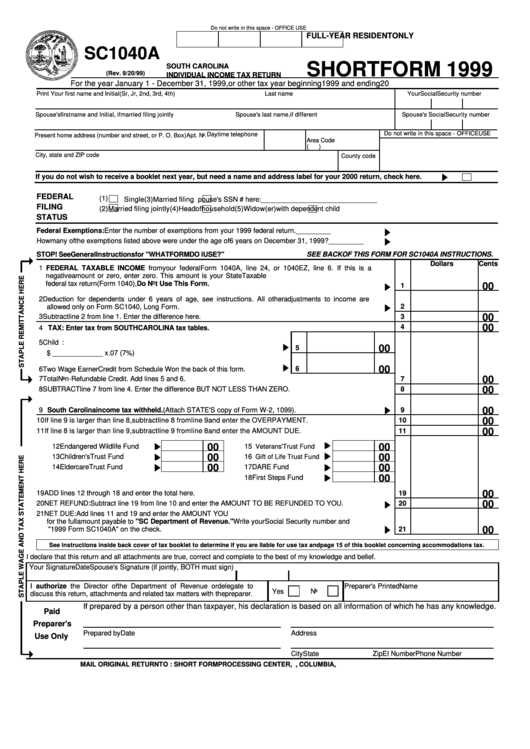

Form Sc1040a South Carolina Individual Tax Return 1999

Signnow allows users to edit, sign, fill and share all type of documents online. Web form sc1040es is a south carolina individual income tax form. If zero or less, enter zero here dollars. Complete, edit or print tax forms instantly. Previous logins no longer provide access to the program.

20192022 Form SC DoR C278 Fill Online, Printable, Fillable, Blank

Web sc fillable forms does not store your information from previous tax years. 44% of returns paid no income tax,. 1 enter federal taxable income from your federal form. Complete, edit or print tax forms instantly. Previous logins no longer provide access to the program.

What Is Homestead Exemption Sc Fill Out and Sign Printable PDF

Web tax and legal forms. Web state of south carolina c corporation income tax return (rev. Are you looking for printed state and federal tax forms? Driver's license renewal [pdf] disabled. 202 3 sc withholding tax formula.

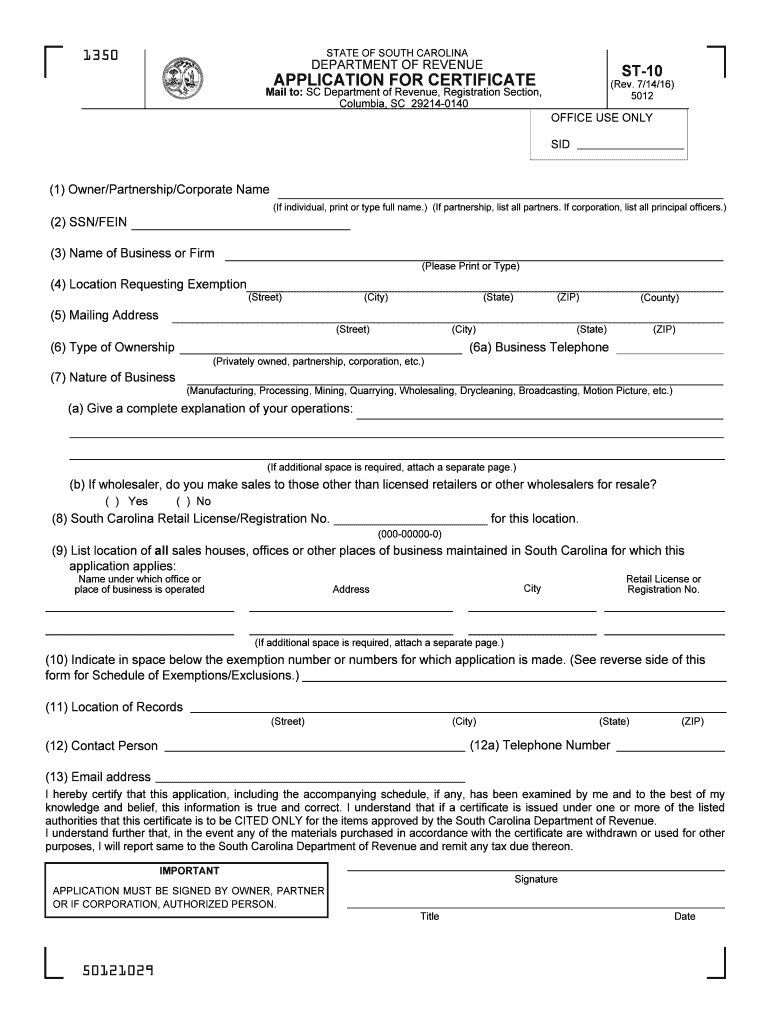

SC ST10 2016 Fill out Tax Template Online US Legal Forms

Web sc fillable forms does not store your information from previous tax years. 202 3 sc withholding tax formula. Web state of south carolina department of revenue 2022 individual income tax return number of dependents claimed that were under the age of 6 years as of. Web south carolina income tax forms for current and previous tax years. If you.

Sc Revenue Tax Fill Out and Sign Printable PDF Template signNow

Previous logins no longer provide access to the program. Web tax forms now available. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. The south carolina state library has them available for pick up at 1500 senate street. Previous logins no longer provide access to the program.

5/18/22) Due By The 15Th Day Of The Fourth Month Following The Close Of The Taxable Year.

Ad download or email sc 1120 & more fillable forms, register and subscribe now! Web state of south carolina department of revenue. 202 3 sc withholding tax formula. If you do not qualify for free filing using one of.

Web Tax Forms Now Available.

Previous logins no longer provide access to the program. Securely file, pay, and register most south carolina taxes using the scdor’s free online tax portal, mydorway. We last updated the individual income. Web tax and legal forms.

If Zero Or Less, Enter Zero Here Dollars.

Get ready for tax season deadlines by completing any required tax forms today. Web south carolina income tax forms for current and previous tax years. 1 enter federal taxable income from your federal form. Web south carolina department of revenue

Previous Logins No Longer Provide Access To The Program.

Web state of south carolina c corporation income tax return (rev. Complete, edit or print tax forms instantly. Signnow allows users to edit, sign, fill and share all type of documents online. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers.