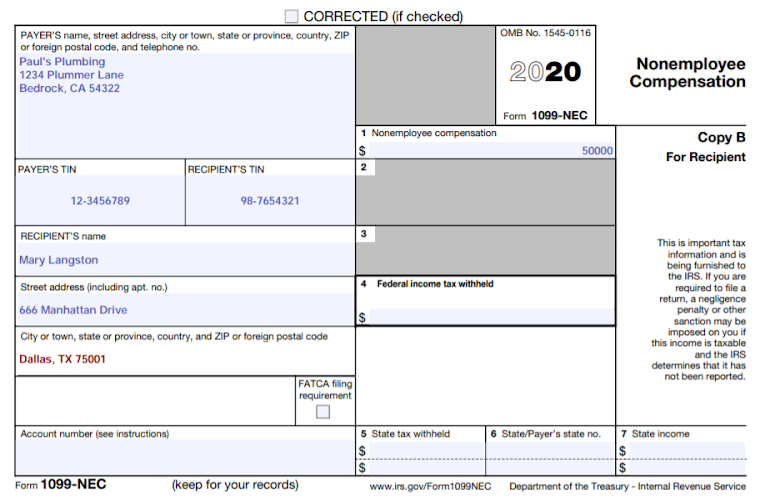

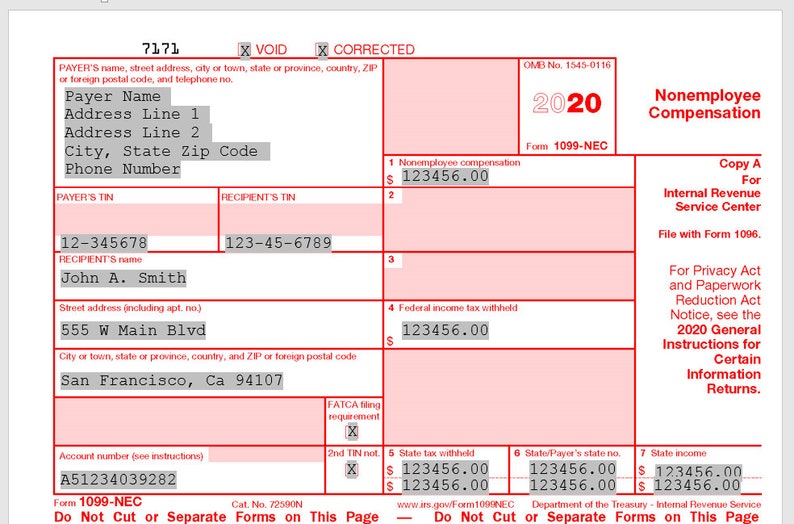

Sample 1099 Nec Form

Sample 1099 Nec Form - Follow the instructions included in the document to enter the data. For internal revenue service center. The 2021 calendar year comes with changes to business owners’ taxes. Current general instructions for certain information returns. Examples of this include freelance work or driving for doordash or uber. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Locate a blank template online or in print. Sources of information for the 1099 form; And on box 4, enter the federal tax withheld if any. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

And on box 4, enter the federal tax withheld if any. Web instructions for recipient recipient’s taxpayer identification number (tin). Download the template, print it out, or fill it in online. Follow the instructions included in the document to enter the data. Current general instructions for certain information returns. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). The 2021 calendar year comes with changes to business owners’ taxes. Both the forms and instructions will be updated as needed. 10 understanding 1099 form samples. Examples of this include freelance work or driving for doordash or uber.

Examples of this include freelance work or driving for doordash or uber. For internal revenue service center. Current general instructions for certain information returns. Web instructions for recipient recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). For privacy act and paperwork reduction act notice, see the. And on box 4, enter the federal tax withheld if any. Web here are the steps you need to take to complete the template: The 2021 calendar year comes with changes to business owners’ taxes. Both the forms and instructions will be updated as needed.

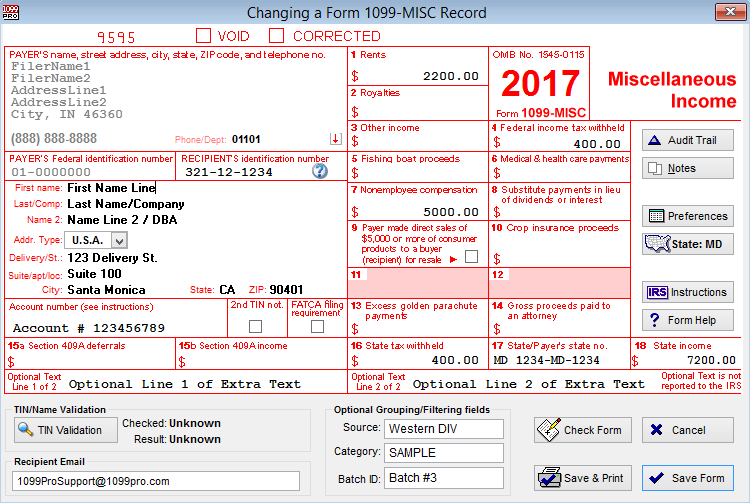

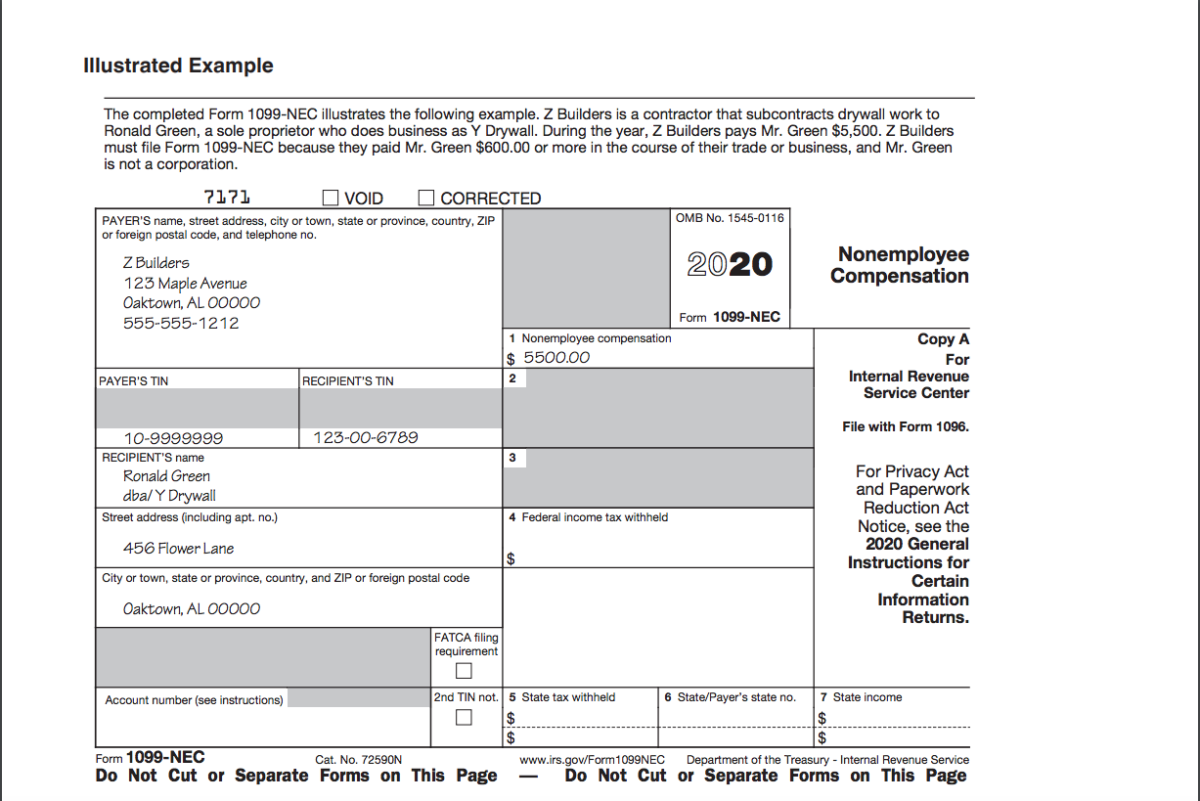

IRS Form 1099 Reporting for Small Business Owners

Follow the instructions included in the document to enter the data. For privacy act and paperwork reduction act notice, see the. Locate a blank template online or in print. Sources of information for the 1099 form; And on box 4, enter the federal tax withheld if any.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Current general instructions for certain information returns. And on box 4, enter the federal tax withheld if any. Download the template, print it out, or fill it in online. The 2021 calendar year comes with changes to business owners’ taxes. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

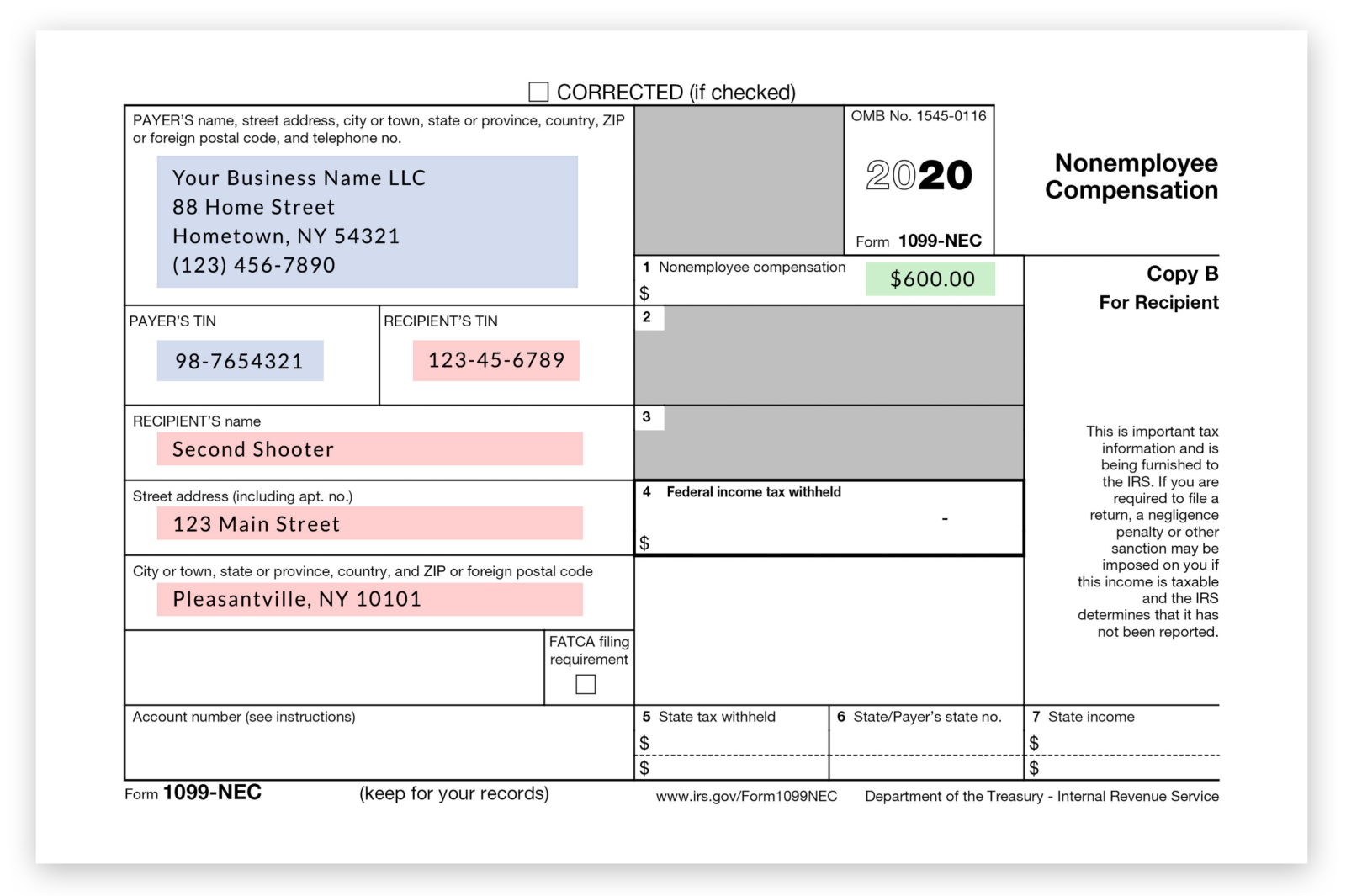

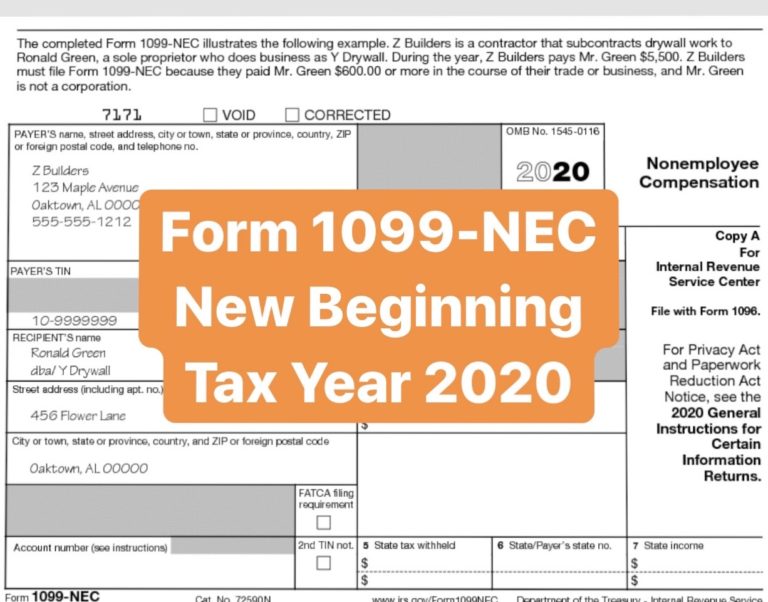

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Both the forms and instructions will be updated as needed. Locate a blank template online or in print. The 2021 calendar year comes with changes to business owners’ taxes. Sources of information for the 1099 form;

1099NEC Software Print & eFile 1099NEC Forms

2020 general instructions for certain information returns. After they were published, go to www.irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). The compensation being reported must be for services for a trade or business..

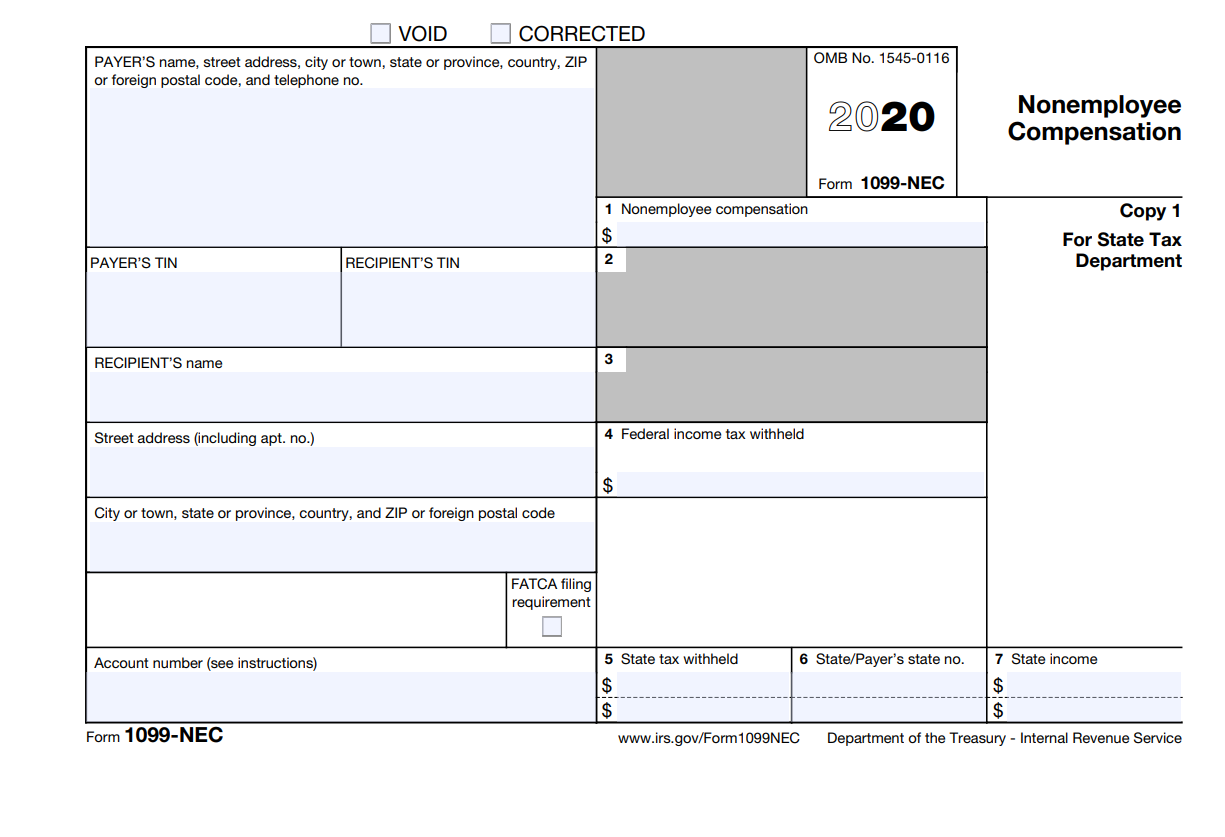

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

10 understanding 1099 form samples. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Web instructions for recipient recipient’s taxpayer identification number (tin). Examples of this include freelance work or driving for doordash or uber. For privacy act and paperwork reduction act notice, see the.

1099NEC 2020 Sample Form Crestwood Associates

Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Examples of this include freelance work or driving for doordash or uber. Both the forms and instructions will be updated as needed. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone..

Form1099NEC

10 understanding 1099 form samples. Web instructions for recipient recipient’s taxpayer identification number (tin). Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. After they were published, go to www.irs.gov/form1099nec. Gather the necessary information, including your name, address, and social security number.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

2020 general instructions for certain information returns. Web here’s what you need: Current general instructions for certain information returns. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Examples of this include freelance work or driving for doordash or uber.

What is Form 1099NEC for Nonemployee Compensation

Their business name (if it’s different from the contractor’s name). And on box 4, enter the federal tax withheld if any. Copy a for internal revenue service center. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number.

Introducing the New 1099NEC for Reporting Nonemployee Compensation

2020 general instructions for certain information returns. Follow the instructions included in the document to enter the data. After they were published, go to www.irs.gov/form1099nec. Gather the necessary information, including your name, address, and social security number. Sources of information for the 1099 form;

For Privacy Act And Paperwork Reduction Act Notice, See The.

Gather the necessary information, including your name, address, and social security number. The compensation being reported must be for services for a trade or business. Web 9 understanding sources of information for the 1099 form. After they were published, go to www.irs.gov/form1099nec.

For The Most Recent Version, Go To Irs.gov/Form1099Misc Or Irs.gov/Form1099Nec.

Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Web here’s what you need: Examples of this include freelance work or driving for doordash or uber. Download the template, print it out, or fill it in online.

Web Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

For internal revenue service center. 2020 general instructions for certain information returns. And on box 4, enter the federal tax withheld if any. Current general instructions for certain information returns.

The 2021 Calendar Year Comes With Changes To Business Owners’ Taxes.

Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Locate a blank template online or in print. Sources of information for the 1099 form; 10 understanding 1099 form samples.