Right Of Use Liability On Balance Sheet

Right Of Use Liability On Balance Sheet - Determining the lease term sometimes requires judgment, particularly when we. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. The changes make it easier for users of financial statements to see a company’s. Web as of jan. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors:

Web as of jan. Determining the lease term sometimes requires judgment, particularly when we. The changes make it easier for users of financial statements to see a company’s. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors:

The changes make it easier for users of financial statements to see a company’s. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web as of jan. Determining the lease term sometimes requires judgment, particularly when we.

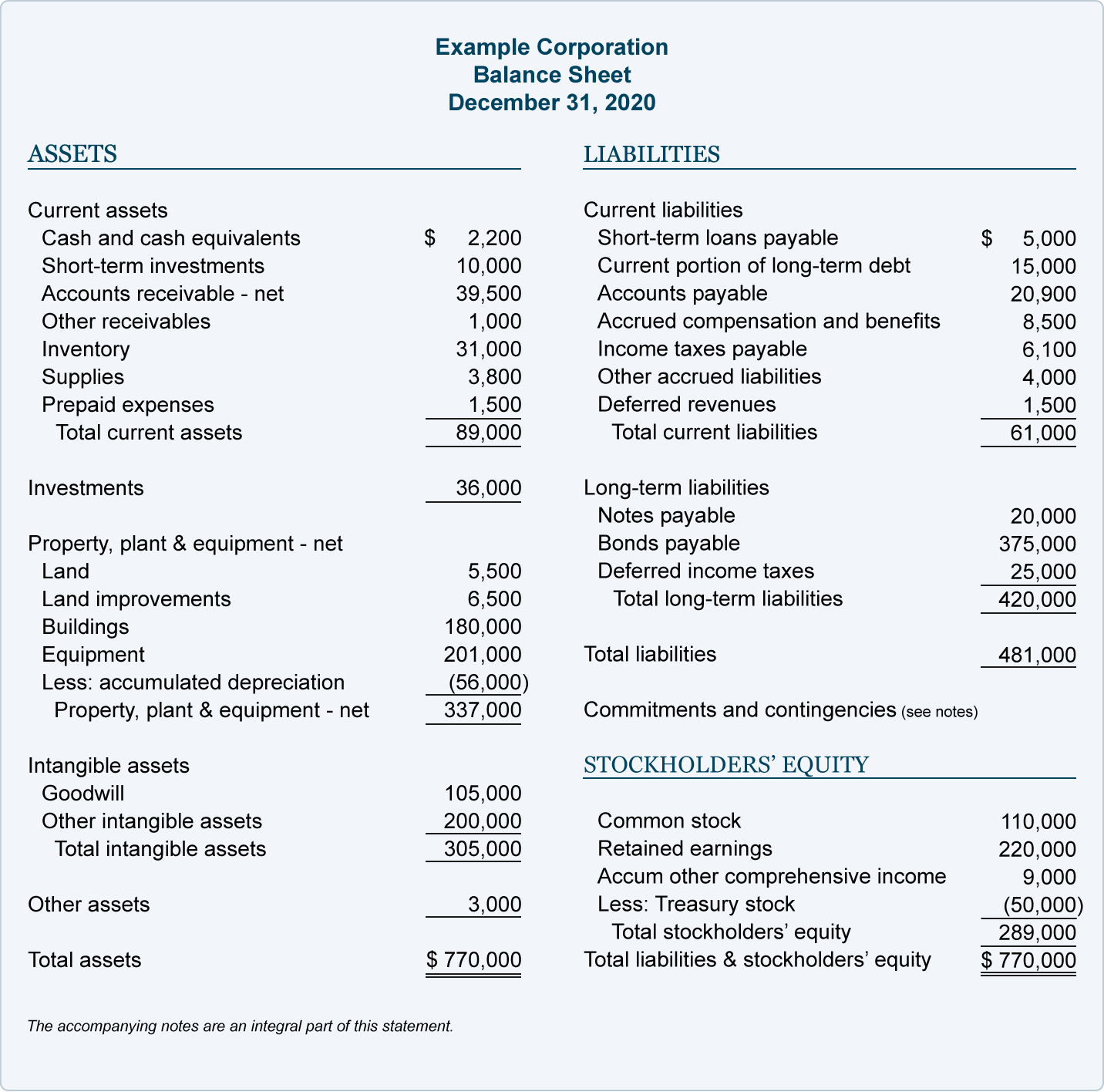

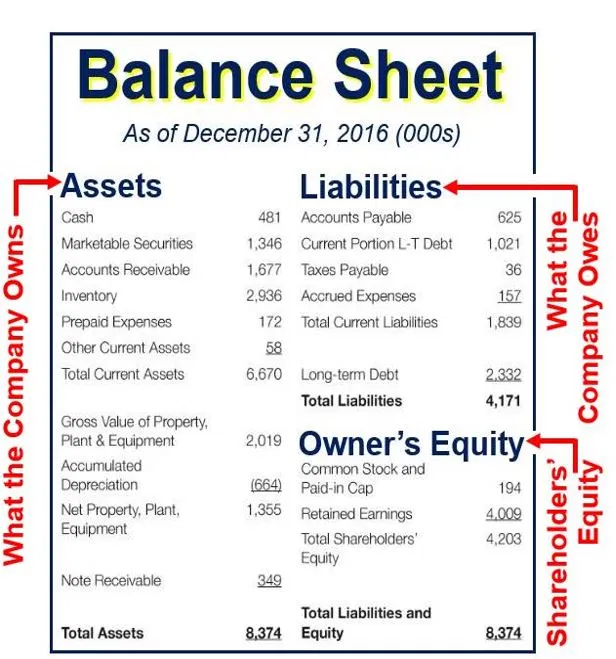

Understanding Your Balance Sheet Financial Accounting Protea

1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web as of jan. Determining the lease term sometimes requires judgment, particularly when we. The changes make it easier.

right of use asset examples examples of web marketing strategies

The changes make it easier for users of financial statements to see a company’s. Determining the lease term sometimes requires judgment, particularly when we. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web as of jan. Web in order to record the lease liability on the.

Accounting for Leases Under the New Standard, Part 1 The CPA Journal

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. The changes make it easier for users of financial statements to see a company’s. Determining the lease term sometimes.

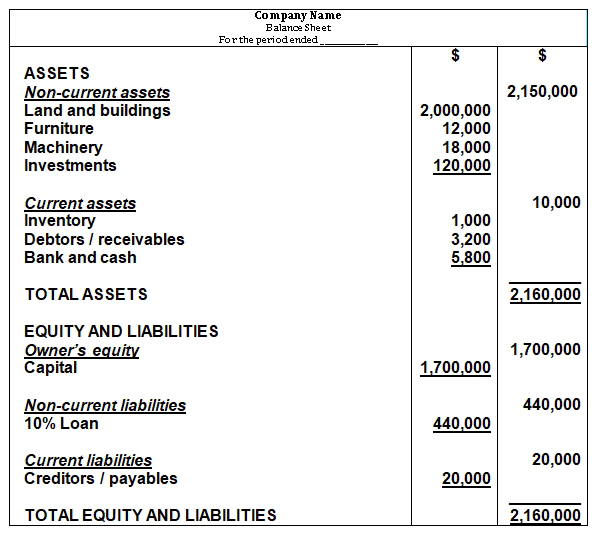

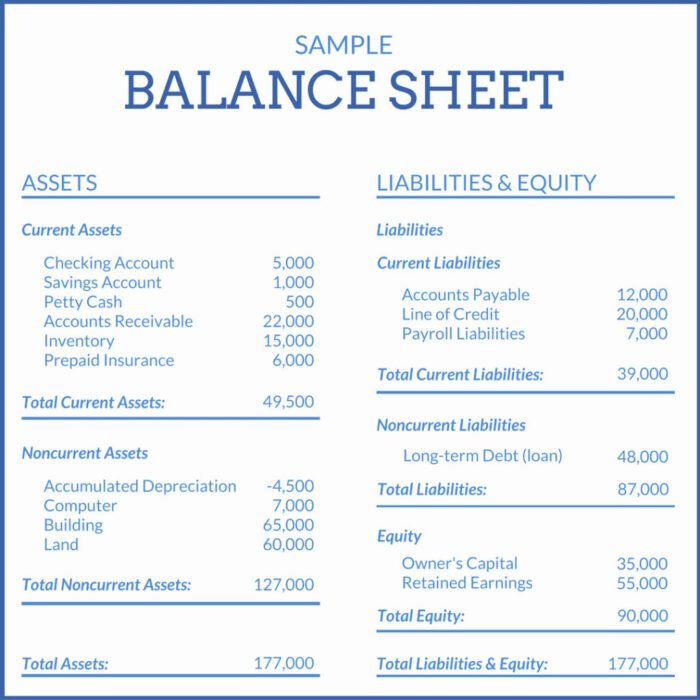

Balance Sheet Explained Structure, Assets, Liabilities with Examples

The changes make it easier for users of financial statements to see a company’s. Determining the lease term sometimes requires judgment, particularly when we. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web in order to record the lease liability on the balance sheet, we need.

Liabilities Side of Balance Sheet Finance Train

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: The changes make it easier for users of financial statements to see a company’s. Determining the lease term sometimes requires judgment, particularly when we. Web as of jan. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards.

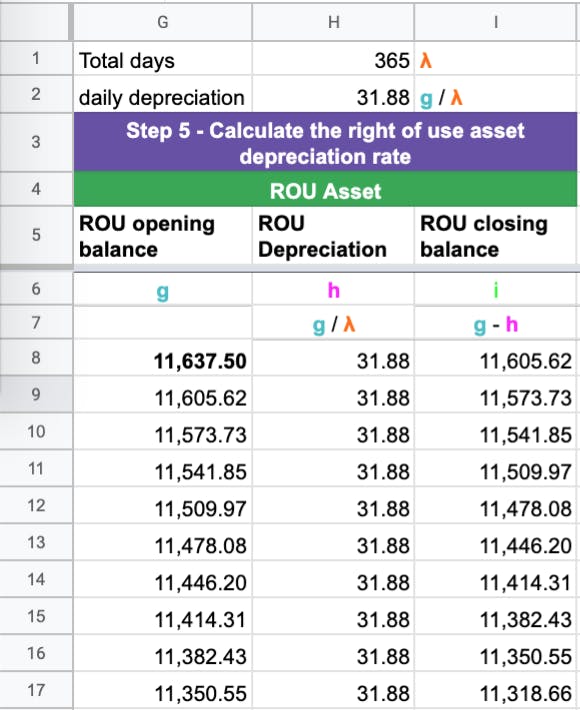

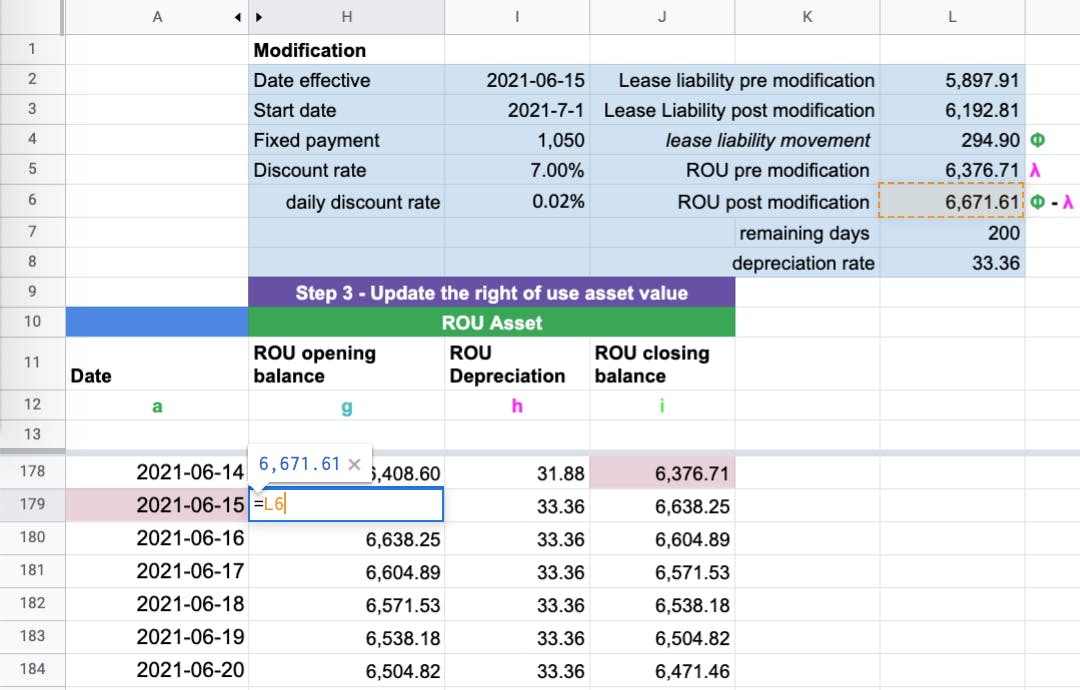

How to calculate a lease liability and rightofuse asset under IFRS 16

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web as of jan. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Determining the lease term sometimes requires judgment, particularly when we. The changes make it easier.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Determining the lease term sometimes requires judgment, particularly when we. Web as of jan. The changes make it easier for users of financial statements to see a company’s. Web in order to record the lease liability on the.

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBX

Determining the lease term sometimes requires judgment, particularly when we. Web as of jan. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: The changes make it easier.

How to calculate a lease liability and rightofuse asset under IFRS 16

The changes make it easier for users of financial statements to see a company’s. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Determining the lease term sometimes.

Liabilities How to classify, Track and calculate liabilities?

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: The changes make it easier for users of financial statements to see a company’s. Determining the lease term sometimes requires judgment, particularly when we. Web as of jan. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards.

Web In Order To Record The Lease Liability On The Balance Sheet, We Need To Know These 3 Factors:

Determining the lease term sometimes requires judgment, particularly when we. The changes make it easier for users of financial statements to see a company’s. 1, 2022, the financial accounting standards board (fasb) lease accounting standard, accounting standards codification (asc) 842, “leases,” became effective for many private. Web as of jan.