Rental Generates 80K In Revenue Every Year

Rental Generates 80K In Revenue Every Year - The interest write off decreases each year in both nominal and real dollars. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. The profit portion of rent increases each year. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property:

There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The profit portion of rent increases each year. The interest write off decreases each year in both nominal and real dollars. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property.

To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. The profit portion of rent increases each year. There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The interest write off decreases each year in both nominal and real dollars. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,.

How to Analyze LongTerm Rentals OSI Properties

The profit portion of rent increases each year. The interest write off decreases each year in both nominal and real dollars. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. There are four primary methods a real estate investor or agent can use to evaluate the.

How Rental Is Taxed A Property Owner’s Guide

There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The profit portion of rent increases each year. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. The number of rental properties you need.

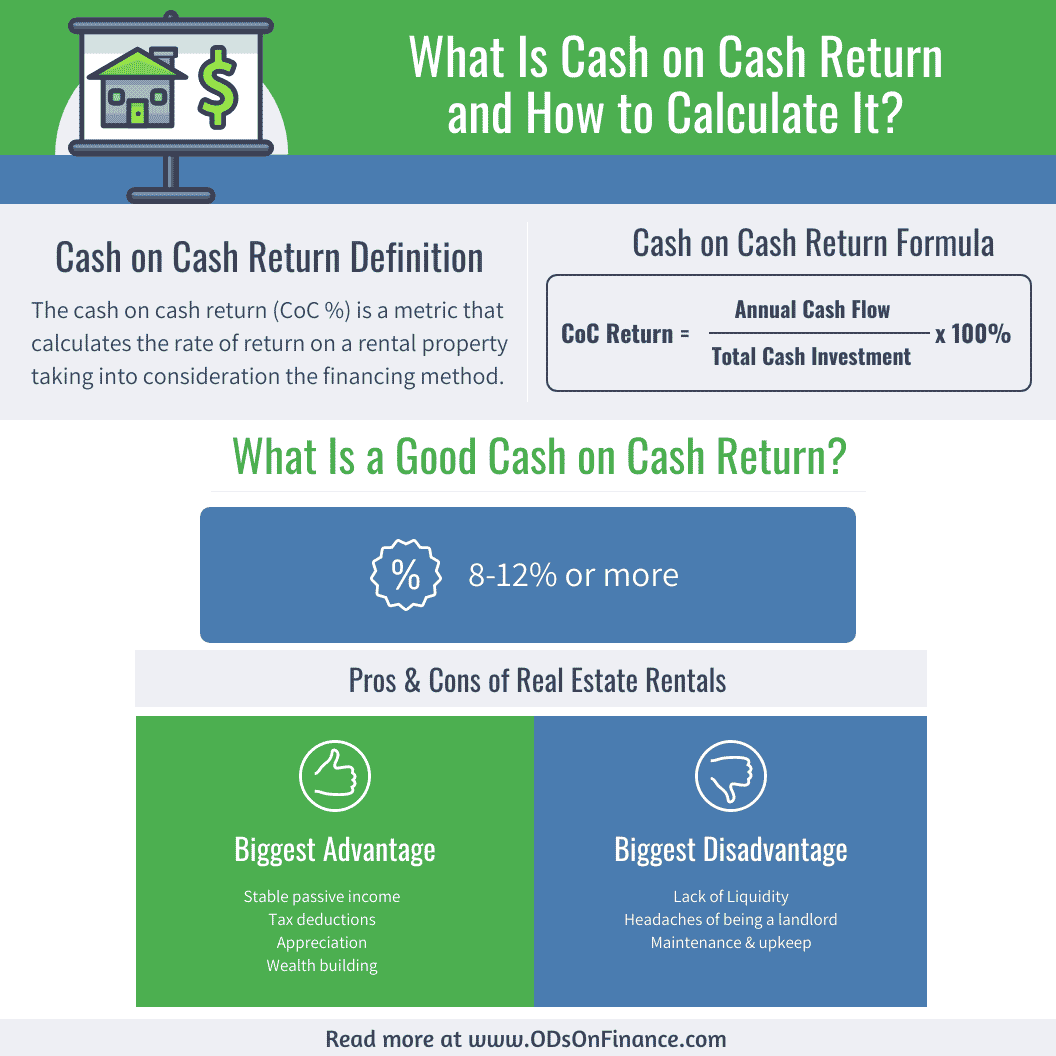

Know How To Calculate ROI On A Rental Property Tata Capital

There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The profit portion of rent increases each year. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. The interest write off decreases each year.

Sanibel Condos Can Gross 80k Rental

The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The interest write off decreases each year in both nominal and real dollars. To calculate.

Sanibel Condos Can Gross 80k Rental

The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. The profit portion of rent increases each year. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. There are four primary methods a.

Rental Statement Spreadsheet, Landlords Template for Excel

The profit portion of rent increases each year. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. The interest write off decreases each.

Rent To Ratio Guide For Landlords SmartMove

There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The interest write off decreases each year in both nominal and real dollars. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. The profit.

Rental Property Calculator Most Accurate Forecast

The interest write off decreases each year in both nominal and real dollars. The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The profit.

7 Ways To Generate Rental At Home New Save Money

The profit portion of rent increases each year. There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The interest write off decreases each year in both nominal and real dollars. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then.

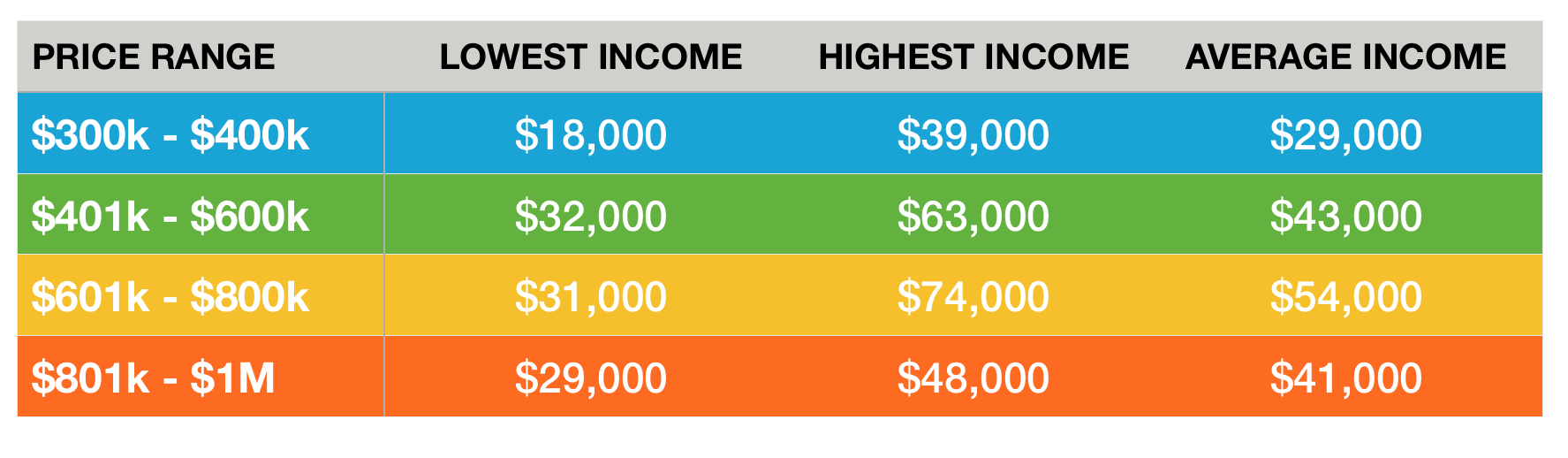

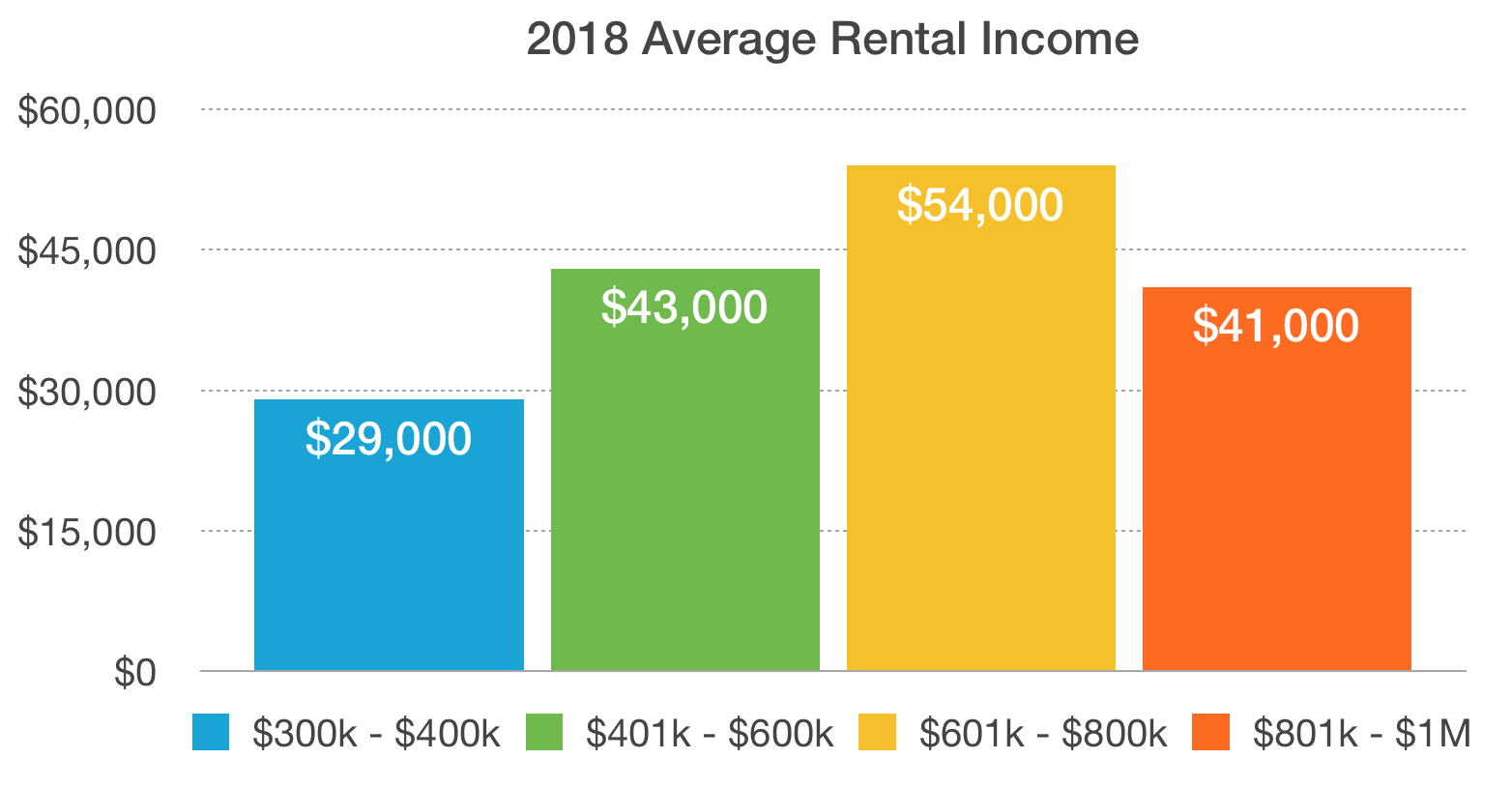

How Much Profit Should Rental Properties Generate? ODs on Finance

There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The profit portion of rent increases each year. To calculate this, start with your total annual rental income (monthly rent multiplied by 12), and then subtract operating expenses such as property. The number of rental properties you need.

To Calculate This, Start With Your Total Annual Rental Income (Monthly Rent Multiplied By 12), And Then Subtract Operating Expenses Such As Property.

There are four primary methods a real estate investor or agent can use to evaluate the potential value of a rental property: The number of rental properties you need to make $100k per year will vary based on several factors, such as the property type,. The profit portion of rent increases each year. The interest write off decreases each year in both nominal and real dollars.