Quickbooks Form 941

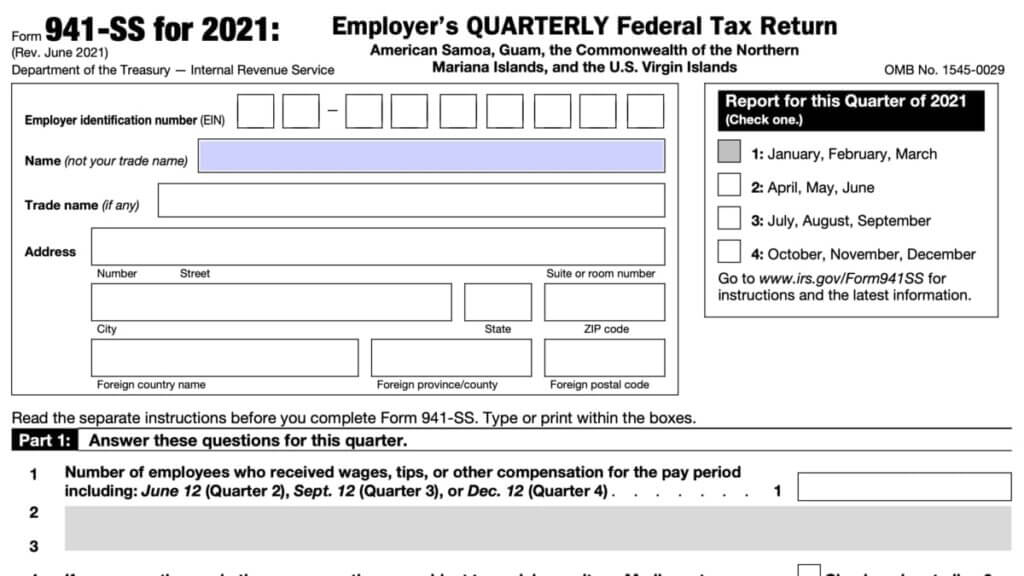

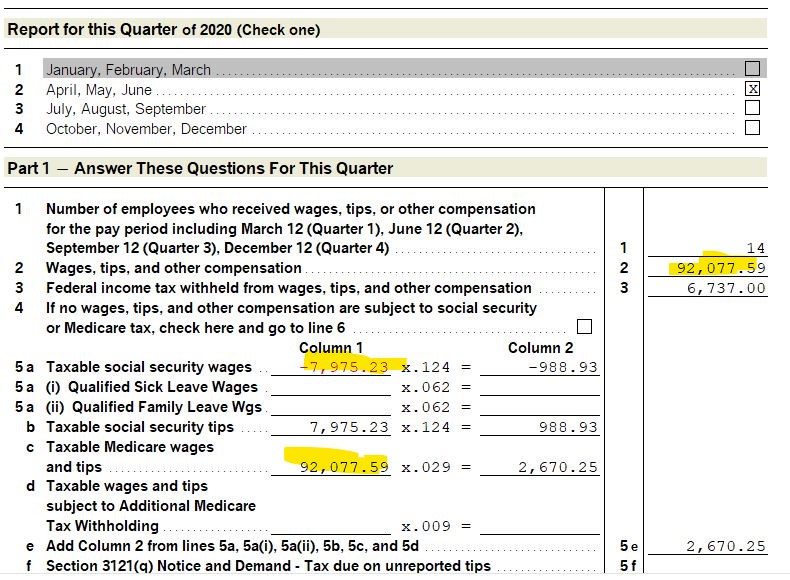

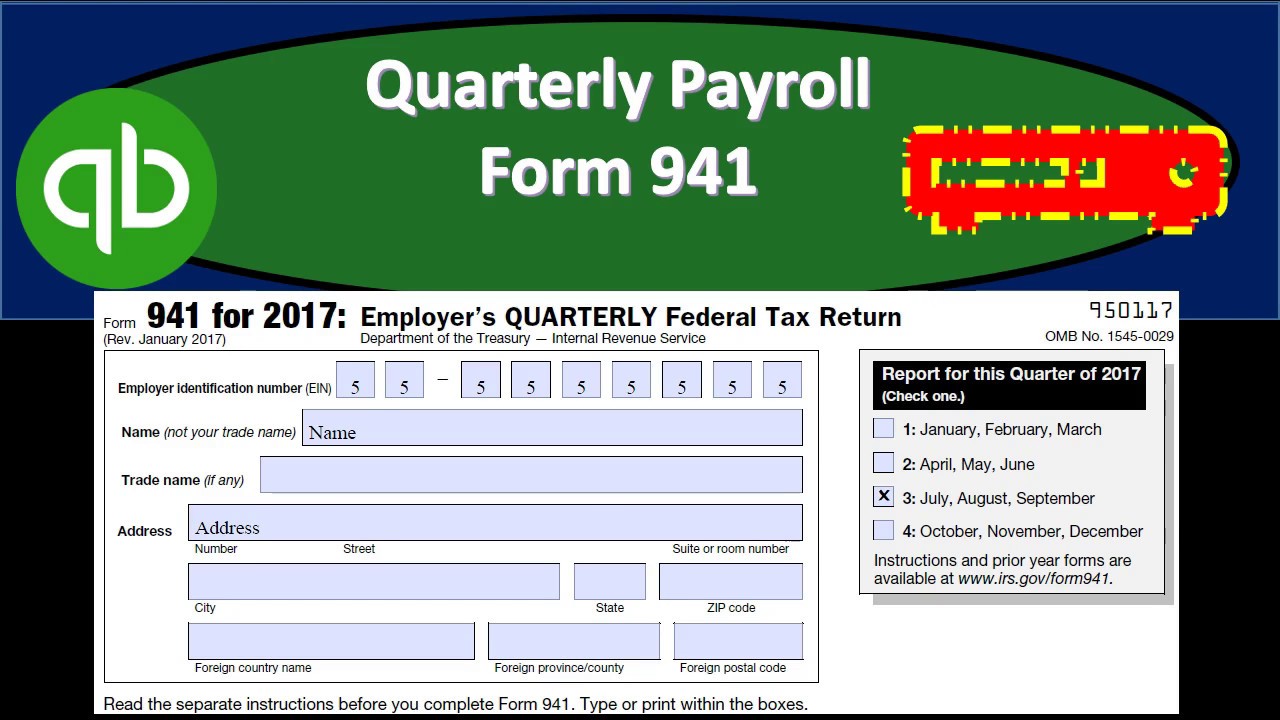

Quickbooks Form 941 - Pay as you go, cancel any time. Track everything in one place. Web first, complete form 8655 reporting agent authorization. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. The process to pay and file quickbooks form 941 manually how to print form 941 from. Web irs form 941 instructions: I keep getting this error: (22108) form 941 for reporting agents (available for. Let freshbooks crunch the numbers for you Select employees & payroll, then click more payroll reports in.

Web form 941 hello, we use desktop quickbooks pro 2018 and online payroll. Employers must file a quarterly form 941 to report wages paid, tips your employees. Let freshbooks crunch the numbers for you Web form 941 and schedule b (form 941) form 941, employer's quarterly federal tax return, has been updated. Web form 941 for 2023: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Track everything in one place. Don't use an earlier revision to report taxes for 2023. You might notice that the quickbooks. Select back to form to get back to the main.

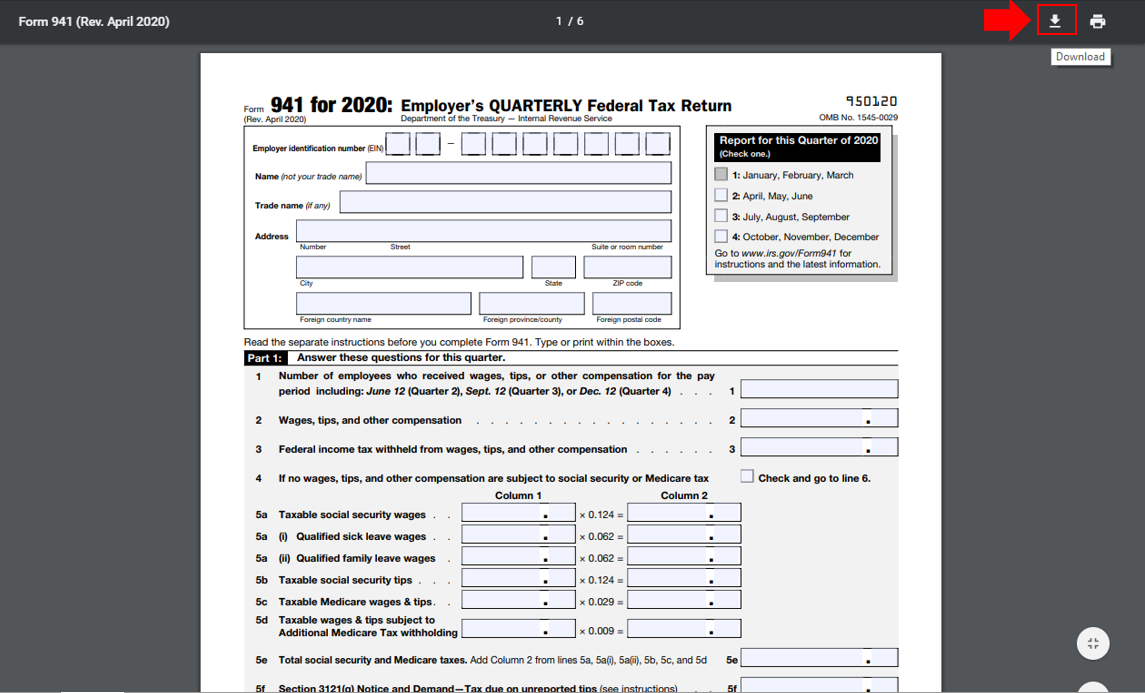

Ad manage all your business expenses in one place with quickbooks®. Spend less time on tax compliance with an avalara avatax plug in for quickbooks. Ad avalara avatax has a prebuilt plug in for quickbooks to make sales tax easier to manage. Don't use an earlier revision to report taxes for 2023. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Go to the reports menu. Indicate the appropriate tax quarter and year in the quarter and year fields. Web irs form 941 instructions: Select employees & payroll, then click more payroll reports in. Web to find your form 941:

QuickBooks form 941 error Fix with Following Guide by sarahwatsonsus

Ad manage all your business expenses in one place with quickbooks®. Web january 10, 2022 02:29 pm yes, @payroll941. Web first, complete form 8655 reporting agent authorization. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. Click on reports at the top menu bar.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. Let freshbooks crunch the numbers for you Web i am attempting to file my 941 in quickbooks desktop version. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Click on reports at the top menu bar.

PPT How can you Fix 941 forms in Quickbooks desktop? PowerPoint

Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021. It.

Where Is Form 941 In Quickbooks?

Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Web to print form 941 or 944. Hit on more payroll reports in excel. Indicate the appropriate tax quarter and year in the quarter and year fields. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue.

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

Explore the #1 accounting software for small businesses. Track everything in one place. Web to find your form 941: Don't use an earlier revision to report taxes for 2023. Web in order to create a 941 report in quickbooks, you have to follow the following steps:

Re Trying to file 941 but getting 'No Employees p... Page 3

I keep getting this error: (22108) form 941 for reporting agents (available for. Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Web i am attempting to file my 941 in quickbooks desktop version. Click on reports at the top menu bar.

Form 941 3Q 2020

Spend less time on tax compliance with an avalara avatax plug in for quickbooks. Don't use an earlier revision to report taxes for 2023. Know exactly what you'll pay each month. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Sign.

QuickBooks 941 Feature Creates Tax Form 941 Fast Video YouTube

Hit on more payroll reports in excel. Employers must file a quarterly form 941 to report wages paid, tips your employees. Select back to form to get back to the main. Track everything in one place. Ad manage all your business expenses in one place with quickbooks®.

What Employers Need to Know about 941 Quarterly Tax Return?

Web january 10, 2022 02:29 pm yes, @payroll941. Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. We have been contacted by the irs that haven't received any 941 reportings since. Let freshbooks crunch the numbers for you Spend less time on tax compliance with an avalara avatax plug in for quickbooks.

11 Form In Quickbooks Seven Things You Should Do In 11 Form In

At this time, the irs. Click on reports at the top menu bar. Ad avalara avatax has a prebuilt plug in for quickbooks to make sales tax easier to manage. Track everything in one place. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023;

Web I Am Attempting To File My 941 In Quickbooks Desktop Version.

Spend less time on tax compliance with an avalara avatax plug in for quickbooks. Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web january 10, 2022 02:29 pm yes, @payroll941.

Web Form 941 Hello, We Use Desktop Quickbooks Pro 2018 And Online Payroll.

Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Employers must file a quarterly form 941 to report wages paid, tips your employees. Select back to form to get back to the main. Select employees & payroll, then click more payroll reports in.

You Might Notice That The Quickbooks.

In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. Web to print form 941 or 944. Let freshbooks crunch the numbers for you Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021.

Web In Order To Create A 941 Report In Quickbooks, You Have To Follow The Following Steps:

Select either form 941 or 944 in the tax reports section of print reports. I keep getting this error: At this time, the irs. Explore the #1 accounting software for small businesses.