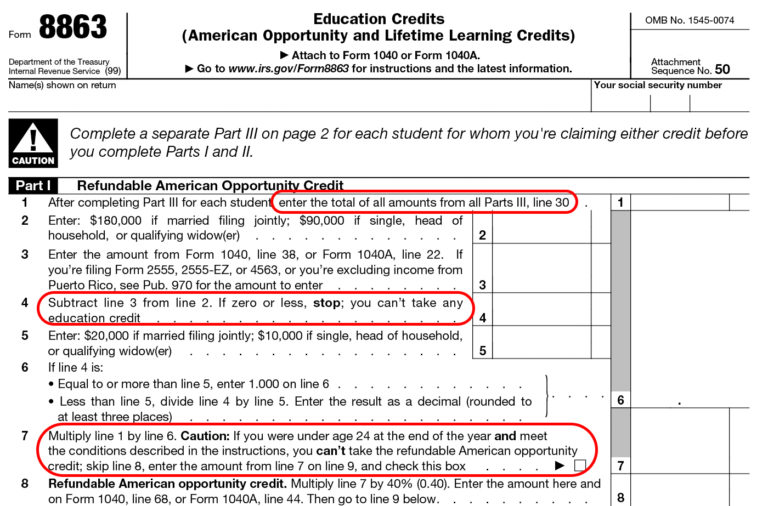

Pub 970 Form 8863

Pub 970 Form 8863 - Department of the treasury internal revenue service. Web how can we help you? ( university of missouri libraries ) services. Web form 8863 pub 4012, tab j, education benefits, nonrefundable credits pub 4012, tab j, education benefits, entering education benefits pub 970. Web this statement may help you claim an education credit. Web so if you are in the 22% or higher bracket, it can make more sense to deduct (and save 22%+) rather than get a 20% credit. Web to claim either credit, you must file your taxes and attach form 8863. Web to see if you qualify for a credit, and for help in calculating the amount of your credit, see pub. Anyways, yeah, just switch to an actually free. Web this is pursuant to the 1997 taxpayer relief act.

Web in completing form 8863, use only the amounts you actually paid (plus any amounts you're treated as having paid) in 2022 (reduced, as necessary, as described under adjusted. Be aware of common mistakes the student is listed as a. Web this statement may help you claim an education credit. Or form 4563, exclusion of income for bona fide residents of american samoa; Web so if you are in the 22% or higher bracket, it can make more sense to deduct (and save 22%+) rather than get a 20% credit. Detailed information for claiming education tax credits is in irs publication 970. Web to claim either credit, you must file your taxes and attach form 8863. Web in order to claim these credits, you have to fill out form 8863 and attach it to your tax return. Web in completing form 8863, use only the amounts you actually paid (plus any amounts you are treated as having paid) in 2013 (reduced, as necessary, as described in adjusted. Web form 8863 pub 4012, tab j, education benefits, nonrefundable credits pub 4012, tab j, education benefits, entering education benefits pub 970.

Web see irs publication 970 and the form 8863 instructions for information on reporting a reduction in your education credit or tuition and fees deduction. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web how can we help you? Form 8863 and instructions are. Be aware of common mistakes the student is listed as a. To see if you qualify for a credit, and for help in calculating the amount of your credit, see pub. Web descriptions of which expenses qualify are available in irs publication 970, tax benefits for education. Web this statement may help you claim an education credit. Web to see if you qualify for a credit, and for help in calculating the amount of your credit, see pub. Or are excluding income from puerto rico, add to the amount on your form.

MW My 2004 Federal and State Tax Returns

Web so if you are in the 22% or higher bracket, it can make more sense to deduct (and save 22%+) rather than get a 20% credit. While you can’t claim both credits for one student, you can use one form to claim both. Web to claim either credit, you must file your taxes and attach form 8863. Web in.

Fill Free fillable Form 8863 Education Credits PDF form

Form 1040 instructions what are education credits? (99) education credits (american opportunity and lifetime learning credits) attach to form 1040 or form. File your taxes for free. Be aware of common mistakes the student is listed as a. Web to claim either credit, you must file your taxes and attach form 8863.

Publication 970 (2017), Tax Benefits for Education Internal Revenue

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Form 1040 instructions what are education credits? Web this statement may help you claim an education credit. Department of the treasury internal revenue service. Be sure to keep all of your receipts and documentation from.

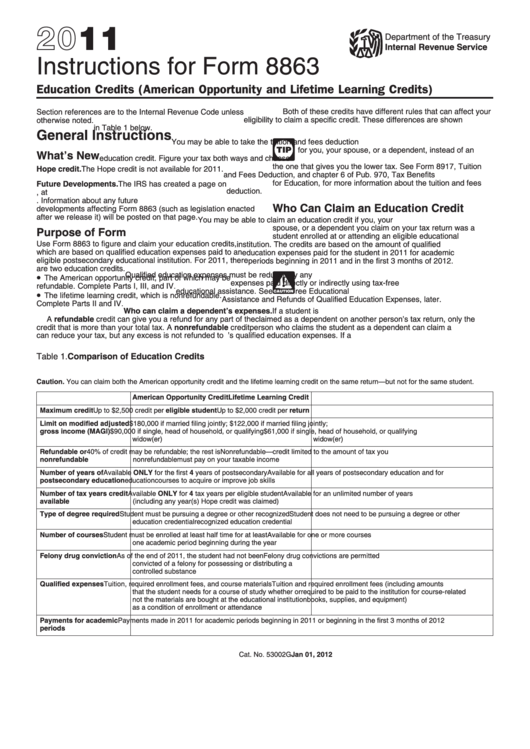

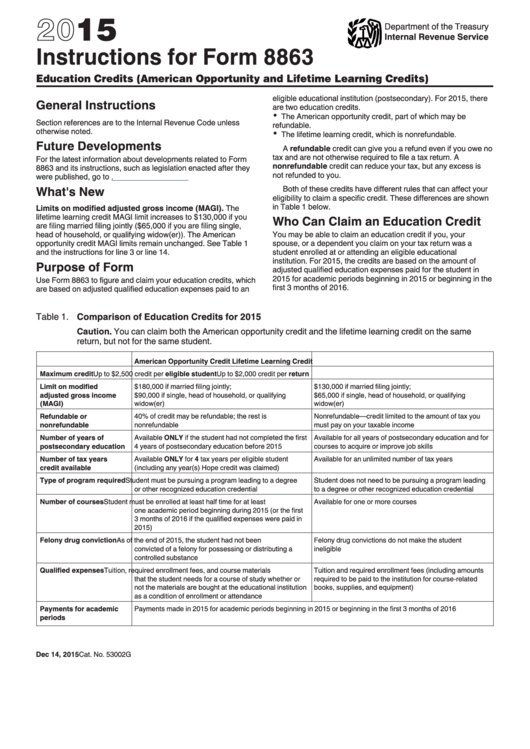

Instructions For Form 8863 Education Credits (American Opportunity

Or form 4563, exclusion of income for bona fide residents of american samoa; Detailed information for claiming education tax credits is in irs publication 970. Web how can we help you? Web in order to claim these credits, you have to fill out form 8863 and attach it to your tax return. Be aware of common mistakes the student is.

Publication 970 Tax Benefits for Higher Education; Illustrated Example

Department of the treasury internal revenue service. Figuring the amount not subject to the 10% tax. Or are excluding income from puerto rico, add to the amount on your form. File your taxes for free. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution.

Instructions For Form 8863 Education Credits (american Opportunity And

Web form 8863 pub 4012, tab j, education benefits, nonrefundable credits pub 4012, tab j, education benefits, entering education benefits pub 970. Web in completing form 8863, use only the amounts you actually paid (plus any amounts you're treated as having paid) in 2022 (reduced, as necessary, as described under adjusted. Or are excluding income from puerto rico, add to.

970 │ SCHLICK twosubstance nozzle fullcone external mixing

Web this statement may help you claim an education credit. Be sure to keep all of your receipts and documentation from your educational expenses. Sign in to your account. To see if you qualify for a credit, and for help in calculating the amount of your credit, see pub. Be aware of common mistakes the student is listed as a.

IRS Form 8863 Education Credits Stock video footage 10492136

Web descriptions of which expenses qualify are available in irs publication 970, tax benefits for education. Be sure to keep all of your receipts and documentation from your educational expenses. Figuring the amount not subject to the 10% tax. Form 1040 instructions what are education credits? ( university of missouri libraries ) services.

Publication 970 (2021), Tax Benefits for Education Internal Revenue

Web so if you are in the 22% or higher bracket, it can make more sense to deduct (and save 22%+) rather than get a 20% credit. Web in completing form 8863, use only the amounts you actually paid (plus any amounts you're treated as having paid) in 2022 (reduced, as necessary, as described under adjusted. Web use form 8863.

Form 8863 Instructions Information On The Education 1040 Form Printable

Web in order to claim these credits, you have to fill out form 8863 and attach it to your tax return. Web this statement may help you claim an education credit. Be aware of common mistakes the student is listed as a. Web descriptions of which expenses qualify are available in irs publication 970, tax benefits for education. While you.

To See If You Qualify For A Credit, And For Help In Calculating The Amount Of Your Credit, See Pub.

While you can’t claim both credits for one student, you can use one form to claim both. Detailed information for claiming education tax credits is in irs publication 970. Web in completing form 8863, use only the amounts you actually paid (plus any amounts you're treated as having paid) in 2022 (reduced, as necessary, as described under adjusted. Web this statement may help you claim an education credit.

Anyways, Yeah, Just Switch To An Actually Free.

Department of the treasury internal revenue service. Or are excluding income from puerto rico, add to the amount on your form. Web to claim either credit, you must file your taxes and attach form 8863. Web to see if you qualify for a credit, and for help in calculating the amount of your credit, see pub.

Sign In To Your Account.

File your taxes for free. Web so if you are in the 22% or higher bracket, it can make more sense to deduct (and save 22%+) rather than get a 20% credit. Form 8863 and instructions are. Web this is pursuant to the 1997 taxpayer relief act.

Web See Irs Publication 970 And The Form 8863 Instructions For Information On Reporting A Reduction In Your Education Credit Or Tuition And Fees Deduction.

Web form 8863 pub 4012, tab j, education benefits, nonrefundable credits pub 4012, tab j, education benefits, entering education benefits pub 970. Or form 4563, exclusion of income for bona fide residents of american samoa; Web in completing form 8863, use only the amounts you actually paid (plus any amounts you are treated as having paid) in 2013 (reduced, as necessary, as described in adjusted. Figuring the amount not subject to the 10% tax.