Print Form 2290

Print Form 2290 - Web you can visit the official irs website to download and print out the blank 2290 form for 2022. Web the irs 2290 form printable is designed to make your life easier by providing a simple and organized way to file your heavy vehicle use tax. You can file it as an individual or as any type of business organization. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Only 3 simple steps to get schedule 1 filing your irs hvut 2290 can be stressful and confusing, especially if you’re not using a 2290 online solution. Web it is easy to file irs form 2290 with expresstrucktax. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of schedule 1 to this return. The current period begins july 1, 2023, and ends june 30, 2024. The form collects the information about all the vehicles of this class you have. Web use form 2290 to:

It takes only a few minutes to file and download your form 2290 with expressefile. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Web the 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered. Web you can visit the official irs website to download and print out the blank 2290 form for 2022. Get irs stamped schedule 1 in minutes; Web you can register here.to obtain a copy of your 2290 proof of payment, simply follow these steps: Web go to www.irs.gov/form2290 for instructions and the latest information. Filing online is simple, fast & secure. Web the 2290 form must be filed by the last day of the month following the first month of use.

The filing rules apply whether you are paying the tax or reporting suspension of the tax. The form collects the information about all the vehicles of this class you have. This article will walk you through the template structure, rules for filling it in, and how to file it correctly. Filing online is simple, fast & secure. Keep a copy of this return for your records. Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web what is form 2290? Web the fillable form 2290 (2023) (heavy highway vehicle use tax return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. The current period begins july 1, 2023, and ends june 30, 2024. All forms are printable and downloadable.

Download Form 2290 for Free Page 3 FormTemplate

July 2017) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july 1, 2017, through june 30, 2018 attach both copies of schedule 1 to this return. This article will walk you through the template structure, rules for filling it in, and how to file it correctly. You can file it as.

form 2290 20182022 Fill Online, Printable, Fillable Blank

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The form collects the information about all the vehicles of this class you have. Web fill online, printable, fillable, blank f2290 form 2290 (rev. Information about form 2290 and its separate instructions is at www.irs.gov/form2290 Use fill to.

Electronic IRS Form 2290 2019 2020 Printable PDF Sample

Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Electronic filing submitting preliminary applications with the irs for electronic returns. Form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross.

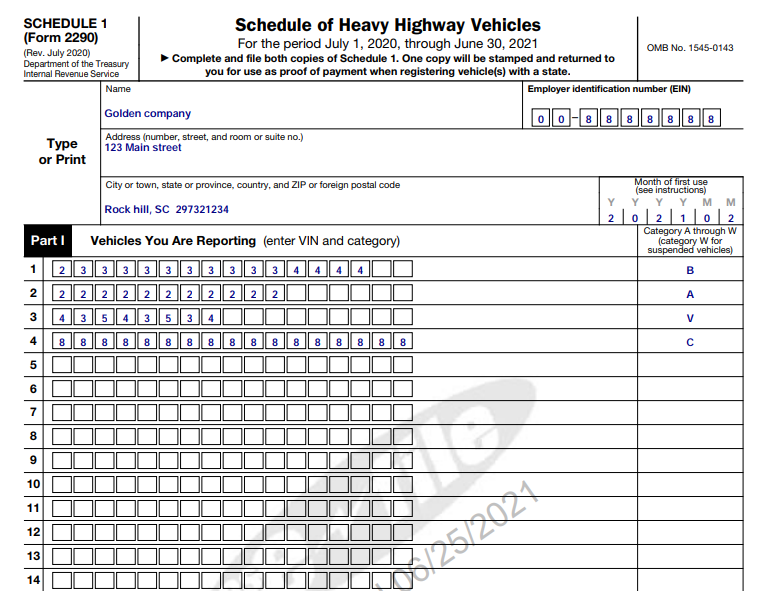

Federal Form 2290 Schedule 1 Universal Network

Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period; Log into your account and visit the schedule 1 status page. Soon, you'll be ready to conquer the 2290 tax form printable like a pro! This article will.

Printable IRS Form 2290 for 2020 Download 2290 Form

It takes only a few minutes to file and download your form 2290 with expressefile. Once your return is accepted by the irs, your stamped schedule 1 can be available within minutes. Electronic filing submitting preliminary applications with the irs for electronic returns. You'll need a pdf reader to open and print it. Soon, you'll be ready to conquer the.

Printable Form 2290 For 2020 Master of Document Templates

Keep a copy of this return for your records. Process, or, if you have over 25 vehicles, our free 2290calculator© step 3: All forms are printable and downloadable. Log into your account and visit the schedule 1 status page. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Electronic filing submitting preliminary applications with the irs for electronic returns. Go to www.irs.gov/form2290 for instructions and the latest information. Keep a copy of this return for your records. Web use form 2290 to: The current period begins july 1, 2023, and ends june 30, 2024.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Web it is easy to file irs form 2290 with expresstrucktax. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Process, or, if you have over 25 vehicles, our free 2290calculator© step 3: The filing rules apply whether you are paying the tax or reporting.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Use fill to complete blank online irs pdf forms for free. The form collects the information about all the vehicles of this class you have. The filing rules apply whether you are paying the tax or reporting suspension of the tax. Information about form 2290 and its separate instructions is at www.irs.gov/form2290 You'll need a pdf reader to open and.

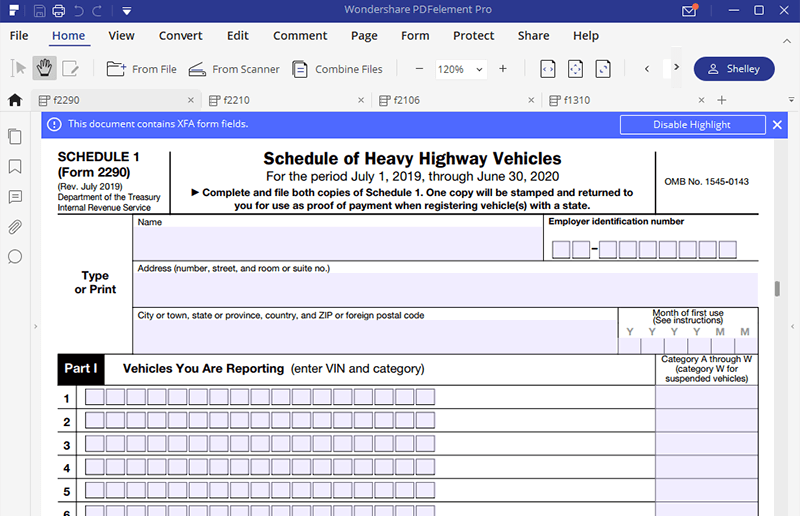

IRS Form 2290 Fill it Without Stress Wondershare PDFelement

Go to www.irs.gov/form2290 for instructions and the latest information. Processing schedule 1 (2290) processing form 2290 for clients filing in multiple periods during the tax year. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period; It takes.

Go To Www.irs.gov/Form2290 For Instructions And The Latest Information.

All forms are printable and downloadable. Download or print 2290 for your records; Electronic filing submitting preliminary applications with the irs for electronic returns. Web download form 2290 for current and previous years.

Processing Schedule 1 (2290) Processing Form 2290 For Clients Filing In Multiple Periods During The Tax Year.

Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period; This article will walk you through the template structure, rules for filling it in, and how to file it correctly. Web what is form 2290? Web you can visit the official irs website to download and print out the blank 2290 form for 2022.

Web Use Form 2290 To:

You can file it as an individual or as any type of business organization. As soon as you have it on paper, you can enter the required data by hand and affix a signature. The current period begins july 1, 2023, and ends june 30, 2024. Review and transmit the form directly to the irs;

The Form Collects The Information About All The Vehicles Of This Class You Have.

Web get a printable tax form 2290 as an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. The filing rules apply whether you are paying the tax or reporting suspension of the tax. Form 2290, heavy highway vehicle use tax return, is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55,000 pounds or more. Once completed you can sign your fillable form or send for signing.