Poshmark Tax Form

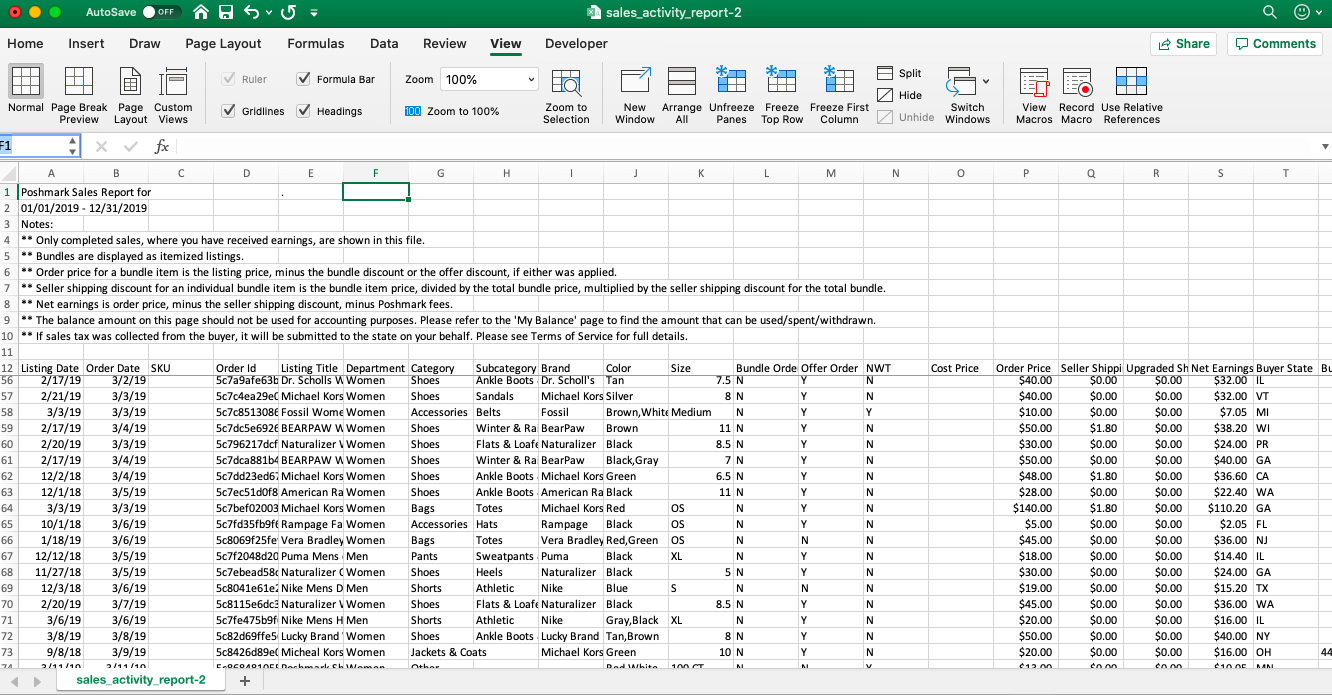

Poshmark Tax Form - For anything above $15, 20% goes to. For new sellers, however, tax season can come with a lot of questions. 5mb file in pdf, jpg or png format) For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as applicable, per state laws and local tax laws or where poshmark is otherwise obligated to do so. Poshmark allows buyer to purchase at listed price and charges a shipping fee (unknown to seller). Do you have to pay taxes on your online sales? If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward.

Web sales tax exemption form. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. Poshmark allows buyer to purchase at listed price and charges a shipping fee (unknown to seller). For anything above $15, 20% goes to. If you have an exemption and would like to submit your certificate for review, you may do so here. 5mb file in pdf, jpg or png format) Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. Do you have to pay taxes on your online sales? Seller chooses a selling price and lists item. For any sales you make under $15, a flat commission fee of $2.95 goes to the platform.

If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. If you have an exemption and would like to submit your certificate for review, you may do so here. Poshmark allows buyer to purchase at listed price and charges a shipping fee (unknown to seller). For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as applicable, per state laws and local tax laws or where poshmark is otherwise obligated to do so. Web sales tax exemption form. For new sellers, however, tax season can come with a lot of questions. For anything above $15, 20% goes to. Seller chooses a selling price and lists item.

Understanding Your Form 1099K FAQs for Merchants Clearent

Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. Web sales tax exemption form. Do you have to pay taxes on your online sales? Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular.

New Poshmark Sales Tax Policy 2019 Posh Remit Program YouTube

Seller chooses a selling price and lists item. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as applicable, per state laws and local tax laws or where poshmark.

I Promote On Poshmark,& Have Profited They Take 20 & Pay Taxes. Do I

If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Web sales tax exemption form. 5mb file in pdf, jpg or png format) For new sellers, however, tax season can come with a lot of questions. Poshmark allows buyer to purchase at listed price and charges a.

Poshmark SEC Filing in Anticipation of Its IPO Shows a Profitable

Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. For anything above $15,.

Taxes for Poshmark Resellers When you sell personal used belongings for

If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. 5mb file in pdf, jpg or png format) If you have an exemption and would like to submit your certificate for review, you may do so here. For any sales you make under $15, a flat commission.

Poshmark Review Is It Worth It to Buy and Sell Clothes in 2022?

5mb file in pdf, jpg or png format) For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. If you have an exemption and would like to submit your certificate for review, you may do so here. If you are unsure what your tax obligations may be, we encourage you to consult an.

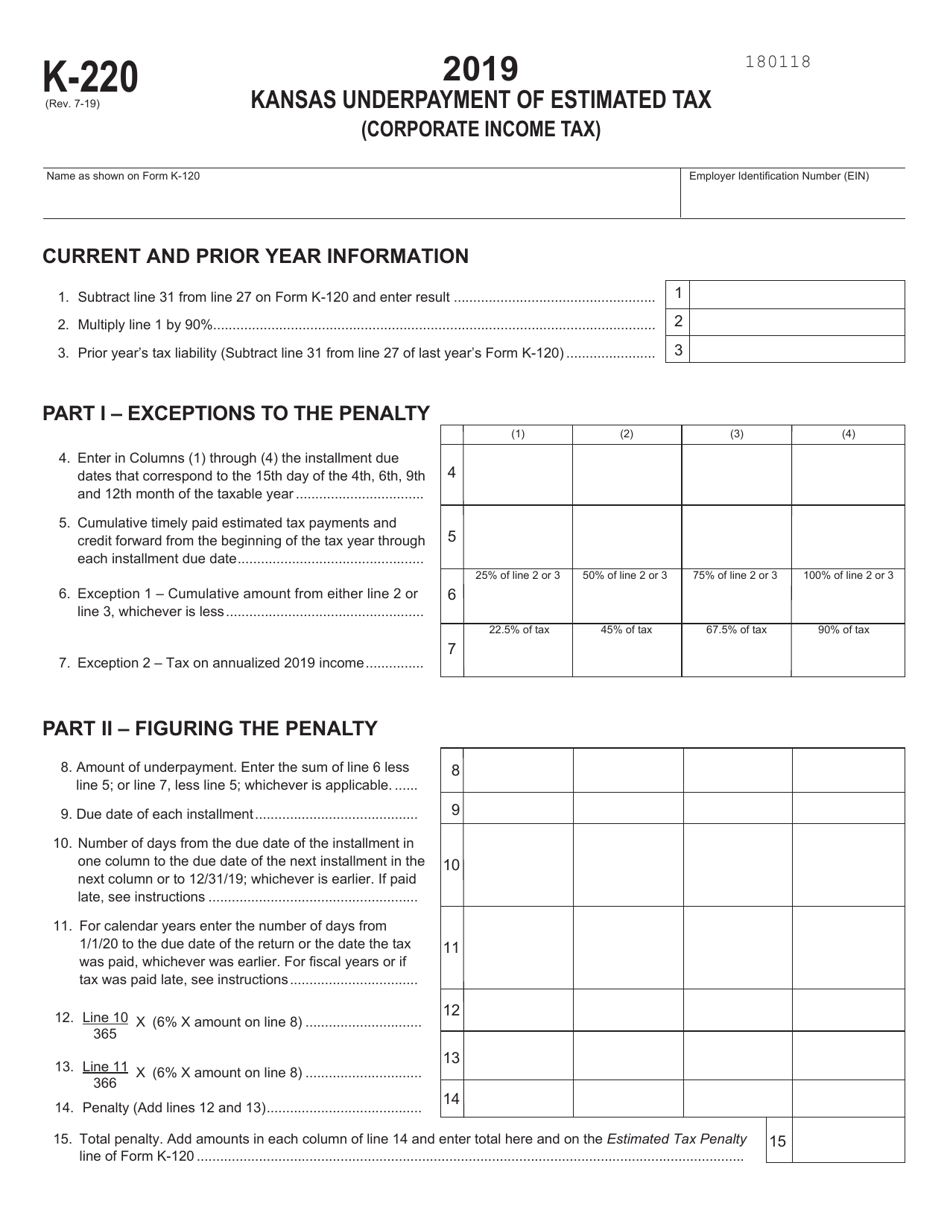

Schedule K220 Download Fillable PDF or Fill Online Kansas Underpayment

If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Seller chooses a selling price and lists item. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. For new sellers, however, tax.

Poshmark Products Listing Sheet Poshmark Seller Form Etsy Finance

For any sales you make under $15, a flat commission fee of $2.95 goes to the platform. 5mb file in pdf, jpg or png format) Seller chooses a selling price and lists item. Do you have to pay taxes on your online sales? Web how to submit an exemption certificate poshmark is responsible for collecting and remitting sales tax, as.

Poshmark Fees and Poshmark Taxes Explained Closet Assistant

Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. For new sellers, however, tax season can come with a lot of questions. Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. Seller chooses a selling price and lists item..

FAQ What is a 1099 K? Pivotal Payments

For anything above $15, 20% goes to. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward. If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. For new sellers, however, tax season can come with a lot of questions. If you.

For Any Sales You Make Under $15, A Flat Commission Fee Of $2.95 Goes To The Platform.

If you are unsure what your tax obligations may be, we encourage you to consult an accountant or other expert in your area. Seller chooses a selling price and lists item. Web sales tax exemption form. Web poshmark and state sale taxes as we know, poshmark's seller's fee is pretty straightforward.

Web How To Submit An Exemption Certificate Poshmark Is Responsible For Collecting And Remitting Sales Tax, As Applicable, Per State Laws And Local Tax Laws Or Where Poshmark Is Otherwise Obligated To Do So.

Poshmark receives buyer's payment (including shipping charges), pays actual shipping cost, retains a commission on selling price, and credits remaining amount to seller's account. Web poshmark will calculate, collect, and remit sales tax on behalf of our sellers to state taxing agencies on a regular basis to only the states listed in the chart above. 5mb file in pdf, jpg or png format) If you have an exemption and would like to submit your certificate for review, you may do so here.

Poshmark Allows Buyer To Purchase At Listed Price And Charges A Shipping Fee (Unknown To Seller).

For new sellers, however, tax season can come with a lot of questions. For anything above $15, 20% goes to. Do you have to pay taxes on your online sales?