Oregon Withholding Form

Oregon Withholding Form - View all of the current year's forms and publications by popularity or program area. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and business assistance. If too little is withheld, you will generally owe tax when you file your tax return. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Otherwise, skip to step 5. Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: See page 2 for more information on each step, who can claim. Your 2020 tax return may still result in a tax due or refund.

Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing. Your 2020 tax return may still result in a tax due or refund. Select a heading to view its forms, then u se the search. See page 2 for more information on each step, who can claim. The oregon tax tables are found in the. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. View all of the current year's forms and publications by popularity or program area. 1511421 ev 11122 2 of 7 223 o 4 o way that federal withholding is done. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. However, an employer must offer in writing to.

Select a heading to view its forms, then u se the search. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing. Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: Web oregon withholding statement and exemption certificate note: Web file your withholding tax returns. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If too little is withheld, you will generally owe tax when you file your tax return. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or.

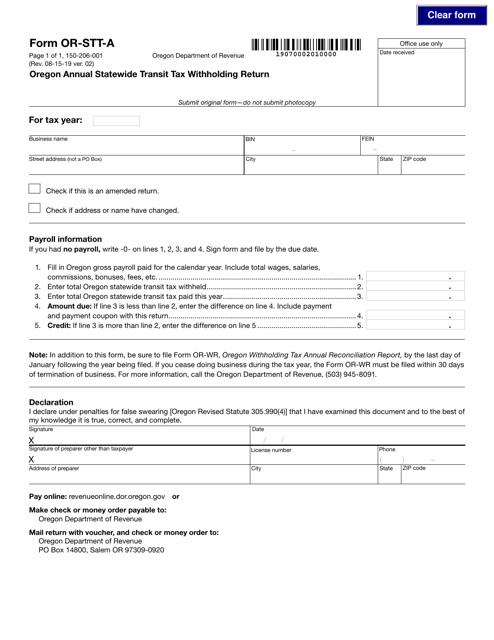

Form ORSTTA (150206001) Download Fillable PDF or Fill Online Oregon

Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Select a heading to view its forms, then u se the search. Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: Web most taxpayers are required to file.

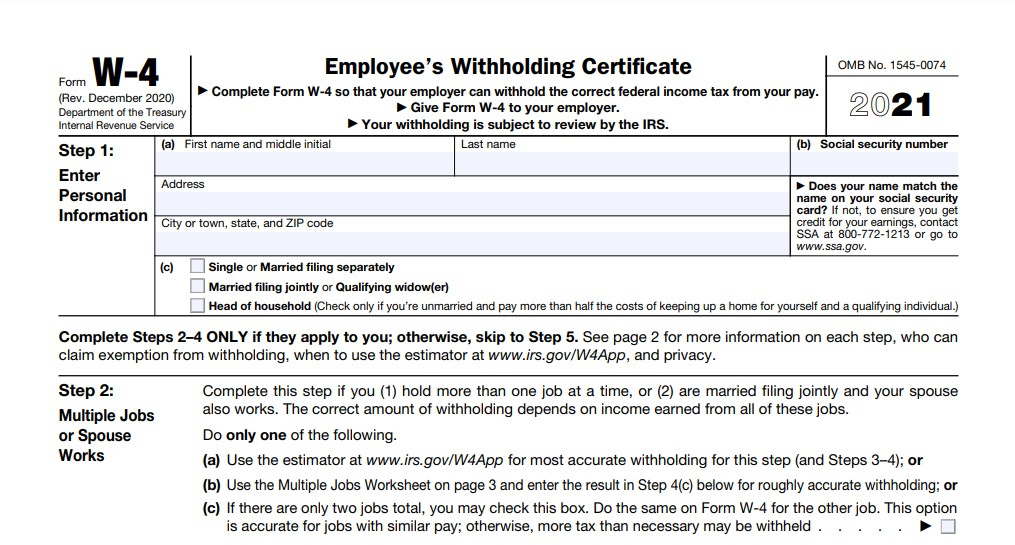

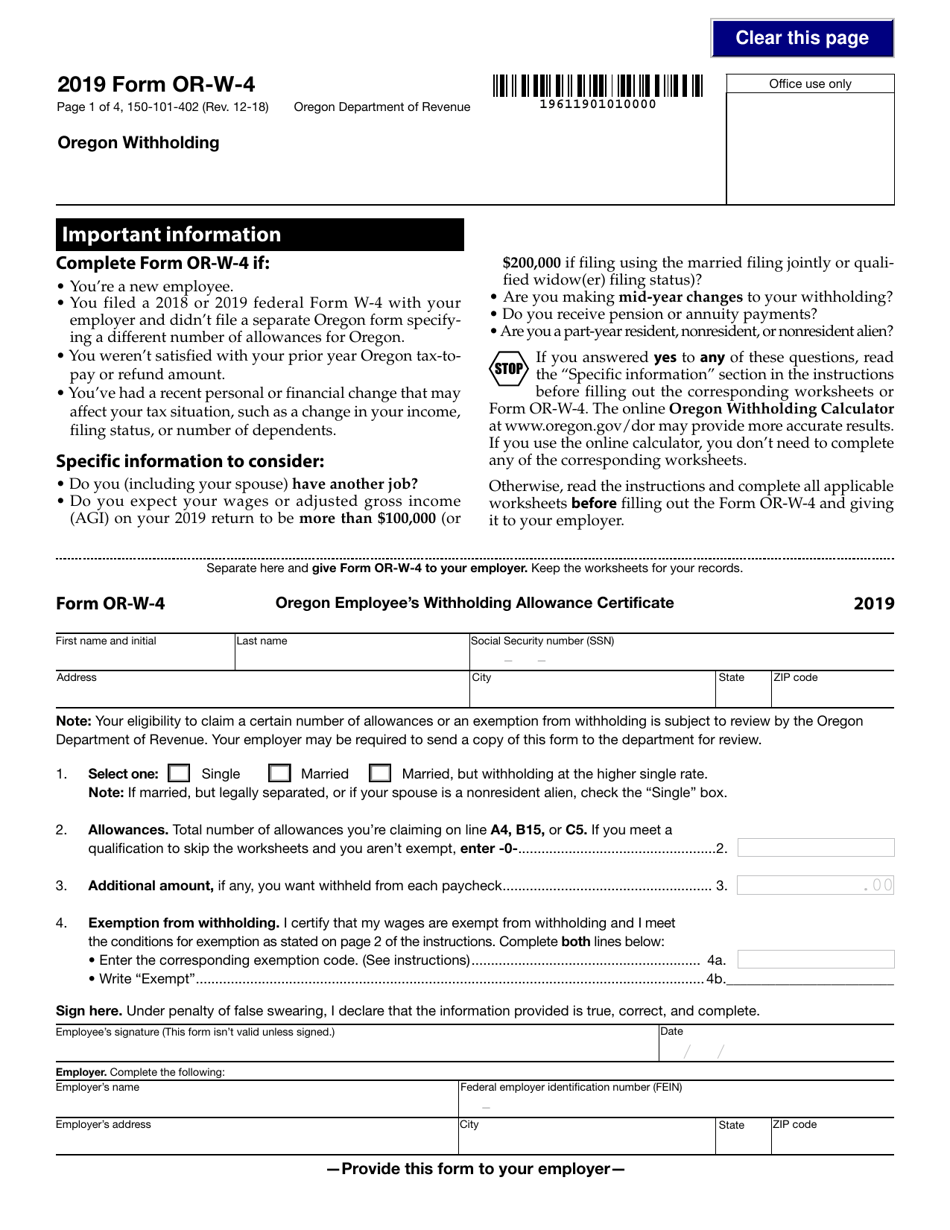

Oregon W4 2021 Form Printable 2022 W4 Form

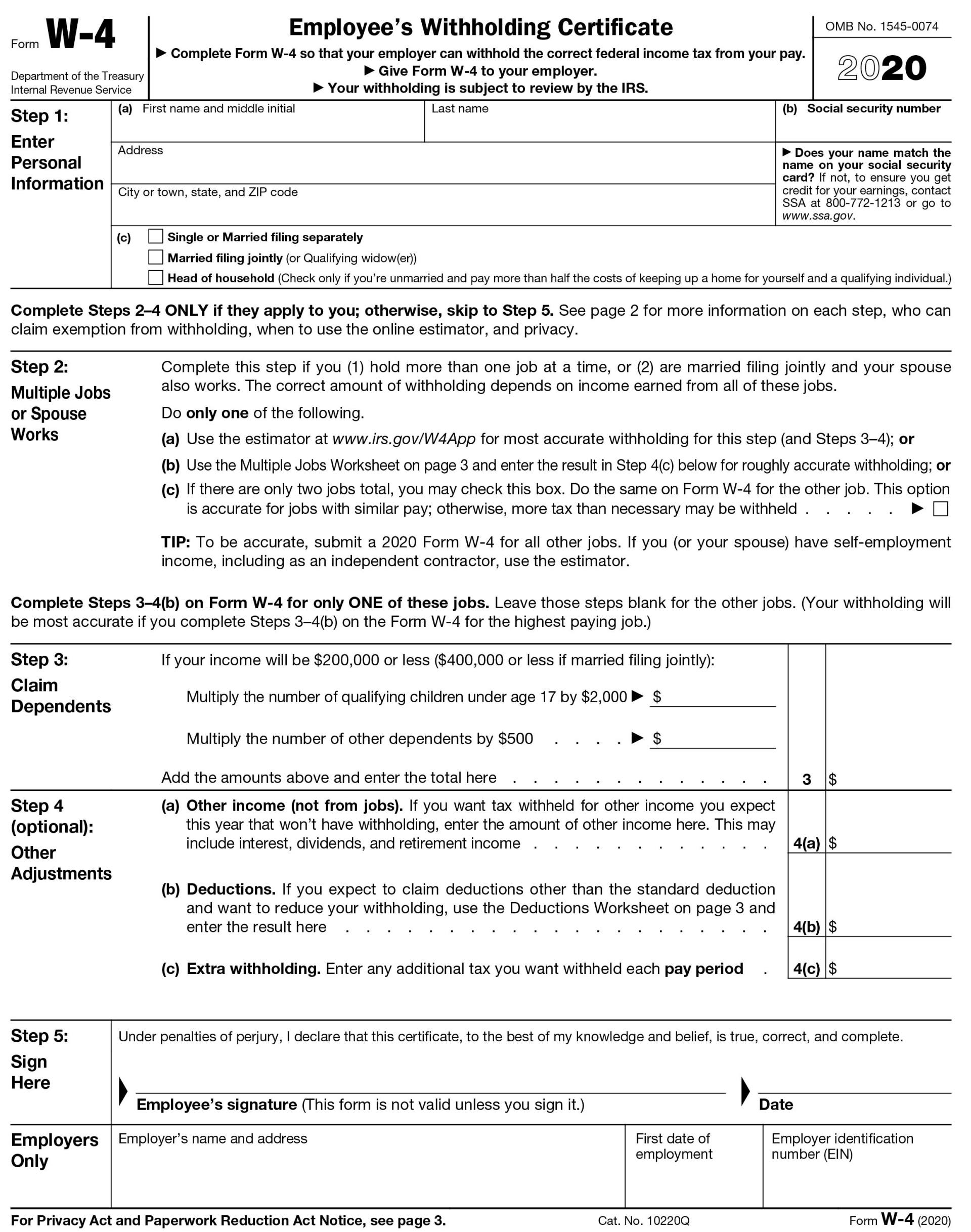

Your 2020 tax return may still result in a tax due or refund. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Otherwise, skip to step 5. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding..

Care oregon Prior Authorization form Best Of 3 21 111 Chapter Three

Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Otherwise, skip to step 5. See page 2 for more information on each step, who can claim. The oregon tax tables.

Forms & Worksheets Storms & Alpaugh PLLC Victoria MN

Web current forms and publications. The completed forms are required for each employee who. Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing. Web file your withholding tax returns. View all of the current year's forms and publications by popularity or program area.

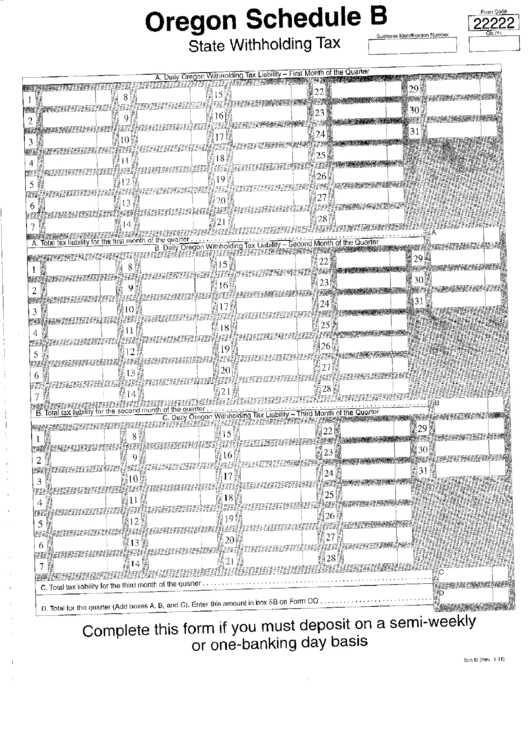

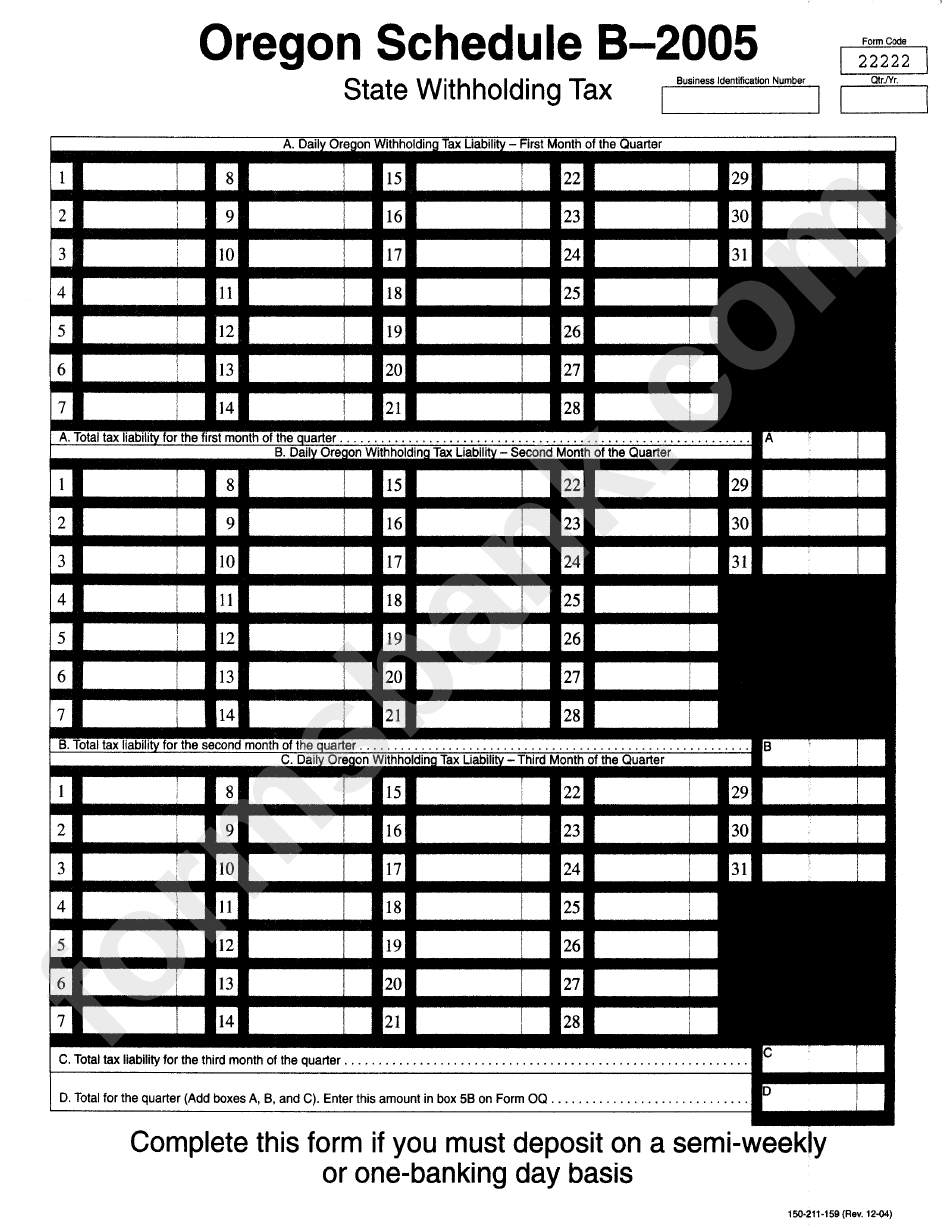

Oregon Schedule B State Withholding Tax Form 2011 printable pdf download

Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing. However, an employer must offer in writing to. View all of the current year's forms and publications by popularity or program area. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Otherwise, skip to step.

Form 150101402 (ORW4) Download Fillable PDF or Fill Online Oregon

Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. The oregon tax tables are found in the. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web a.

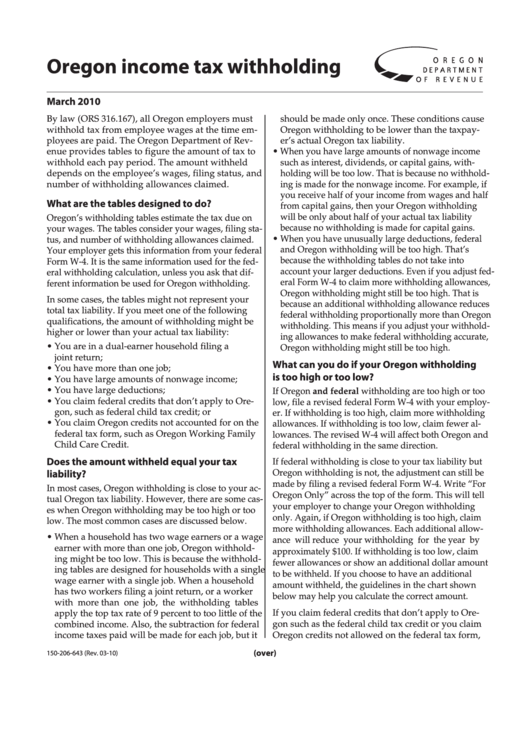

Oregon Tax Withholding Form Department Of Revenue 2010

See page 2 for more information on each step, who can claim. Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. Web oregon withholding statement and exemption certificate first name address initial last name city social security number (ssn) redeterimination state zip code note: Employers and payroll service providers must file.

Fill Free fillable forms for the state of Oregon

Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and business assistance. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Your eligibility to claim a certain number of allowances or an exemption from withholding may be.

Oregon Annual Withholding Tax Reconciliation Report 2019 20202022

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The oregon tax tables are found in the. However, an employer must offer in writing to. If too little is withheld, you will generally owe tax when you.

Form 22222 Oregon Schedule B State Withholding Tax Form Oregon

The completed forms are required for each employee who. If too little is withheld, you will generally owe tax when you file your tax return. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Your 2020 tax return may still result in a tax due or refund. Employers and payroll service providers must.

See Page 2 For More Information On Each Step, Who Can Claim.

Web payroll withholding requirements metro shs personal income tax for calendar year 2021, payroll withholding is not required. Web all oregon employers who have an income tax withholding and statewide transit tax account open with the oregon department of revenue must file form or. Web the wou payroll system utilizes figures listed under the annualized formula to calculate your withholding. Employers and payroll service providers must file quarterly returns and annual reconciliation returns for the metro supporting housing.

Web Oregon Withholding Statement And Exemption Certificate Note:

Web the oregon start a business guide povides a general checklist for the process of starting your r business, along with information on key contacts and business assistance. Web file your withholding tax returns. The oregon tax tables are found in the. Web a withholding statement includes:

Web Current Forms And Publications.

View all of the current year's forms and publications by popularity or program area. Select a heading to view its forms, then u se the search. However, an employer must offer in writing to. 1511421 ev 11122 2 of 7 223 o 4 o way that federal withholding is done.

The Completed Forms Are Required For Each Employee Who.

If too little is withheld, you will generally owe tax when you file your tax return. Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to. Otherwise, skip to step 5. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.