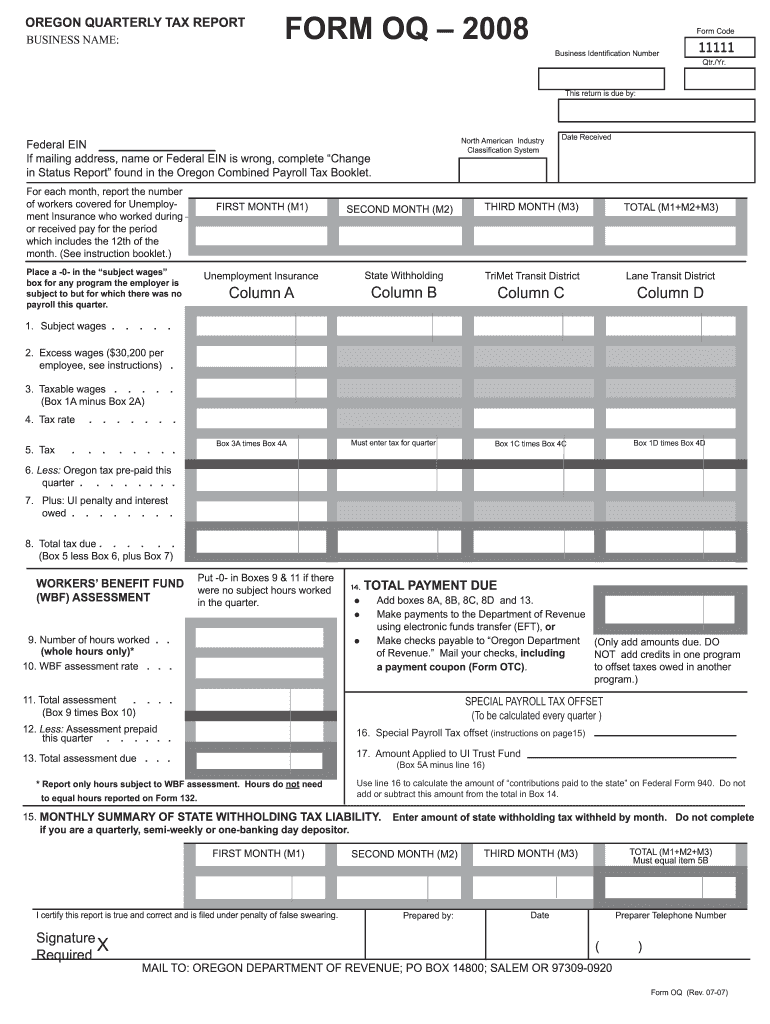

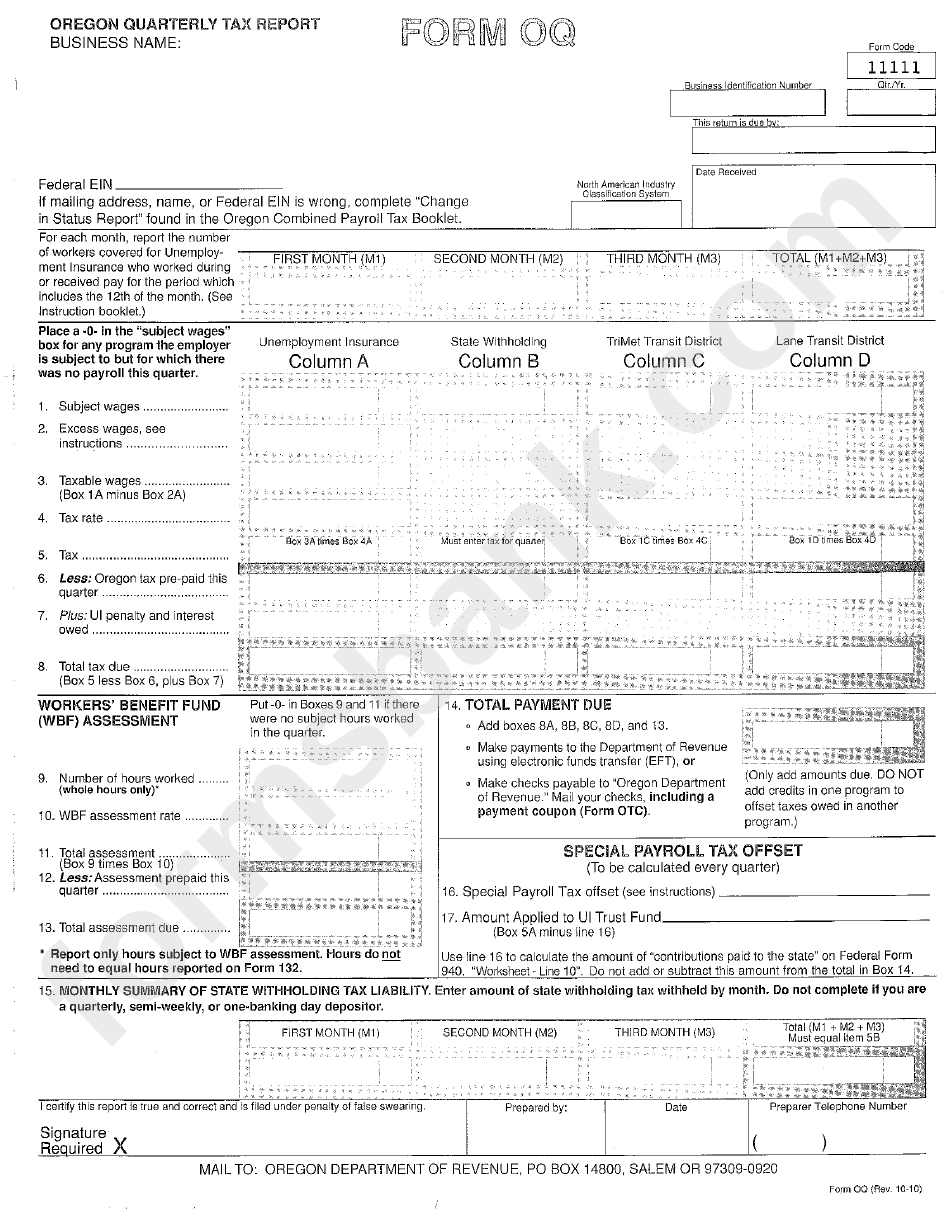

Oregon Oq Form 2022

Oregon Oq Form 2022 - Employers are required to file an oregon quarterly tax. Employers will detail the paid leave portion of all paid. Get everything done in minutes. Web 2022 forms and publications. Web form otc, oregon combined payroll tax coupon is used to determine how much tax is due each quarter for state unemployment and withholding; Form oq can be submitted on blank paper without headings, columns, or instructions. Form 132 is filed with form oq on a quarterly basis. Pay taxes or reimbursements when they are due. Web 518 votes how to fill out and sign oregon form oq 2023 online? Web current forms and publications.

Return and payment are due by july 31, 2022. Web 2022 forms and publications. Web we have drafted updates to the oq & 132 to include paid leave oregon, which we will release prior to january 2023. Web filing reports you are expected to file required quarterly reports or annual tax forms on time with complete information. Ad download or email form oq/oa & more fillable forms, register and subscribe now! Form oq, form 132, and schedule b. Form 132 is filed with form oq on a quarterly basis. Form oq can be submitted on blank paper without headings, columns, or instructions. Sign it in a few clicks draw your signature, type it,. Get everything done in minutes.

You can also download it, export it or print it out. Ad download or email form oq/oa & more fillable forms, register and subscribe now! Web oregon amended payroll tax report 6522010123 fax to: Web share your form with others. Edit your oregon form oq online. Get ready for tax season deadlines by completing any required tax forms today. Web current forms and publications. Web 518 votes how to fill out and sign oregon form oq 2023 online? View all of the current year's forms and publications by popularity or program area. Send oregon form oq pdf via email, link, or fax.

Oregon Form Oq Fill Online, Printable, Fillable, Blank pdfFiller

Return and payment are due by april 30, 2022. Web 2022 forms and publications. Web oregon amended payroll tax report 6522010123 fax to: Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due the. Get everything done in.

Form Oq ≡ Fill Out Printable PDF Forms Online

Get ready for tax season deadlines by completing any required tax forms today. Line 1 through line 4. Ad download or email form oq/oa & more fillable forms, register and subscribe now! Ad download or email oregon dor oq / oa & more fillable forms, register and subscribe now! Select a heading to view its forms, then u se the.

2014 Form OR DoR 40 Fill Online, Printable, Fillable, Blank PDFfiller

You can also download it, export it or print it out. Download and save the form to your computer, then open it in adobe reader to complete and print. Web follow the instructions below for each line number. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Form oq can.

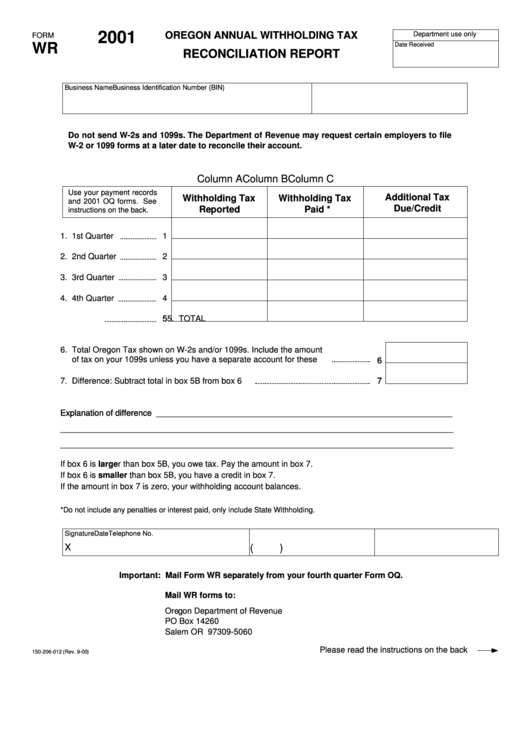

Form Wr, Oregon Annual Withholding Tax Reconciliation Report printable

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web filing reports you are expected to file required quarterly reports or annual tax forms on time with complete information. Ad download or email oregon dor oq / oa & more fillable forms, register and subscribe now! Web follow the instructions.

Form Oq Oregon Quarterly Tax Report printable pdf download

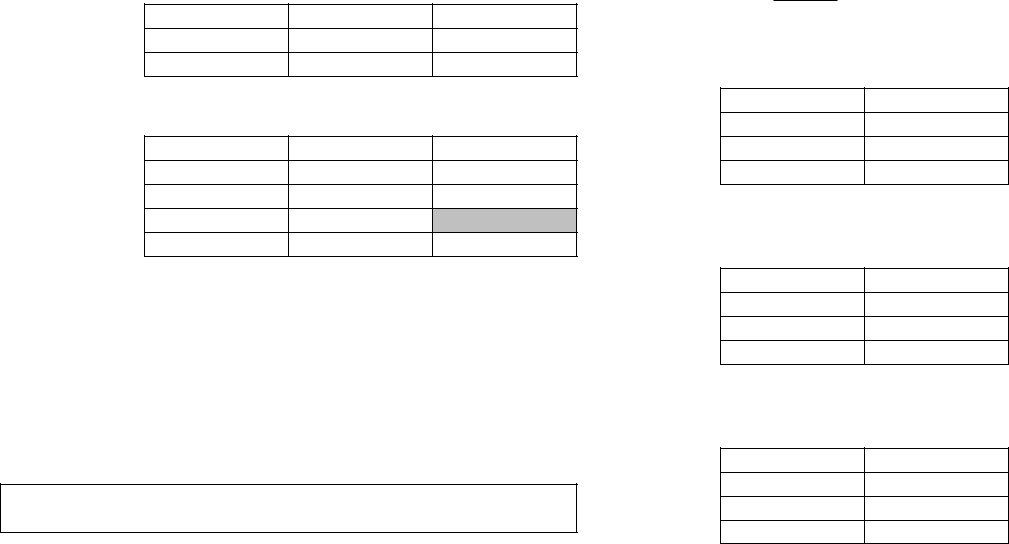

Web form otc, oregon combined payroll tax coupon is used to determine how much tax is due each quarter for state unemployment and withholding; Get your online template and fill it in using progressive features. Return and payment are due by april 30, 2022. Fill in the total oregon tax reported for each quarter (use the amounts from box 5b.

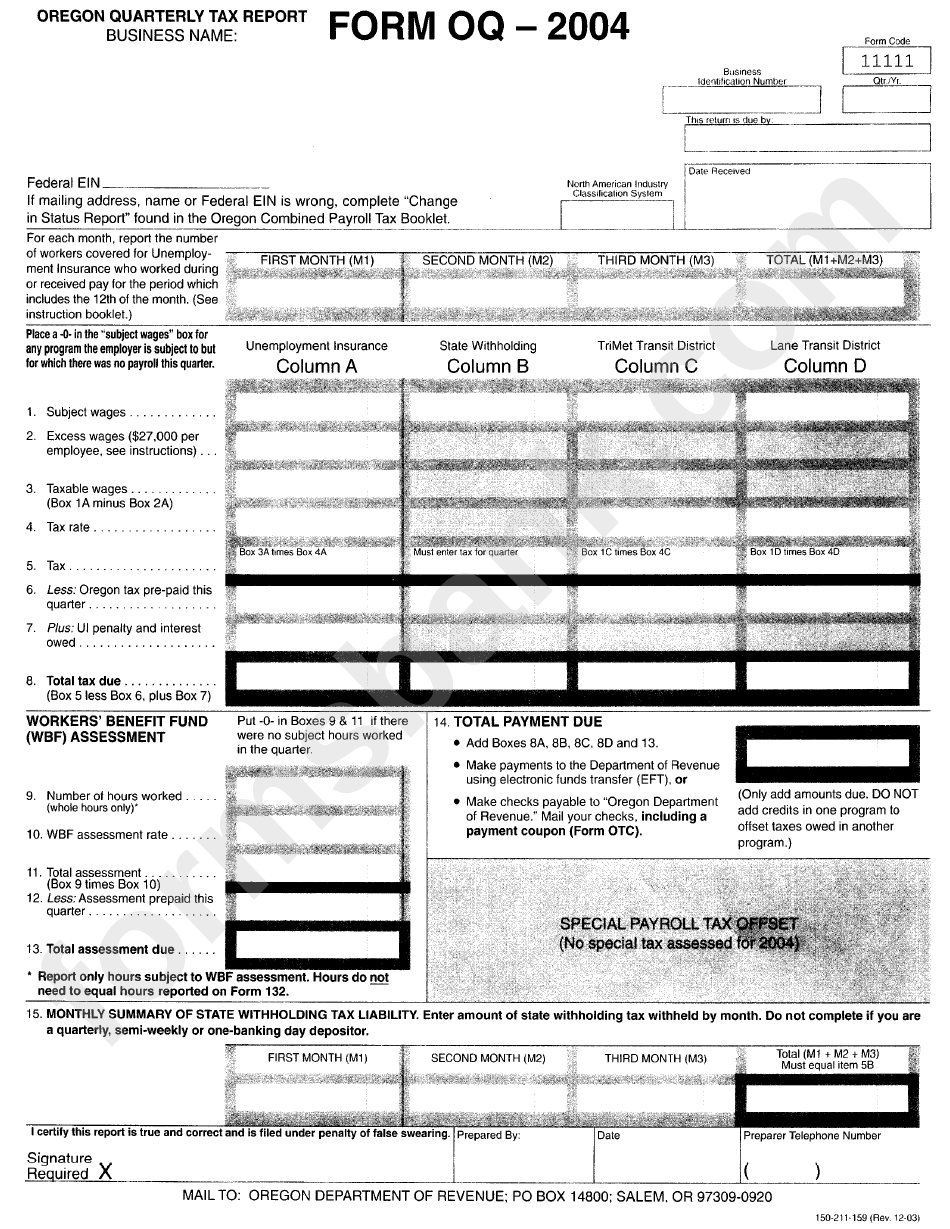

Form Oq Oregon Quarterly Tax Report 2004 printable pdf download

Select a heading to view its forms, then u se the search. Return and payment are due by july 31, 2022. We don't recommend using your. Get ready for tax season deadlines by completing any required tax forms today. Web follow the instructions below for each line number.

Form Oq Oregon Quarterly Tax Report (Page 2 of 2) in pdf

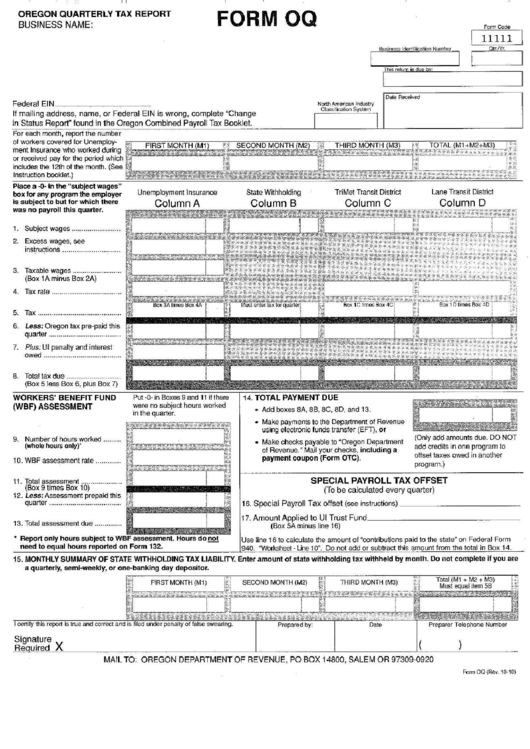

Web follow the instructions below for each line number. Get everything done in minutes. 01) office use only date received 19112201010000 oregon department of revenue oregon. Web we have drafted updates to the oq & 132 to include paid leave oregon, which we will release prior to january 2023. File required quarterly reports or annual tax forms.

Deadline for Oregon Quarterly essay contest is Jan. 20 Around the O

Employers will detail the paid leave portion of all paid. Get your online template and fill it in using progressive features. Get everything done in minutes. Sign it in a few clicks draw your signature, type it,. Web filing reports you are expected to file required quarterly reports or annual tax forms on time with complete information.

Form Oq Oregon Quarterly Tax Report printable pdf download

Get your online template and fill it in using progressive features. File required quarterly reports or annual tax forms. Web share your form with others. You can also download it, export it or print it out. Form oq, form 132, and schedule b.

New Oregon Quarterly digs up the UO's hidden treasures Around the O

Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due the. Employers will detail the paid leave portion of all paid. Web 518 votes how to fill out and sign oregon form oq 2023 online? Line 1 through.

Web Form Otc, Oregon Combined Payroll Tax Coupon Is Used To Determine How Much Tax Is Due Each Quarter For State Unemployment And Withholding;

Web oregon amended payroll tax report 6522010123 fax to: Form oq can be submitted on blank paper without headings, columns, or instructions. Return and payment are due by july 31, 2022. Edit your form oq online type text, add images, blackout confidential details, add comments, highlights and more.

Fill In The Total Oregon Tax Reported For Each Quarter (Use The Amounts From Box 5B Of Your.

Web follow the instructions below for each line number. Web filing reports you are expected to file required quarterly reports or annual tax forms on time with complete information. You can also download it, export it or print it out. Employers are required to file an oregon quarterly tax.

Download And Save The Form To Your Computer, Then Open It In Adobe Reader To Complete And Print.

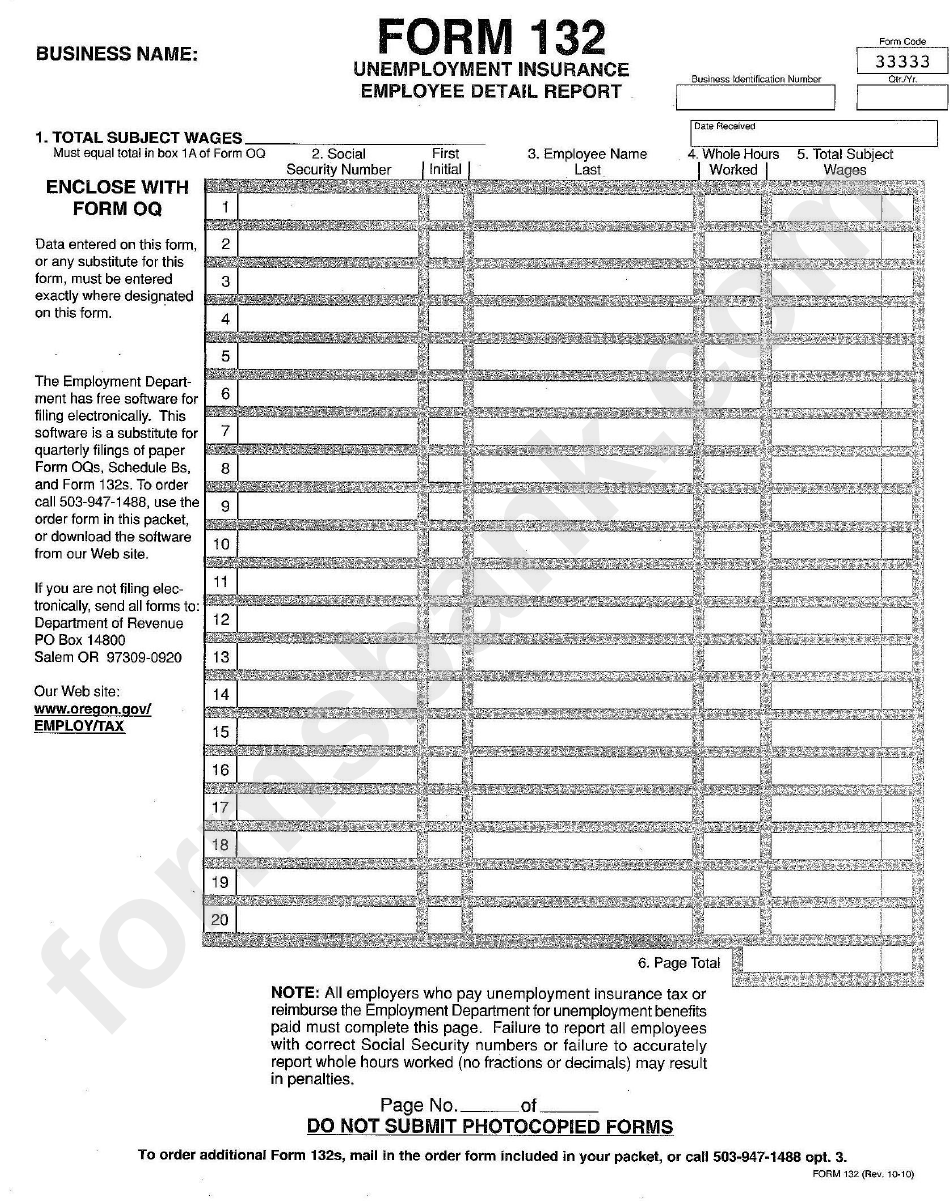

Form 132 is filed with form oq on a quarterly basis. Web explains that for form oq, oregon quarterly tax report, filed with the department of revenue, if the due date is on a weekend or holiday, the report and payment are due the. Form oq, form 132, and schedule b. 01) office use only date received 19112201010000 oregon department of revenue oregon.

Web We Have Drafted Updates To The Oq & 132 To Include Paid Leave Oregon, Which We Will Release Prior To January 2023.

Web 518 votes how to fill out and sign oregon form oq 2023 online? Get your online template and fill it in using progressive features. Employers will detail the paid leave portion of all paid. Web payroll records of when and how much you paid each employee.