On Off Balance Sheet

On Off Balance Sheet - An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. It is used to impact a company’s level of debt and. Letters of credit loan commitments financial assets sold with recourse financial assets sold. This practice helps companies keep.

It is used to impact a company’s level of debt and. This practice helps companies keep. Letters of credit loan commitments financial assets sold with recourse financial assets sold. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet.

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. This practice helps companies keep. Letters of credit loan commitments financial assets sold with recourse financial assets sold. It is used to impact a company’s level of debt and.

What is off Balance Sheet Accounting Education

This practice helps companies keep. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. It is used to impact a company’s level of debt and. Letters of credit loan commitments financial assets sold with recourse financial assets sold.

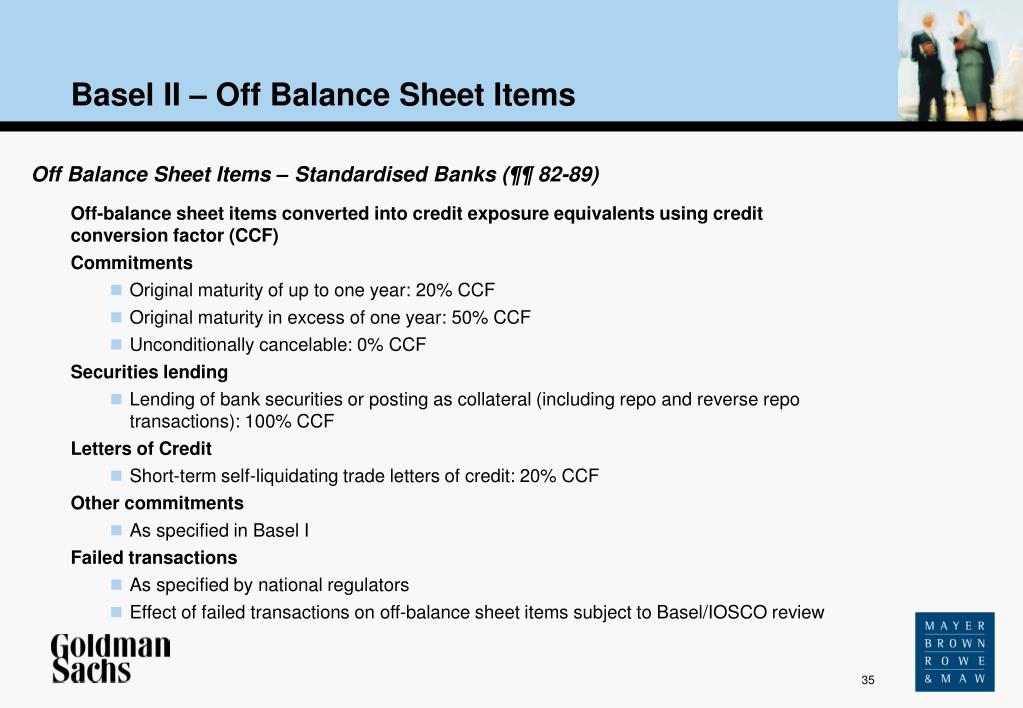

balance sheet risk analysis

This practice helps companies keep. It is used to impact a company’s level of debt and. Letters of credit loan commitments financial assets sold with recourse financial assets sold. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet.

Off balance sheets

Letters of credit loan commitments financial assets sold with recourse financial assets sold. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. This practice helps companies keep. It is used to impact a company’s level of debt and.

Off Balance Sheet On Balance Sheet vs Off Balance Sheet

Letters of credit loan commitments financial assets sold with recourse financial assets sold. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. This practice helps companies keep. It is used to impact a company’s level of debt and.

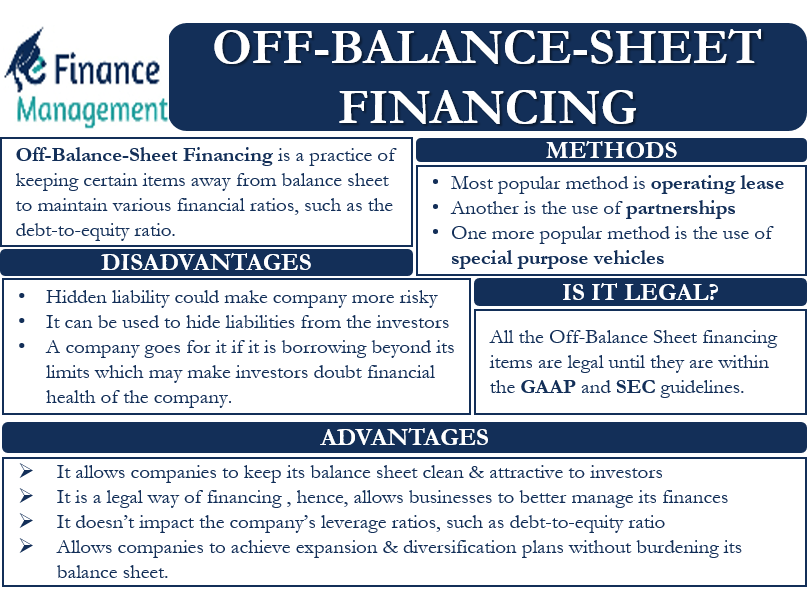

OffBalanceSheet Financing Meaning, Methods, Example & More eFM

This practice helps companies keep. It is used to impact a company’s level of debt and. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. Letters of credit loan commitments financial assets sold with recourse financial assets sold.

Balance Sheet Example India Dictionary

This practice helps companies keep. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. It is used to impact a company’s level of debt and. Letters of credit loan commitments financial assets sold with recourse financial assets sold.

Off Balance Sheet Financing Is OffBalance Sheet Financing Legal?

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. It is used to impact a company’s level of debt and. This practice helps companies keep. Letters of credit loan commitments financial assets sold with recourse financial assets sold.

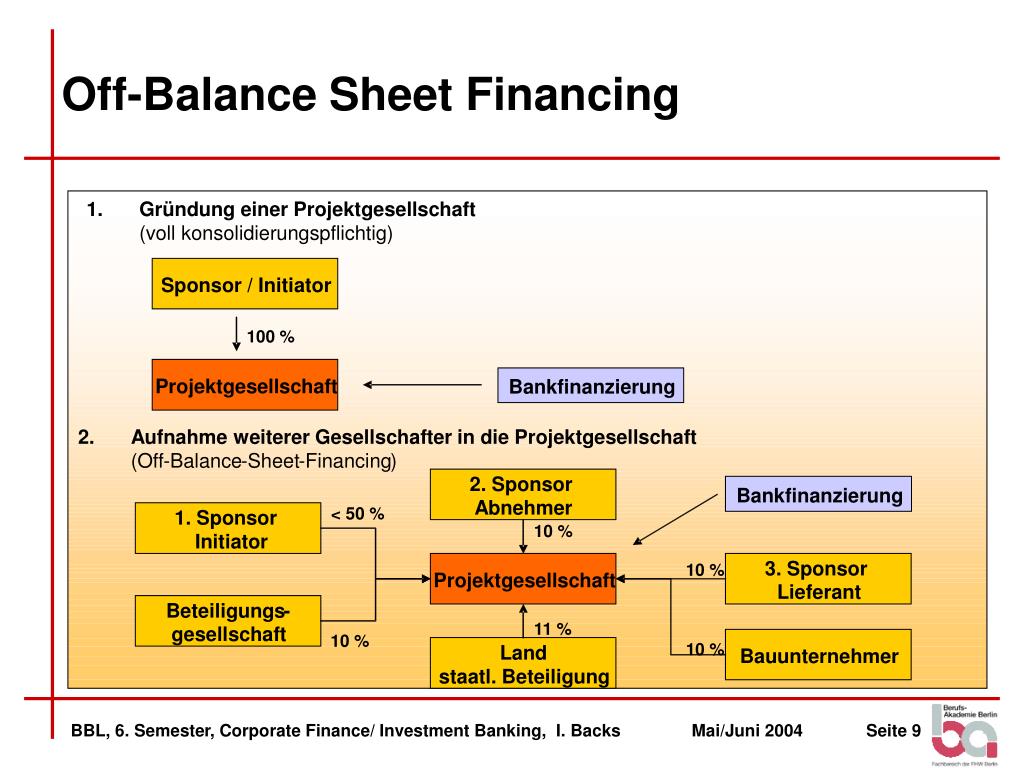

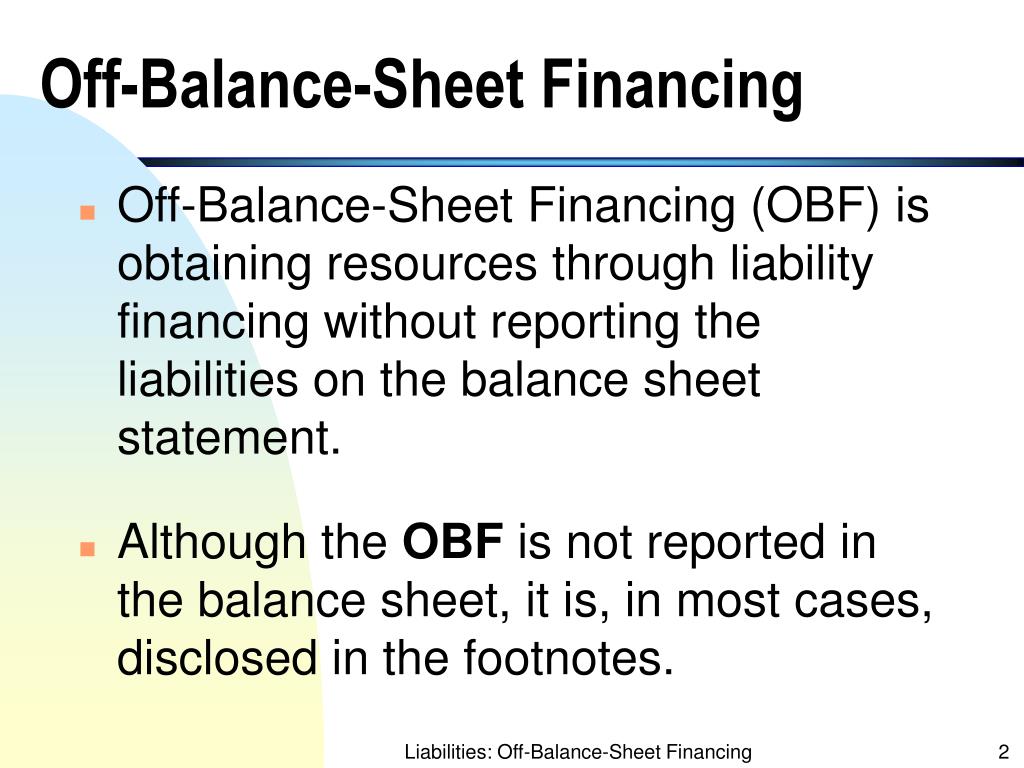

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

Letters of credit loan commitments financial assets sold with recourse financial assets sold. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. This practice helps companies keep. It is used to impact a company’s level of debt and.

OffBalance Sheet (OBS) Activities Types and Examples Trial Balance

Letters of credit loan commitments financial assets sold with recourse financial assets sold. It is used to impact a company’s level of debt and. This practice helps companies keep. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet.

Off Balance Sheet Financing OffBalance Sheet Financing (Definition

This practice helps companies keep. It is used to impact a company’s level of debt and. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. Letters of credit loan commitments financial assets sold with recourse financial assets sold.

An Obs Operating Lease Is One In Which The Lessor Retains The Leased Asset On Its Balance Sheet.

This practice helps companies keep. It is used to impact a company’s level of debt and. Letters of credit loan commitments financial assets sold with recourse financial assets sold.

:max_bytes(150000):strip_icc()/Off-BalanceSheetOBS_v2-cf2bd1cd968548168bc24501a8c93d3c.jpg)