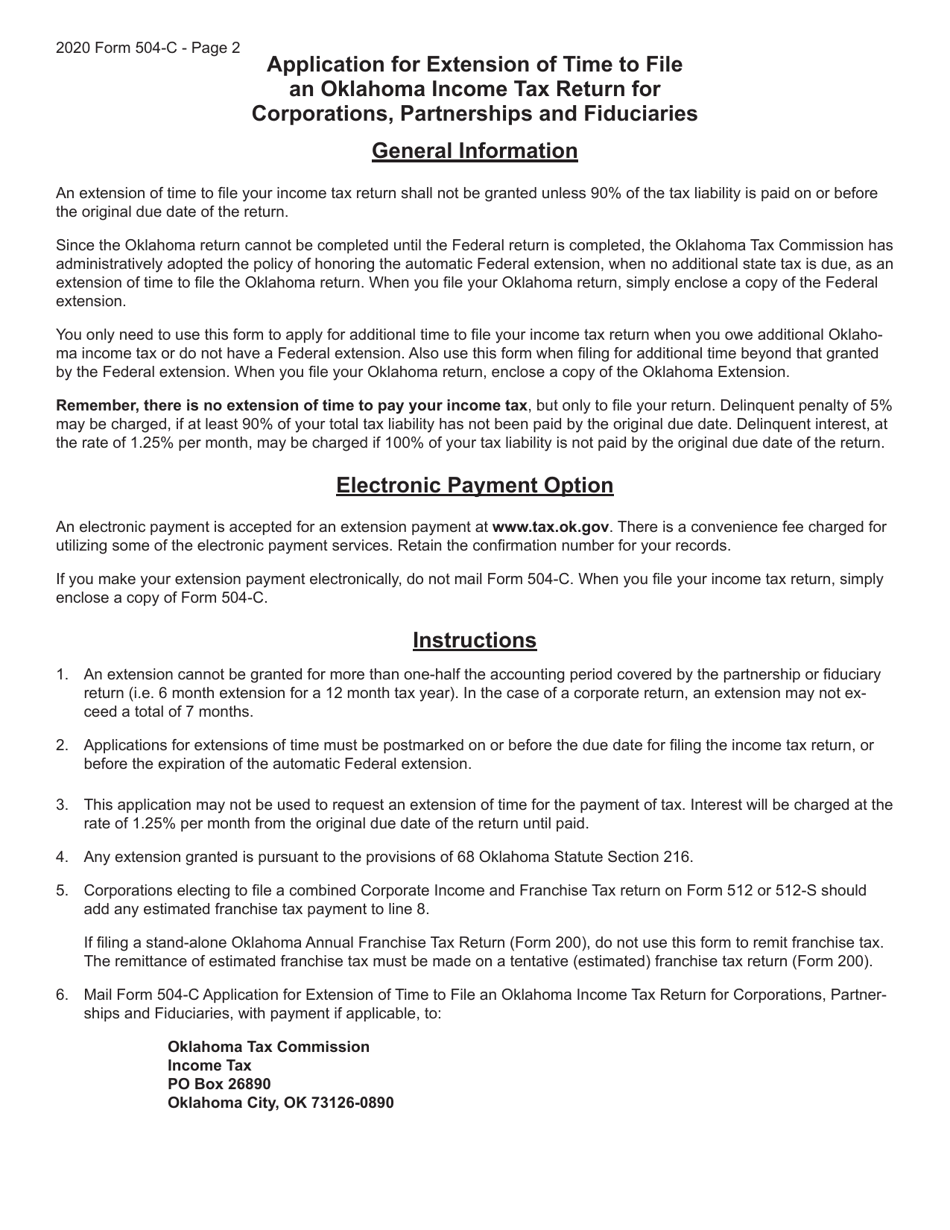

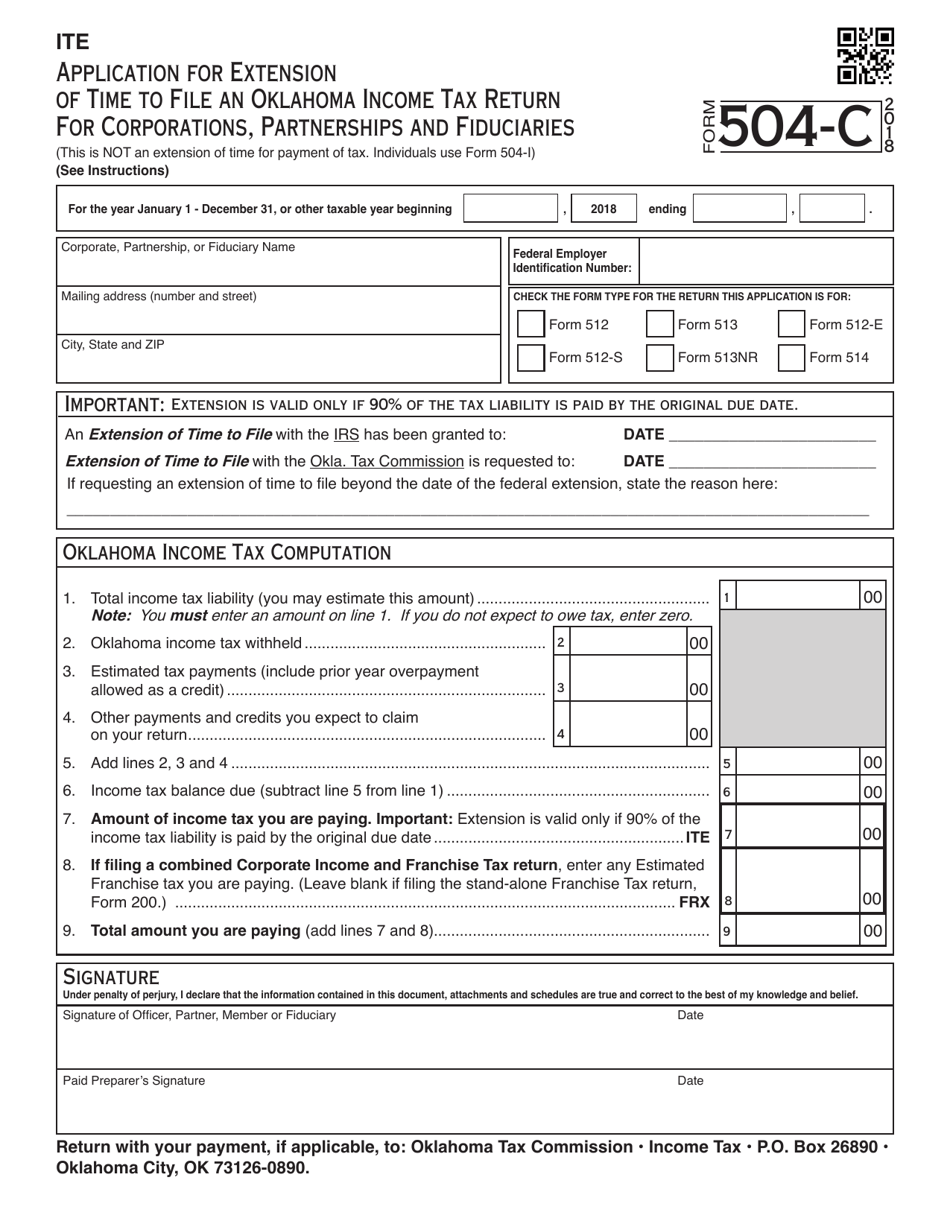

Oklahoma Form 504 Extension Instructions

Oklahoma Form 504 Extension Instructions - Extension is valid only if 90% of the tax liability is paid by the original due date. However, with our preconfigured web templates, things get simpler. • the individual income tax rate used to calculate fiduciary income tax was reduced by 0.25% for each. At least 90% of the tax. Use fill to complete blank online state of. Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? Tax commission is requested to: Web follow the simple instructions below: Oklahoma income tax computation 7rwdo lqfrph wd[ oldelolw\ \rx pd\. You can make an oklahoma extension payment with form 504, or pay.

Tax commission is requested to: Does oklahoma support tax extensions for business income tax returns? You can make an oklahoma extension payment with form 504, or pay. Extension is valid only if 90% of the tax liability is paid by the original due date. However, a copy of the federal extension must be provided with your. Web an extension of time to file with the irs has been granted to: When you file your income tax return, simply enclose a copy of form 504. At least 90% of the tax. Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? 15th day of the 4th month after the end of your tax.

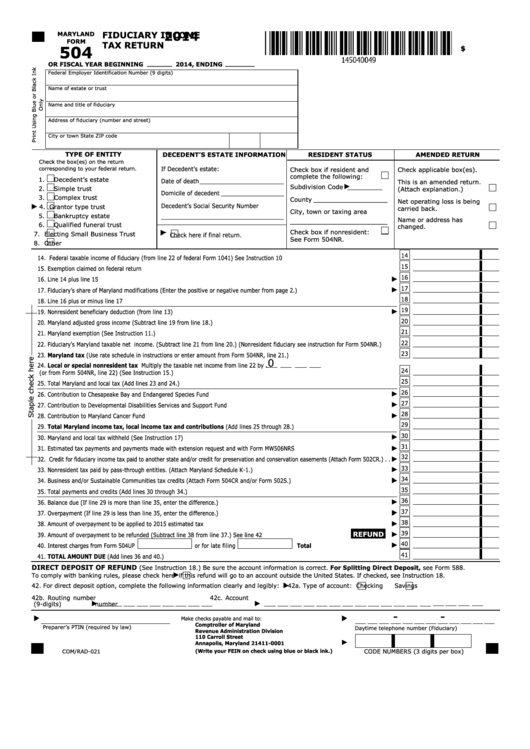

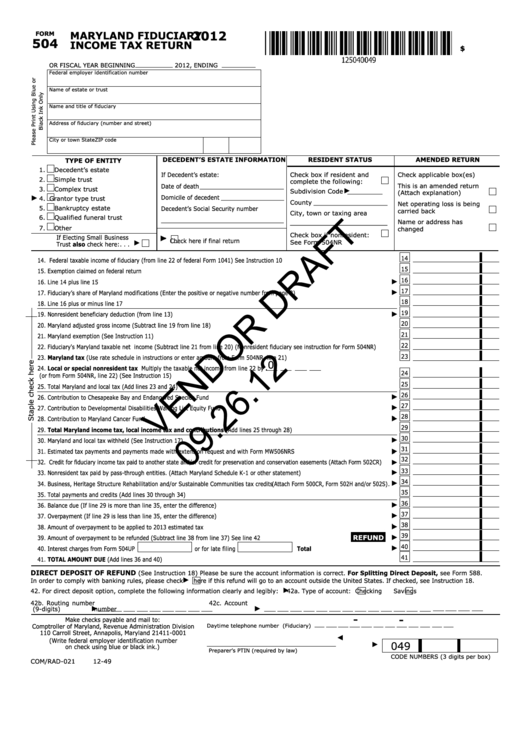

Web due date to file oklahoma tax extension. Use fill to complete blank online state of. Web extension of time to file with the okla. Web fill online, printable, fillable, blank form 2: Oklahoma income tax computation 7rwdo lqfrph wd[ oldelolw\ \rx pd\. Extension is valid only if 90% of the tax liability is paid by the original due date. Web since the oklahoma return cannot be completed until the federal return is completed, the oklahoma tax commission has administratively adopted the policy of honoring the. Does oklahoma support tax extensions for business income tax returns? Web your social security number: Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission.

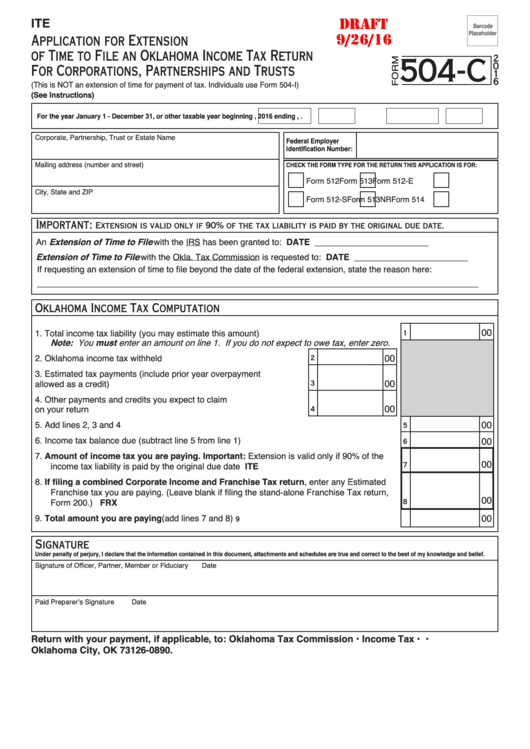

Form 504C Draft Application For Extension Of Time To File An

Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission. Web follow the simple instructions below: Web extension of time from the irs in which to file your federal return, an oklahoma extension is automatic. You can make an oklahoma extension payment with form 504, or pay. Web 2 what’s new in the.

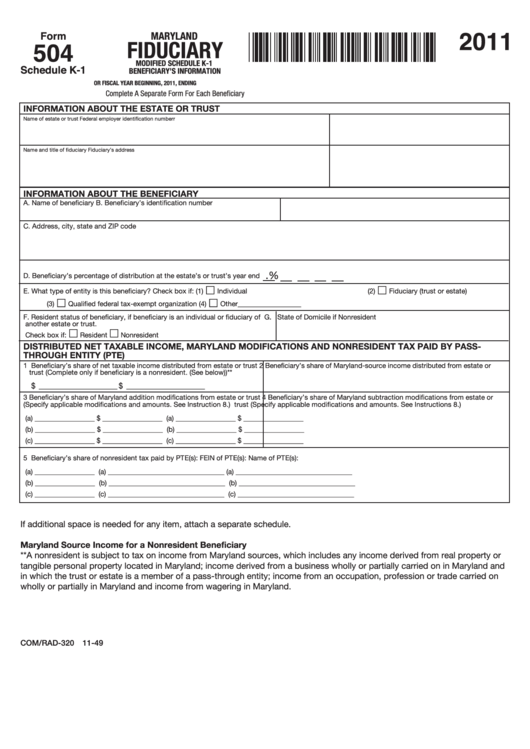

Fillable Form 504 (Schedule K1) Maryland Fiduciary Modified Schedule

At least 90% of the tax. Web your social security number: What form does the state require to file an extension? Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission. However, a copy of the federal extension must be provided with your.

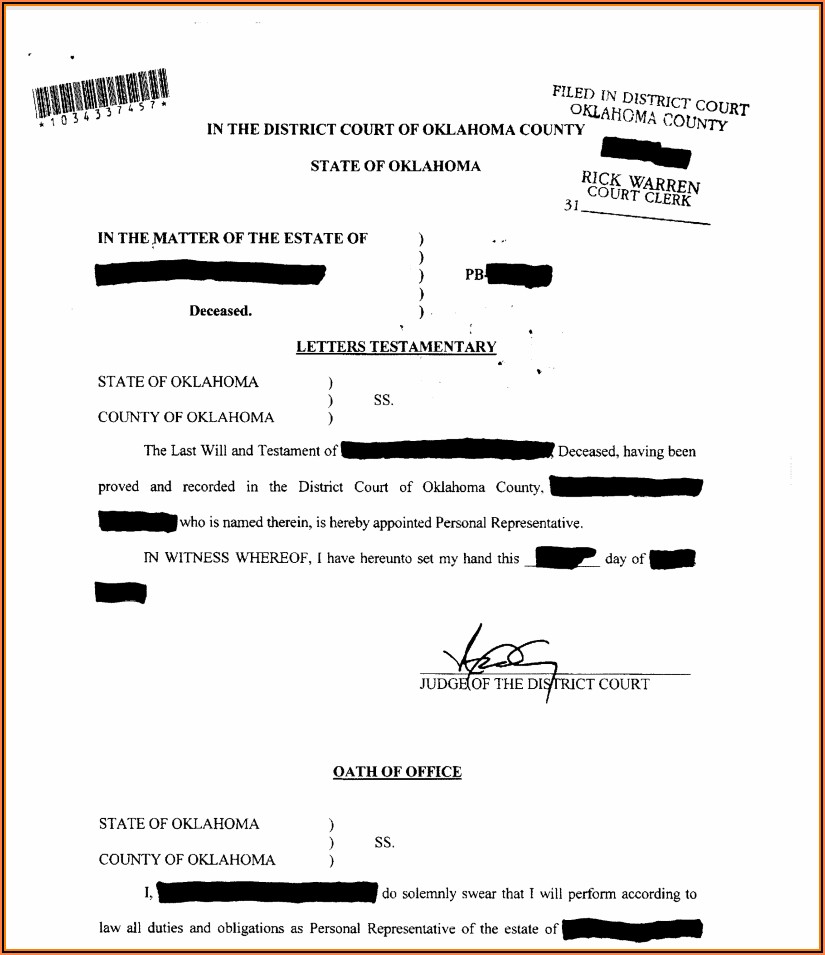

Hunting Lease Forms Oklahoma Form Resume Examples GM9O8QNYDL

Web follow the simple instructions below: Web fill online, printable, fillable, blank form 2: 15th day of the 4th month after the end of your tax. Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? However, a copy of the federal extension must be provided with your.

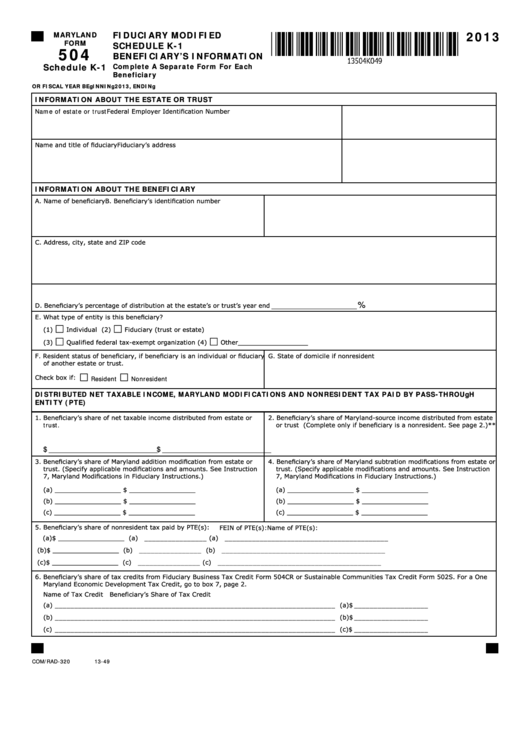

Fillable Maryland Form 504 (Schedule K1) Fiduciary Modified Schedule

Web fill online, printable, fillable, blank form 2: 15th day of the 4th month after the end of your tax. You can make an oklahoma extension payment with form 504, or pay. • the individual income tax rate used to calculate fiduciary income tax was reduced by 0.25% for each. However, with our preconfigured web templates, things get simpler.

Form 504C Download Fillable PDF or Fill Online Application for

However, with our preconfigured web templates, things get simpler. Web fill online, printable, fillable, blank form 2: Extension of time to file with the okla. At least 90% of the tax. Web since the oklahoma return cannot be completed until the federal return is completed, the oklahoma tax commission has administratively adopted the policy of honoring the.

Fillable Maryland Form 504 Fiduciary Tax Return/schedule K1

Web fill online, printable, fillable, blank form 2: At least 90% of the tax. Tax commission is requested to: However, a copy of the federal extension must be provided with your. Use fill to complete blank online state of.

Form 504 Draft Fiduciary Tax Return/schedule K1 Fiduciary

Web an extension of time to file with the irs has been granted to: Web since the oklahoma return cannot be completed until the federal return is completed, the oklahoma tax commission has administratively adopted the policy of honoring the. Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? You can make an oklahoma extension payment with form.

DD Form 504 Download Fillable PDF, Request and Receipt for Health and

When you file your income tax return, simply enclose a copy of form 504. Web if you make your extension payment electronically, do not mail form 504. Does oklahoma support tax extensions for business income tax returns? Web follow the simple instructions below: However, a copy of the federal extension must be provided with your.

OTC Form 504C Download Fillable PDF or Fill Online Application for

Web your social security number: Tax commission is requested to: Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. Does oklahoma support tax extensions for business income tax returns? What form does the state require to file an extension?

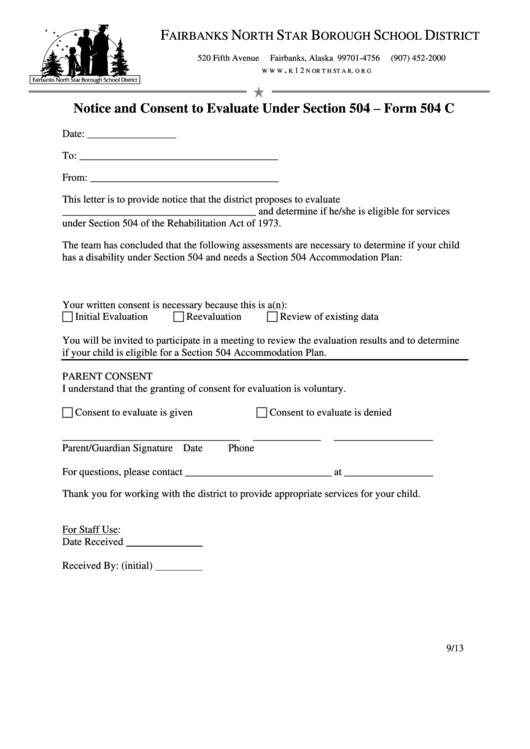

Notice And Consent To Evaluate Under Section 504 Form 504 C printable

Web in order to get an oklahoma tax extension, at least 90% of your state tax liability must be paid on time. Tax commission is requested to: What form does the state require to file an extension? At least 90% of the tax. Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission.

What Form Does The State Require To File An Extension?

Web your social security number: The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web an extension of time to file with the irs has been granted to: At least 90% of the tax.

Tax Commission Is Requested To:

Web fill online, printable, fillable, blank form 2: Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? Web follow the simple instructions below: Use fill to complete blank online state of.

Web Businesses That Have A Valid Federal Tax Extension (Irs Form 7004) Will Automatically Be Granted An Oklahoma Tax Extension For The Same Amount Of Time.

However, a copy of the federal extension must be provided with your. Web extension of time from the irs in which to file your federal return, an oklahoma extension is automatic. • the individual income tax rate used to calculate fiduciary income tax was reduced by 0.25% for each. Does oklahoma support tax extensions for business income tax returns?

Web 5 Rows We Last Updated Oklahoma Form 504 In January 2023 From The Oklahoma Tax Commission.

Tax commission is requested to: Oklahoma income tax computation 7rwdo lqfrph wd[ oldelolw\ \rx pd\. When you file your income tax return, simply enclose a copy of form 504. Web if you make your extension payment electronically, do not mail form 504.