Oklahoma Farm Tax Exemption Form

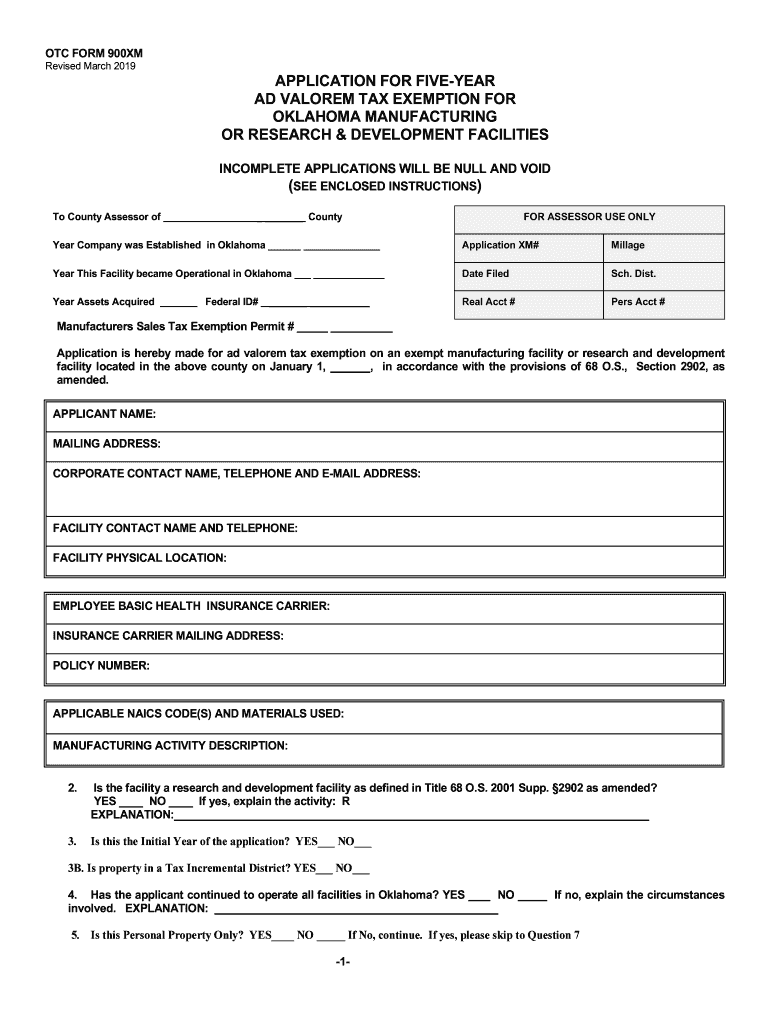

Oklahoma Farm Tax Exemption Form - To begin an agriculture exemption application: Highlight relevant segments of your documents or blackout delicate information with instruments that. Producers should have the option to provide one of the following forms to prove eligibility: Click the apply for agriculture exemption link on the oktap. Check with the state for exemption information and requirements. Oklahoma agricultural sales tax exemption. The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Web if listing property with the county assessor is insufficient, agriculture producers should apply for an exemption permit through the oklahoma tax commission. The entities that qualify for sales tax exemption in oklahoma are specifically legislated. Pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption.

To begin an agriculture exemption application: The entities that qualify for sales tax exemption in oklahoma are specifically legislated. Pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Producers should have the option to provide one of the following forms to prove eligibility: Web the agriculture exemption application on oktap allows you to apply for a new exemption permit, renew an expiring or already expired permit, update information for your already existing permit, or cease an exemption permit which is no longer required. Check with the state for exemption information and requirements. Oklahoma agricultural sales tax exemption. Web locate oktap agriculture exemption and then click get form to get started. A federal tax form that shows income from agriculture, such as a schedule f, form 1065 or form 4835 The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from.

Make use of the instruments we offer to submit your form. Web locate oktap agriculture exemption and then click get form to get started. Web if listing property with the county assessor is insufficient, agriculture producers should apply for an exemption permit through the oklahoma tax commission. A federal tax form that shows income from agriculture, such as a schedule f, form 1065 or form 4835 Check with the state for exemption information and requirements. Not all states allow all exemptions listed on this form. To begin an agriculture exemption application: The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Any person who misuses their permit is subject to a $500 penalty from the tax commission per instance. Oklahoma agricultural sales tax exemption.

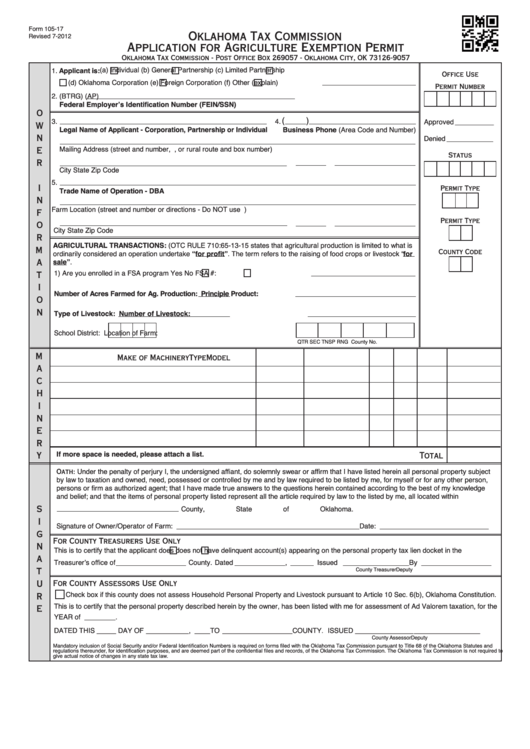

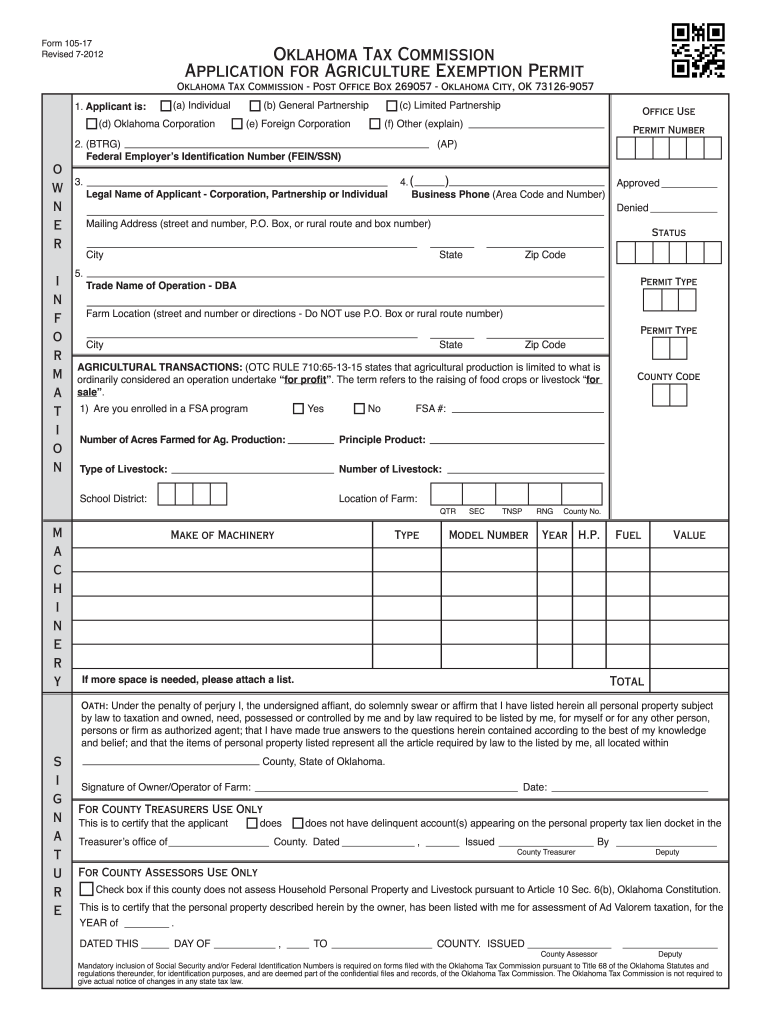

Fillable Oklahoma Tax Commission Application For Agriculture Exemption

Web if listing property with the county assessor is insufficient, agriculture producers should apply for an exemption permit through the oklahoma tax commission. The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Oklahoma agricultural sales tax exemption. Web locate oktap agriculture exemption and then click get form.

Fillable Online cartercountyassessor ok tax comm ag permit form Fax

Check with the state for exemption information and requirements. Oklahoma agricultural sales tax exemption. The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Web if listing property with the county assessor is insufficient, agriculture producers should apply for an exemption permit through the oklahoma tax commission. Producers.

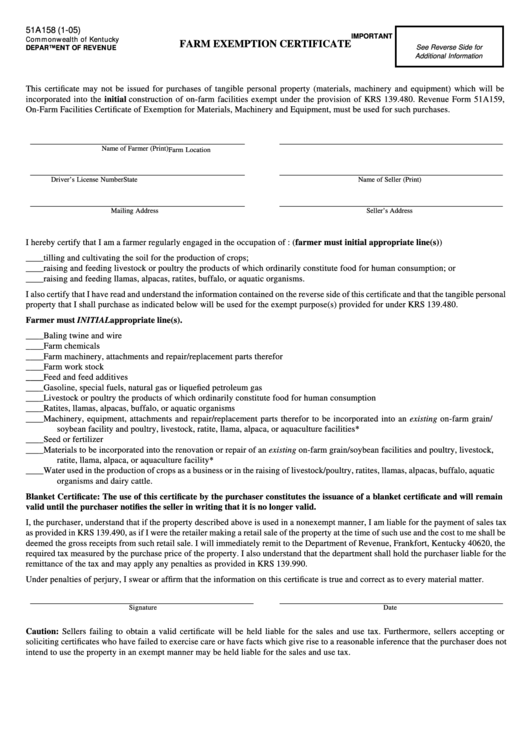

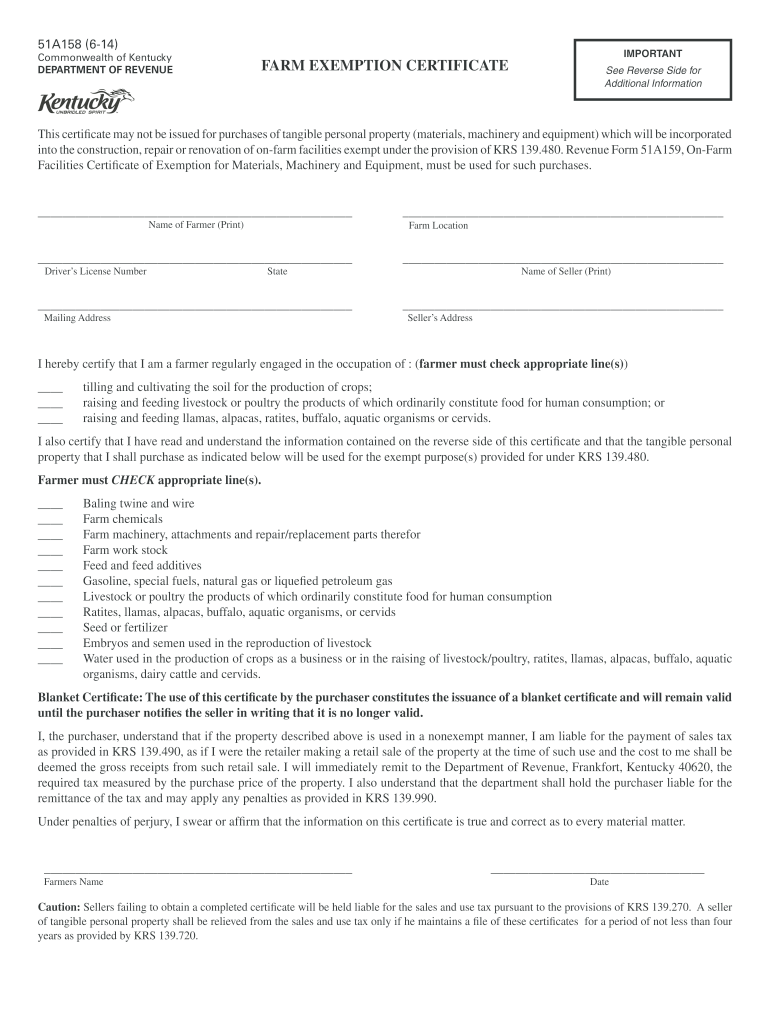

Farm Tax Exempt Form Tn

Web if listing property with the county assessor is insufficient, agriculture producers should apply for an exemption permit through the oklahoma tax commission. Highlight relevant segments of your documents or blackout delicate information with instruments that. Make use of the instruments we offer to submit your form. Check with the state for exemption information and requirements. Pursuant to title 68.

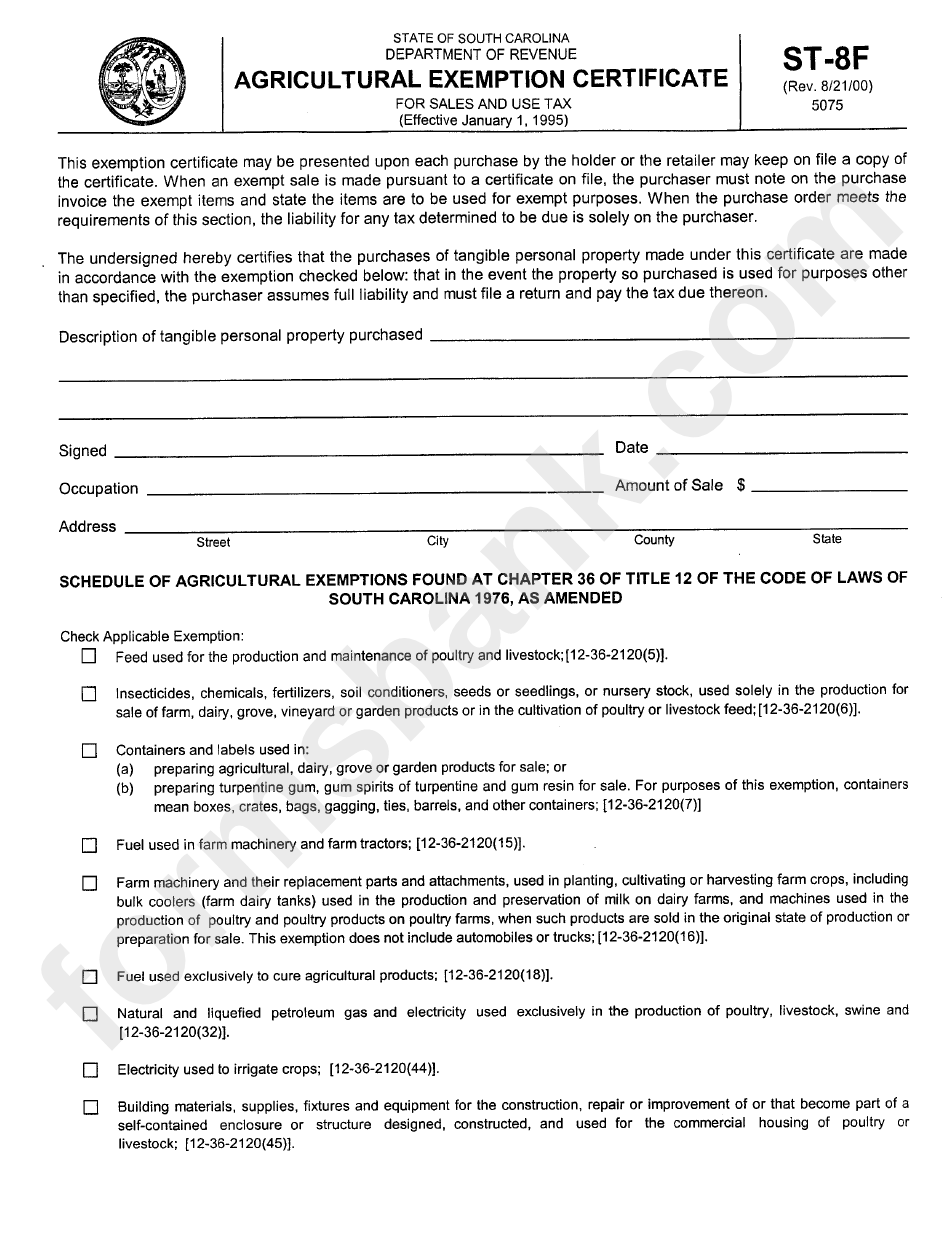

Form St8f Agricultural Exemption Certificate printable pdf download

Pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. To begin an agriculture exemption application: To begin an agriculture exemption application: Any person who misuses their permit is subject to a $500 penalty from the tax commission per instance. A federal tax form.

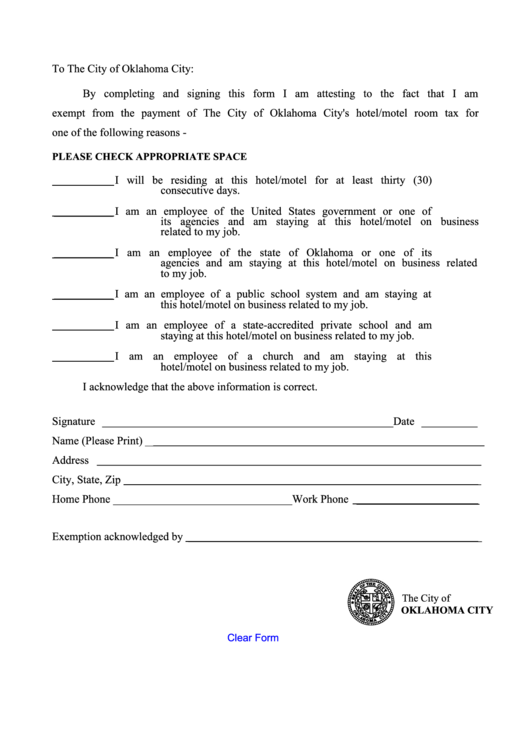

Oklahoma Tax Exempt Form printable pdf download

Any person who misuses their permit is subject to a $500 penalty from the tax commission per instance. Pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Not all states allow all exemptions listed on this form. The entities that qualify for sales.

Farm Tax Exemption Kentucky Fill Online, Printable, Fillable, Blank

The entities that qualify for sales tax exemption in oklahoma are specifically legislated. Make use of the instruments we offer to submit your form. Oklahoma agricultural sales tax exemption. Highlight relevant segments of your documents or blackout delicate information with instruments that. Web locate oktap agriculture exemption and then click get form to get started.

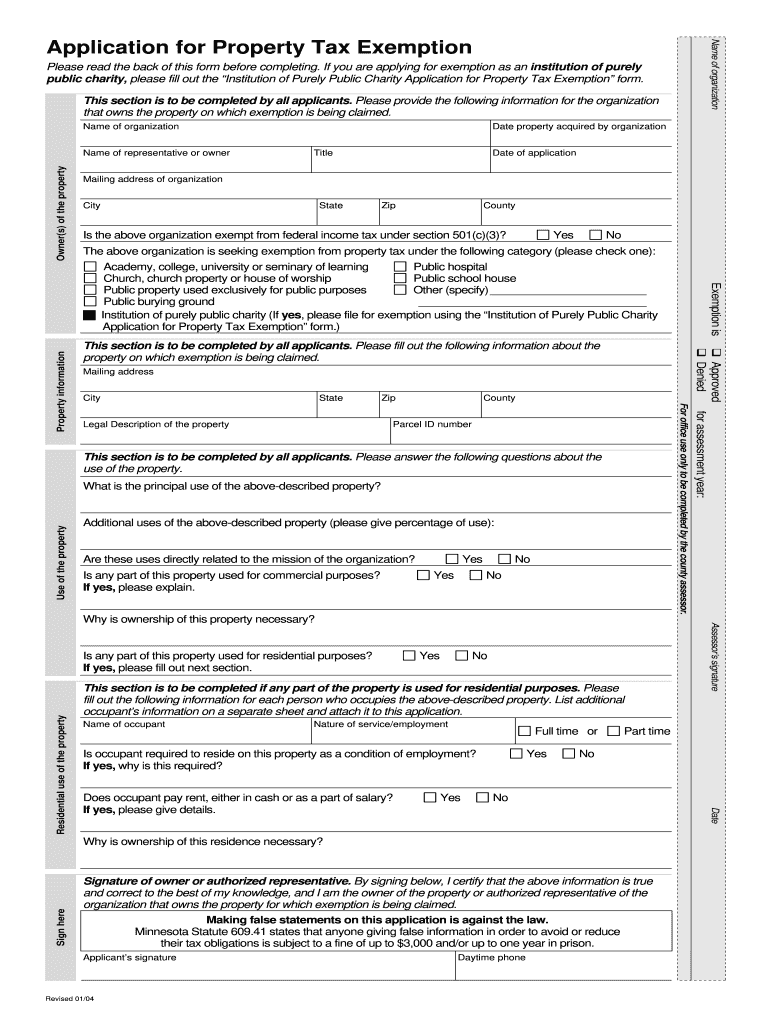

Property Tax Form Pdf Fill Out and Sign Printable PDF Template signNow

The entities that qualify for sales tax exemption in oklahoma are specifically legislated. Any person who misuses their permit is subject to a $500 penalty from the tax commission per instance. Click the apply for agriculture exemption link on the oktap. To begin an agriculture exemption application: Make use of the instruments we offer to submit your form.

E File form 2290 Free Brilliant form Road Use Tax Irs Farm Exemption

Not all states allow all exemptions listed on this form. Web locate oktap agriculture exemption and then click get form to get started. To begin an agriculture exemption application: Oklahoma agricultural sales tax exemption. Click the apply for agriculture exemption link on the oktap.

Oklahoma Farm Tax Exemption Renewal Form Fill Out and Sign Printable

A federal tax form that shows income from agriculture, such as a schedule f, form 1065 or form 4835 To begin an agriculture exemption application: The entities that qualify for sales tax exemption in oklahoma are specifically legislated. Oklahoma agricultural sales tax exemption. Not all states allow all exemptions listed on this form.

Top 20 Oklahoma Tax Exempt Form Templates free to download in PDF format

The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Check with the state for exemption information and requirements. Make use of the instruments we offer to submit your form. Not all states allow all exemptions listed on this form. Any person who misuses their permit is subject.

Make Use Of The Instruments We Offer To Submit Your Form.

Click the apply for agriculture exemption link on the oktap. Web locate oktap agriculture exemption and then click get form to get started. Producers should have the option to provide one of the following forms to prove eligibility: Highlight relevant segments of your documents or blackout delicate information with instruments that.

Any Person Who Misuses Their Permit Is Subject To A $500 Penalty From The Tax Commission Per Instance.

To begin an agriculture exemption application: A federal tax form that shows income from agriculture, such as a schedule f, form 1065 or form 4835 Oklahoma agricultural sales tax exemption. Check with the state for exemption information and requirements.

Pursuant To Title 68 Section 1358.1 Of The Oklahoma Statutes, Individuals Or Businesses Engaged In Farming Or Ranching For Profit May Qualify For An Agricultural Exemption.

Web if listing property with the county assessor is insufficient, agriculture producers should apply for an exemption permit through the oklahoma tax commission. The entities that qualify for sales tax exemption in oklahoma are specifically legislated. The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. Web the agriculture exemption application on oktap allows you to apply for a new exemption permit, renew an expiring or already expired permit, update information for your already existing permit, or cease an exemption permit which is no longer required.

Not All States Allow All Exemptions Listed On This Form.

To begin an agriculture exemption application: