Ohio Income Tax Extension Form

Ohio Income Tax Extension Form - Web how do i file an extension? Irs 1040 foreign tax return u.s. For taxpayers on a federal extension, a separate request for a municipal extension is not required. Web individual and net profit filers who need additional time to file beyond the april 18 deadline can request a filing extension. Web the buckeye state ohio state income tax return for tax year 2022 (jan. Web extension request form (due on the return due date) tax year tax year end date return due date the undersigned or duly authorized agent hereby requests. A federal extension (form 4868) gives taxpayers until. Filing this form gives you until october 15 to file. Access the forms you need to file taxes or do business in ohio. The ohio department of taxation provides a searchable repository of individual tax.

Ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. Web extended deadline with ohio tax extension: Ohio does not have a separate extension request. The ohio department of taxation provides a searchable repository of individual tax. Irs 1040 foreign tax return u.s. Web what federal income tax return would the person requesting the extension file for 2019? Submit a copy of the federal extension with the filing. Web you can make a state extension payment using ohio form it 40p (income tax payment voucher), or by going online to the ohio “epayment” portal:. The steps to calculating your tax liability are as follows: Web how do i file an extension?

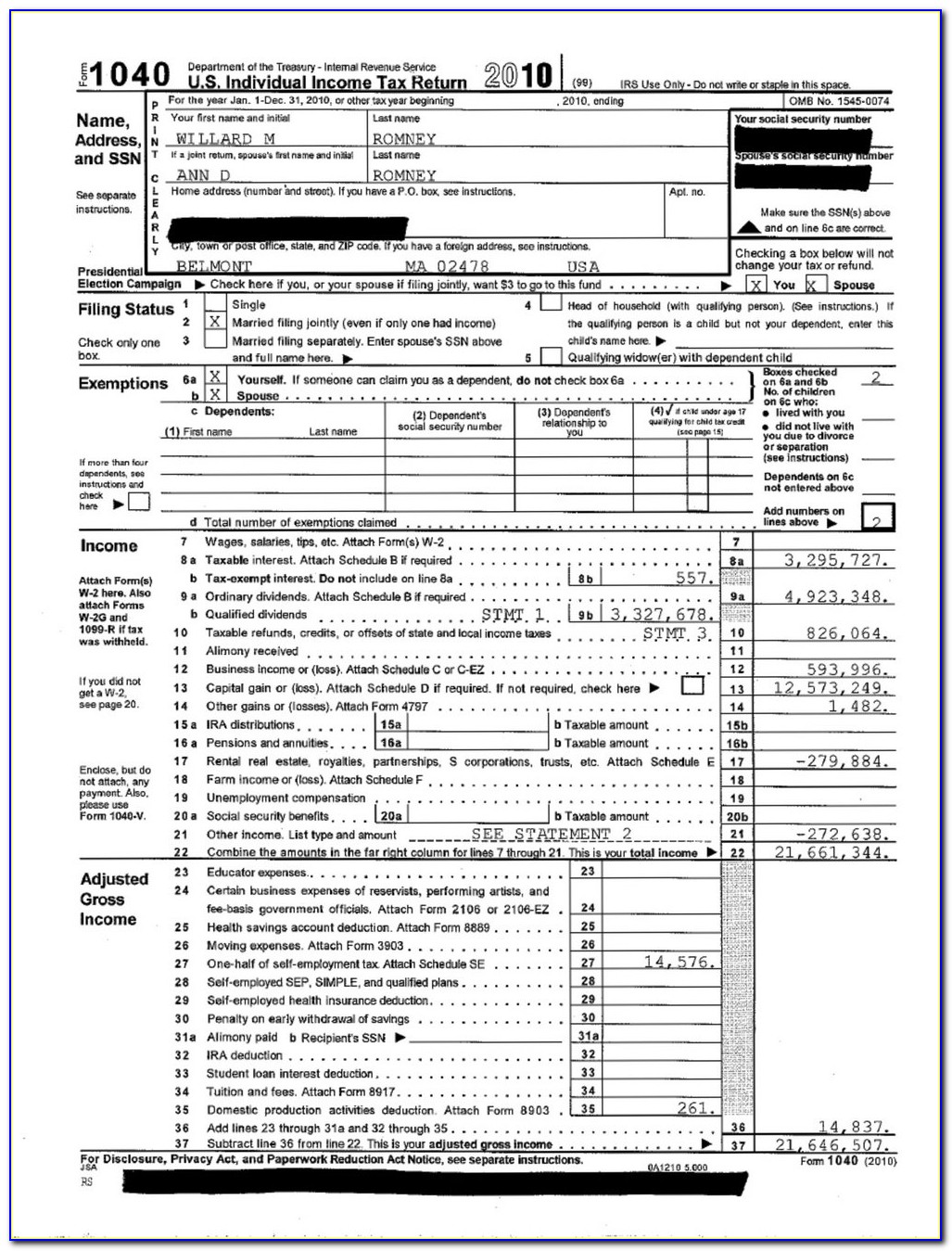

Web what federal income tax return would the person requesting the extension file for 2019? New york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. The form gives a person or agency access to provide info about unemployment taxes. Web extended deadline with ohio tax extension: Web extension request form (due on the return due date) tax year tax year end date return due date the undersigned or duly authorized agent hereby requests. Web as a reminder, you can file for an extension to submit an income tax return with the irs (that ohio will honor), but any tax due to ohio must still be paid by the april. Web individual and net profit filers who need additional time to file beyond the april 18 deadline can request a filing extension. What would be the federal tax filing status of. If you are receiving this message, you have either attempted to use a. The ohio department of taxation provides a searchable repository of individual tax.

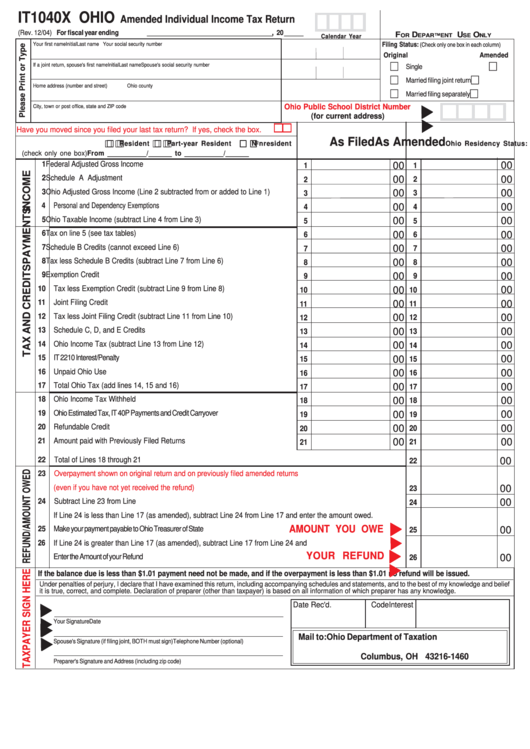

Form It1040x Ohio Amended Individual Tax Return 2004

What would be the federal tax filing status of. Web extension request form (due on the return due date) tax year tax year end date return due date the undersigned or duly authorized agent hereby requests. Ohio fiduciary income tax return pdf. Web individual and net profit filers who need additional time to file beyond the april 18 deadline can.

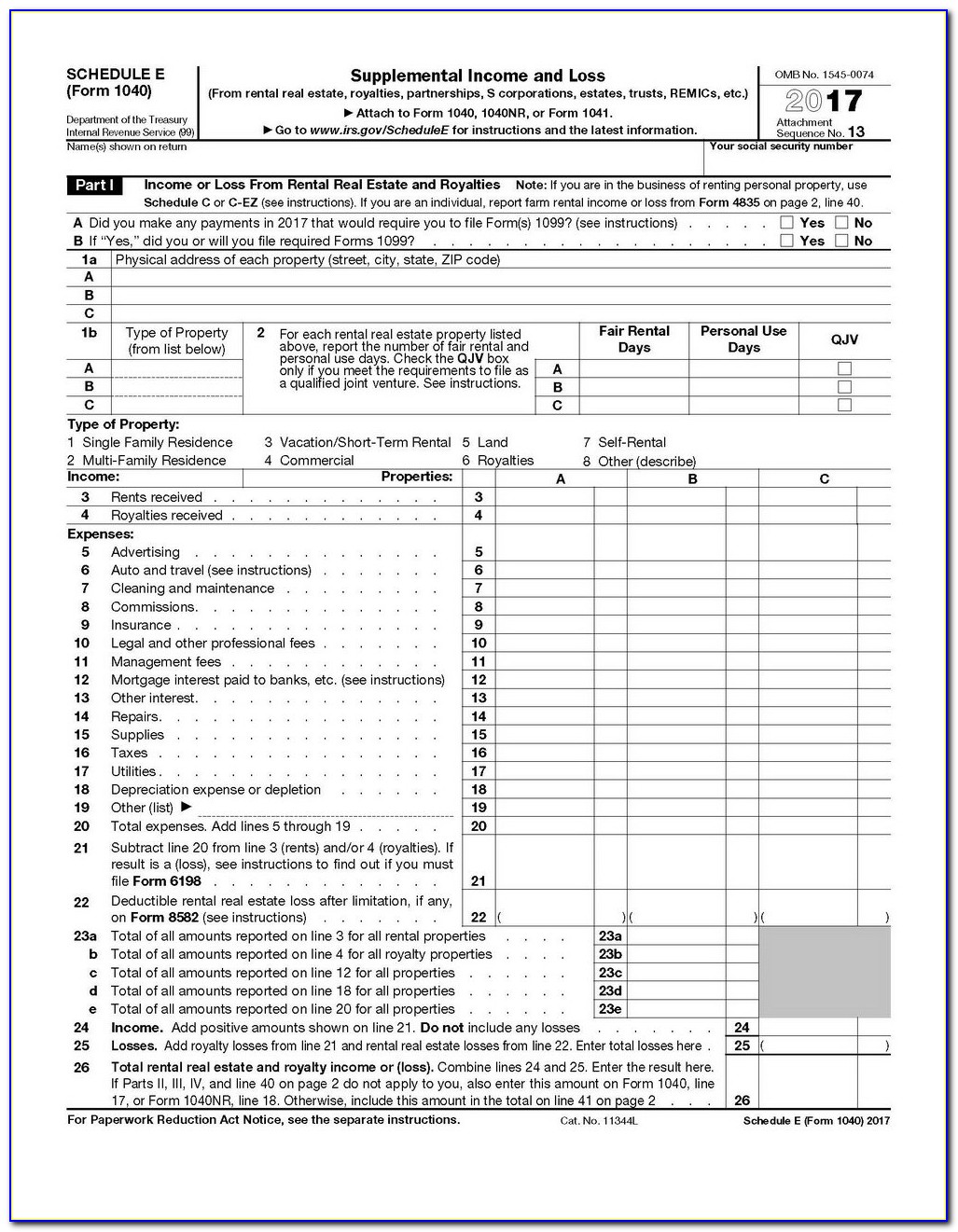

Tax Form 1040ez 2015 Form Resume Examples J3DWEoxOLp

The steps to calculating your tax liability are as follows: Web you can make a state extension payment using ohio form it 40p (income tax payment voucher), or by going online to the ohio “epayment” portal:. Ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. Web allows.

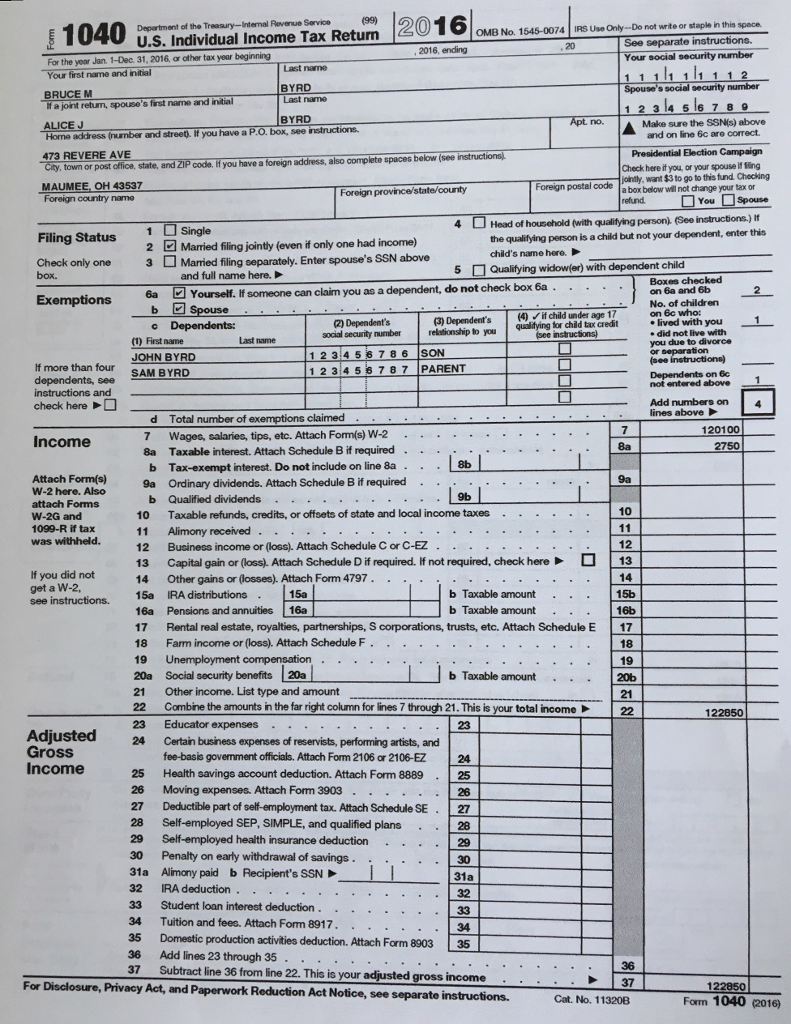

Prepare An Ohio State Tax Return Form IT 1 2021 Tax Forms 1040

Web we last updated the income tax payment voucher in february 2023, so this is the latest version of form it 40p, fully updated for tax year 2022. New york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. If you are receiving this message,.

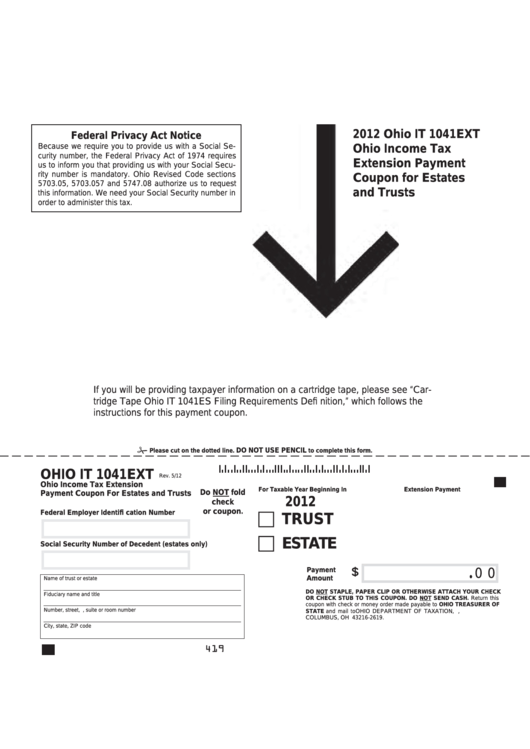

Fillable Ohio Form It 1041ext Ohio Tax Extension Payment

Submit a copy of the federal extension with the filing. For taxpayers on a federal extension, a separate request for a municipal extension is not required. Web personal income tax extension you can only access this application through your online services account. Access the forms you need to file taxes or do business in ohio. Web ohio’s individual income tax.

Ny State Tax Extension Form It 201 Form Resume Examples erkKMqB5N8

For taxpayers on a federal extension, a separate request for a municipal extension is not required. Web individual and net profit filers who need additional time to file beyond the april 18 deadline can request a filing extension. Web allows you to electronically make ohio individual income and school district income tax payments. Submit a copy of the federal extension.

The strange saga of the IRS' plague of broken printers POLITICO

Ohio fiduciary income tax return pdf. Web what federal income tax return would the person requesting the extension file for 2019? This includes extension and estimated payments, original and amended. Web ohio’s individual income tax is calculated on form it 1040 and its supporting schedules. Ohio has a state income tax that ranges between 2.85% and 4.797% , which is.

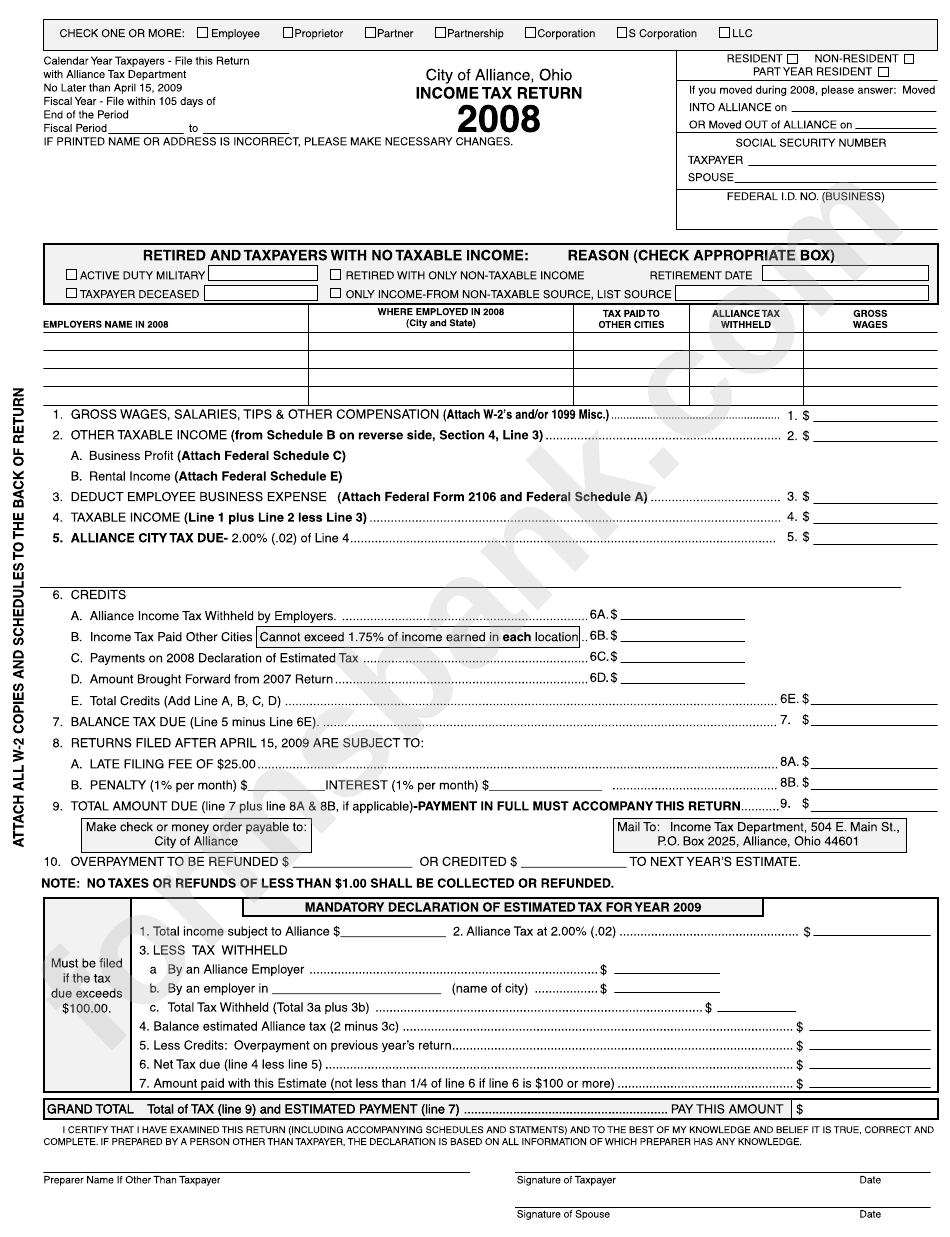

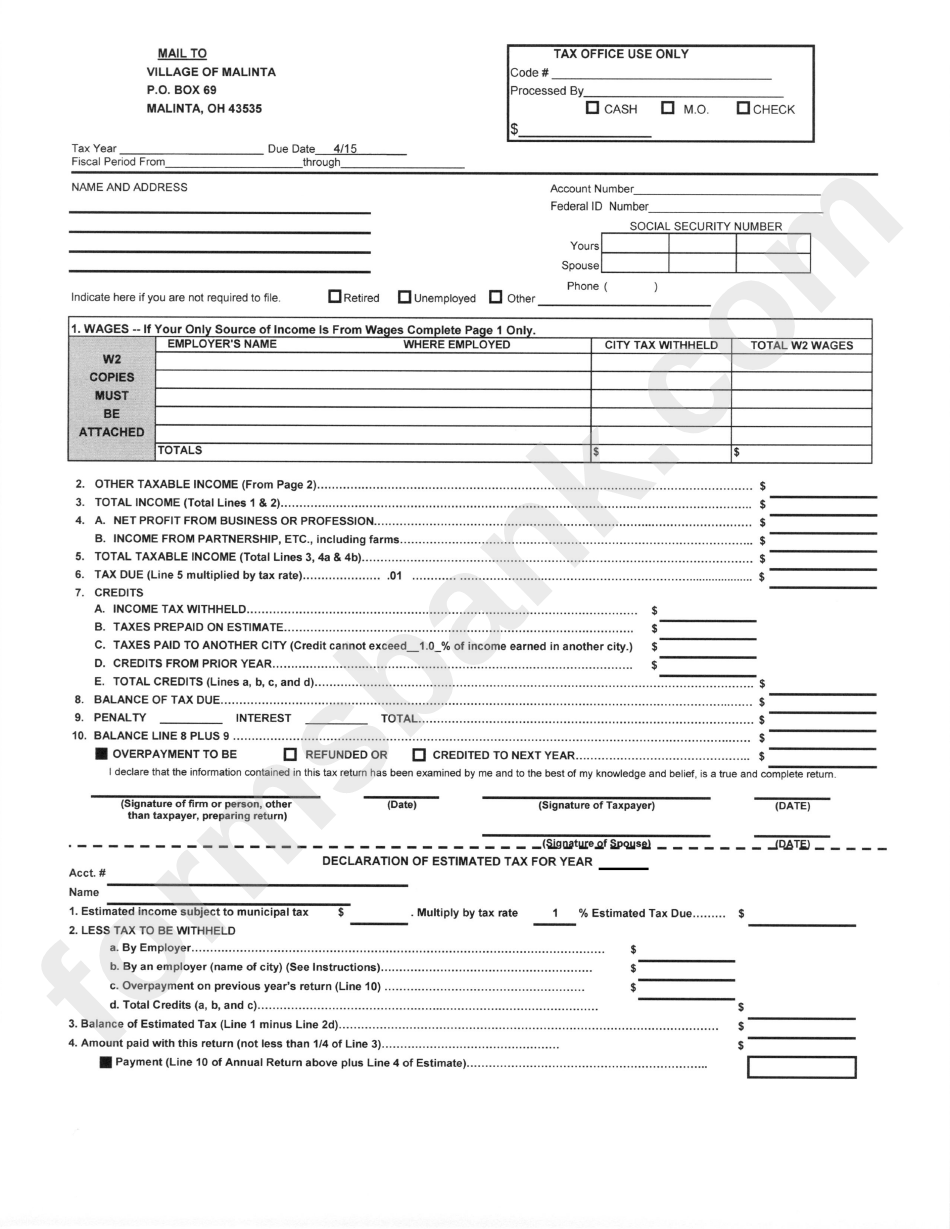

Tax Return Form Alliance Ohio printable pdf download

Web personal income tax extension you can only access this application through your online services account. The ohio department of taxation provides a searchable repository of individual tax. Begin with your federal adjusted. A federal extension (form 4868) gives taxpayers until. Filing this form gives you until october 15 to file.

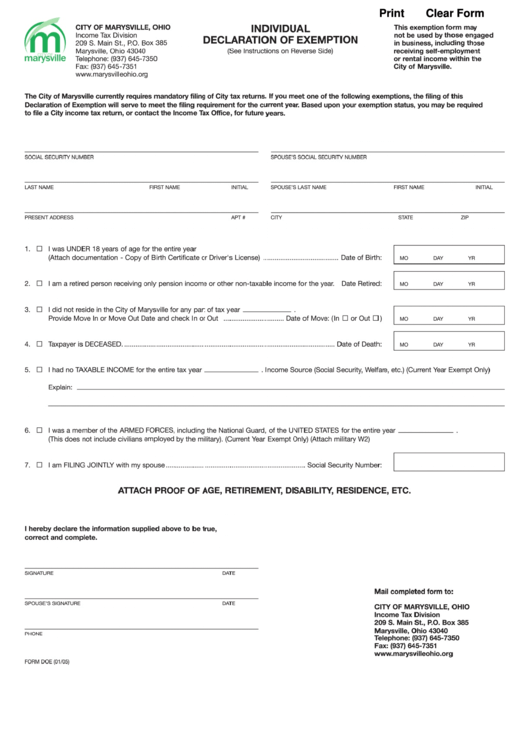

Fillable Individual Declaration Of Exemption Form Ohio Tax

New york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. This includes extension and estimated payments, original and amended. Web how do i file an extension? You can download or print. The form gives a person or agency access to provide info about unemployment.

State Of Ohio Tax Forms Fill Out and Sign Printable PDF Template

If you are receiving this message, you have either attempted to use a. Ohio does not have a separate extension request. Web personal income tax extension you can only access this application through your online services account. What would be the federal tax filing status of. A federal extension (form 4868) gives taxpayers until.

Ohio State Tax Forms Printable Printable Form 2022

Web extended deadline with ohio tax extension: New york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Web we last updated the income tax payment voucher in february 2023, so this is the latest version of form it 40p, fully updated for tax year.

Web Extension Request Form (Due On The Return Due Date) Tax Year Tax Year End Date Return Due Date The Undersigned Or Duly Authorized Agent Hereby Requests.

The steps to calculating your tax liability are as follows: Ohio fiduciary income tax return pdf. Irs 1040 foreign tax return u.s. Begin with your federal adjusted.

Web What Federal Income Tax Return Would The Person Requesting The Extension File For 2019?

Web personal income tax extension you can only access this application through your online services account. The ohio department of taxation provides a searchable repository of individual tax. Ohio has a state income tax that ranges between 2.85% and 4.797% , which is administered by the ohio department of taxation. Web you can make a state extension payment using ohio form it 40p (income tax payment voucher), or by going online to the ohio “epayment” portal:.

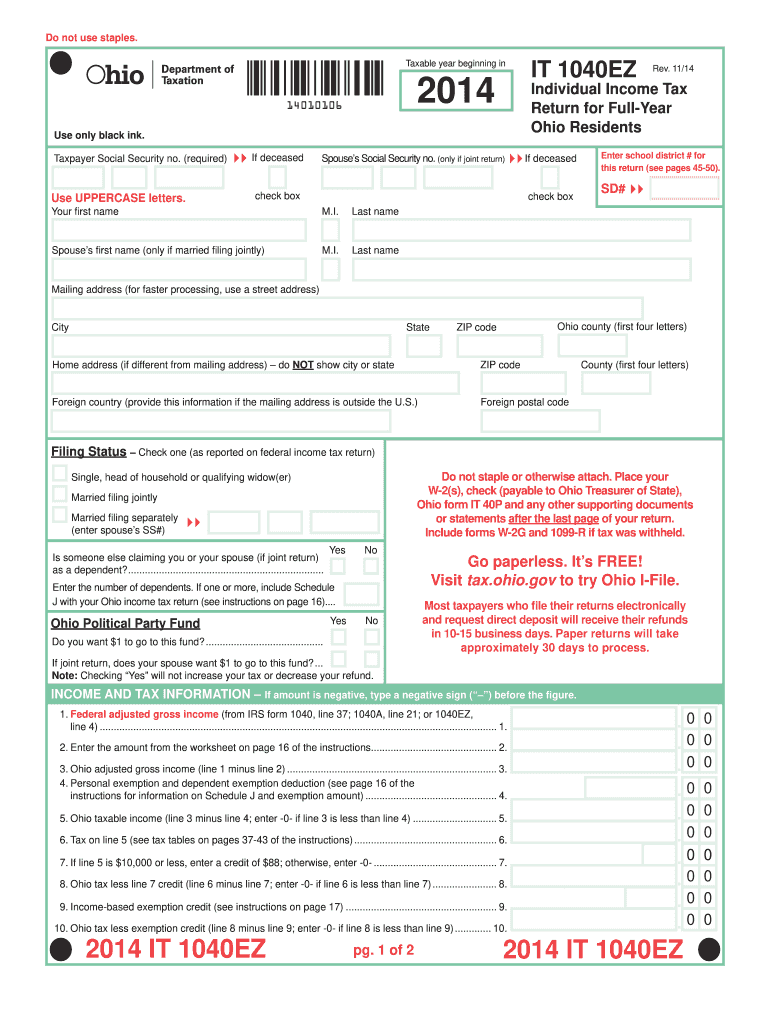

Web Ohio’s Individual Income Tax Is Calculated On Form It 1040 And Its Supporting Schedules.

Submit a copy of the federal extension with the filing. New york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Web individual and net profit filers who need additional time to file beyond the april 18 deadline can request a filing extension. Filing this form gives you until october 15 to file.

Web We Last Updated The Income Tax Payment Voucher In February 2023, So This Is The Latest Version Of Form It 40P, Fully Updated For Tax Year 2022.

Web allows you to electronically make ohio individual income and school district income tax payments. A federal extension (form 4868) gives taxpayers until. What would be the federal tax filing status of. You can download or print.