Ohio 1099 Form

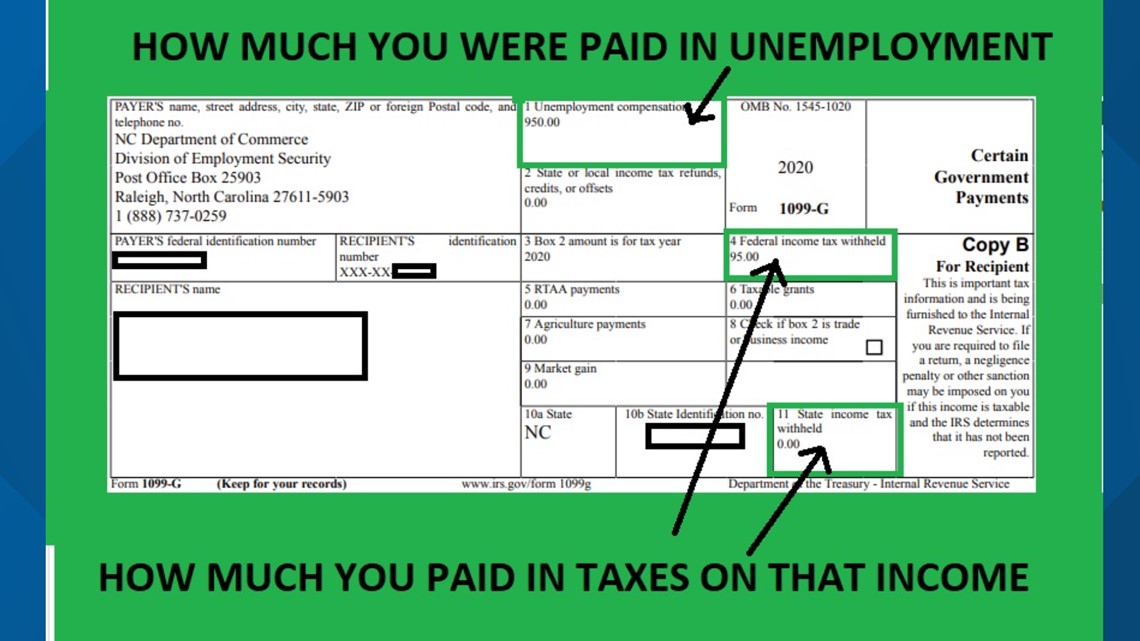

Ohio 1099 Form - Web apply now for individuals for individual filing, refund status, identity confirmation, online services and more. Tax payments are based on the amount listed on the. Department of agriculture cash program payments belonging to other. The state does not require a reconciliation form to be submitted. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Ad get ready for tax season deadlines by completing any required tax forms today. Web instructions for recipient recipient’s taxpayer identification number (tin). (this information is provided to benefit recipients for tax. Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about the amount of interest you received as part of your claim payment, then.

And you are not enclosing a payment, then use this address. Web instructions for recipient recipient’s taxpayer identification number (tin). What is the 1099 filing address for ohio? Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about the amount of interest you received as part of your claim payment, then. The state does not require a reconciliation form to be submitted. For your protection, this form may show only the last four digits of your social security number. Web if you live in ohio. Ad get ready for tax season deadlines by completing any required tax forms today. And you are filing a form. Web form 4347 has been issued for optional use by persons who, as payees of record, receive from the u.s.

Web the ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. This page provides the latest resources on ohio state 1099. Ad get ready for tax season deadlines by completing any required tax forms today. What is the 1099 filing address for ohio? Ad get the latest 1099 misc online. (this information is provided to benefit recipients for tax. Fill, edit, sign, download & print. Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). And you are not enclosing a payment, then use this address.

Ohio Form 1099 G Form Resume Examples WjYDlebYKB

Tax payments are based on the amount listed on the. Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about the amount of interest you received as part of your claim payment, then. Fill, edit, sign, download & print. The state does not require a reconciliation form.

Ohio Form 1099 G Form Resume Examples 6V3R5AQK7b

Web ohio state taxon to design 1099 form ohio printable? Ad get the latest 1099 misc online. Fill, edit, sign, download & print. The state does not require a reconciliation form to be submitted. And you are enclosing a payment, then use this.

Ohio 1099 Tax Form Form Resume Examples GM9OLlgYDL

Web contract labor/1099s compliance reporting payroll contract labor/1099s independent contractor use of independent contractors is common in the construction industry and. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). Web apply now for individuals for individual filing, refund status, identity confirmation, online services and more..

Ohio Form 1099 R Form Resume Examples EZVgPMj2Jk

Tax payments are based on the amount listed on the. Fill, edit, sign, download & print. (this information is provided to benefit recipients for tax. Web the ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web form 4347 has been issued for optional use by persons who, as payees of record, receive from.

sd100w2

Web instructions for recipient recipient’s taxpayer identification number (tin). Web if you live in ohio. Fill, edit, sign, download & print. Web apply now for individuals for individual filing, refund status, identity confirmation, online services and more. Web contract labor/1099s compliance reporting payroll contract labor/1099s independent contractor use of independent contractors is common in the construction industry and.

Ohio Tax Form 1099 Misc Form Resume Examples lV8N2GA80o

Web apply now for individuals for individual filing, refund status, identity confirmation, online services and more. The state does not require a reconciliation form to be submitted. And you are filing a form. Department of agriculture cash program payments belonging to other. And you are enclosing a payment, then use this.

How To Get 1099 G Form Online Iowa Nicolette Mill's Template

Web if you live in ohio. This page provides the latest resources on ohio state 1099. Web contract labor/1099s compliance reporting payroll contract labor/1099s independent contractor use of independent contractors is common in the construction industry and. Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about.

Ohio 1099 Form Form Resume Examples XE8jEa63Oo

Web the ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. The state does not require a reconciliation form to be submitted. And you are enclosing a payment, then use this. This page provides the latest resources on ohio state 1099. And you are filing a form.

Grandparent Guardianship Form Ohio Form Resume Examples EZVgJlOYJk

Web apply now for individuals for individual filing, refund status, identity confirmation, online services and more. Web instructions for recipient recipient’s taxpayer identification number (tin). Tax payments are based on the amount listed on the. Web form 4347 has been issued for optional use by persons who, as payees of record, receive from the u.s. Department of agriculture cash program.

State Of Ohio Form 1099 G Form Resume Examples Or85VMx1Wz

Web if you live in ohio. The state does not require a reconciliation form to be submitted. And you are not enclosing a payment, then use this address. Most forms are available for download and. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs).

Most Forms Are Available For Download And.

Web form 4347 has been issued for optional use by persons who, as payees of record, receive from the u.s. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). Ad get the latest 1099 misc online. Those who issue 10 or more must remit the information electronically on the ohio.

Complete, Edit Or Print Tax Forms Instantly.

Web ohio state taxon to design 1099 form ohio printable? The state does not require a reconciliation form to be submitted. Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about the amount of interest you received as part of your claim payment, then. Web apply now for individuals for individual filing, refund status, identity confirmation, online services and more.

Web If You Live In Ohio.

And you are filing a form. (this information is provided to benefit recipients for tax. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Tax payments are based on the amount listed on the.

And You Are Enclosing A Payment, Then Use This.

Web instructions for recipient recipient’s taxpayer identification number (tin). Web contract labor/1099s compliance reporting payroll contract labor/1099s independent contractor use of independent contractors is common in the construction industry and. Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous. Ad get ready for tax season deadlines by completing any required tax forms today.