Nr4 Form Canada

Nr4 Form Canada - Report gross income (box 16 or 26) in canadian funds. The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. See appendix b for a list of types of income. See general information for details. Report the income on your tax return. Web if you are a resident of canada and you received an nr4 slip: Web how do i apply my canadian nr4 on my federal tax form? You can view this form in: Report the tax withheld (box 17 or 27) in canadian funds. To report this information to the irs, u.s.

To report this information to the irs, u.s. Report the income on your tax return. Report the tax withheld (box 17 or 27) in canadian funds. For best results, download and open this form in adobe reader. See appendix b for a list of types of income. Web if you are a resident of canada and you received an nr4 slip: The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. You can view this form in: Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Report gross income (box 16 or 26) in canadian funds.

See appendix b for a list of types of income. Report the income on your tax return. Web if you are a resident of canada and you received an nr4 slip: Report the tax withheld (box 17 or 27) in canadian funds. Use the income code (in box 14) to determine what kind of slip to use in wealthsimple tax. You’ll need to “convert” your nr4 into the correct type of slip. For best results, download and open this form in adobe reader. Web how do i apply my canadian nr4 on my federal tax form? You can view this form in: Use separate lines when you report income that is partially exempt.

NR4 Statement of Amounts Paid or Credited to NonResidents of Canada

For best results, download and open this form in adobe reader. Report the tax withheld (box 17 or 27) in canadian funds. See appendix b for a list of types of income. Web if you are a resident of canada and you received an nr4 slip: Report the income on your tax return.

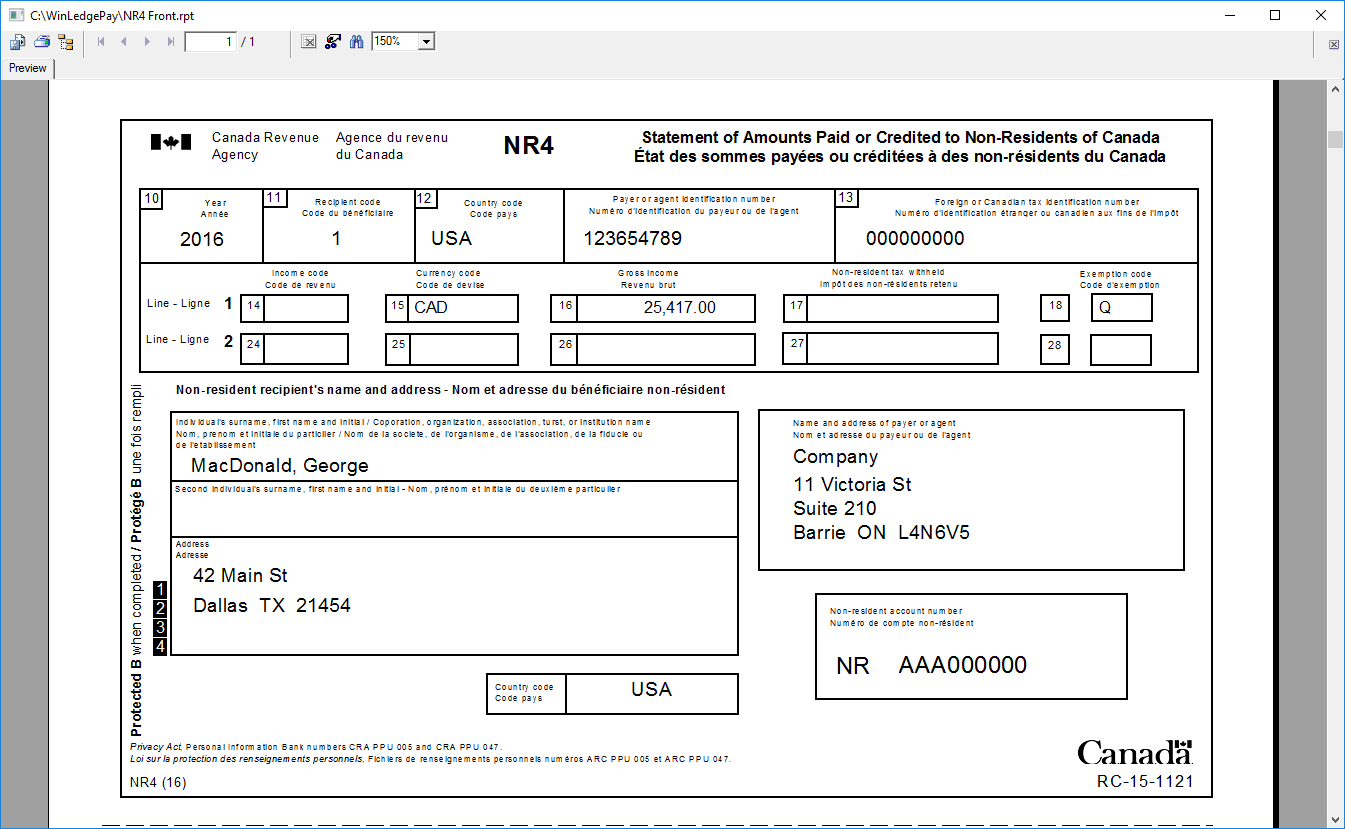

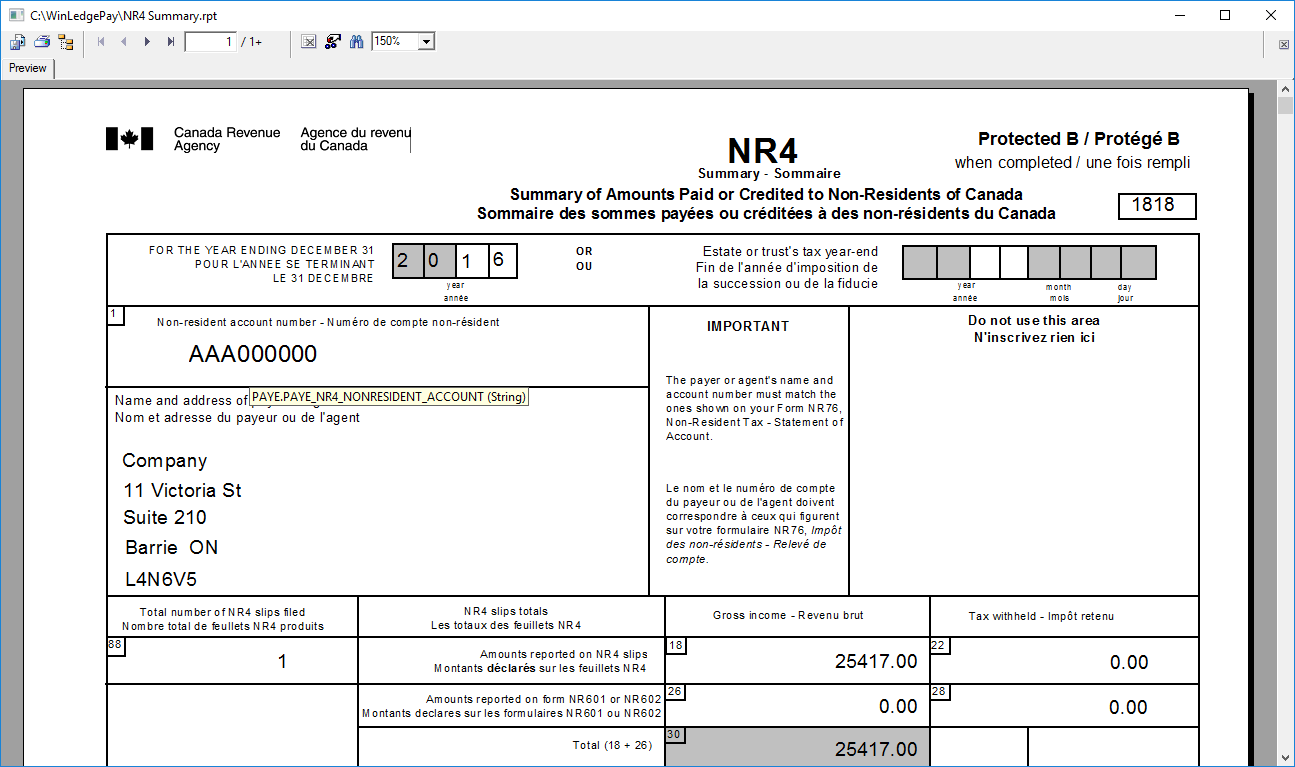

Sample Forms

Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. You can view this form in: Report gross income (box 16 or 26) in canadian funds. To report this information to the irs, u.s. Web how do i apply my canadian nr4 on my federal.

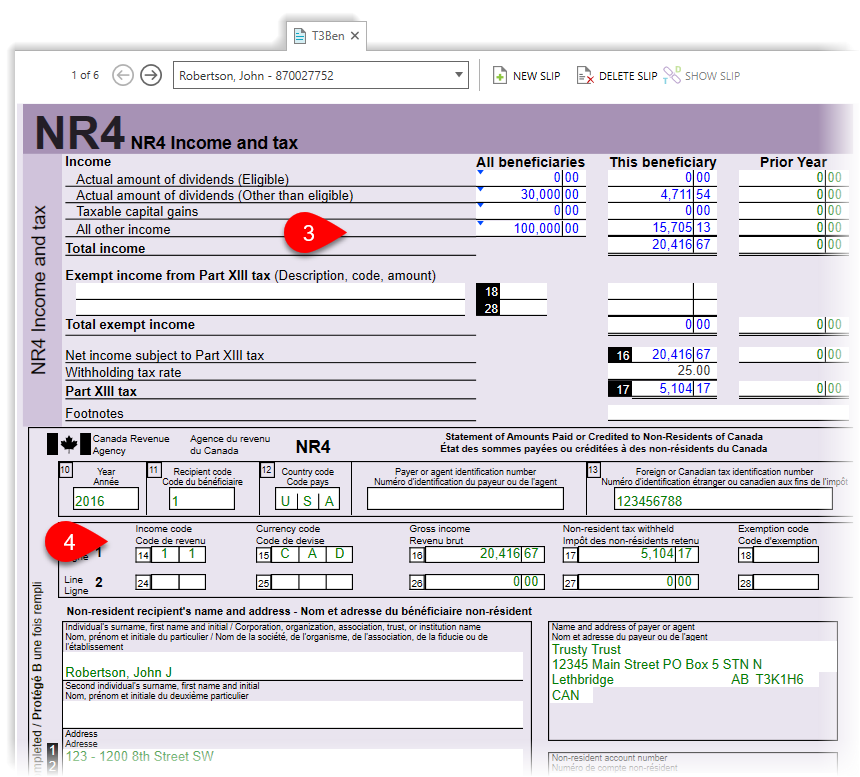

NR4 slips for nonresident trust beneficiaries TaxCycle

Web how do i apply my canadian nr4 on my federal tax form? Report the tax withheld (box 17 or 27) in canadian funds. See general information for details. Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Use separate lines when you report.

Classic Software

Report the tax withheld (box 17 or 27) in canadian funds. The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. Web if you are a resident of canada and you received an nr4 slip: Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who.

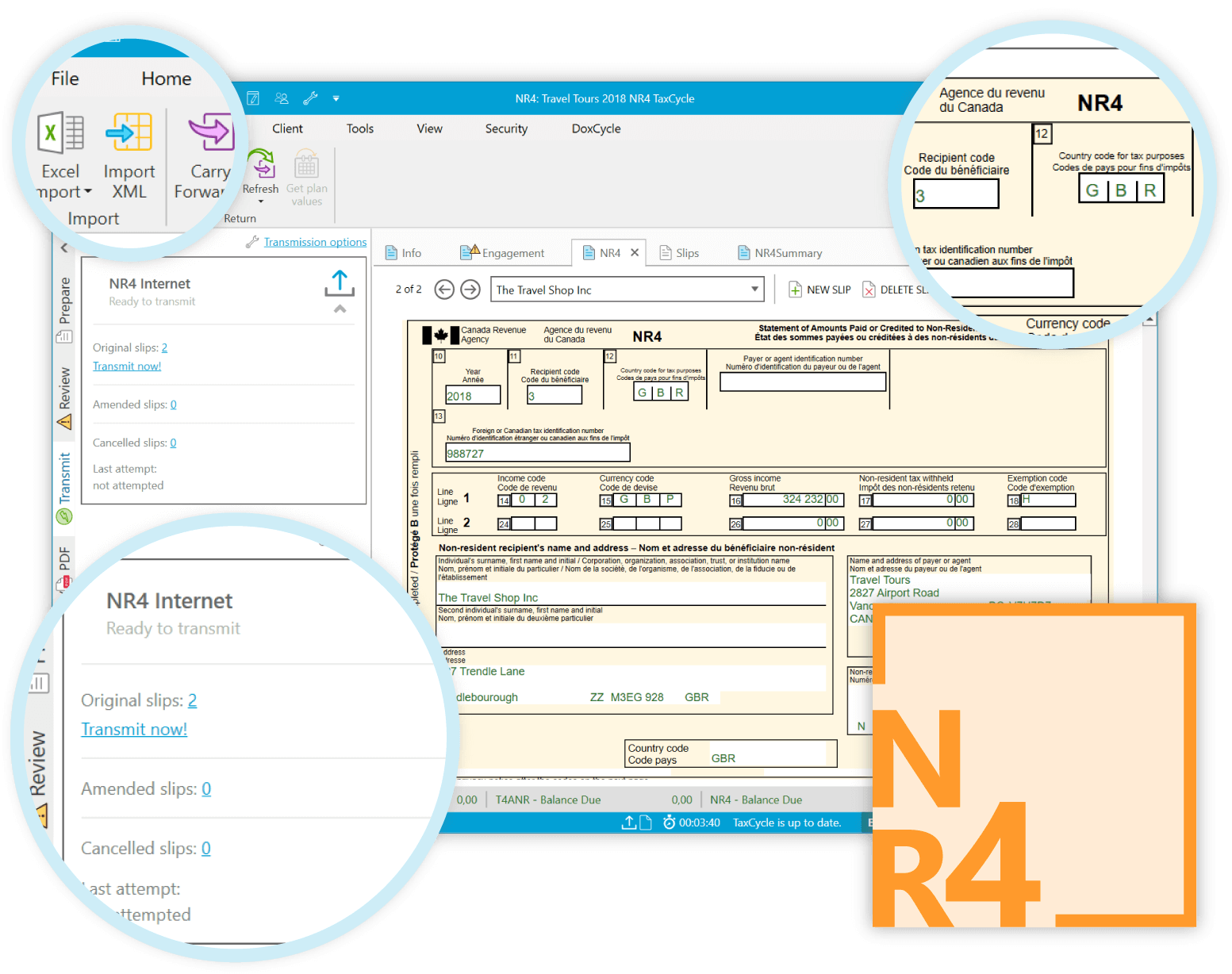

TaxCycle NR4 TaxCycle

For best results, download and open this form in adobe reader. The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. You can view this form in: Report gross income (box 16 or 26) in canadian funds. Report the income on your tax return.

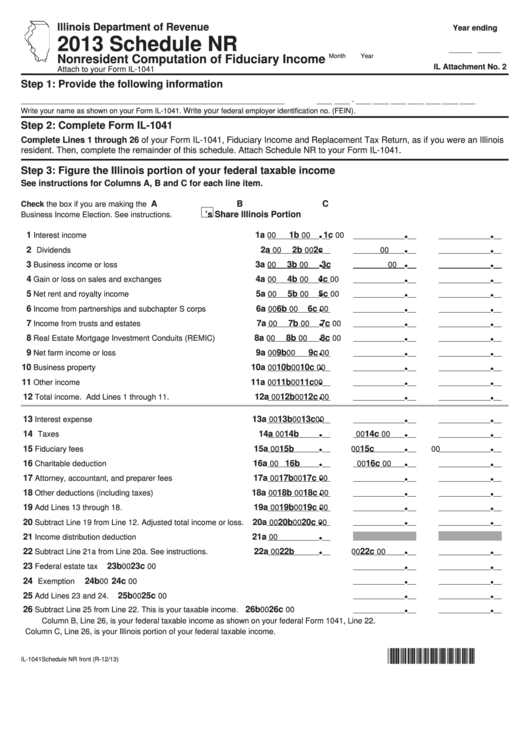

Fillable Schedule Nr Nonresident Computation Of Fiduciary

See general information for details. You’ll need to “convert” your nr4 into the correct type of slip. Report the income on your tax return. See appendix b for a list of types of income. Use separate lines when you report income that is partially exempt.

NR4 Form and Withholding Taxes YouTube

For best results, download and open this form in adobe reader. Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Web how do i apply my canadian nr4 on my federal tax form? To report this information to the irs, u.s. Report gross income.

Classic Software

Report gross income (box 16 or 26) in canadian funds. Web if you are a resident of canada and you received an nr4 slip: The slip issuer must withhold tax from the payment to the nonresident and remit it to the government. Web how do i apply my canadian nr4 on my federal tax form? Web an nr4 slip is.

NR4 and NR7 Trading Strategy Setup

You’ll need to “convert” your nr4 into the correct type of slip. You can view this form in: Report the income on your tax return. Residents must record the information found on an nr4 on irs form 8891. See appendix b for a list of types of income.

Sample Forms

Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Report the tax withheld (box 17 or 27) in canadian funds. To report this information to the irs, u.s. For best results, download and open this form in adobe reader. Use the income code (in.

You Can View This Form In:

Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Use the income code (in box 14) to determine what kind of slip to use in wealthsimple tax. Web how do i apply my canadian nr4 on my federal tax form? Report gross income (box 16 or 26) in canadian funds.

Web If You Are A Resident Of Canada And You Received An Nr4 Slip:

Residents must record the information found on an nr4 on irs form 8891. To report this information to the irs, u.s. You’ll need to “convert” your nr4 into the correct type of slip. See general information for details.

The Slip Issuer Must Withhold Tax From The Payment To The Nonresident And Remit It To The Government.

Use separate lines when you report income that is partially exempt. For best results, download and open this form in adobe reader. Report the tax withheld (box 17 or 27) in canadian funds. See appendix b for a list of types of income.