New York State Tax Form It-201 Instructions

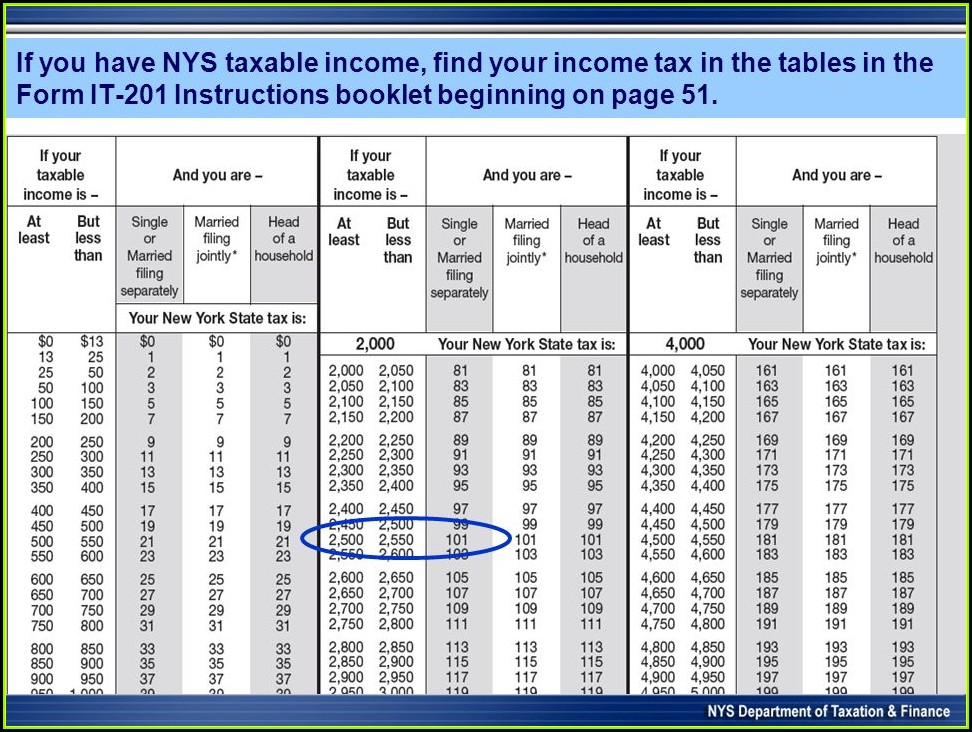

New York State Tax Form It-201 Instructions - Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web file now with turbotax related new york individual income tax forms: Part 1 — other new york state, new. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. Web good news for 2022! To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. This form is for income earned in tax. If you are filing a joint personal.

Part 1 — other new york state, new. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. This form is for income earned in tax. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. Web this instruction booklet will help you to fill out and file form 203. Web good news for 2022! We last updated the individual income tax instructions in january 2023, so this is the latest version of form. If you are filing a joint personal.

Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web good news for 2022! To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. This form is for income earned in tax. Web this instruction booklet will help you to fill out and file form 203. We last updated the individual income tax instructions in january 2023, so this is the latest version of form. Part 1 — other new york state, new. Web this instruction booklet will help you to fill out and file form 201. If you are filing a joint personal.

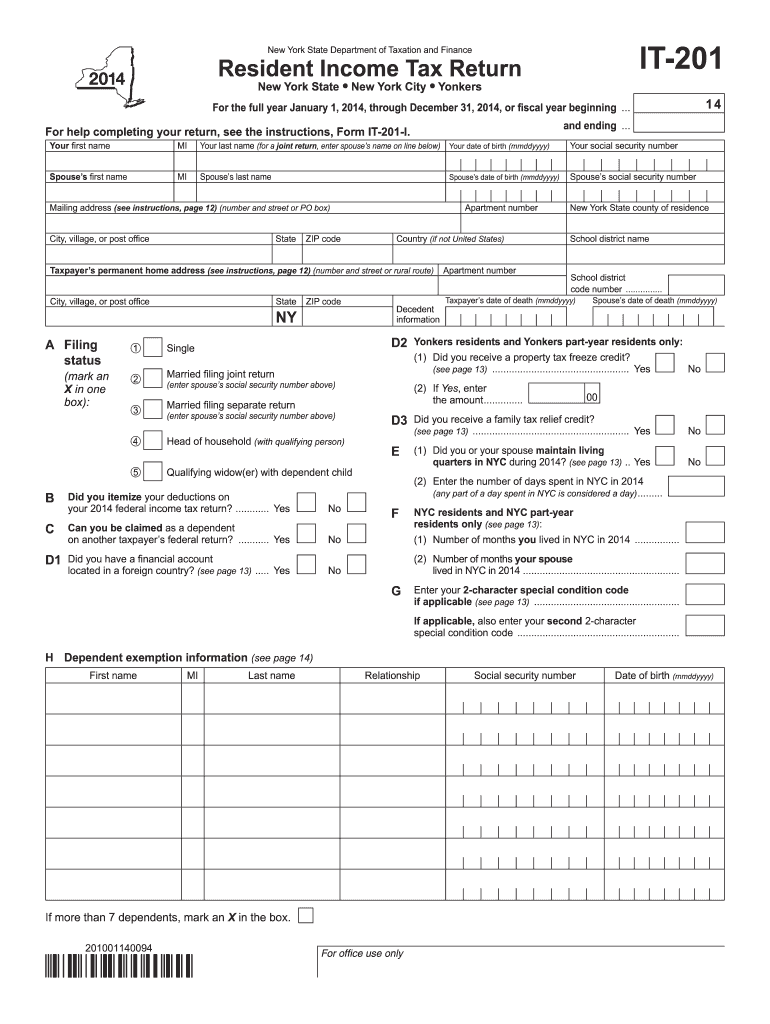

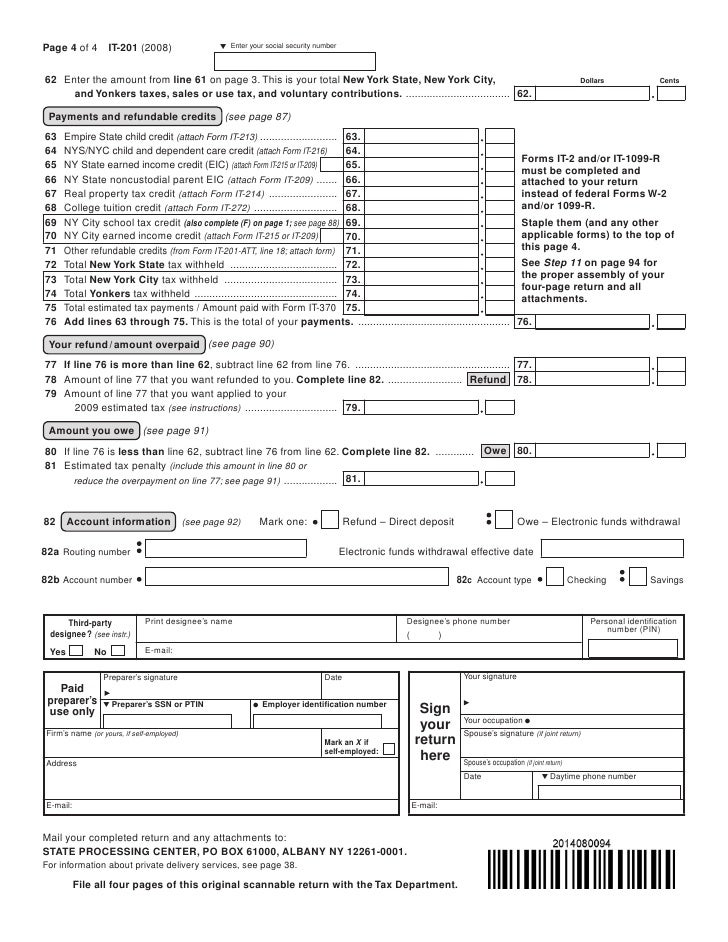

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

Web good news for 2022! This form is for income earned in tax. If you are filing a joint personal. Web this instruction booklet will help you to fill out and file form 201. Web this instruction booklet will help you to fill out and file form 203.

dadquantum Blog

Web good news for 2022! This form is for income earned in tax. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing..

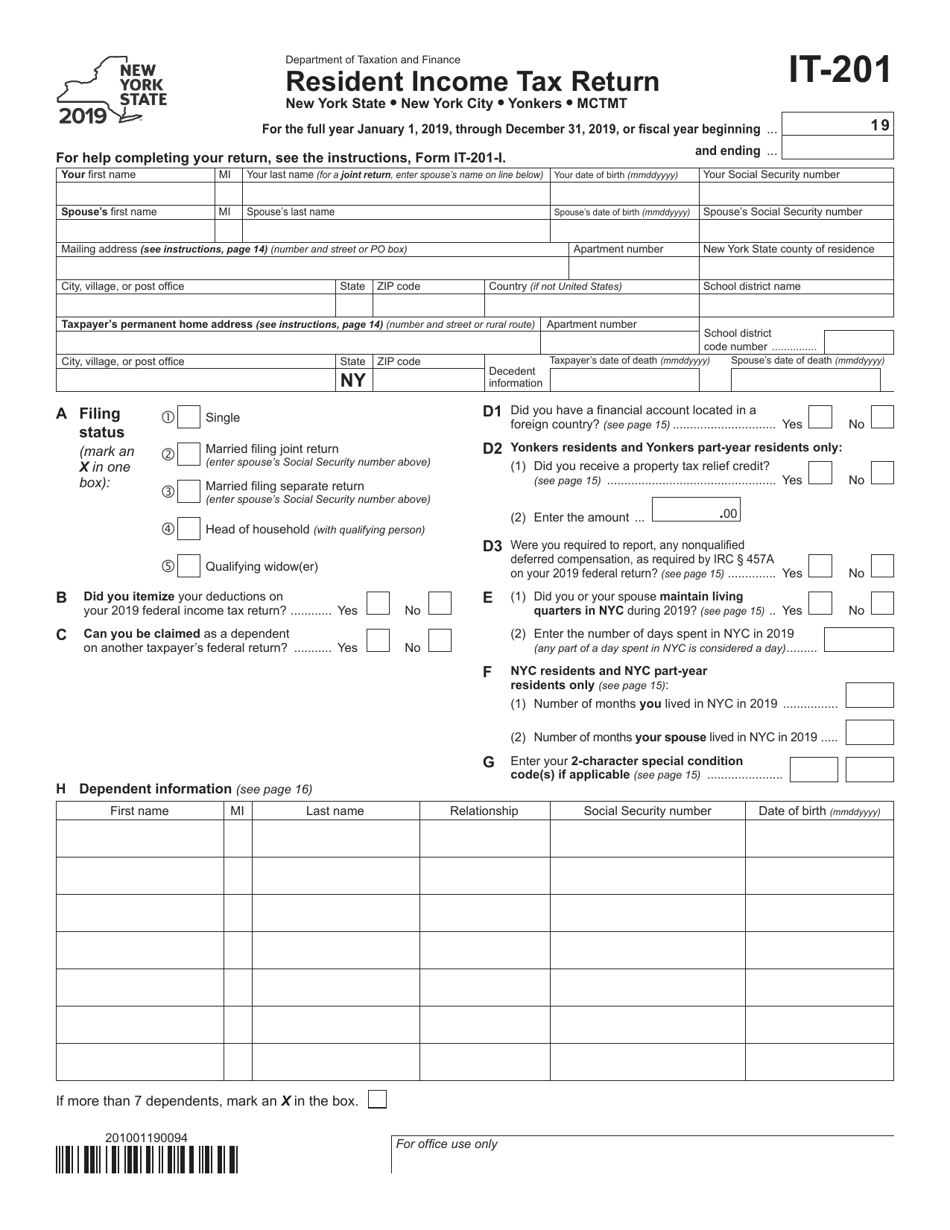

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Web good news for 2022! Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. We last updated the individual income tax instructions in january 2023, so this is the latest version of form..

Free Printable State Tax Forms Printable Templates

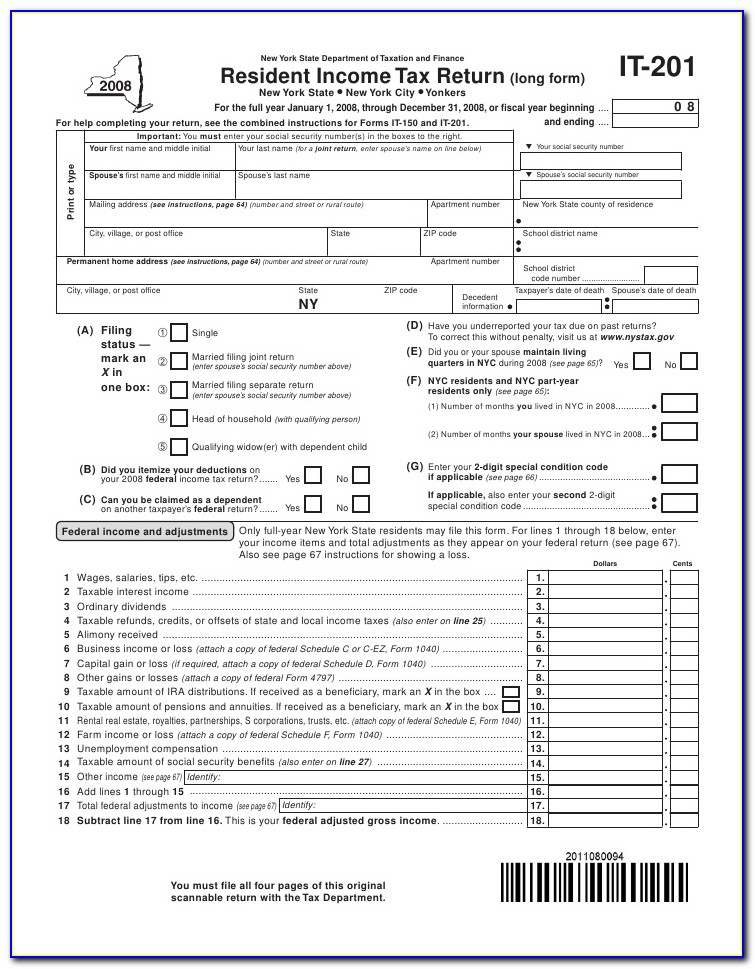

Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web new york state return,.

20172022 Form NY DTF IT201D Fill Online, Printable, Fillable, Blank

Web file now with turbotax related new york individual income tax forms: Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Web good news for 2022! Web this instruction booklet will help you to fill out and file form 203. This form is for income.

What is the IT201 tax form?

We last updated the individual income tax instructions in january 2023, so this is the latest version of form. To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. Part 1 — other new york state, new. Web to help you decide whether you have to file.

Do these 2 things to get your New York state tax refund 2 weeks sooner

This form is for income earned in tax. Web this instruction booklet will help you to fill out and file form 201. Part 1 — other new york state, new. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow.

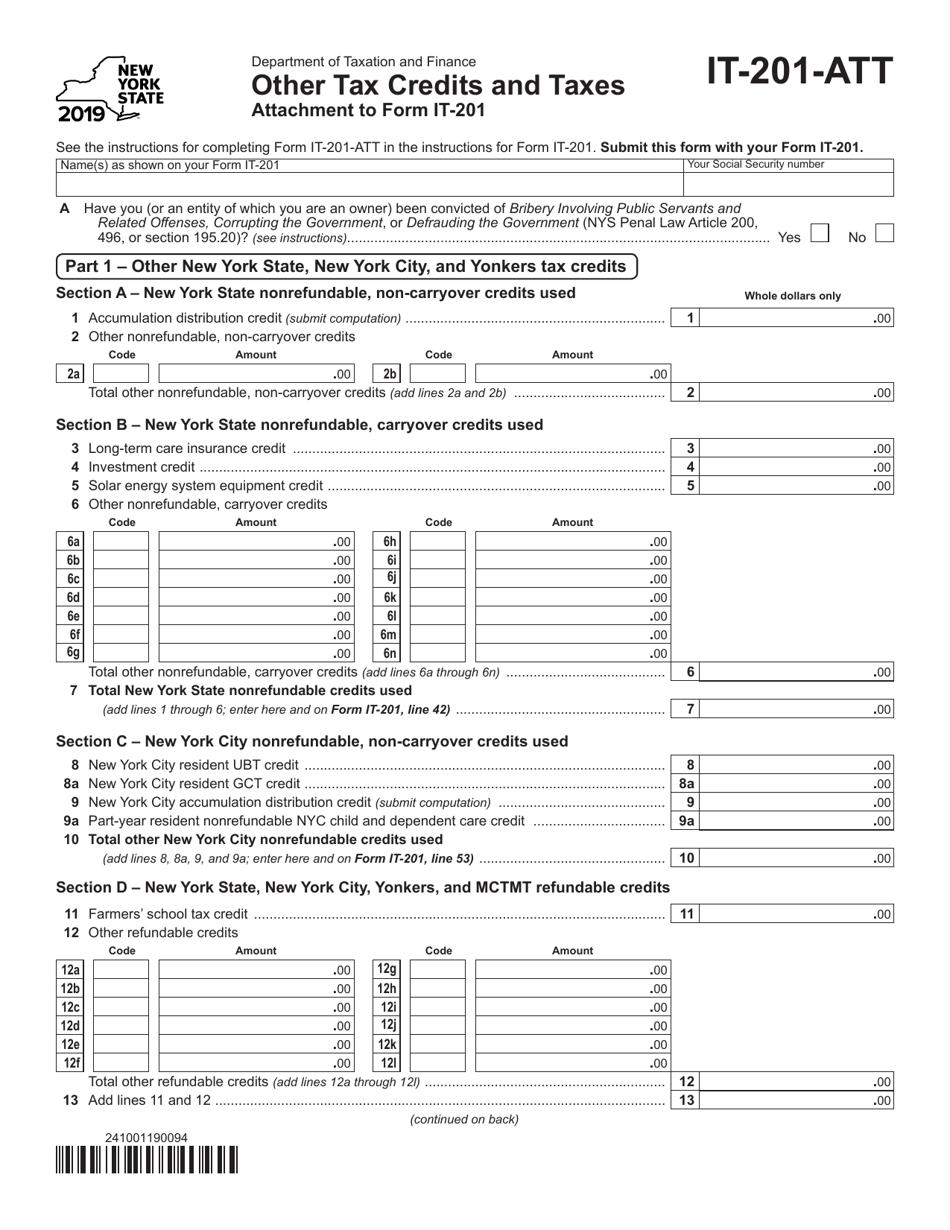

Form IT201ATT Download Fillable PDF or Fill Online Other Tax Credits

This form is for income earned in tax. Web this instruction booklet will help you to fill out and file form 201. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web to help you decide whether you have to file a new york state return, and which of the two new.

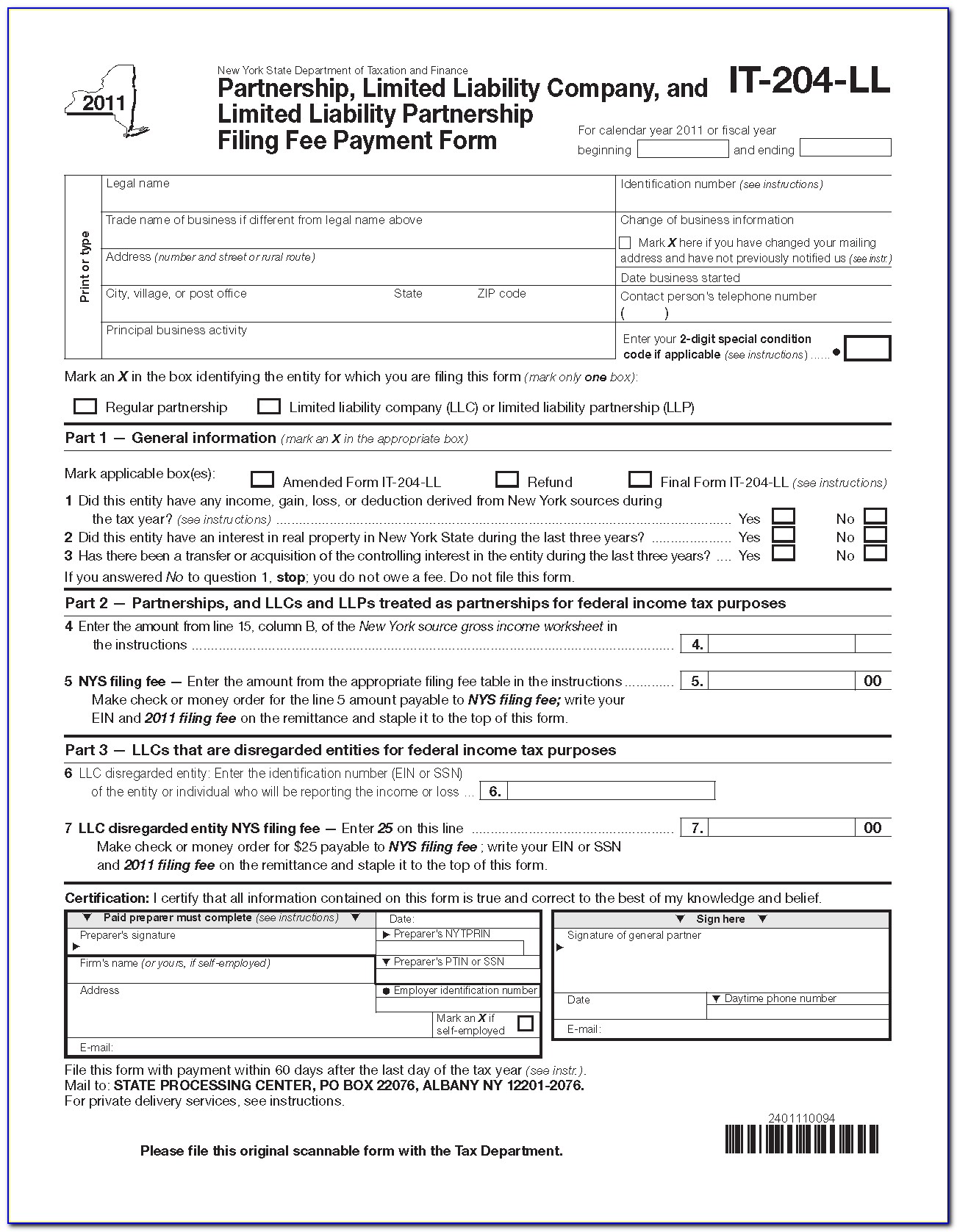

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

If you are filing a joint personal. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web this instruction booklet will help you to fill out and file form 203. We last updated the individual income tax instructions in january 2023, so this is the latest version of form. Web.

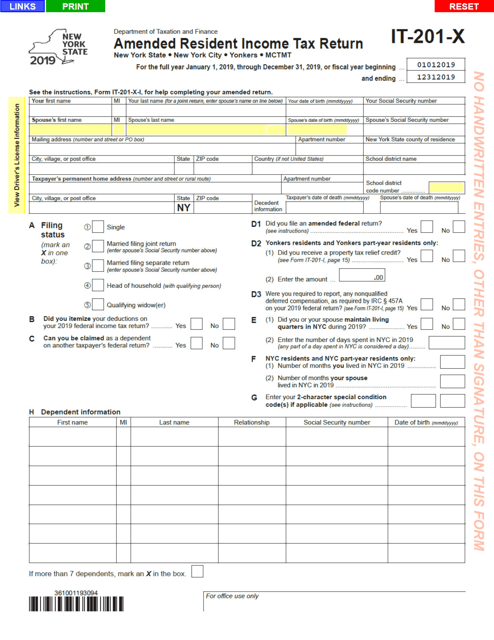

Form IT201X Download Fillable PDF or Fill Online Amended Resident

Web this instruction booklet will help you to fill out and file form 203. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web new york state return, and which of the two new york resident returns you should file, use the flow chart on page 5. Web good news for 2022!.

Web New York State Return, And Which Of The Two New York Resident Returns You Should File, Use The Flow Chart On Page 5.

If you are filing a joint personal. Taxformfinder has an additional 271 new york income tax forms that you may need, plus all federal. Web this instruction booklet will help you to fill out and file form 203. Web file now with turbotax related new york individual income tax forms:

Web Good News For 2022!

To report new york state tax preference items totaling more than your specific deduction of $5,000 ($2,500 if you are married and filing. We last updated the individual income tax instructions in january 2023, so this is the latest version of form. Web to help you decide whether you have to file a new york state return, and which of the two new york resident returns you should file, use the flow chart on page caution should be. Web this instruction booklet will help you to fill out and file form 201.

This Form Is For Income Earned In Tax.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Part 1 — other new york state, new.