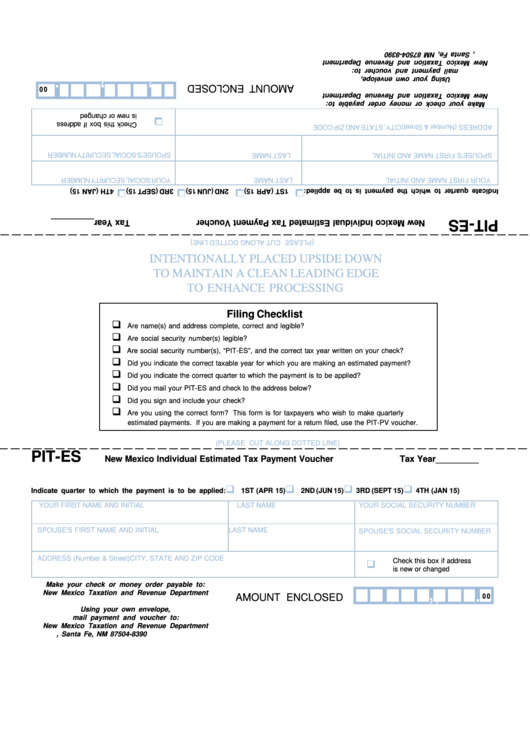

New Mexico Pit-Es Form

New Mexico Pit-Es Form - If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. Web up to $40 cash back get, create, make and sign tax from pit es new mexico 2018. Easily fill out pdf blank, edit, and sign them. The folders on this page contain everything from returns and instructions to payment. Complete, edit or print tax forms instantly. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web welcome to the taxation and revenue department’s forms & publications page. Taxpayers, tax professionals and others can access the new forms and. Web are you using the correct form? You can meet this requirement.

• every person who is a new mexico resident or. Web this form is for taxpayers who want to make a quarterly estimated payment. If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. Web 2024 central new mexico stem research challenge regional entries transmittal form regional entries transmittal form; Easily fill out pdf blank, edit, and sign them. Online with us legal forms. Web are you using the correct form? Your previous year new mexico personal income tax multiplied by 100%. It is not intended to. If you are a new mexico resident, you must file if you meet any of the following conditions:

• every person who is a new mexico resident or. If you are a new mexico resident, you must file if you meet any of the following conditions: Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web up to $40 cash back get, create, make and sign tax from pit es new mexico 2018. The folders on this page contain everything from returns and instructions to payment. Complete, edit or print tax forms instantly. If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. Get form esign fax email add annotation share this is how it works. The document has moved here. Web welcome to the taxation and revenue department’s forms & publications page.

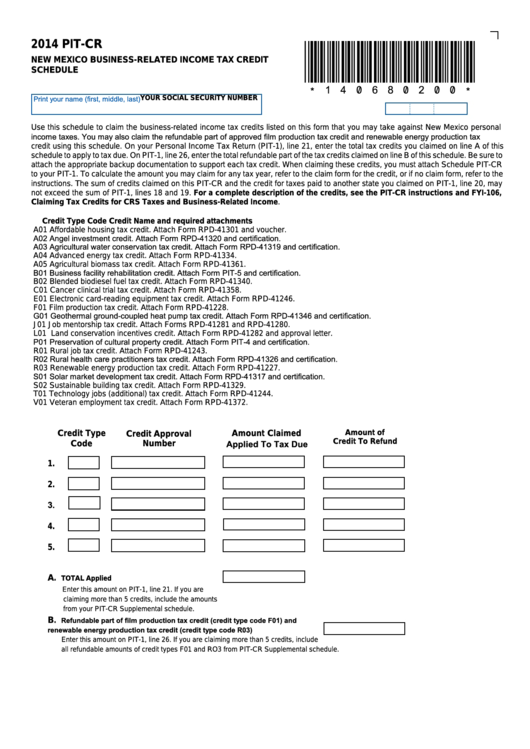

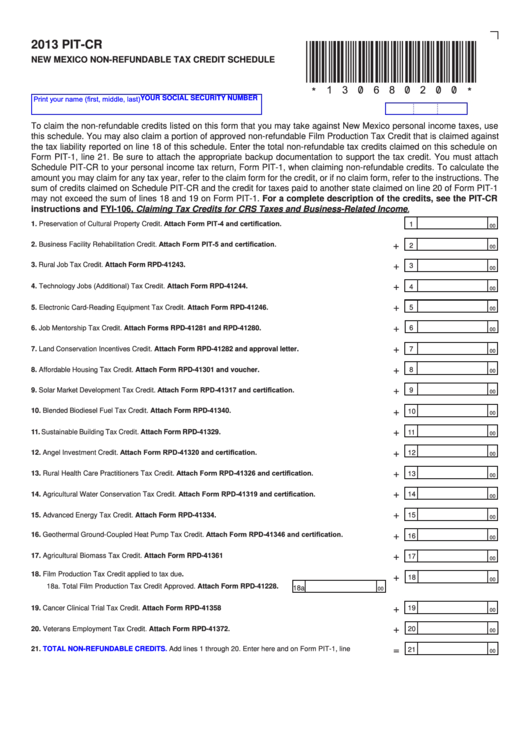

Fillable Form PitCr New Mexico BusinessRelated Tax Credit

Get form esign fax email add annotation share this is how it works. Web up to $40 cash back get, create, make and sign tax from pit es new mexico 2018. If you are a new mexico resident, you must file if you meet any of the following conditions: Web individual income tax form. Web personal income tax and corporate.

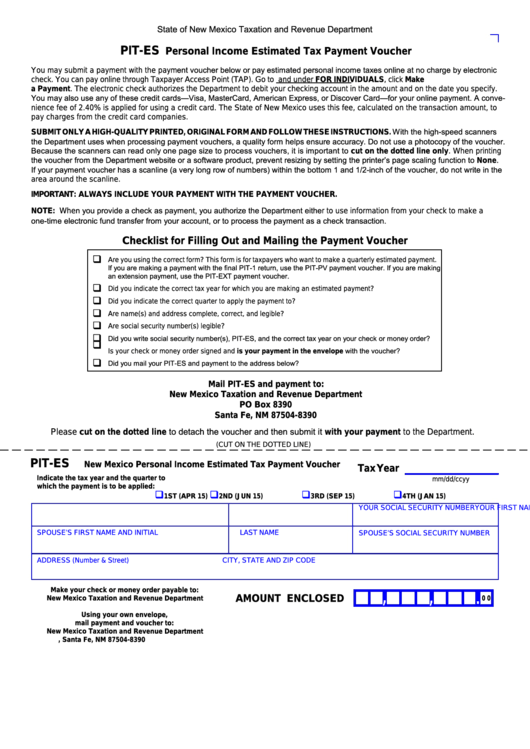

Form PitEs New Mexico Personal Estimated Tax Payment Voucher

Web are you using the correct form? Web welcome to the taxation and revenue department’s forms & publications page. Taxpayers, tax professionals and others can access the new forms and. The document has moved here. It is not intended to.

Pit New Mexico News Port

You can meet this requirement. If you are a new mexico resident, you must file if you meet any of the following conditions: Web welcome to the taxation and revenue department’s forms & publications page. If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. Web this form is.

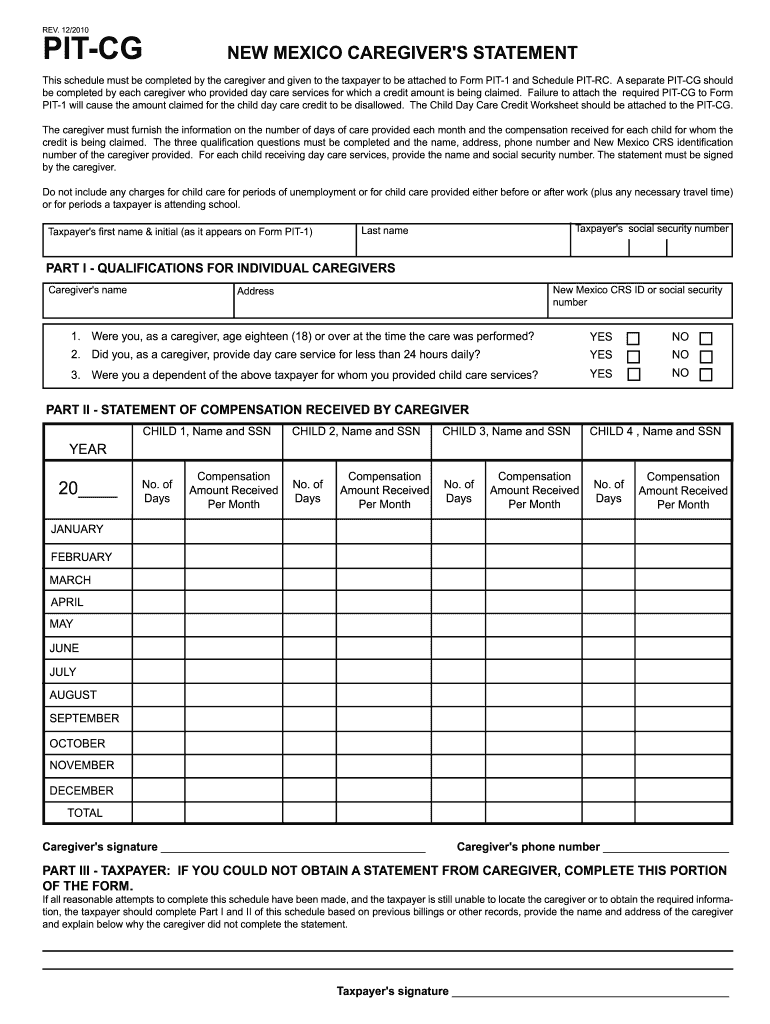

2010 Form NM PITCG Fill Online, Printable, Fillable, Blank pdfFiller

Taxpayers, tax professionals and others can access the new forms and. Web up to $40 cash back get, create, make and sign tax from pit es new mexico 2018. You can meet this requirement. Online with us legal forms. Web 2024 central new mexico stem research challenge regional entries transmittal form regional entries transmittal form;

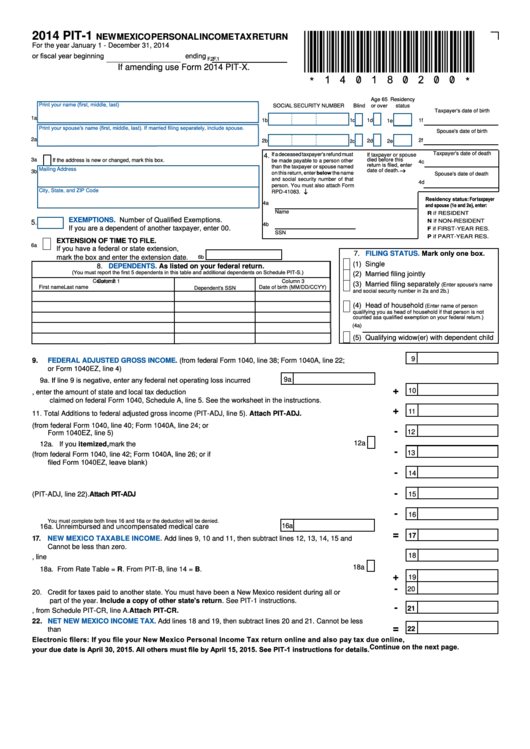

Fillable Form Pit1 New Mexico Personal Tax Return 2014

If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. If you are a new mexico resident, you must file if you meet any of the following conditions: The folders on this page contain everything from returns and instructions to payment. The document has moved here. Your previous year.

NM TRD PIT110 20192021 Fill and Sign Printable Template Online US

Taxpayers, tax professionals and others can access the new forms and. It is not intended to. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web individual income tax form. • every person who is a new mexico resident or.

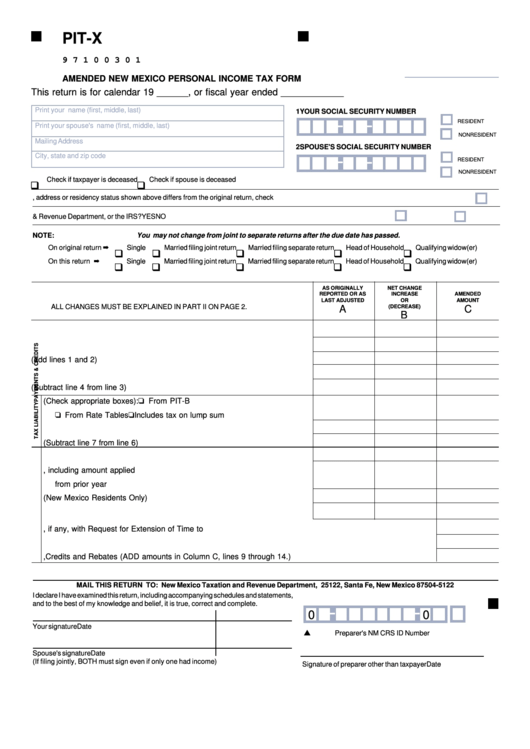

Fillable Form PitX Amended New Mexico Personal Tax Form

Web welcome to the taxation and revenue department’s forms & publications page. • every person who is a new mexico resident or. If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. Web up to $40 cash back get, create, make and sign tax from pit es new mexico.

Fillable Form PitCr New Mexico NonRefundable Tax Credit Schedule

Your previous year new mexico personal income tax multiplied by 100%. Online with us legal forms. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Taxpayers, tax professionals and others can access the new forms and. Web this form is for taxpayers who want to make a quarterly estimated payment.

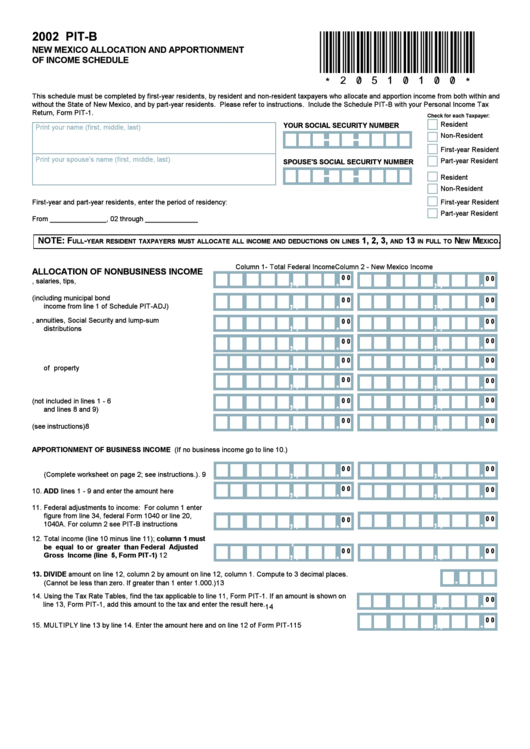

Form PitB New Mexico Allocation And Apportionment Of Schedule

Get form esign fax email add annotation share this is how it works. Web 2024 central new mexico stem research challenge regional entries transmittal form regional entries transmittal form; Taxpayers, tax professionals and others can access the new forms and. Web are you using the correct form? • every person who is a new mexico resident or.

Form PitEs New Mexico Individual Estimated Tax Payment Voucher

It is not intended to. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. The document has moved here. Get form esign fax email add annotation share this is how it works. Complete, edit or print tax forms instantly.

Web 2024 Central New Mexico Stem Research Challenge Regional Entries Transmittal Form Regional Entries Transmittal Form;

Taxpayers, tax professionals and others can access the new forms and. You can meet this requirement. If you are self employed or otherwise need to file estimated income taxes (if your employer doesnt wothhold your taxes), file. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online.

Web Individual Income Tax Form.

The document has moved here. Easily fill out pdf blank, edit, and sign them. The folders on this page contain everything from returns and instructions to payment. If you are a new mexico resident, you must file if you meet any of the following conditions:

Get Form Esign Fax Email Add Annotation Share This Is How It Works.

• every person who is a new mexico resident or. It is not intended to. Web up to $40 cash back get, create, make and sign tax from pit es new mexico 2018. Complete, edit or print tax forms instantly.

Web Welcome To The Taxation And Revenue Department’s Forms & Publications Page.

Your previous year new mexico personal income tax multiplied by 100%. Web this form is for taxpayers who want to make a quarterly estimated payment. Online with us legal forms. Web are you using the correct form?