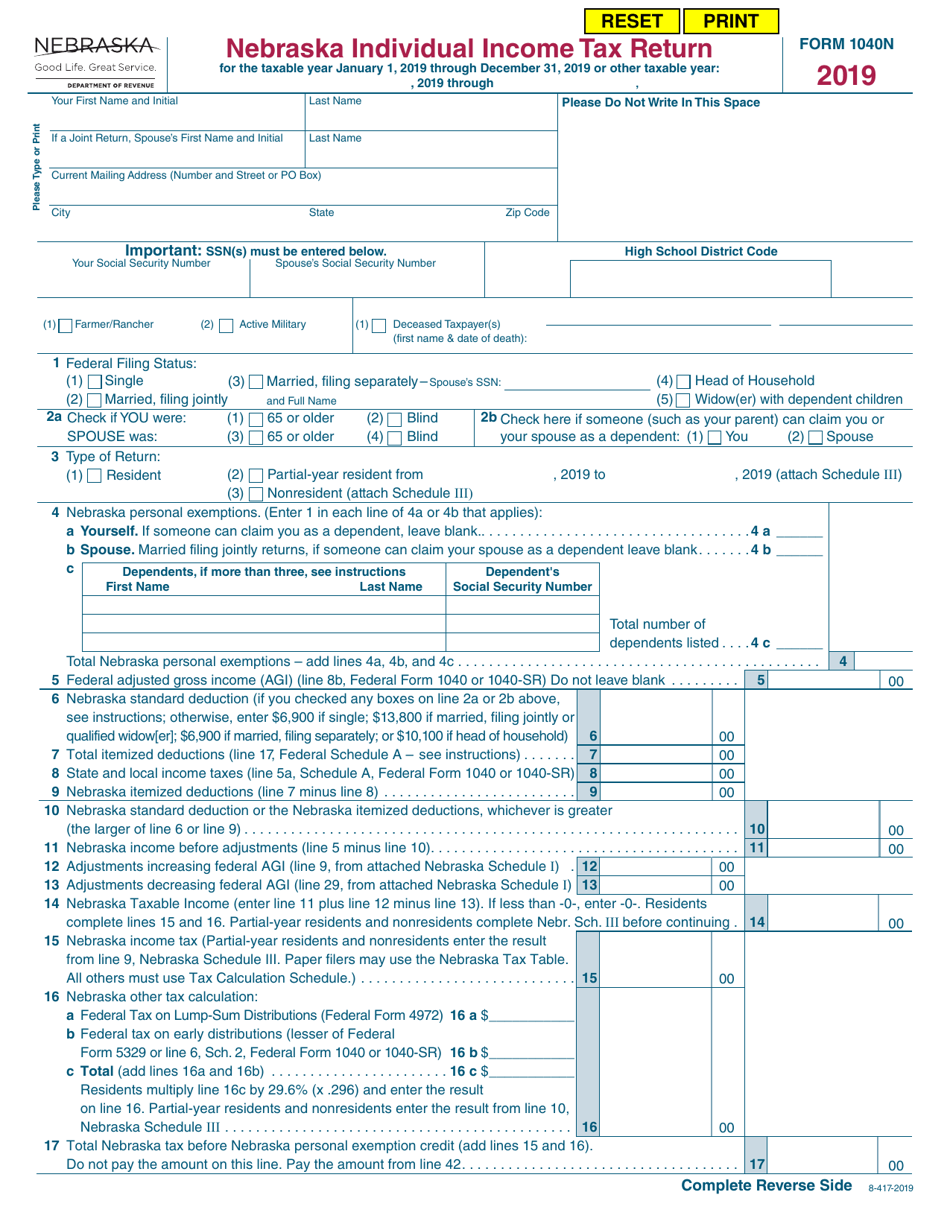

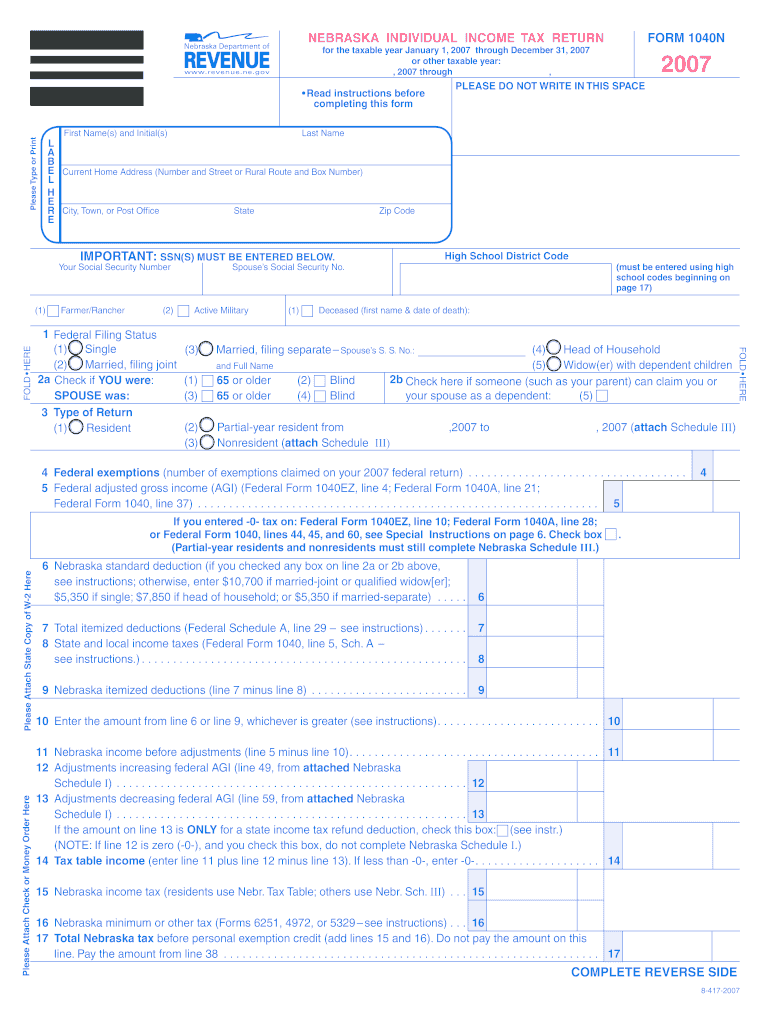

Nebraska Form 1040N 2022

Nebraska Form 1040N 2022 - Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Web you can check the status of your nebraska state tax refund online at the nebraska department of revenue website. Nebraska usually releases forms for the current tax year between january and april. You can download or print. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year: This form is for income earned in tax year 2022, with tax returns due in april. Web you are filing your 2022 return after the last timely filed date of april 18, 2023. Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. 2022 please do not write in this. Web it appears you don't have a pdf plugin for this browser.

Penalty and interest will apply if this filing results in a balance due. Upload, modify or create forms. — computation of nebraska tax. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse side.) schedule i attach this page to form 1040n. This form is for income earned in tax year 2022, with tax returns due in april. 2022 nebraska individual income tax return (12/2022). Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. Complete, edit or print tax forms instantly.

Penalty and interest will apply if this filing results in a balance due. Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse side.) schedule i attach this page to form 1040n. This form is for income earned in tax year 2022, with tax returns due in april. Web you are filing your 2022 return after the last timely filed date of april 18, 2023. Nebraska individual income tax return: Web nebraska individual income tax return form 1040n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year: — computation of nebraska tax. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web view all 35 nebraska income tax forms.

Nebraska Form 1040NSchedules (Schedules I, II, and III) 2021

Nebraska individual income tax return: Upload, modify or create forms. Penalty and interest will apply if this filing results in a balance due. Web you can check the status of your nebraska state tax refund online at the nebraska department of revenue website. Web view all 35 nebraska income tax forms.

Our Python Collections Counter Statements Telegraph

Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Nebraska usually releases forms for the current tax year between january and april. You can download or print. Web you can check the status of your nebraska state tax refund.

Breanna Tax Form Image

Web if you file your 2022 nebraska individual income tax return, form 1040n, on or before march 1, 2023, and pay the total income tax due at that time, you do not need to make. Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse side.) schedule i attach this page to form 1040n. Nebraska.

NE 1040N Schedule I 2020 Fill out Tax Template Online US Legal Forms

2022 nebraska individual income tax return (12/2022). Web • attach this page to form 1040n. Web if you file your 2022 nebraska individual income tax return, form 1040n, on or before march 1, 2023, and pay the total income tax due at that time, you do not need to make. Penalty and interest will apply if this filing results in.

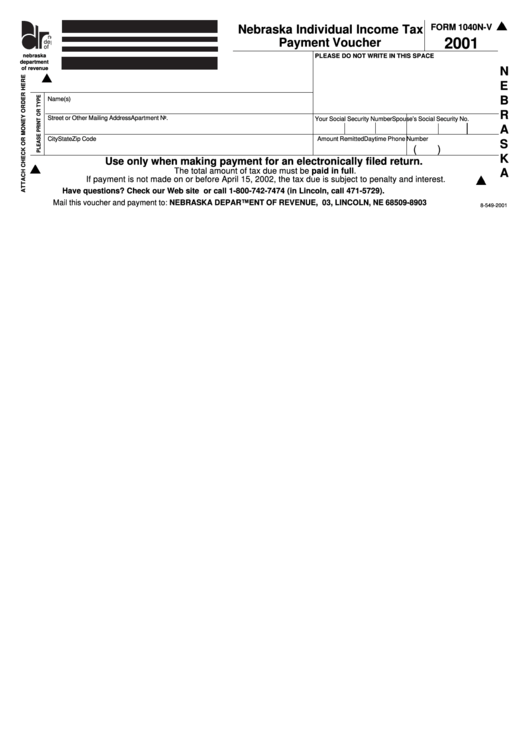

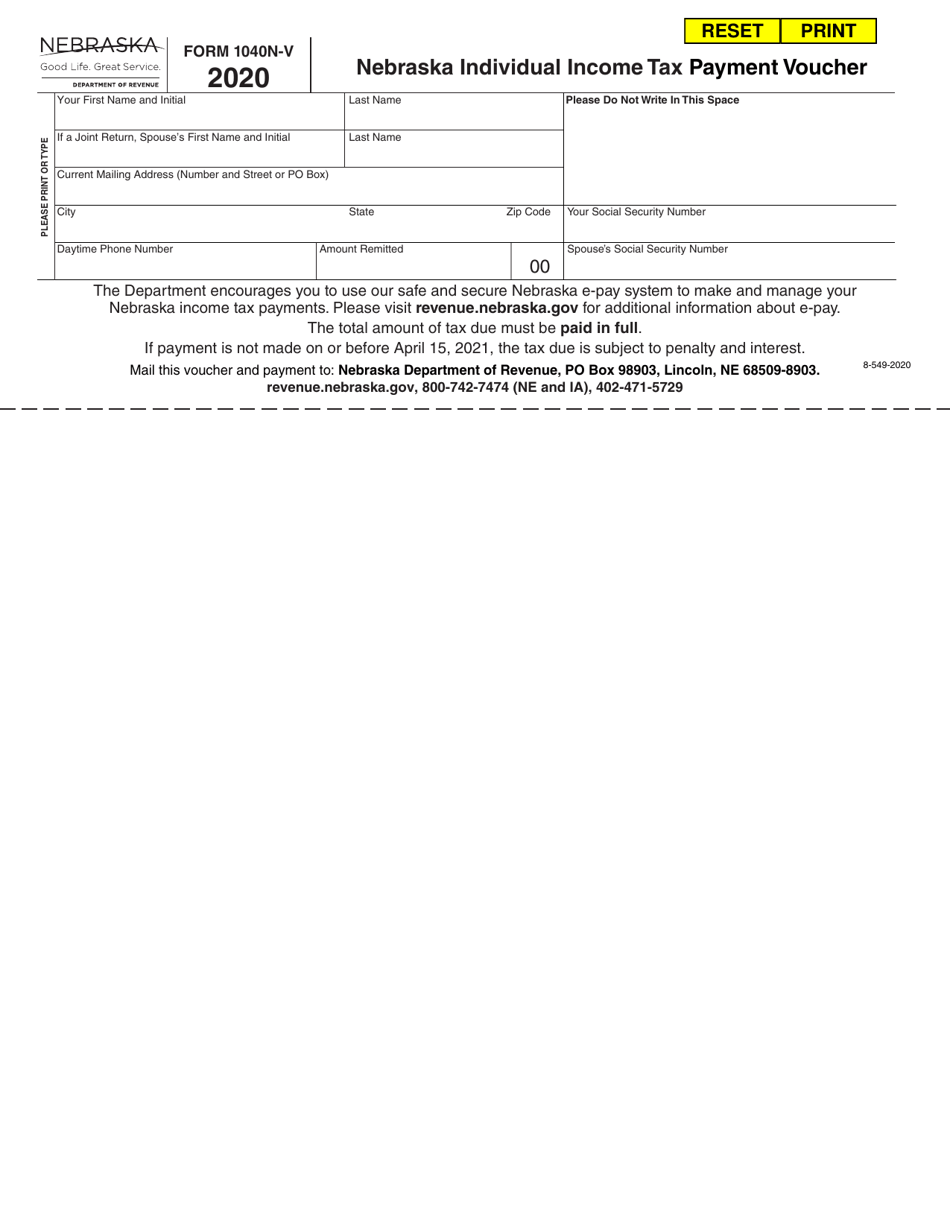

Form 1040nV Nebraska Individual Tax Payment Voucher 2001

Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. 2022 † schedules i, ii, and iii: Web it appears you don't have a pdf plugin for this browser. This form is for income earned in tax year 2022, with.

Printable state nebraska 1040n form Fill out & sign online DocHub

Web we last updated the nebraska individual income tax return in april 2023, so this is the latest version of form 1040n, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april. Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the.

Tax Return 2022 When Will I Get It

Web it appears you don't have a pdf plugin for this browser. You must have an email address. Web if you file your 2022 nebraska individual income tax return, form 1040n, on or before march 1, 2023, and pay the total income tax due at that time, you do not need to make. Complete, edit or print tax forms instantly..

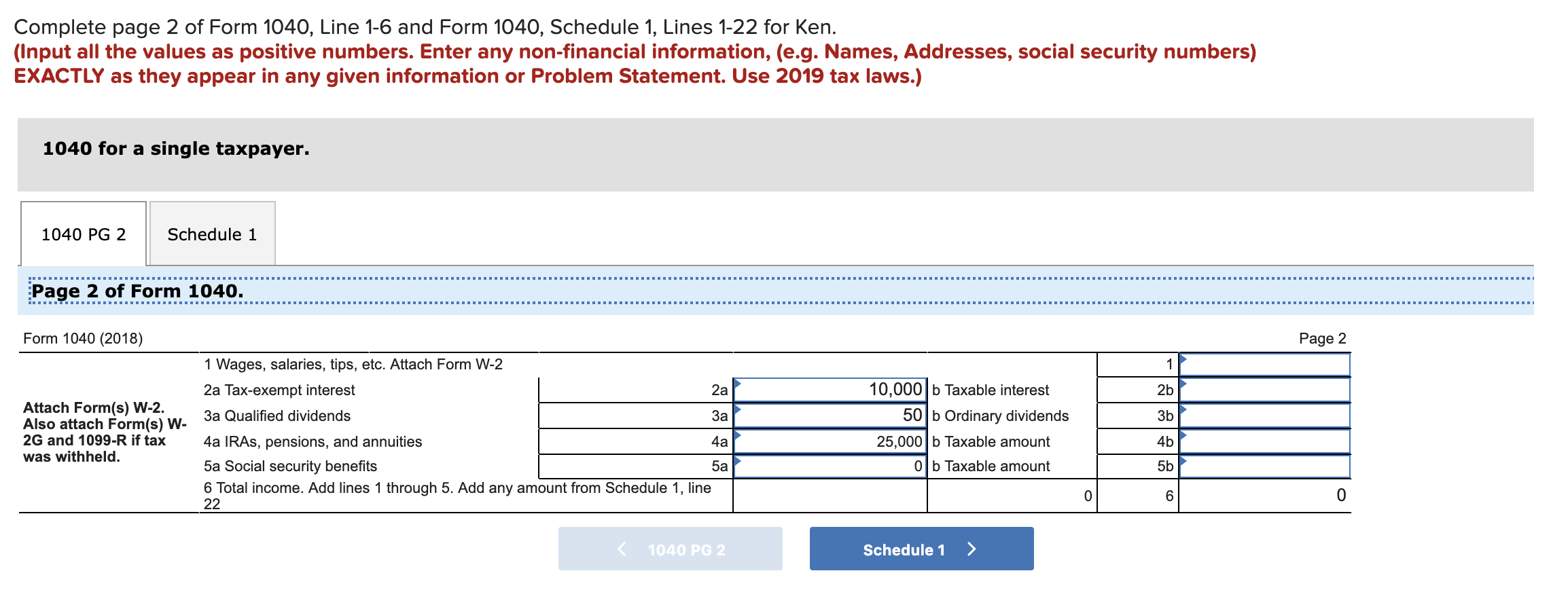

Required information (The following information

Nebraska individual income tax return: Web you can check the status of your nebraska state tax refund online at the nebraska department of revenue website. Upload, modify or create forms. We will update this page with a new version of the form for 2024 as soon as it is made available. Web nebraska individual income tax return form 1040n for.

Form 1040NV Download Fillable PDF or Fill Online Nebraska Individual

2022 nebraska individual income tax return (12/2022). Web if you file your 2022 nebraska individual income tax return, form 1040n, on or before march 1, 2023, and pay the total income tax due at that time, you do not need to make. 2022 † schedules i, ii, and iii: Complete, edit or print tax forms instantly. We will update this.

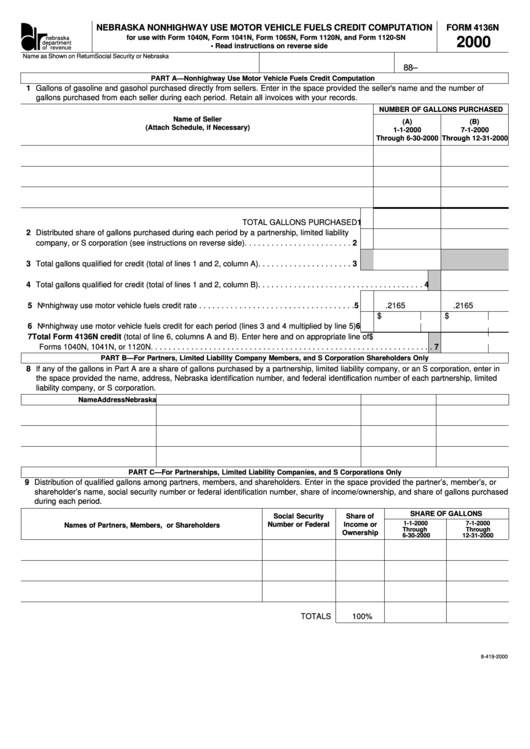

Form 4136n Nebraska Nonhighway Use Motor Vehicle Fuels Credit printable

Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. Web nebraska schedule i — nebraska adjustments to income form 1040n (nebraska schedule ii reverse side.) schedule i attach this page to form 1040n. Web you can check the status.

Web If You File Your 2022 Nebraska Individual Income Tax Return, Form 1040N, On Or Before March 1, 2023, And Pay The Total Income Tax Due At That Time, You Do Not Need To Make.

This form is for income earned in tax year 2022, with tax returns due in april. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year: Web view all 35 nebraska income tax forms. You can download or print.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available.

Nebraska usually releases forms for the current tax year between january and april. 2022 nebraska individual income tax return (12/2022). Try it for free now! Web • attach this page to form 1040n.

Web Nebraska Schedule I — Nebraska Adjustments To Income Form 1040N (Nebraska Schedule Ii Reverse Side.) Schedule I Attach This Page To Form 1040N.

Web you are filing your 2022 return after the last timely filed date of april 18, 2023. Web more about the nebraska form 1040xn individual income tax ty 2022 we last updated the amended nebraska individual income tax return in april 2023, so this is the latest. 2022 † schedules i, ii, and iii: Nebraska adjustments to income for nebraska.

Penalty And Interest Will Apply If This Filing Results In A Balance Due.

Web it appears you don't have a pdf plugin for this browser. — computation of nebraska tax. Part b —adjustments decreasing federal agi. 2022 please do not write in this.