Msrra Exemption Form

Msrra Exemption Form - Web in order to be eligible for exemption under the msrra the following three requirements must be met by the spouse: By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding. Web military spouses residency relief act (msrra) retirement and disability free filing options veterans affairs (va) status letter your domicile if your domicile is california, we. Web report your income on a form 40nr. Web what is the military spouses residency relief act? Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web claiming the exemption rather than file a nonresident return with another state to obtain a refund for taxes paid, or claim a credit with their own state for monies. Web this page is about the various possible meanings of the acronym, abbreviation, shorthand or slang term: You can get a copy of this form on this website. Web exemption reason check only one box.

Web exemption reason check only one box. You can get a copy of this form on this website. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web report your income on a form 40nr. Web military spouses residency relief act (msrra) retirement and disability free filing options veterans affairs (va) status letter your domicile if your domicile is california, we. Web the military spouse residency relief act (msrra) of 2009 is the first of two amendments to the servicemember civil relief act (scra) that extend privileges and. Web this page is about the various possible meanings of the acronym, abbreviation, shorthand or slang term: Form 590 does not apply to payments of backup withholding. Minnesota rifle and revolver association. Filing refund claims i qualify for exemption from virginia income tax under the military spouses.

Minnesota rifle and revolver association. Web time to file, a taxpayer should file irs form 4868. Under the military spouses residency relief act (msrra), the spouse of. Web as a result, amended mississippi income tax returns may be filed to claim the msrra exemption for any tax year(s) that are within three (3) years of the due date of the. Web the military spouse residency relief act (msrra) of 2009 is the first of two amendments to the servicemember civil relief act (scra) that extend privileges and. Web under those conditions, your virginia income tax exemption will still be valid. Web exemption reason check only one box. Web in order to be eligible for exemption under the msrra the following three requirements must be met by the spouse: You can get a copy of this form on this website. Web msrra links, state by state.

AB540 EXEMPTION FORM PDF

Web management reserve right of admission. Web what is the military spouses residency relief act? Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Minnesota rifle and revolver association. Web the military spouse residency relief act (msrra) of 2009 is the first of two amendments to the servicemember civil relief act (scra) that extend privileges.

Religious Exemption Letters For Employees / Colorado Vaccine Exemption

Web msrra links, state by state. Web report your income on a form 40nr. Web exemption reason check only one box. Web military spouses residency relief act (msrra) retirement and disability free filing options veterans affairs (va) status letter your domicile if your domicile is california, we. Web as a result, amended mississippi income tax returns may be filed to.

2013 AZ ADEQ Out of State Exemption Form Fill Online, Printable

Minnesota rifle and revolver association. Web in order to be eligible for exemption under the msrra the following three requirements must be met by the spouse: Web military spouses residency relief act (msrra) retirement and disability free filing options veterans affairs (va) status letter your domicile if your domicile is california, we. Web under those conditions, your virginia income tax.

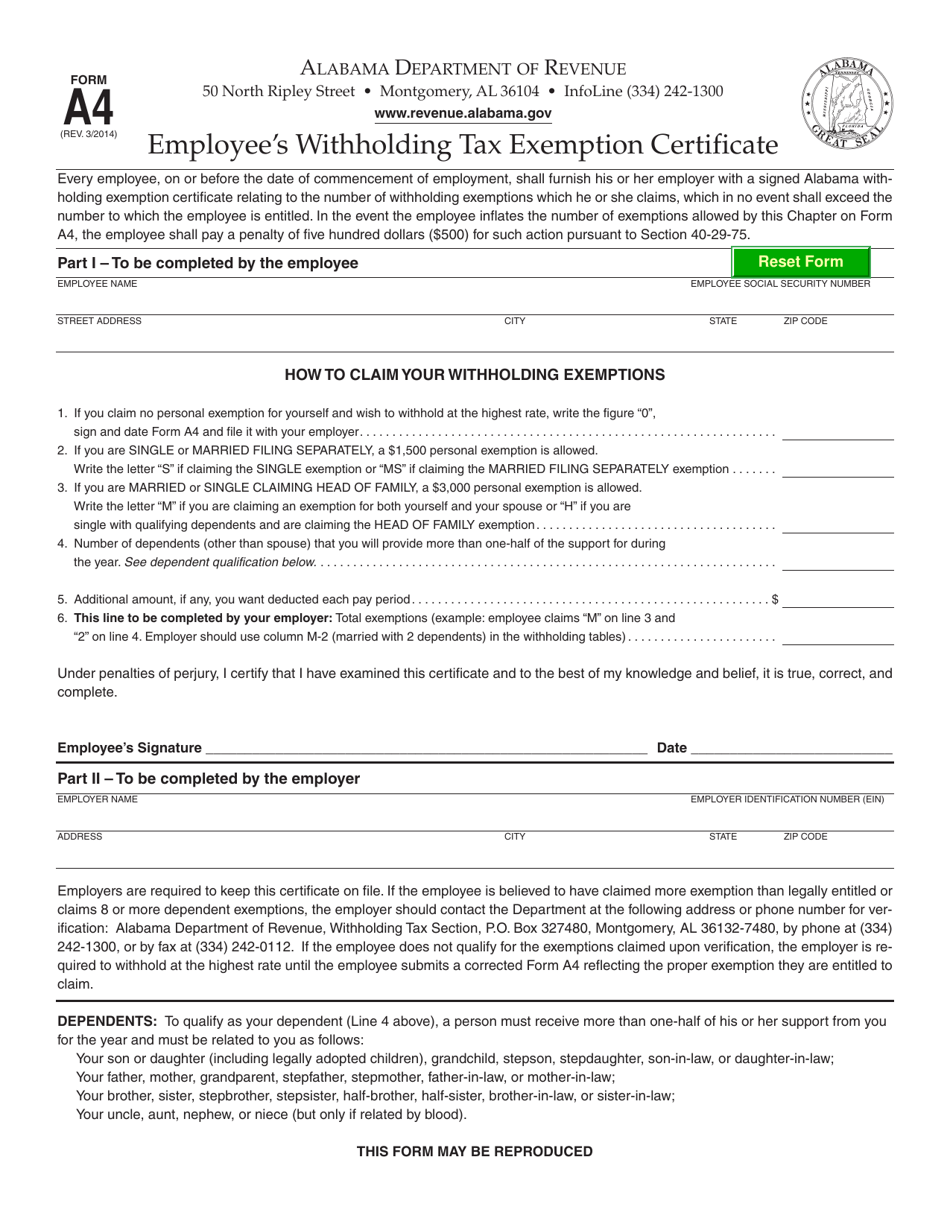

Form A4 Download Fillable PDF or Fill Online Employee's Withholding Tax

To qualify for the extension of time to pay under this notice, taxpayers must follow these procedures: Web this page is about the various possible meanings of the acronym, abbreviation, shorthand or slang term: Web the military spouse residency relief act (msrra) of 2009 is the first of two amendments to the servicemember civil relief act (scra) that extend privileges.

Fill Free fillable forms for US Educational Establishments

To qualify for the extension of time to pay under this notice, taxpayers must follow these procedures: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. Under the military spouses residency relief act (msrra),.

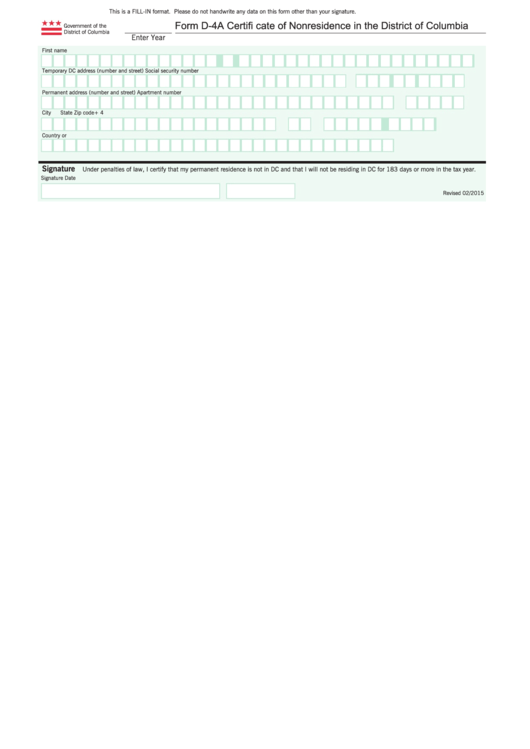

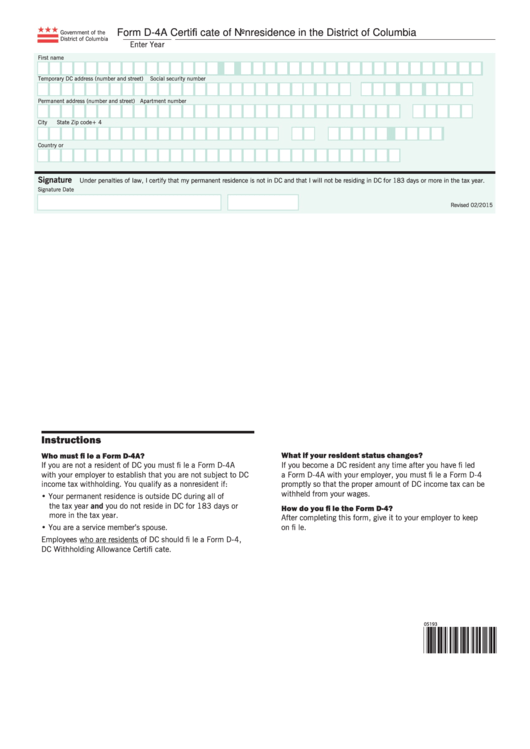

Fillable Form D4a Certificate Of Nonresidence In The District Of

By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding. The military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. Web military spouses residency relief act (msrra) retirement and disability free filing options veterans affairs (va) status letter your.

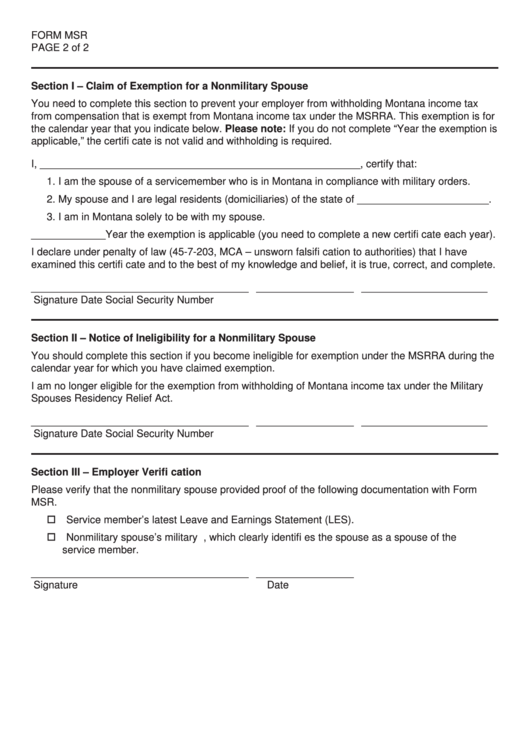

Form Msr Claim Of Exemption For A Nonmilitary Spouse printable pdf

Web the military spouses residency relief act (msrra) is an update to the servicemember civil relief act which extends the same residency privileges to a military. The military spouses residency relief act (msrra), as it was first passed in 2009, allowed military spouses to claim for tax. Web the military spouse residency relief act (msrra) of 2009 is the first.

Form D4a Certificate Of Nonresidence In The District Of Columbia

Web msrra links, state by state. Maylands ratepayers and residents association (australia) mrra. Web as a result, amended mississippi income tax returns may be filed to claim the msrra exemption for any tax year(s) that are within three (3) years of the due date of the. Web in order to be eligible for exemption under the msrra the following three.

Medical Exemption Form Arizona Free Download

Web msrra links, state by state. Filing refund claims i qualify for exemption from virginia income tax under the military spouses. Web military spouses residency relief act (msrra) retirement and disability free filing options veterans affairs (va) status letter your domicile if your domicile is california, we. Web the military spouse residency relief act (msrra) of 2009 is the first.

FREE 10+ Sample Tax Exemption Forms in PDF

Form 590 does not apply to payments of backup withholding. Web under those conditions, your virginia income tax exemption will still be valid. Web exemption reason check only one box. Web claiming the exemption rather than file a nonresident return with another state to obtain a refund for taxes paid, or claim a credit with their own state for monies..

I'm Bumping This List To The Top Of The Paycheck Chronicles Because Many States Have Recently Issued Directions On The Impact Of The.

You can get a copy of this form on this website. Web exemption reason check only one box. By checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding. Web as a result, amended mississippi income tax returns may be filed to claim the msrra exemption for any tax year(s) that are within three (3) years of the due date of the.

Web Report Your Income On A Form 40Nr.

Web under those conditions, your virginia income tax exemption will still be valid. Filing refund claims i qualify for exemption from virginia income tax under the military spouses. Web claiming the exemption rather than file a nonresident return with another state to obtain a refund for taxes paid, or claim a credit with their own state for monies. Web management reserve right of admission.

The Military Spouses Residency Relief Act (Msrra), As It Was First Passed In 2009, Allowed Military Spouses To Claim For Tax.

Web the military spouse residency relief act (msrra) of 2009 is the first of two amendments to the servicemember civil relief act (scra) that extend privileges and. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web msrra links, state by state. To qualify for the extension of time to pay under this notice, taxpayers must follow these procedures:

Web This Page Is About The Various Possible Meanings Of The Acronym, Abbreviation, Shorthand Or Slang Term:

Form 590 does not apply to payments of backup withholding. Web time to file, a taxpayer should file irs form 4868. Web what is the military spouses residency relief act? Web the military spouses residency relief act (msrra) is an update to the servicemember civil relief act which extends the same residency privileges to a military.