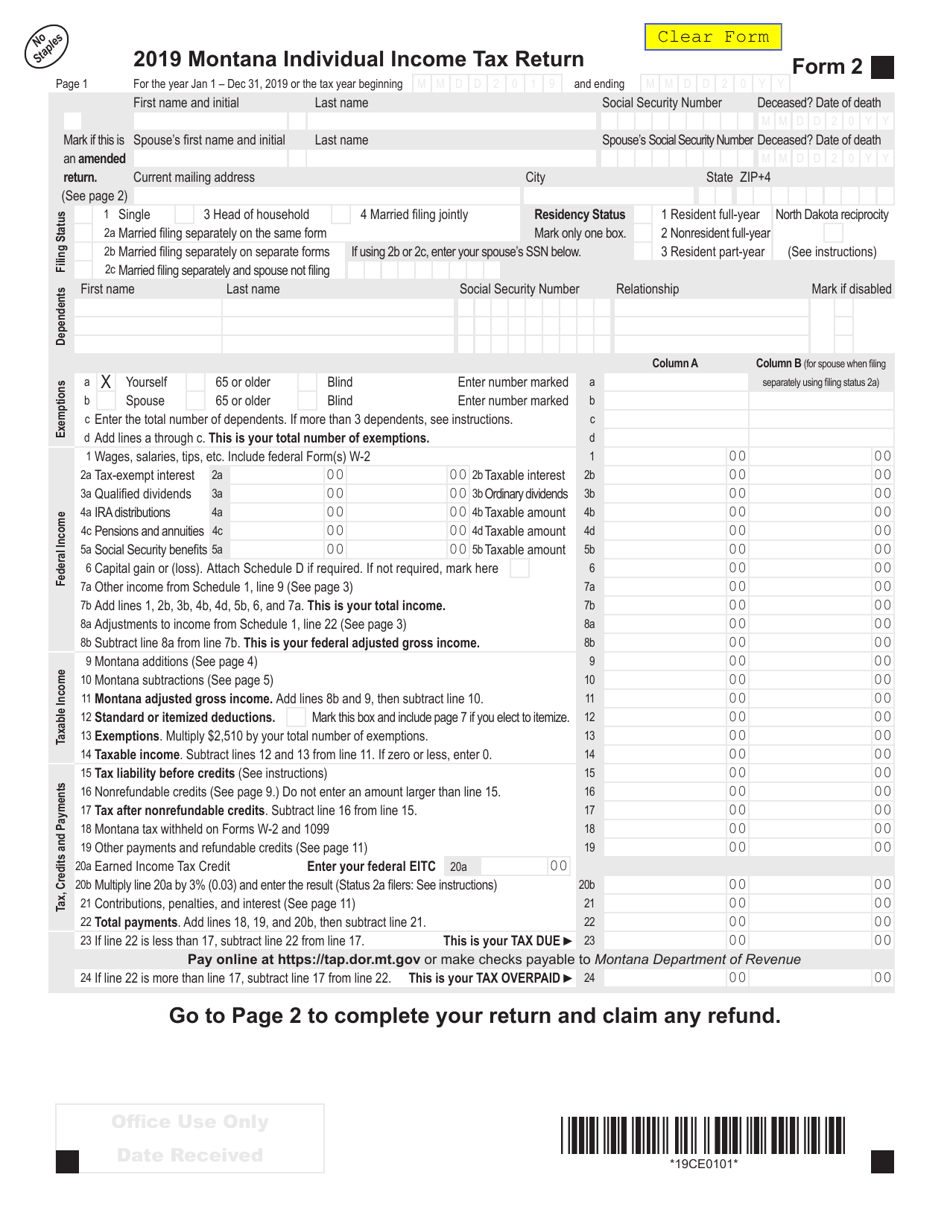

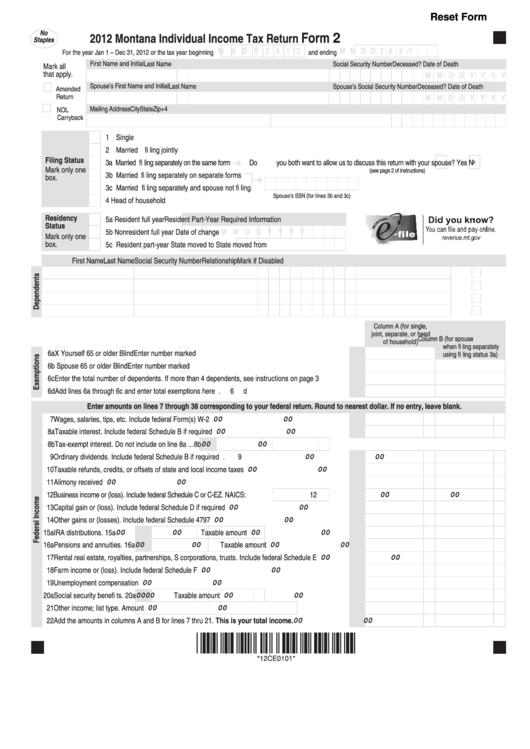

Montana Form 2

Montana Form 2 - Web more about the montana form 2 worksheet viii. Web published 8:31 am pdt, july 23, 2023. Check the status of your refund with the “where’s my refund?” tool in our. Web find and fill out the correct montana income tax instructions 2022. Web montana department of revenue Apply by april 15 to see if you qualify for property tax relief. Web montana individual income tax return (form 2) january 4, 2022 waiting for your refund? Web montana form 2, itemized deductions schedule, line 4a is reporting the amount from form 1040, line 11a, instead of form 1040, line 16 as expected. Web printable montana income tax form 2. Web we last updated montana form 2 in march 2023 from the montana department of revenue.

Enrolled tribal member exempt income certification/return (form etm) approved commercial. This form is used to report your income, claim deductions and tax credits, calculate your. Web these you have to apply for. Web more about the montana form 2 worksheet viii. Form 1040, line 11a reports. Web printable montana income tax form 2. Web montana individual income tax return (form 2) january 4, 2022 waiting for your refund? Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web form 2 in the supreme court of the state of montana supreme court cause no._____. Web montana department of revenue

Web printable montana income tax form 2. Web form 2 in the supreme court of the state of montana supreme court cause no._____. Web find and fill out the correct montana income tax instructions 2022. Web montana individual income tax return (form 2) january 4, 2022 waiting for your refund? Web you need montana form 2 to file your individual income tax return for the state of montana. Web we last updated montana form 2 in march 2023 from the montana department of revenue. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. This form is used to report your income, claim deductions and tax credits, calculate your. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form. This form is for income earned in tax year 2022, with tax returns due in april 2023.

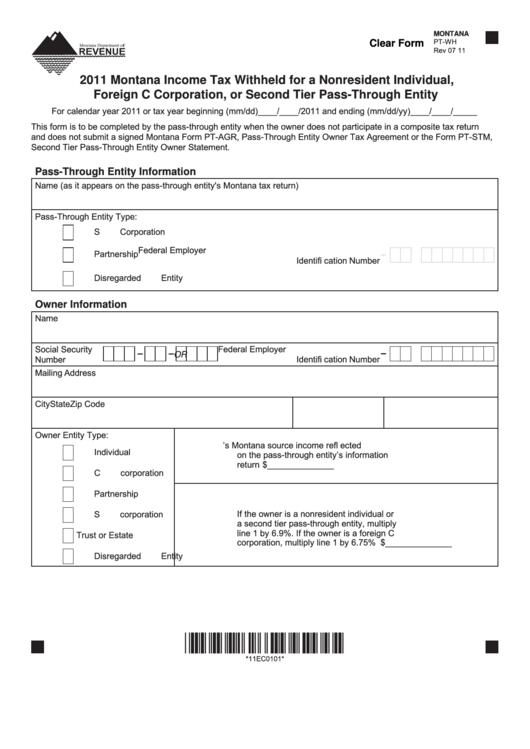

Fillable Montana Form PtWh 2011 Montana Tax Withheld For A

Web you need montana form 2 to file your individual income tax return for the state of montana. Web taxpayers must complete the montana department of revenue, partial pension and annuity income exemption worksheet, form 2, page 6 to see if they qualify for an. Web form 2ec is a montana individual income tax form. Web printable montana income tax.

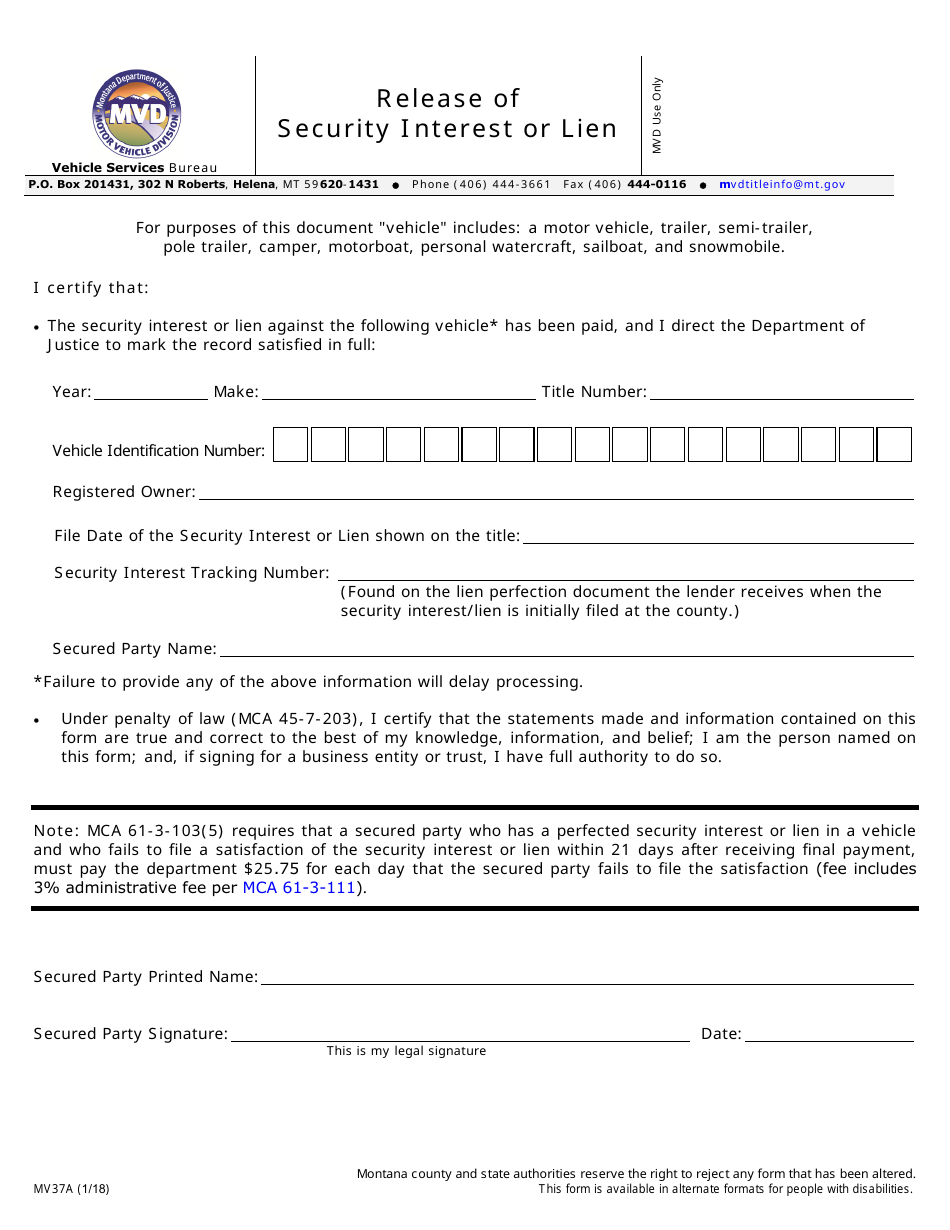

Form MV37A Download Fillable PDF or Fill Online Release of Security

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form. Web beginning in tax year 2018,.

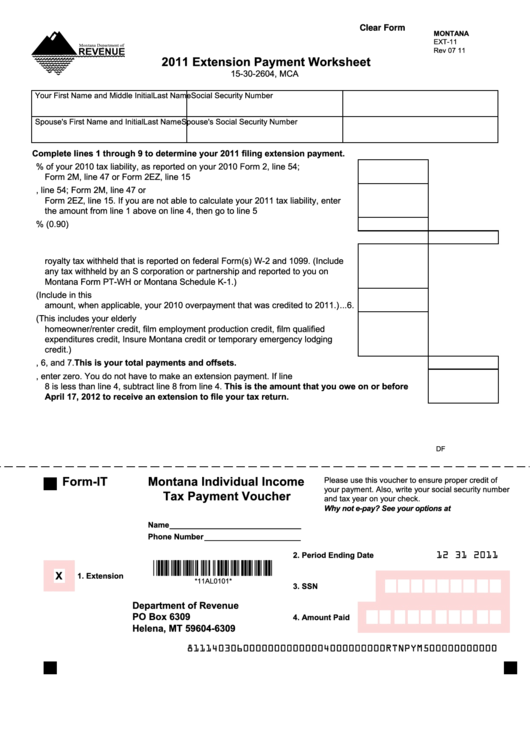

Fillable Montana Form Ext11 Extension Payment Worksheet 2011

Web more about the montana form 2 worksheet viii. (ap) — search teams in pennsylvania were focusing on one underwater area sunday as they. You may file it by mail or you can efile online for free on the montana department. Web taxpayers must complete the montana department of revenue, partial pension and annuity income exemption worksheet, form 2, page.

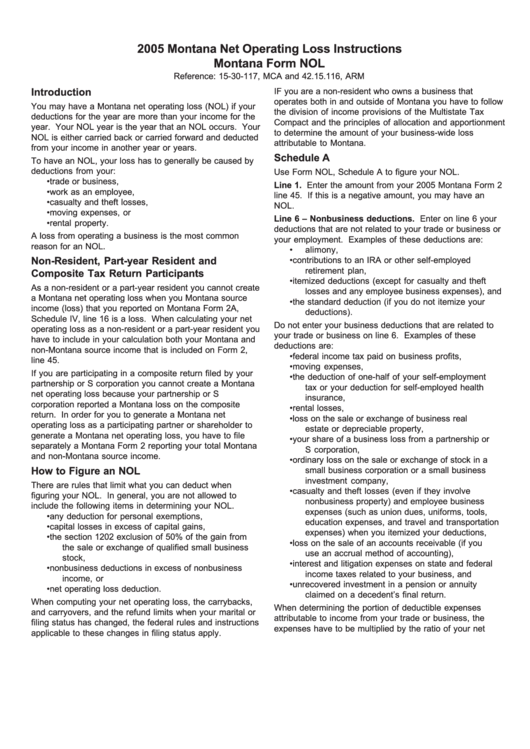

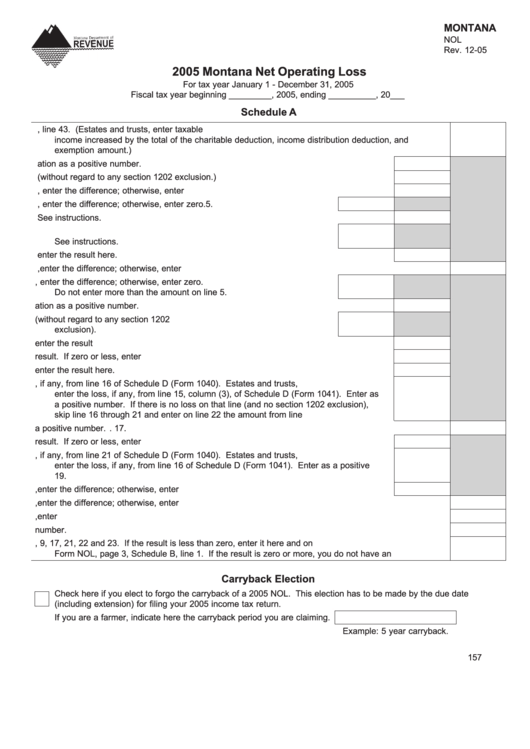

Instructions For Montana Net Operating Loss Instructions Montana Form

Web these you have to apply for. Web find and fill out the correct montana income tax instructions 2022. Web montana individual income tax return (form 2) january 4, 2022 waiting for your refund? Web montana individual income tax return (form 2) form 2 instructions and booklet; The department says taxpayers can apply for the 2022 property tax rebates through.

Fillable Montana Form Nol Montana Net Operating Loss 2005 printable

Choose the correct version of the editable. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form. Web beginning in tax year 2018, the montana income tax return (form 2) schedules are no longer available separately from the montana income tax return (form 2). Web montana individual income.

Montana Form Clt4s Montana Small Business Corporation Tax Return

Web montana form 2, itemized deductions schedule, line 4a is reporting the amount from form 1040, line 11a, instead of form 1040, line 16 as expected. Web these you have to apply for. Apply by april 15 to see if you qualify for property tax relief. Form 2 is the general individual income tax return form. We last updated montana.

Form 2 Download Fillable PDF or Fill Online Montana Individual

Form 1040, line 11a reports. Web these you have to apply for. Form 2 is the general individual income tax return form. Web more about the montana form 2 worksheet viii. Web printable montana income tax form 2.

Montana Disability Form Fill Online, Printable, Fillable, Blank

Web published 8:31 am pdt, july 23, 2023. Web form 2ec is a montana individual income tax form. (ap) — search teams in pennsylvania were focusing on one underwater area sunday as they. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will.

Fillable Form 2 Montana Individual Tax Return 2012 printable

Form 2 is the general individual income tax return form. Web montana individual income tax return (form 2) january 4, 2022 waiting for your refund? Web montana form 2, itemized deductions schedule, line 4a is reporting the amount from form 1040, line 11a, instead of form 1040, line 16 as expected. Web we last updated montana form 2 in march.

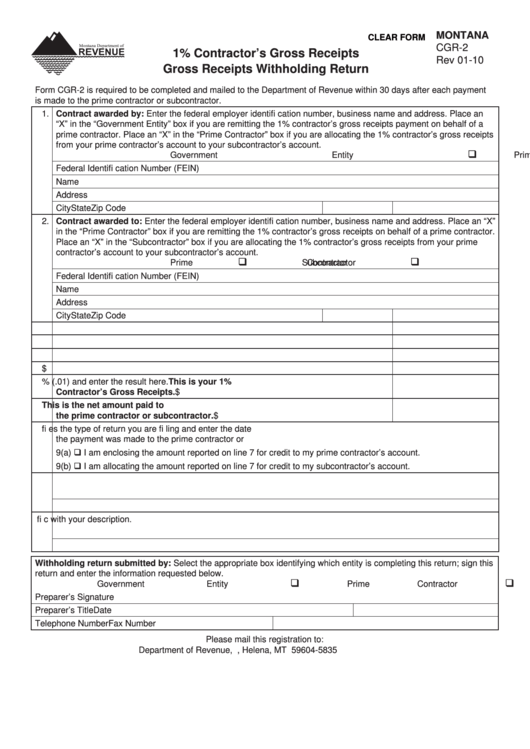

Fillable Montana Form Cgr2 1 Contractor'S Gross Receipts Gross

Web form 2 in the supreme court of the state of montana supreme court cause no._____. Apply by april 15 to see if you qualify for property tax relief. Form 1040, line 11a reports. Web these you have to apply for. This form is used to report your income, claim deductions and tax credits, calculate your.

Enrolled Tribal Member Exempt Income Certification/Return (Form Etm) Approved Commercial.

Apply by april 15 to see if you qualify for property tax relief. Web montana individual income tax return (form 2) january 4, 2022 waiting for your refund? Web these you have to apply for. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

Web We Last Updated The Individual Income Tax Instructional Booklet In February 2023, So This Is The Latest Version Of Form 2 Instructions, Fully Updated For Tax Year 2022.

Form 1040, line 11a reports. Web montana department of revenue Web form 2ec is a montana individual income tax form. (ap) — search teams in pennsylvania were focusing on one underwater area sunday as they.

Web Published 8:31 Am Pdt, July 23, 2023.

Hereby certify that i have filed a true and accurate copy of the foregoing. Web beginning in tax year 2018, the montana income tax return (form 2) schedules are no longer available separately from the montana income tax return (form 2). Check the status of your refund with the “where’s my refund?” tool in our. Web we last updated montana form 2 in march 2023 from the montana department of revenue.

Form 2 Is The General Individual Income Tax Return Form.

Web find and fill out the correct montana income tax instructions 2022. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web you need montana form 2 to file your individual income tax return for the state of montana. Web montana form 2, itemized deductions schedule, line 4a is reporting the amount from form 1040, line 11a, instead of form 1040, line 16 as expected.