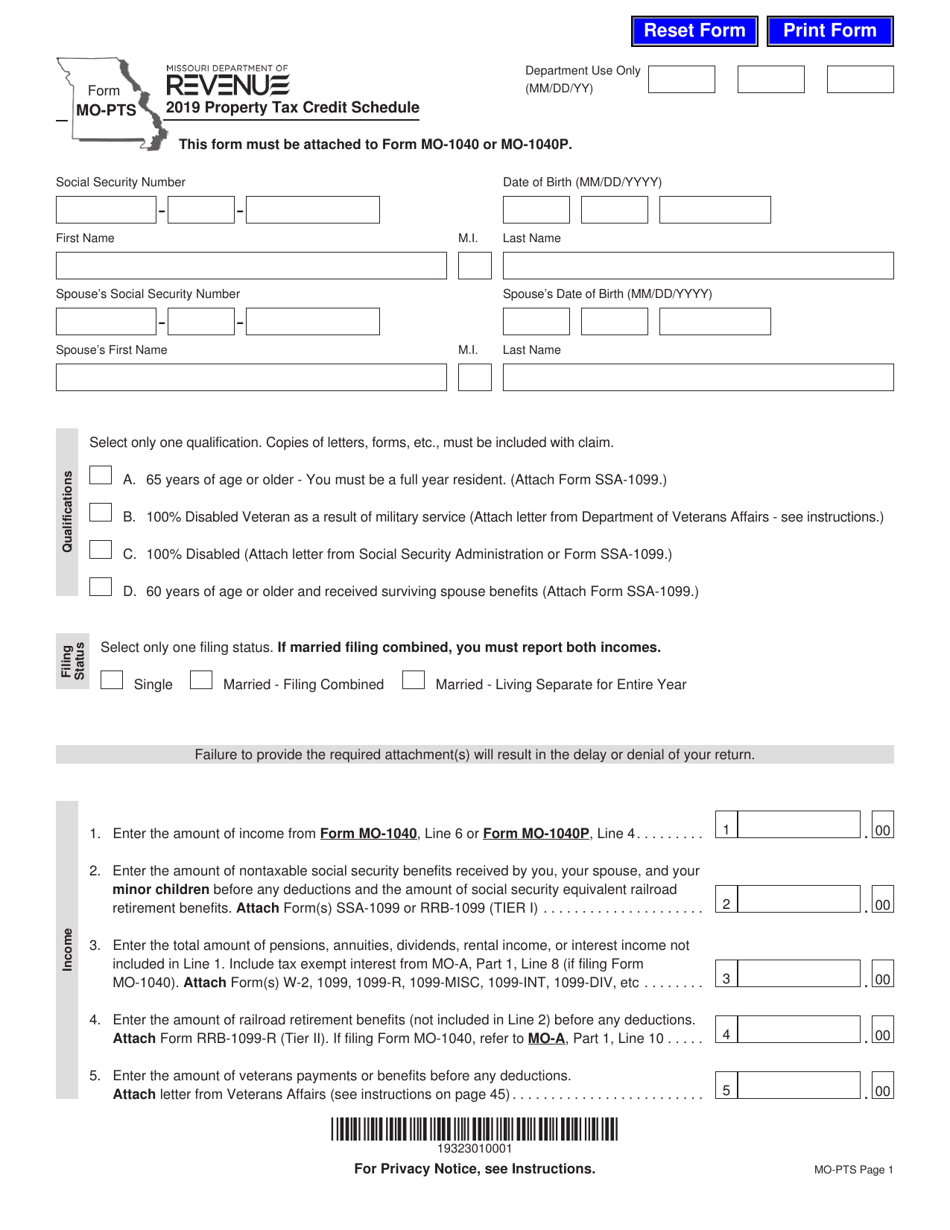

Mo Property Tax Credit Form

Mo Property Tax Credit Form - The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Ink only and do not staple. • specific questions can be sent to: For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Web 2022 property tax credit claim. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. • detailed instructions, forms, and charts can be found at: Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Web • specific questions can be sent to:

Ink only and do not staple. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Web 2022 property tax credit claim. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Web • specific questions can be sent to: • specific questions can be sent to: • detailed instructions, forms, and charts can be found at: Ink only and do not staple.

Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. • detailed instructions, forms, and charts can be found at: Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Web 2021 property tax credit claim. • specific questions can be sent to: Ink only and do not staple.

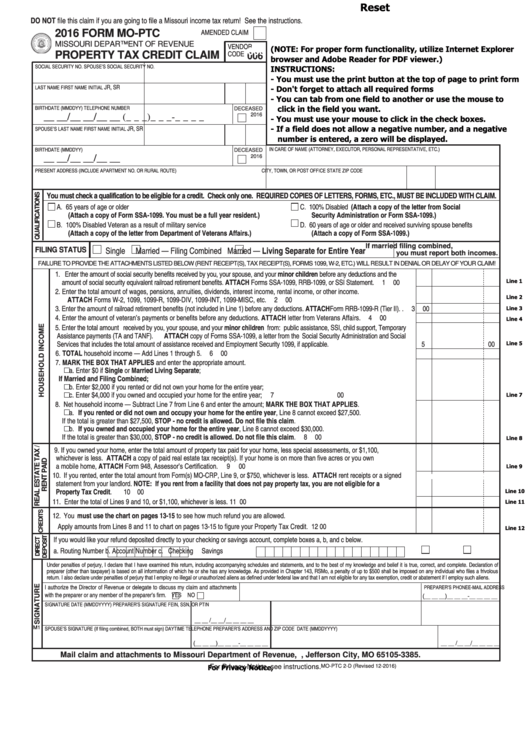

Fillable Form MoPtc Property Tax Credit Claim 2016 printable pdf

Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Ink only and do not staple. Ink only and do not staple. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. Web the missouri property tax credit claim gives credit to certain senior citizens and.

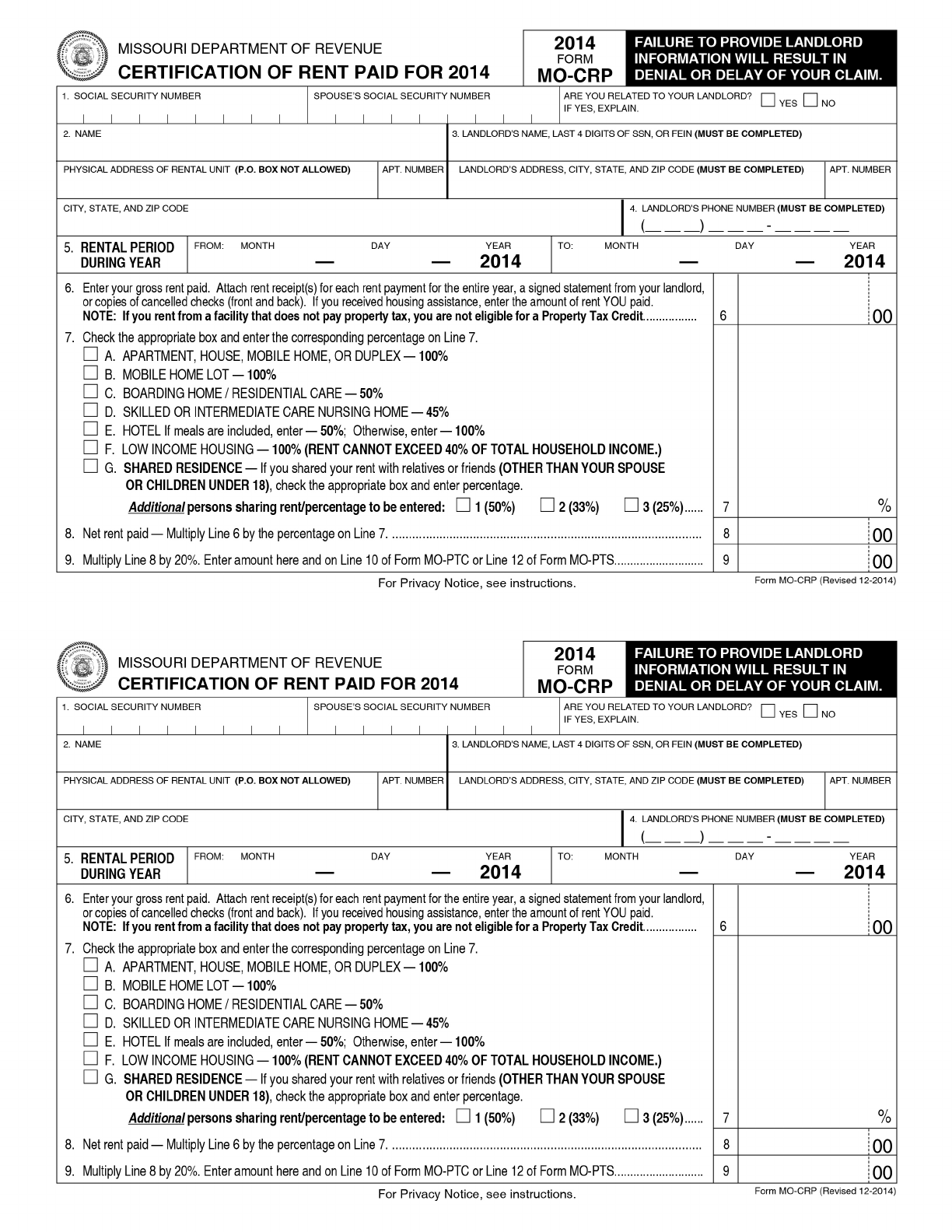

2014 Form MoPtc, Property Tax Credit Claim Edit, Fill, Sign Online

Ink only and do not staple. Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. • specific questions can be sent to: Web • specific questions can be sent to:

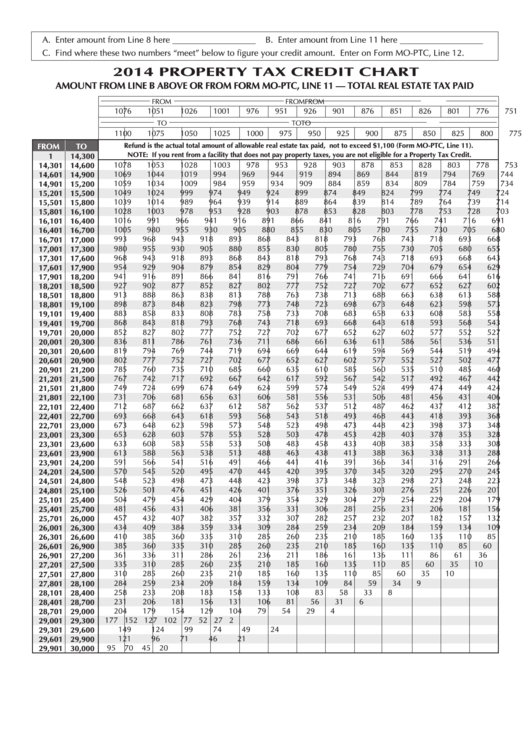

Form MoPtc Property Tax Credit Chart 2014 printable pdf download

Web 2022 property tax credit claim. • specific questions can be sent to: • detailed instructions, forms, and charts can be found at: Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Ink only and do not staple.

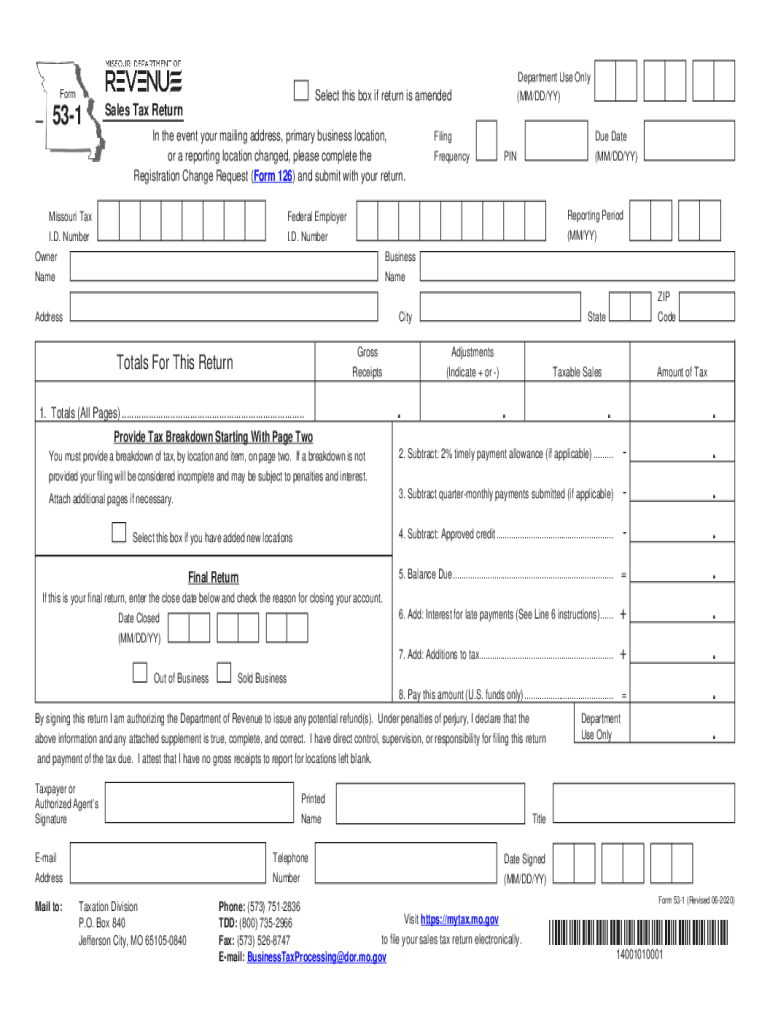

20202022 MO DoR Form 531 Fill Online, Printable, Fillable, Blank

• specific questions can be sent to: Web 2021 property tax credit claim. Ink only and do not staple. Ink only and do not staple. • detailed instructions, forms, and charts can be found at:

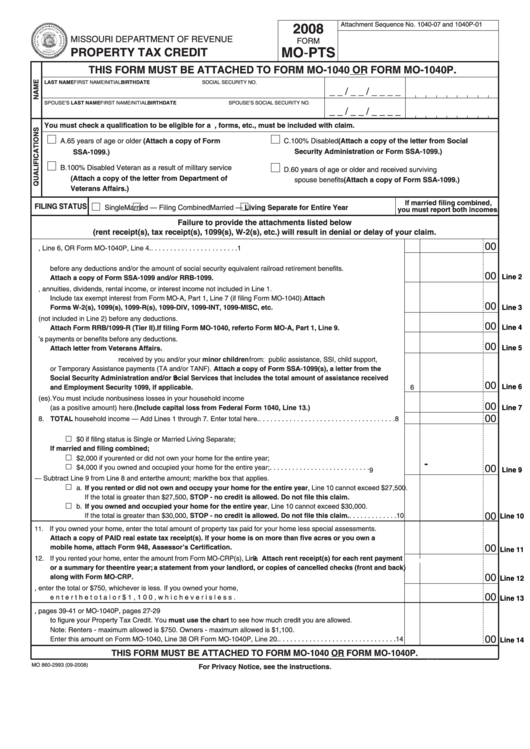

Fillable Form MoPts Property Tax Credit 2008 printable pdf download

The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Web • specific questions can be.

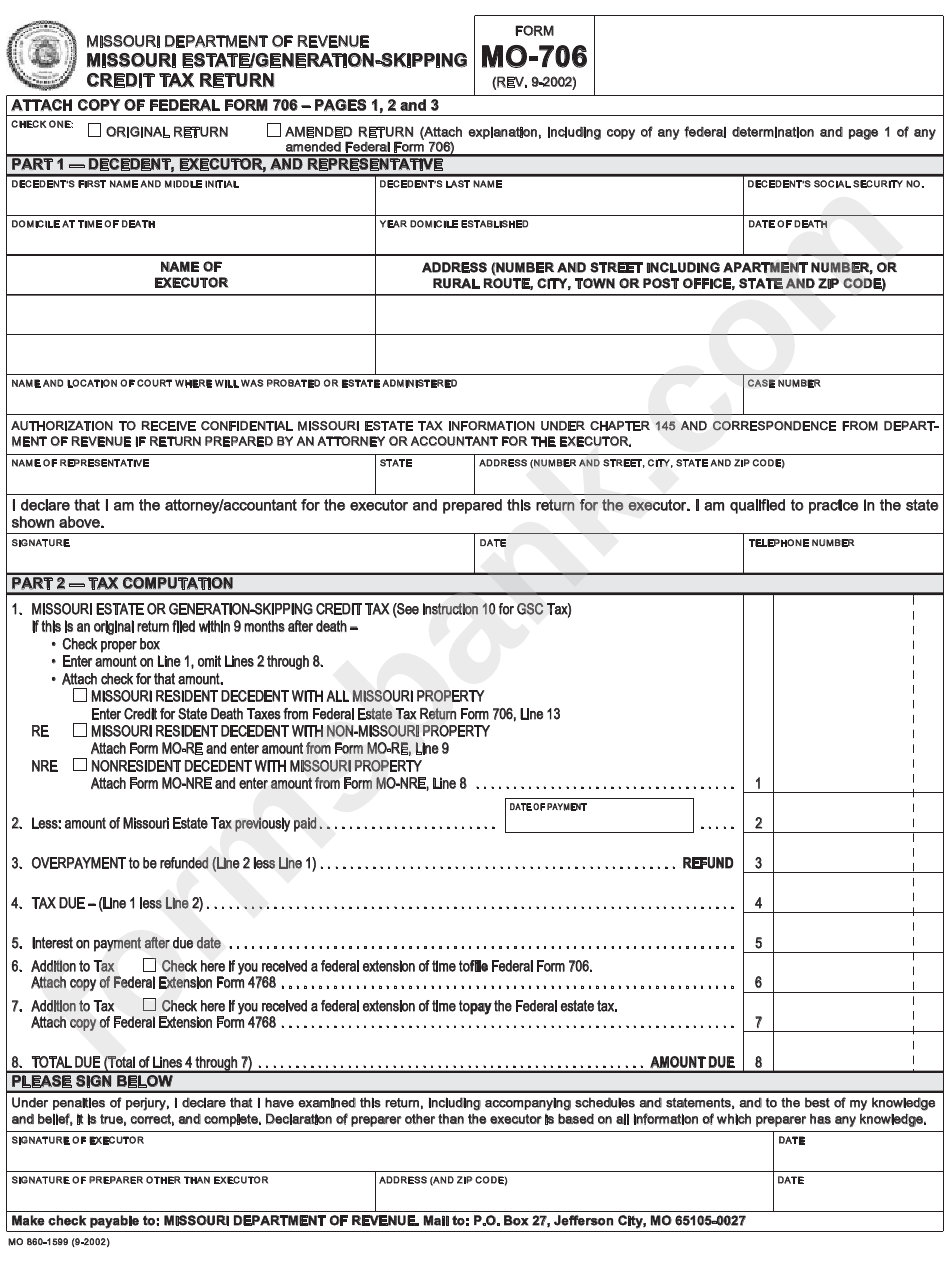

Form Mo706 Missouri Estate/generationSkipping Credit Tax Return

Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue. Web 2022 property tax credit claim. Ink only and do not staple. Ink only and do not staple. • detailed instructions, forms, and charts can be found at:

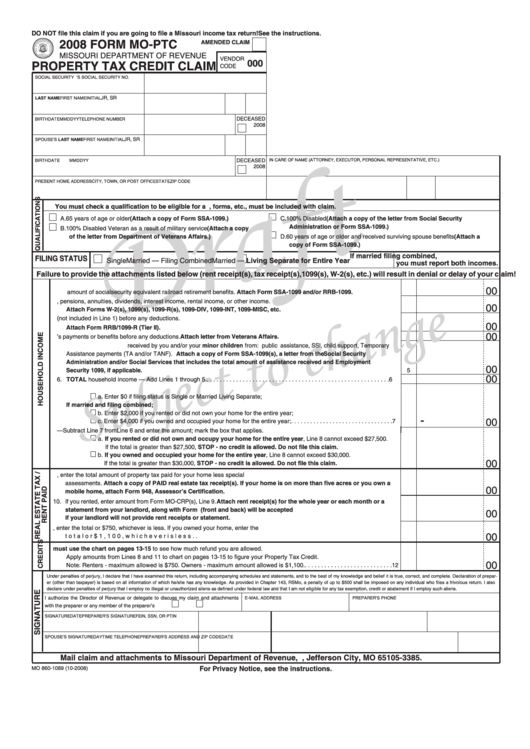

Form MoPtc Draft Property Tax Credit Claim 2008 printable pdf download

For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Web 2022 property tax credit claim. Ink only and do not staple. Ink only and do not staple. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit.

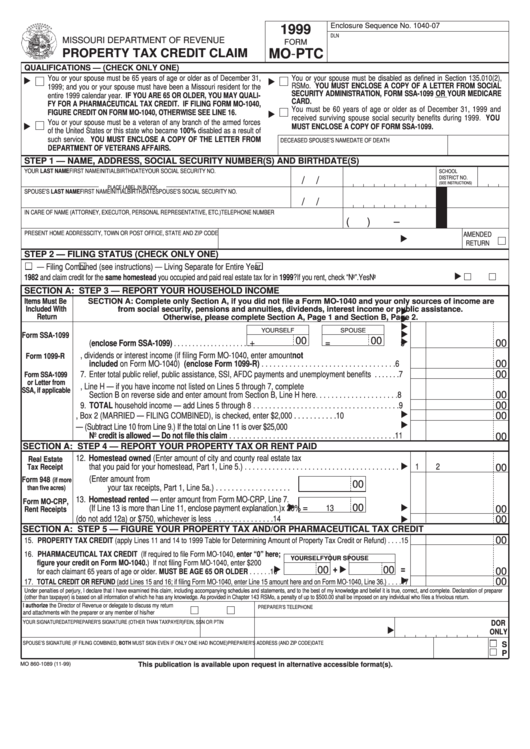

Form MoPtc Property Tax Credit Claim 1999 printable pdf download

For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Ink only and do not staple. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. •.

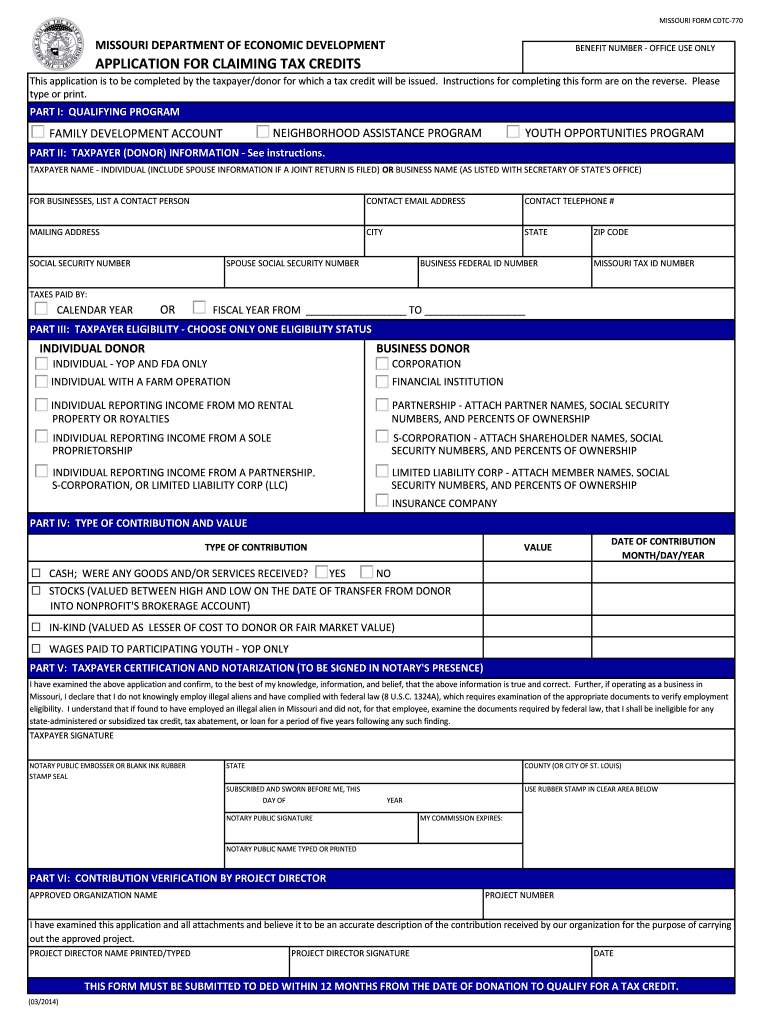

20142022 Form MO CDTC770 Fill Online, Printable, Fillable, Blank

Web • specific questions can be sent to: Ink only and do not staple. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Web 2022 property tax credit claim. Web download or print the 2022.

Form MOPTS Download Fillable PDF or Fill Online Property Tax Credit

• specific questions can be sent to: Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Web the credit is for a maximum of $750.00 for household income, taxable and nontaxable. • detailed instructions, forms, and charts can be found at: The credit is for a maximum of $750 for.

• Specific Questions Can Be Sent To:

Ink only and do not staple. Use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Ink only and do not staple. Please note, direct deposit of a property tax credit refund claim is not an option with this filing method.

Web The Credit Is For A Maximum Of $750.00 For Household Income, Taxable And Nontaxable.

Web • specific questions can be sent to: For optimal functionality, save the form to your computer before completing or printing and utilize adobe reader.) 2022. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Web download or print the 2022 missouri (property tax credit claim) (2022) and other income tax forms from the missouri department of revenue.

The Credit Is For A Maximum Of $750 For Renters And $1,100 For Owners Who Owned And Occupied Their Home.

Web 2022 property tax credit claim. • detailed instructions, forms, and charts can be found at: Web 2021 property tax credit claim.