Mn Form M8

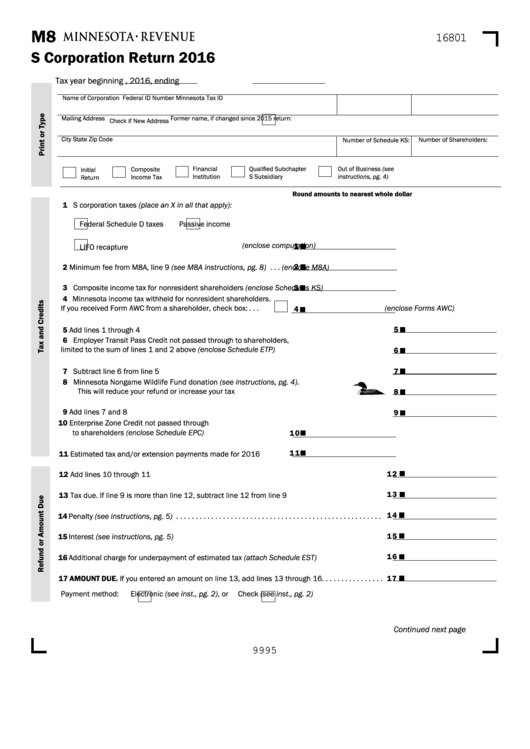

Mn Form M8 - Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Minnesota s corporation income tax mail station 1770 st. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. Type text, add images, blackout confidential. Shareholder’s share of income, credits and modifications. Web we last updated the s corporation return (m8 and m8a) in february 2023, so this is the latest version of form m8, fully updated for tax year 2022. Irc section 1362 must file form m8. Minnesota s corporation income tax mail station 1770 st. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8.

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Who must file the entire share of an. You can also download it, export it or print it out. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Irc section 1362 must file form m8. Web estimated payments for s corporations filing form m8 (rev. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. •form m4x, amended franchise tax return, if you are a corporate partner.

Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. If you make a claim for a refund and we do not act on it within six. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Use form m8x to make a claim for refund and report changes to your minnesota liability. Who must file the entire share of an entity’s. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Shareholder’s share of income, credits and modifications. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. The entire share of an.

Buy HPE Data Cartridge LTO8 Type M (LTO7 M8) Labeled 20 Pack RTG

Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. The entire share of an. Use fill to complete blank online. Web send minnesota instructions via email, link, or fax. Who must file the entire share of an.

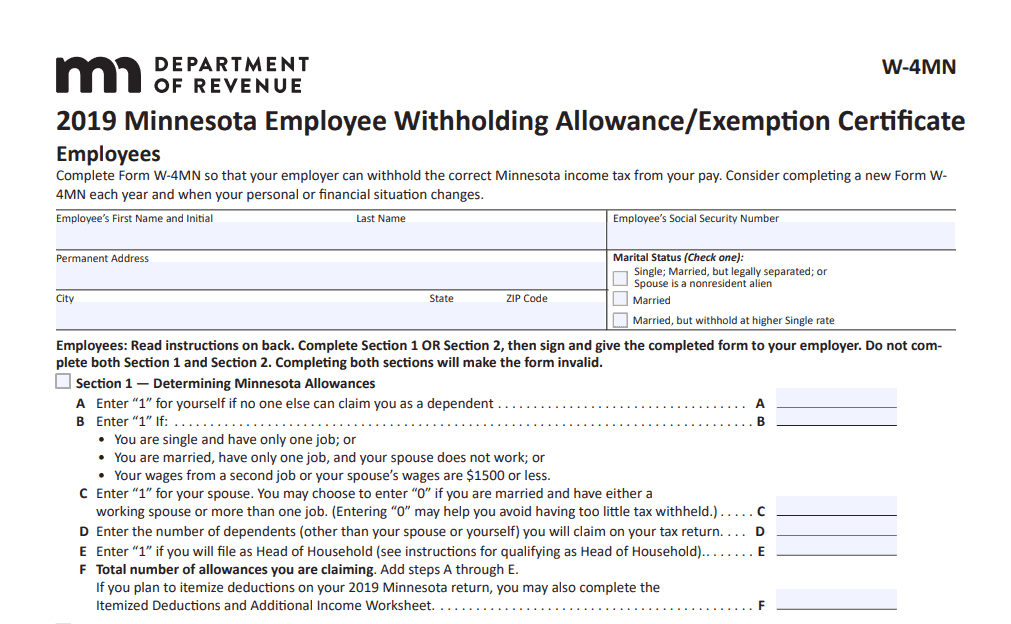

W 4 Mn Form 2021 2022 W4 Form

Edit your form m8 online. Web send minnesota instructions via email, link, or fax. The entire share of an. Use fill to complete blank online. Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form.

2014 Form MN DoR M8 Instructions Fill Online, Printable, Fillable

Web corporations doing business in minnesota that have elected to be taxed as s corporations under. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. Use form m8x to make a claim for refund and report changes to your minnesota.

2018 Form MN M1W Fill Online, Printable, Fillable, Blank PDFfiller

Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web send minnesota instructions via email, link, or fax. Who must file the entire share of an. Easily fill out pdf blank, edit, and sign them. Web we last updated the s corporation form m8 instructions in february.

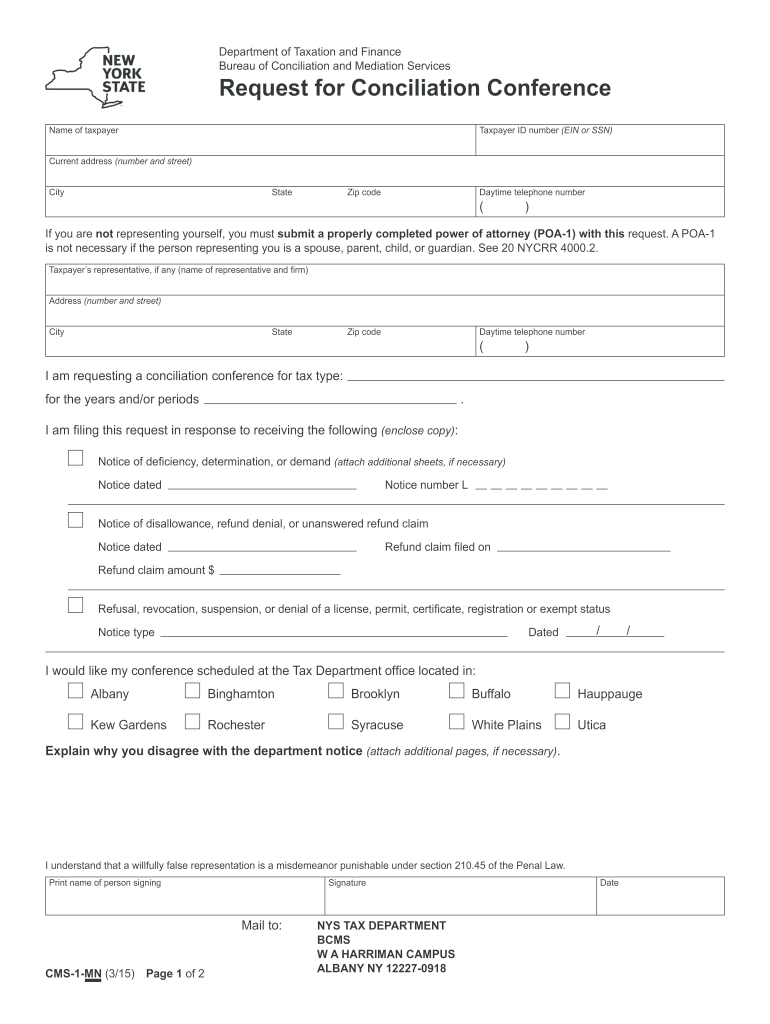

Form Cms 1 Mn Fill Online, Printable, Fillable, Blank pdfFiller

Minnesota s corporation income tax, mail station 1770, st. Irc section 1362 must file form m8. An s corporation must pay estimated tax if. Web fill online, printable, fillable, blank 2020 m8, s corporaon return (minnesota department of revenue) form. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file.

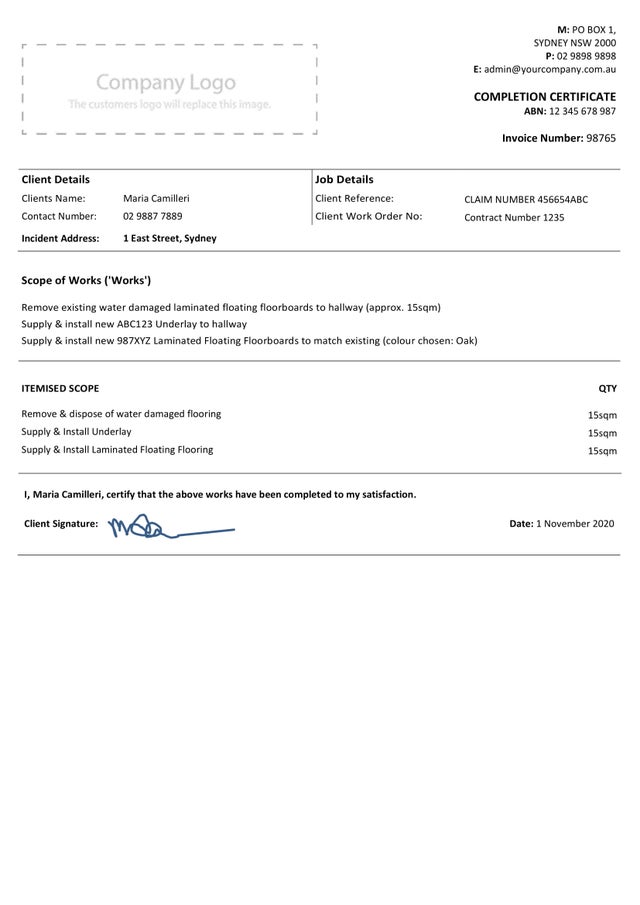

Service M8

Who must file the entire share of an entity’s. Use fill to complete blank online. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. To file an amended return, use one of the following: If you make a claim for a refund and we do not act.

Fillable Form M8 S Corporation Return 2016 printable pdf download

If you make a claim for a refund and we do not act on it within six. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Who must file the entire share of an entity’s. You can download or print. Web corporations doing business in minnesota that.

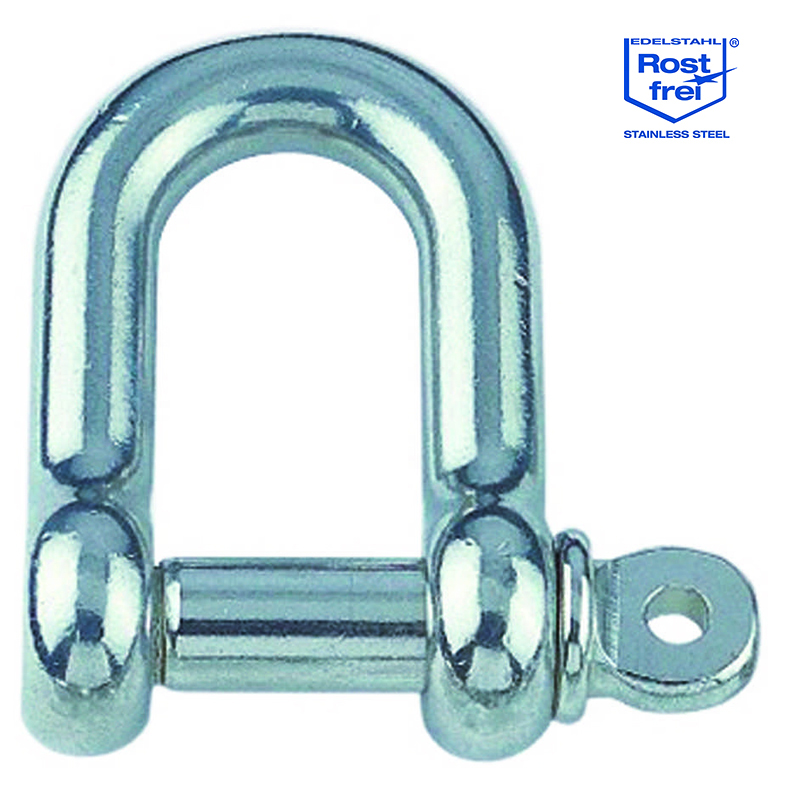

DSchäkel, kurze Form M8, Edelstahl A4 1.4401, Bruchlast 3000kg1017008

Save or instantly send your ready documents. Minnesota s corporation income tax mail station 1770 600 n. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment. Use form m8x to make a claim for refund and report changes to your minnesota liability. Irc section 1362 must file.

Fillable Online mn form 3024 Fax Email Print pdfFiller

Save or instantly send your ready documents. If you make a claim for a refund and we do not act on it within six. Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. Web we last updated the s corporation return (m8 and m8a) in.

2019 Form MN DoR M8 Instructions Fill Online, Printable, Fillable

Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Minnesota s corporation income tax mail station 1770 st. Minnesota s corporation income tax mail station 1770 st. Who must file the entire share of an entity’s. Web corporations doing business in minnesota that have elected to be.

To File An Amended Return, Use One Of The Following:

Shareholder’s share of income, credits and modifications. Web we last updated the s corporation form m8 instructions in february 2023, so this is the latest version of form m8 instructions, fully updated for tax year 2022. Web corporations doing business in minnesota that have elected to be taxed as s corporations under. Web corporations doing business in minnesota that have elected to be taxed as s corporations under.

Web Send Minnesota Instructions Via Email, Link, Or Fax.

If you make a claim for a refund and we do not act on it within six. Who must file the entire share of an entity’s. The entire share of an. Irc section 1362 must file form m8.

Web Estimated Payments For S Corporations Filing Form M8 (Rev.

Use form m8x to make a claim for refund and report changes to your minnesota liability. Corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Web corporations doing business in minnesota that have elected to be taxed as s corporations under irc section 1362 must file form m8. Use fill to complete blank online.

Minnesota S Corporation Income Tax Mail Station 1770 St.

Web s corporations file minnesota form m8 corporation return, with the state, along with copies of federal form 1120s and supporting forms and schedules. •form m4x, amended franchise tax return, if you are a corporate partner. You can download or print. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment.