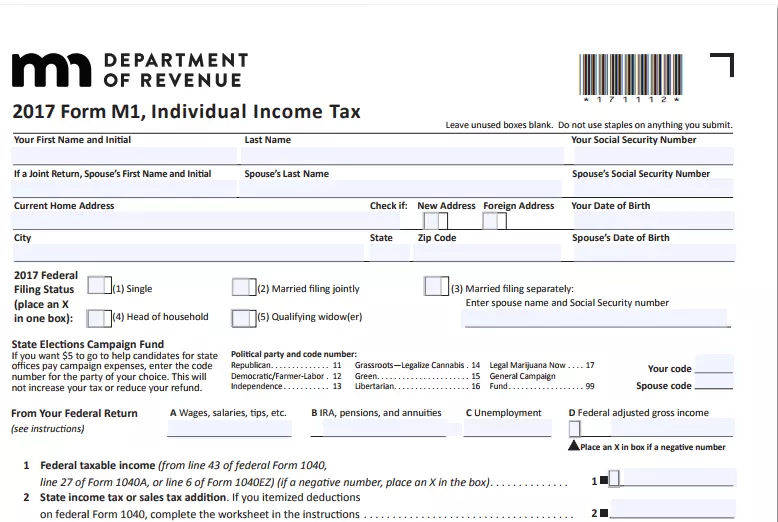

Mn Form M1

Mn Form M1 - You must file yearly by april 15. You can also look for forms by category below the search box. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web 2022 form m1, individual income tax *221111* 2022 form m1, individual income tax do not use staples on anything you submit. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Income you calculated in step 1 on form m1 , line 1. We last updated the individual income tax return in. • as a nonresident, you are required to. See the form m1 instructions for details.

Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Do not use staples on anything you submit. • as a nonresident, you are required to. Web filing a paper income tax return. This states that if you maintain your residence in the state of minnesota for the entire year and you meet the requirements of minimum earned income of $12,525 for tax. Web upload the minnesota form m1 instructions 2022 edit & sign mn tax from anywhere save your changes and share minnesota m1 instructions rate the 2021 minnesota form 4.7. Use this tool to search for a specific tax form using the tax form number or name. Your first name and initial last name. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. See the form m1 instructions for details.

Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. See the form m1 instructions for details. Do not use staples on anything you submit. Your first name and initial last name. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Click filing on the left. This states that if you maintain your residence in the state of minnesota for the entire year and you meet the requirements of minimum earned income of $12,525 for tax. Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Use this tool to search for a specific tax form using the tax form number or name. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for.

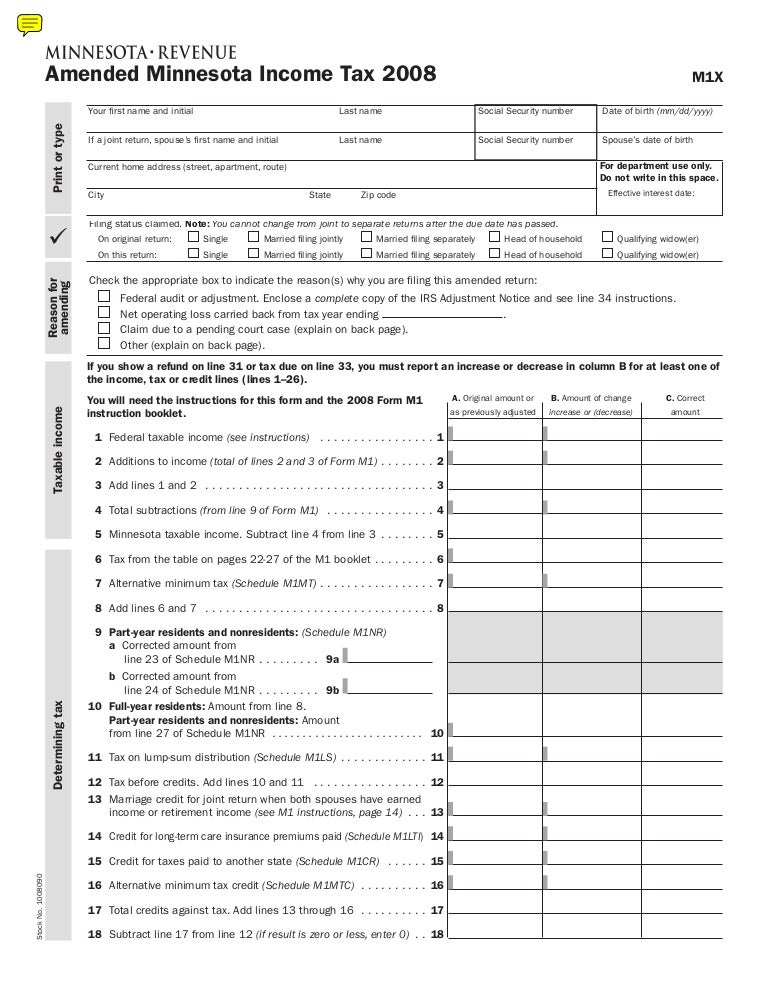

M1X taxes.state.mn.us

Web we last updated minnesota form m1 instructions in february 2023 from the minnesota department of revenue. Click continue to locate the amount on the screen titled minnesota tax summary. See the form m1 instructions for details. Web what is minnesota form m1? • as a nonresident, you are required to.

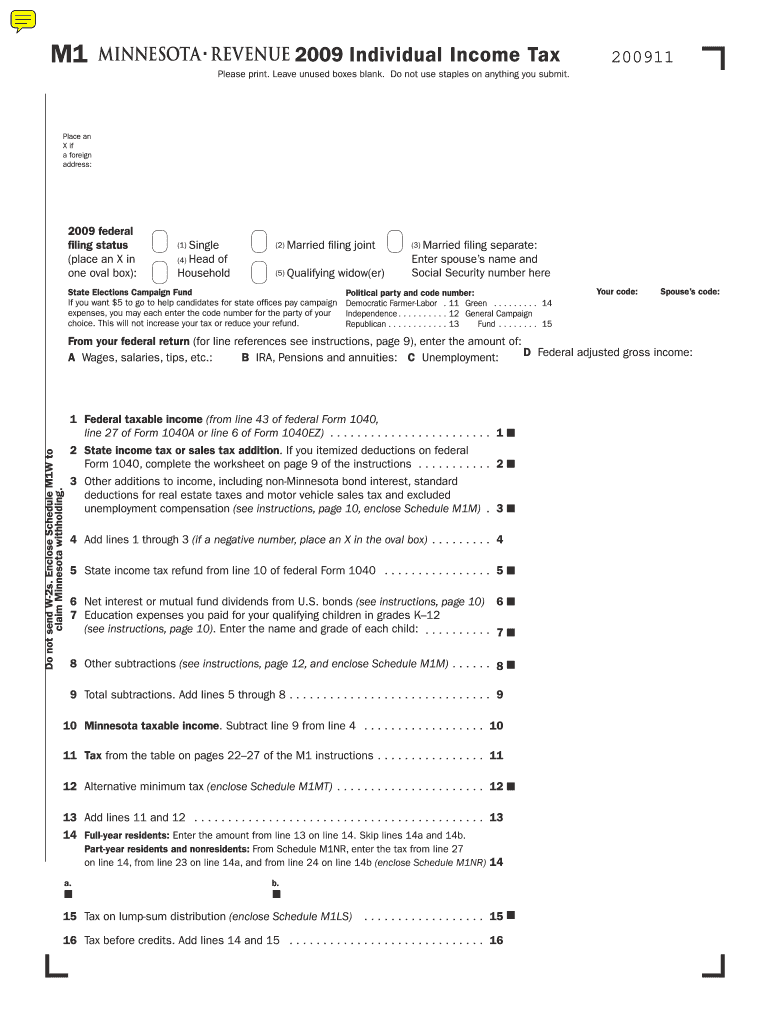

MN DoR M1 2009 Fill out Tax Template Online US Legal Forms

• as a nonresident, you are required to. For more information about the minnesota income tax,. Use this tool to search for a specific tax form using the tax form number or name. If you make any statements on this form that. If zero or less leave blank.

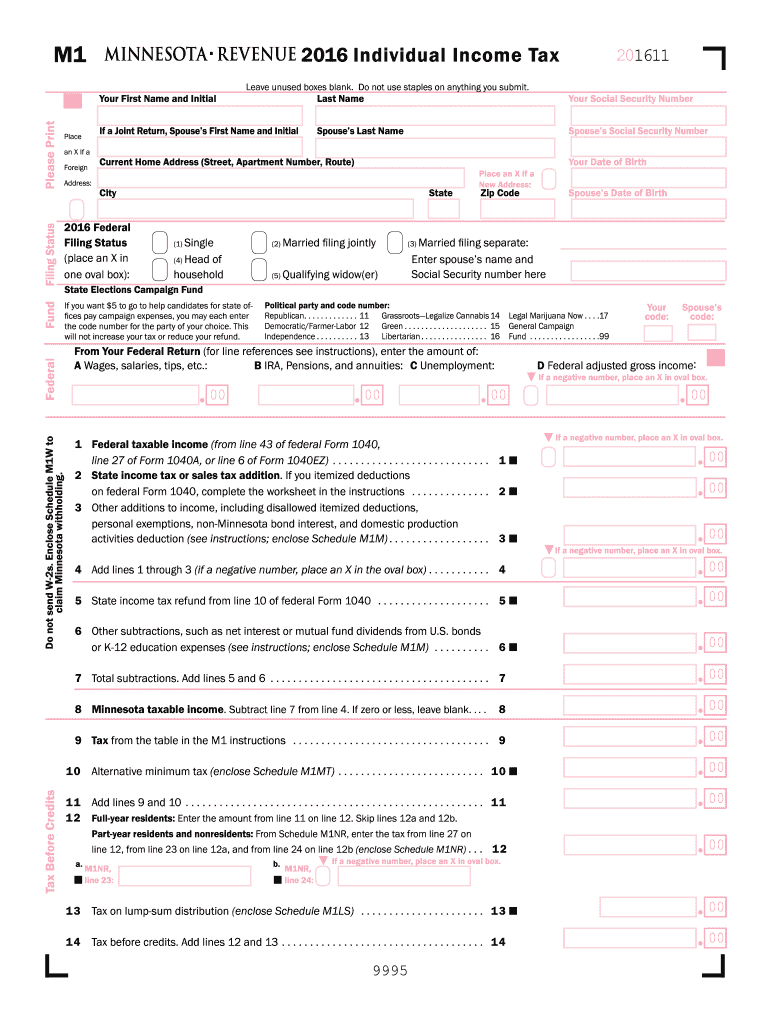

2016 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

Do not use staples on anything you submit. Click continue to locate the amount on the screen titled minnesota tax summary. We'll make sure you qualify, calculate your minnesota property tax refund,. Your first name and initial last name. Complete form m1 using the minnesota.

2016 M1 Instructions Fill Out and Sign Printable PDF Template signNow

Click continue to locate the amount on the screen titled minnesota tax summary. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Income you calculated in step 1 on form m1 , line 1. We last updated the individual income tax return in. You must file yearly.

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

Web use form m1 , individual income tax , to estimate your minnesota tax. See the form m1 instructions for details. Click filing on the left. Income you calculated in step 1 on form m1 , line 1. Use this tool to search for a specific tax form using the tax form number or name.

M1 Tax Table 2017 Instructions

Web form m1 is the most common individual income tax return filed for minnesota residents. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Income you calculated in step 1 on form m1 , line 1. For more information about the minnesota income tax,. Before starting your minnesota income tax return (.

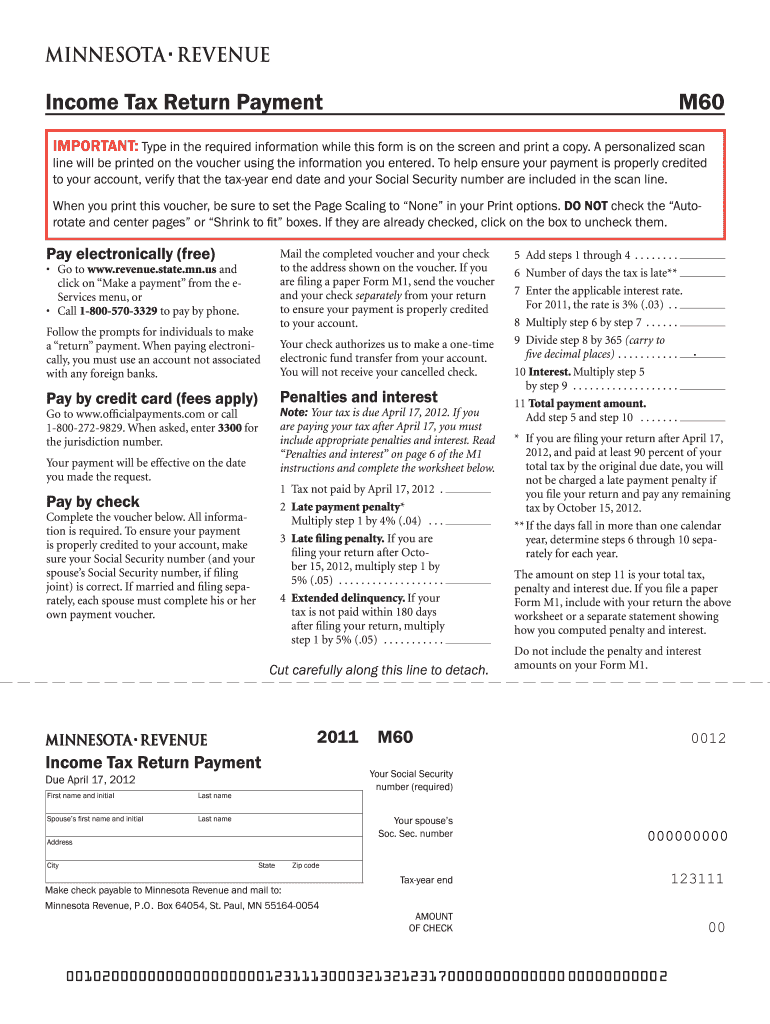

Mn tax payment voucher m60 Fill out & sign online DocHub

This states that if you maintain your residence in the state of minnesota for the entire year and you meet the requirements of minimum earned income of $12,525 for tax. This form is for income earned in tax year 2022, with tax returns. 10 tax from the table in. Click continue to locate the amount on the screen titled minnesota.

Minnesota Form M1

If zero or less leave blank. Web form m1 is the most common individual income tax return filed for minnesota residents. • as a nonresident, you are required to. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Web form m1 is the most common individual income tax return filed for minnesota.

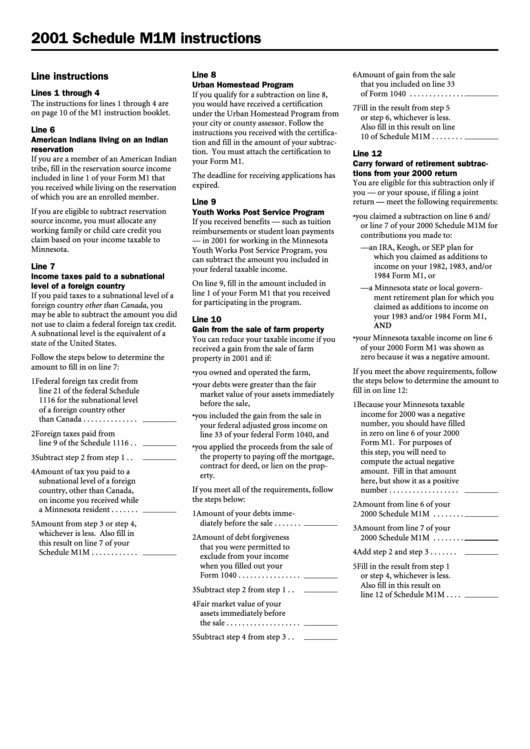

Schedule M1m Instructions 2001 printable pdf download

Web form m1 is the most common individual income tax return filed for minnesota residents. Web upload the minnesota form m1 instructions 2022 edit & sign mn tax from anywhere save your changes and share minnesota m1 instructions rate the 2021 minnesota form 4.7. Web what is minnesota form m1? This form is for income earned in tax year 2022,.

Before Starting Your Minnesota Income Tax Return ( Form M1, Individual Income Tax ), You Must Complete Federal Form 1040 To Determine.

The purpose of form m1 is to determine. It will help candidates for state offices. Income you calculated in step 1 on form m1 , line 1. You must file yearly by april 15.

Web What Is Minnesota Form M1?

Web use form m1 , individual income tax , to estimate your minnesota tax. Web file form m1, individual income tax, with the minnesota department of revenue. Web upload the minnesota form m1 instructions 2022 edit & sign mn tax from anywhere save your changes and share minnesota m1 instructions rate the 2021 minnesota form 4.7. Your first name and initial last name.

Web Up To $40 Cash Back 181111 2018 Form M1 Individual Income Tax Leave Unused Boxes Blank.

Web form m1 is the most common individual income tax return filed for minnesota residents. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Click continue to locate the amount on the screen titled minnesota tax summary. Web filing a paper income tax return.

This States That If You Maintain Your Residence In The State Of Minnesota For The Entire Year And You Meet The Requirements Of Minimum Earned Income Of $12,525 For Tax.

You can also look for forms by category below the search box. Complete form m1 using the minnesota. Web form m1 is the most common individual income tax return filed for minnesota residents. Click filing on the left.