Mn Form M1 Instructions

Mn Form M1 Instructions - Round your amounts to the nearest whole dollar. Minnesota individual income tax, mail station 0010, 600 n. Year resident or nonresident you must file form m1 and schedule m1nr,. For examples of qualifying education expenses, see the form m1 instructions. Web forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule m1sa minnesota. 2022 minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Leave lines blank if they do. You can also look for forms by category below the search box. Web 2019 form m1, individual income tax. If the result is less than $12,400 and you had amounts withheld or paid.

Use your legal name, not a nickname. Your first name and initial last name. If the result is less than $12,400 and you had amounts withheld or paid. New foreign single married filing jointly. 2018 m1 page 2 1 5 tax. Web 2019 form m1, individual income tax. Do not use staples on anything you submit. Web if the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. Web filing a paper income tax return. Minnesota individual income tax, mail station 0010, 600 n.

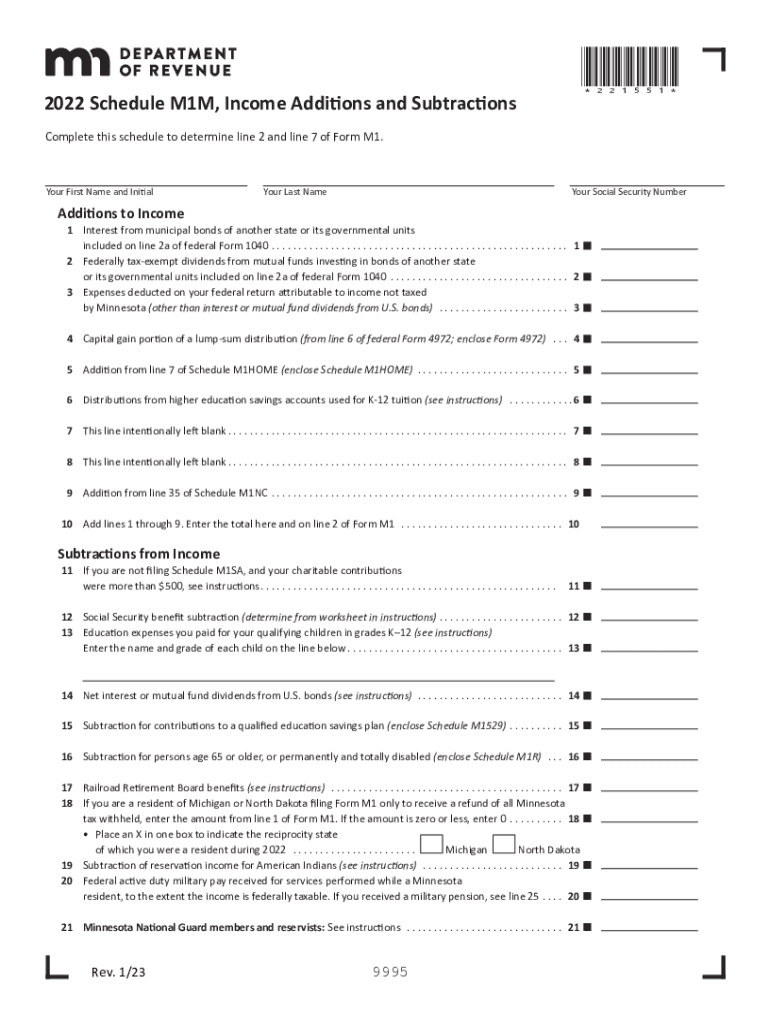

New foreign single married filing jointly. Round your amounts to the nearest whole dollar. Web show details we are not affiliated with any brand or entity on this form. If the result is less than $12,400 and you had amounts withheld or paid. Web you must file a minnesota form m1, individual income tax return, if you are a: How it works open the minnesota form m1m instructions 2022 and follow the instructions easily sign the. For examples of qualifying education expenses, see the form m1 instructions. 2018 m1 page 2 1 5 tax. Spouse’s social security number spouse’s date of birth check if address is: Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota.

M1 Tax Table 2017 Instructions

Web show details we are not affiliated with any brand or entity on this form. Web you must file a minnesota form m1, individual income tax return, if you are a: Minnesota individual income tax, mail station 0010, 600 n. Use your legal name, not a nickname. You can also look for forms by category below the search box.

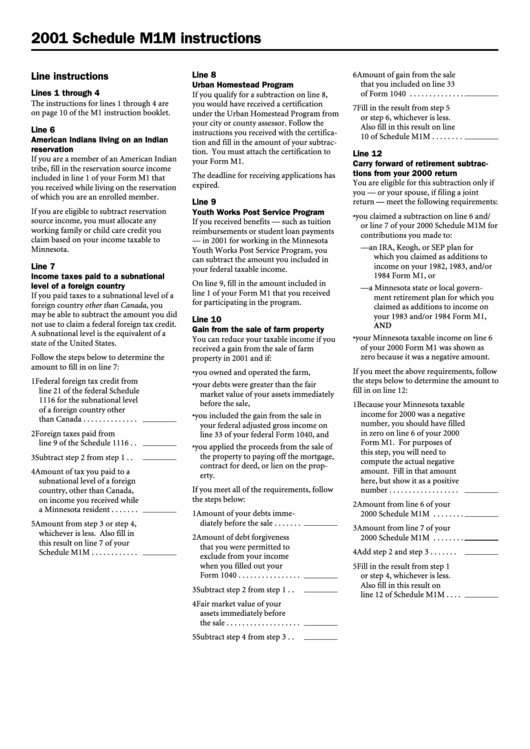

Schedule M1m Instructions 2001 printable pdf download

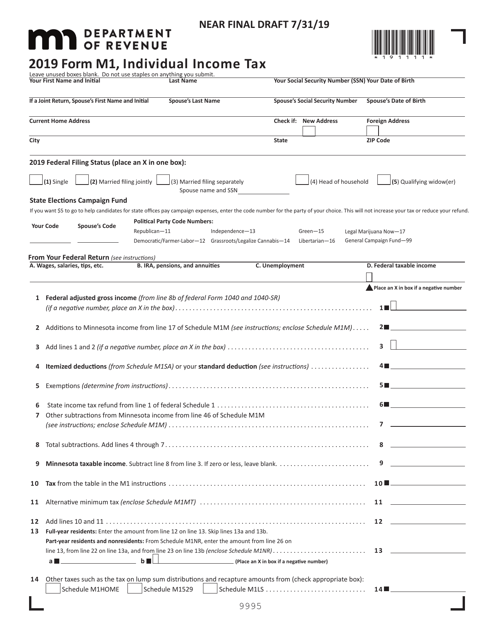

2022 minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Do not use staples on anything you submit. Web if the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. Your first name and initial last name. Web 2019 form m1,.

Tax Table M1 Instructions 2021 Canada

If the result is less than $12,400 and you had amounts withheld or paid. Use your legal name, not a nickname. How it works open the minnesota form m1m instructions 2022 and follow the instructions easily sign the. Your first name and initial last name. Subtraction limits the maximum subtraction allowed for purchases of personal computer.

Minnesota Tax Table M1

Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. For examples of qualifying education expenses, see the form m1 instructions. Web if the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. New foreign.

Minnesota tax forms Fill out & sign online DocHub

Web filing a paper income tax return. Year resident or nonresident you must file form m1 and schedule m1nr,. Use this tool to search for a specific tax form using the tax form number or name. Subtraction limits the maximum subtraction allowed for purchases of personal computer. If the result is less than $12,400 and you had amounts withheld or.

2012 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Web filing a paper income tax return. Minnesota individual income tax, mail station 0010, 600 n. Web how it works browse for the minnesota m1 instructions pdf customize and esign mn form m1 instructions send out signed minnesota form m1 instructions or print it rate. Use this tool to search for a specific tax form using the tax form number.

Form M1 Individual Tax Printable YouTube

Subtraction limits the maximum subtraction allowed for purchases of personal computer. If the result is less than $12,400 and you had amounts withheld or paid. Your first name and initial last name. Use your legal name, not a nickname. Web if the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr.

Mn schedule m1m Fill out & sign online DocHub

Web you must file a minnesota form m1, individual income tax return, if you are a: You can also look for forms by category below the search box. Do not use staples on anything you submit. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota. Your first name and initial last name.

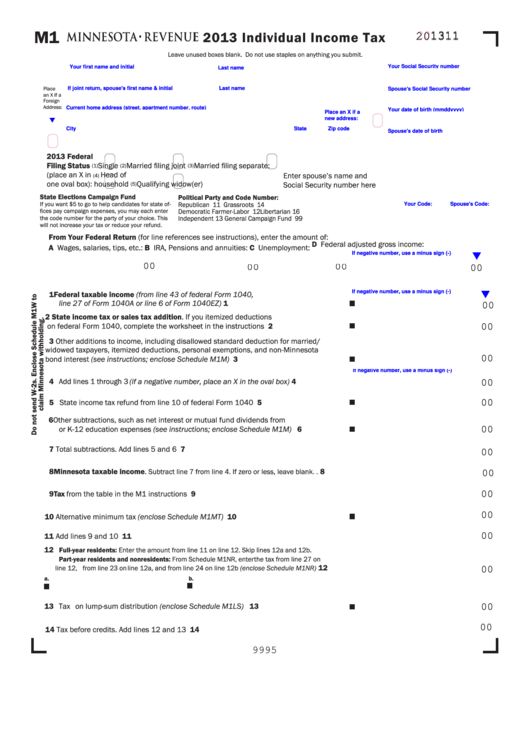

Fillable Form M1 Individual Tax 2013 printable pdf download

Web if the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr. Minnesota individual income tax, mail station 0010, 600 n. Year resident or nonresident you must file form m1 and schedule m1nr,. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill.

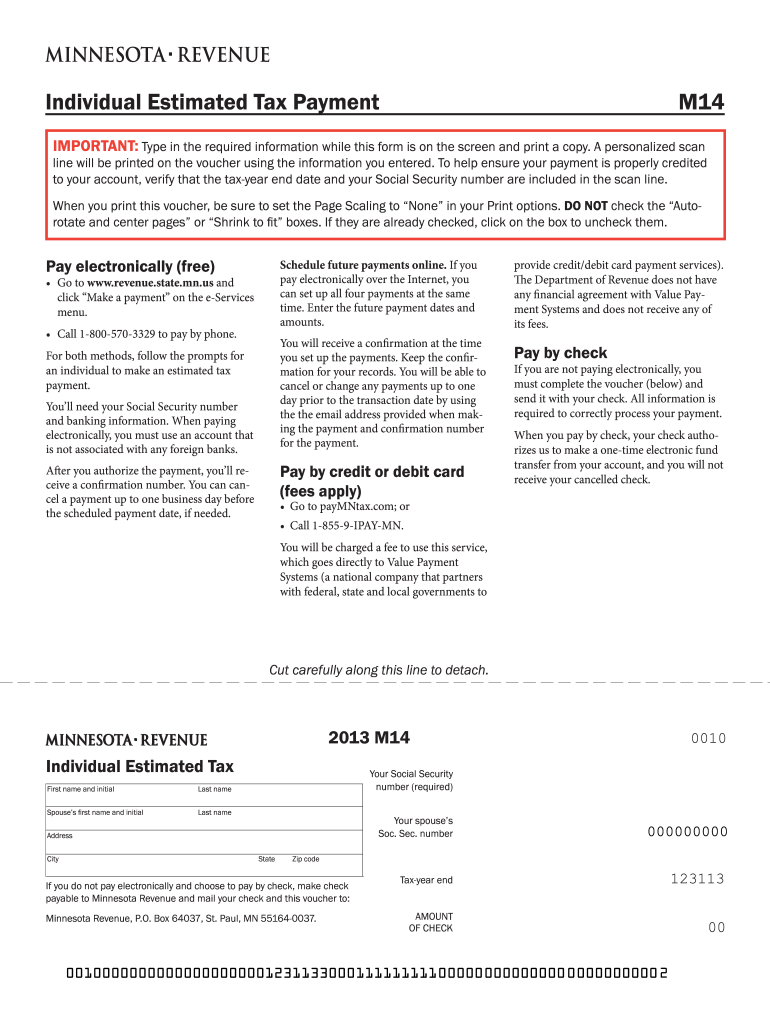

Minnesota Estimated Tax Payments Form 20132022 Fill Out and Sign

Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. Spouse’s social security number spouse’s date of birth check if address is: New foreign single married filing jointly. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum.

Minnesota Individual Income Tax, Mail Station 0010, 600 N.

If the result is less than $12,400 and you had amounts withheld or paid. Use your legal name, not a nickname. Do not use staples on anything you submit. 2022 minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax.

Round Your Amounts To The Nearest Whole Dollar.

You can also look for forms by category below the search box. Web forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule m1sa minnesota. Web *225211* 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund:. Use this tool to search for a specific tax form using the tax form number or name.

Web Filing A Paper Income Tax Return.

Subtraction limits the maximum subtraction allowed for purchases of personal computer. Leave lines blank if they do. Web free printable 2022 minnesota form m1 and 2022 minnesota form m1 instructions booklet in pdf format to print, fill in, and mail your state income tax return. How it works open the minnesota form m1m instructions 2022 and follow the instructions easily sign the.

For Examples Of Qualifying Education Expenses, See The Form M1 Instructions.

Web show details we are not affiliated with any brand or entity on this form. Web you must file a minnesota form m1, individual income tax return, if you are a: Web city 2022 federal filing status (place an x in one box): Web if the total is $12,400 or more, you must file a minnesota income tax return and schedule m1nr.