Mileage Form For Employees

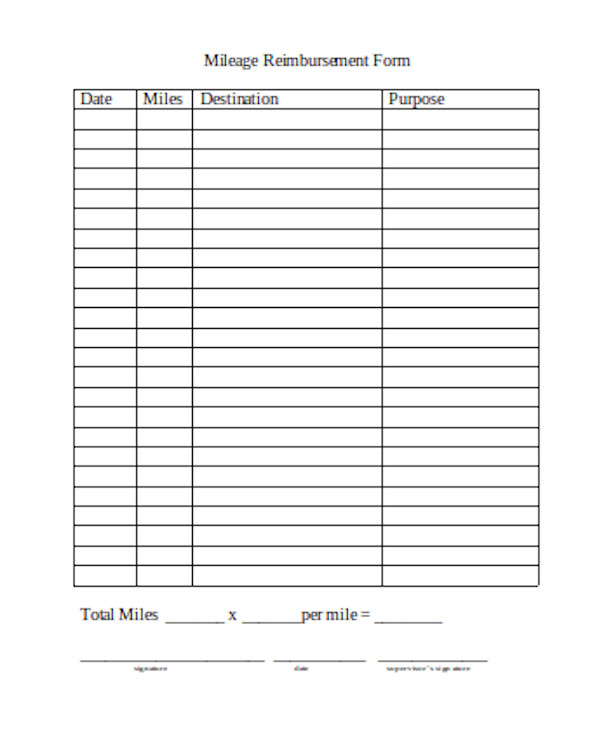

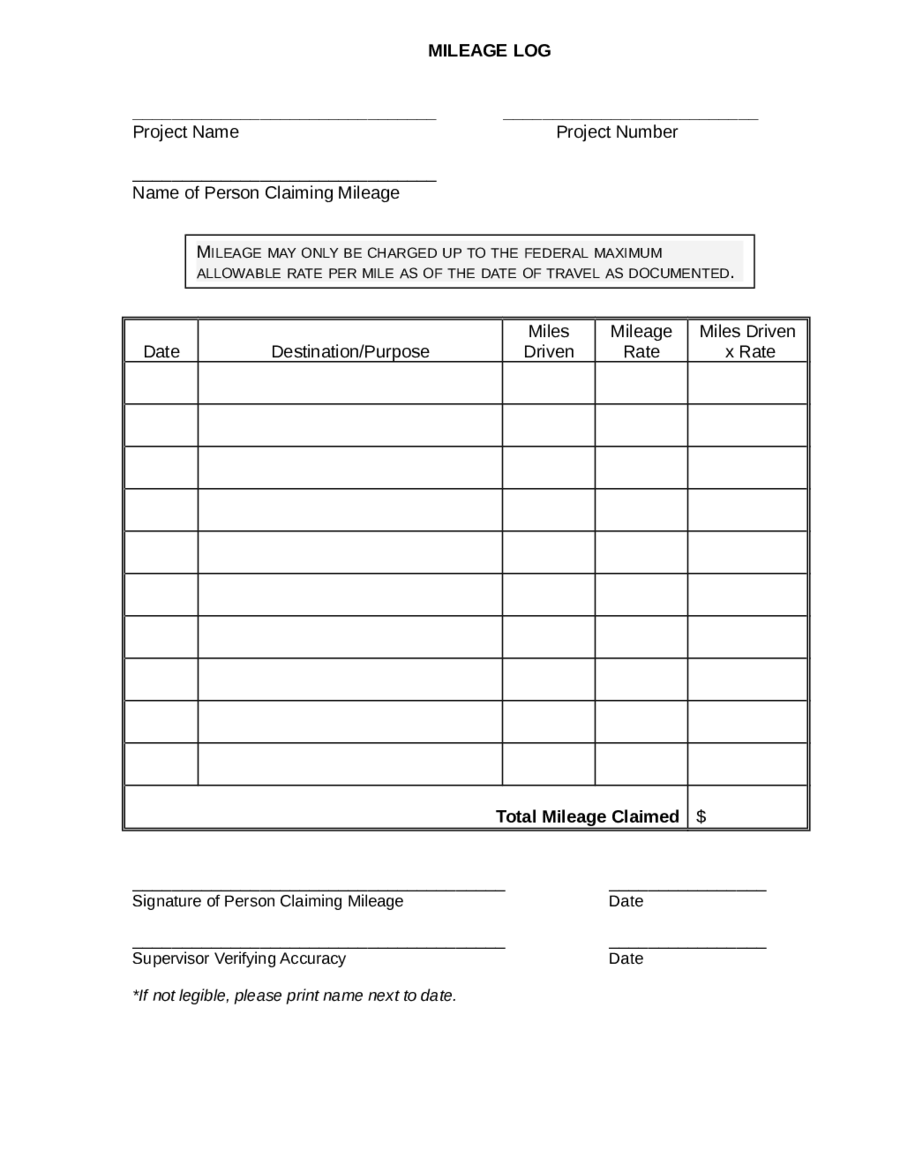

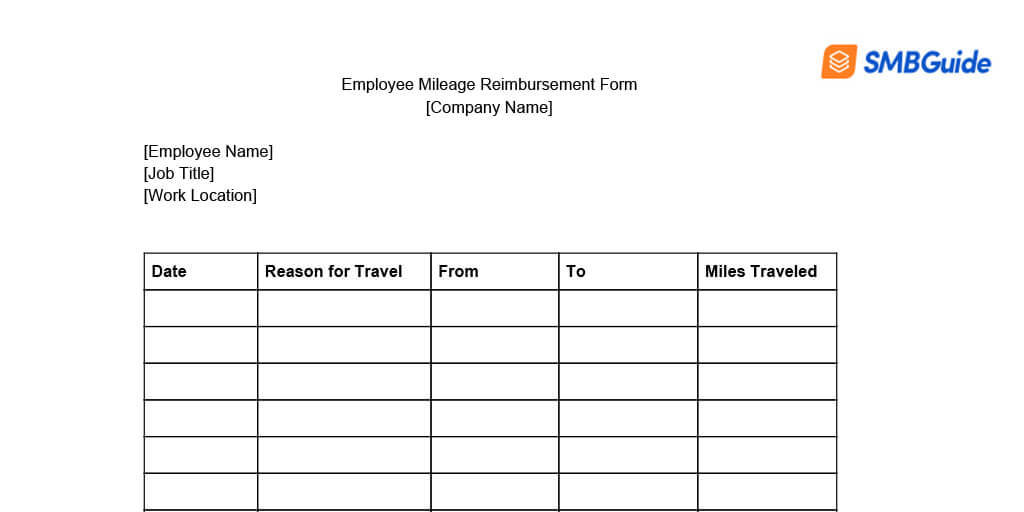

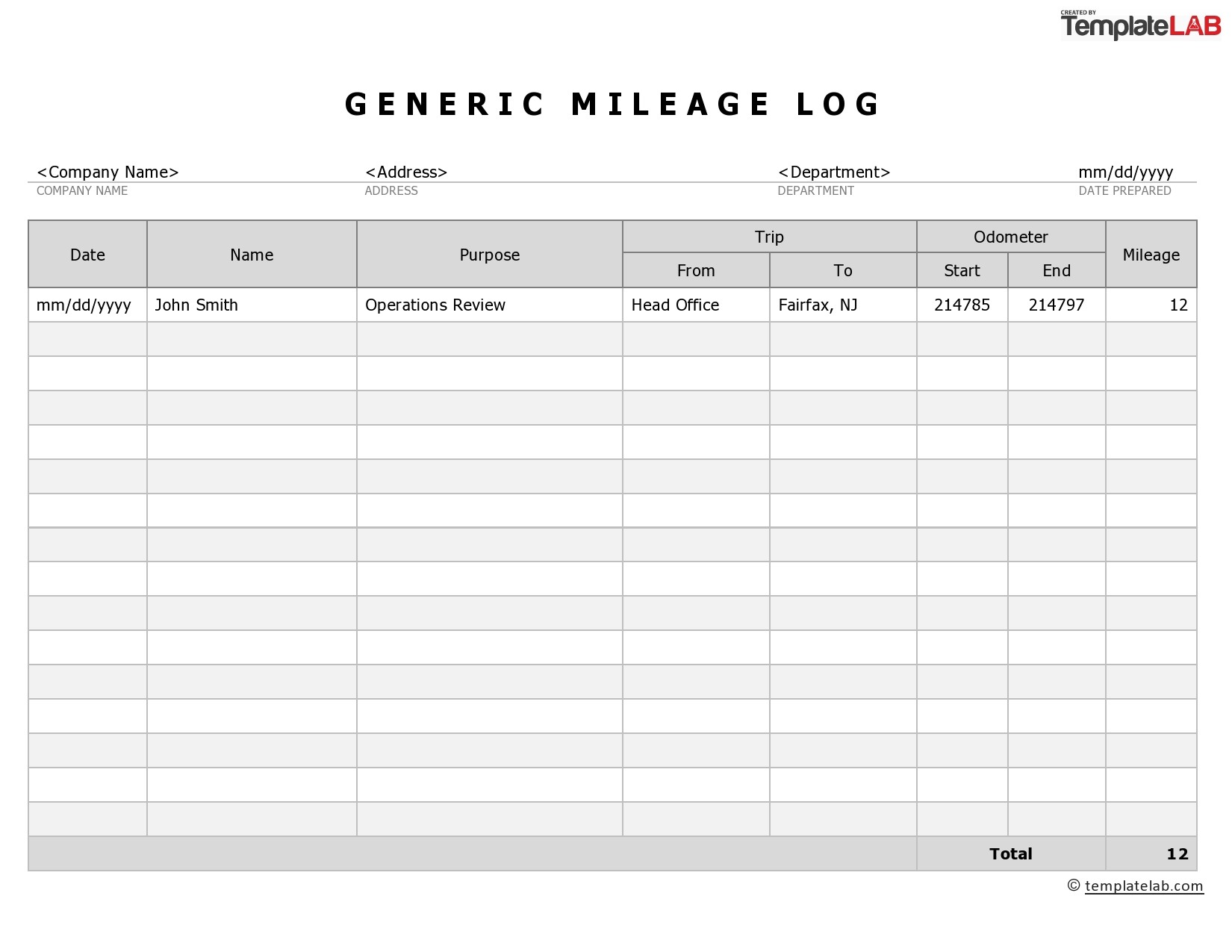

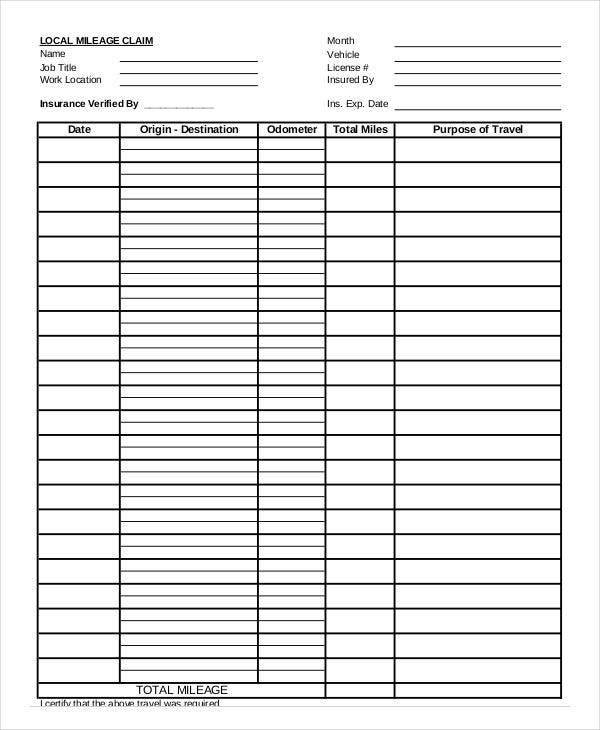

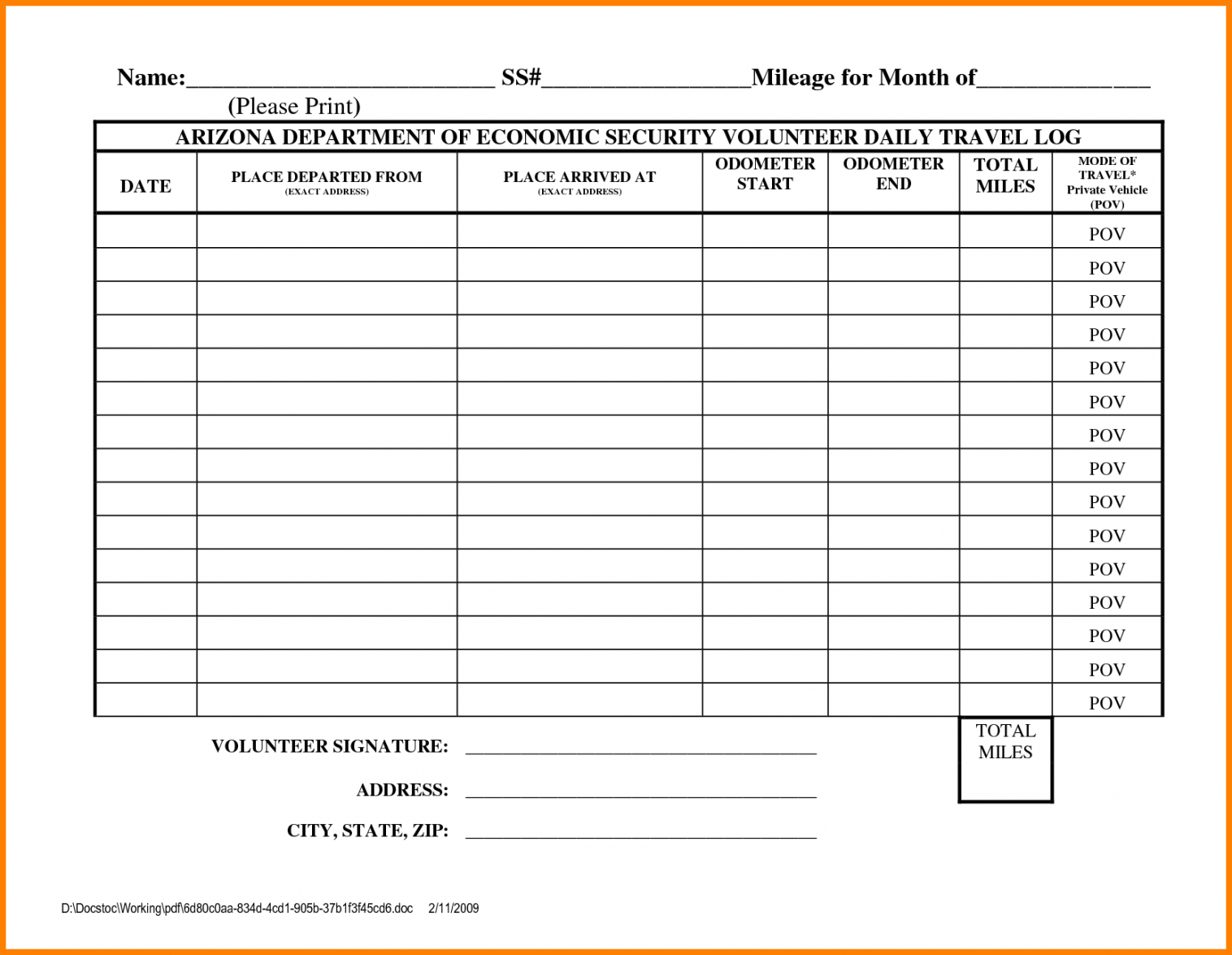

Mileage Form For Employees - Web mileage rate is 56 cents ($0.56) per mile. Web how to file a mileage reimbursement claim. Web members of commissions or advisory boards of the county, or other persons performing specialized services for the county, who are entitled by law to receive mileage allowance, may include mileage form their homes to place of transaction of official business and return. Web track mileage reimbursements effortlessly with our free mileage reimbursement form. Employees can simply download a mileage log template in any format that is preferred, that is, pdf, ms excel or ms word. Web the mileage tracker template in pdf only requires basic information including company name, employee name, department, expense period, date, reason for travel, start location, end location, miles traveled, total miles, mileage rate, reimbursement, notes, employee signature, and approval signature. Web updated on january 25th, 2022. Reimbursements based on the federal mileage rate aren't considered income, making them nontaxable to your employees. Web the employee mileage record request form is a simple way for employees to claim a reimbursement. After you've introduced the basic concepts, the next step is to inform your employees about their responsibilities regarding their business mileage claims.

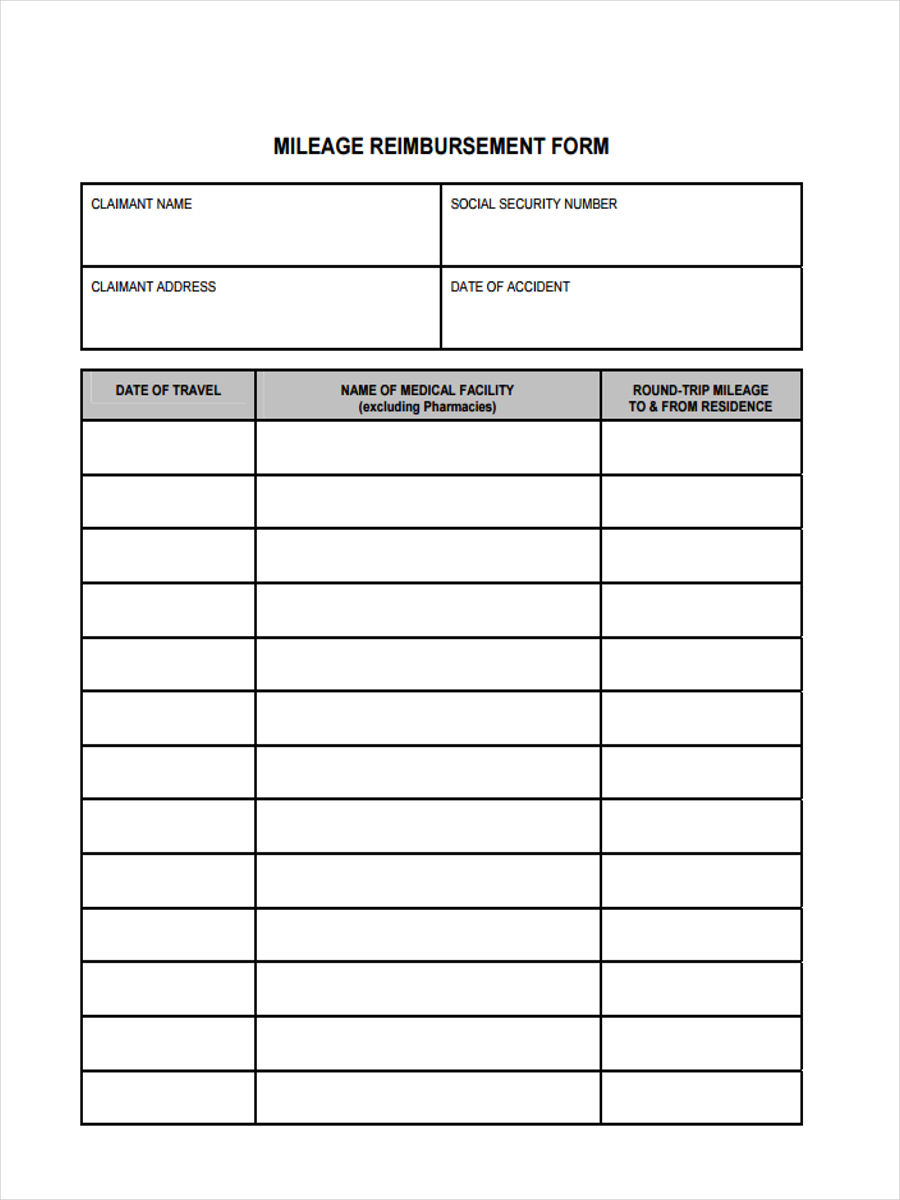

Web how to calcuate mileage for certain employees. Employees can simply download a mileage log template in any format that is preferred, that is, pdf, ms excel or ms word. Web employees have the easiest method of tracking their mileage and business. Web irs mileage reimbursement form author: Send the original to the insurance company and keep a copy. Printable mileage log for employee reimbursement form. Do not send the original or a copy to the local workers’ Web employee mileage reimbursement: Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Simply customize the form fields to fit the way you want to communicate with your insurance company, embed it in your website, or share it with a link.

Get started by downloading, customizing, and printing yours today. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. Companies usually require each individual employee to maintain a log for computation at the end of the year. Reimbursements based on the federal mileage rate aren't considered income, making them nontaxable to your employees. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Web a mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Web employee mileage reimbursement: Web how to calcuate mileage for certain employees. If you’re one of the types of employees listed above, you’ll also be able to claim mileage on your individual tax return at the rate of $0.63 in 2022. Related to form for mileage mileage logs for 2012 form date odometer.

Mileage Reimbursement Form Excel Excel Templates

Seeing as there is no way to properly calculate the true cost of performing the trip by the employee, the irs announces these rates on an annual basis for employers and businesses. Web members of commissions or advisory boards of the county, or other persons performing specialized services for the county, who are entitled by law to receive mileage allowance,.

Mileage Reimbursement Forms Sample Mous Syusa

Web employee mileage reimbursement: Web how to calcuate mileage for certain employees. Many companies use mileage reimbursement programs to repay employees for driving their own vehicle for business purposes. Web employees have the easiest method of tracking their mileage and business. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here,.

Mileage Report Template (7) TEMPLATES EXAMPLE TEMPLATES EXAMPLE

Some companies may reimburse you for travel costs or you may choose to list mileage for certain travel as a tax deduction. This mileage reimbursement form asks for employee information, covered dates, mileage calculation, the rate per mile, and total reimbursements. Simply customize the form fields to fit the way you want to communicate with your insurance company, embed it.

Mileage Reimbursement Spreadsheet MS Excel Templates

Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Web for employees employees are normally required by employers to keep accurate records for reimbursements. Web how to file a mileage reimbursement claim. You’ll report your miles and also answer a few questions about the vehicle on. If you’re one.

Travel Expense Reimbursement Form Template MS Excel Templates

Companies usually require each individual employee to maintain a log for computation at the end of the year. Web track mileage reimbursements effortlessly with our free mileage reimbursement form. Web for employees employees are normally required by employers to keep accurate records for reimbursements. Related to form for mileage mileage logs for 2012 form date odometer. The mileage calculate is.

Workers Comp Mileage Reimbursement 2021 Form Fill Out and Sign

Web updated on january 25th, 2022. Do not send the original or a copy to the local workers’ Employees can simply download a mileage log template in any format that is preferred, that is, pdf, ms excel or ms word. Depreciation limits on cars, trucks, and vans. Web a mileage reimbursement form is primarily used by employees seeking to be.

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel

Web for 2020, the federal mileage rate is $0.575 cents per mile. Page last reviewed or updated: This mileage reimbursement form asks for employee information, covered dates, mileage calculation, the rate per mile, and total reimbursements. Web the mileage tracker template in pdf only requires basic information including company name, employee name, department, expense period, date, reason for travel, start.

Downloadable Mileage Log MS Excel Templates

You’ll report your miles and also answer a few questions about the vehicle on. Page last reviewed or updated: Depreciation limits on cars, trucks, and vans. If you plan to travel for business, it helps to understand employer expectations and requirements for mileage reimbursement. Web how to calcuate mileage for certain employees.

Mileage Reimbursement Form IRS Mileage Rate 2021

Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Web the employee mileage record request form is a simple way for employees to claim a reimbursement. Do not send the original or a copy to the local workers’ Keywords relevant to mileage form mileage log mileage log sheet. If.

Mileage Claim Form Template

Web how to file a mileage reimbursement claim. Depreciation limits on cars, trucks, and vans. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Web medical mileage expense form if you need a medical mileage expense form for a year not listed here, please contact the information and assistance.

After You've Introduced The Basic Concepts, The Next Step Is To Inform Your Employees About Their Responsibilities Regarding Their Business Mileage Claims.

Employees need to provide a detailed mileage log and use it to file their expense reports. Depreciation limits on cars, trucks, and vans. Web the mileage tracker template in pdf only requires basic information including company name, employee name, department, expense period, date, reason for travel, start location, end location, miles traveled, total miles, mileage rate, reimbursement, notes, employee signature, and approval signature. If you plan to travel for business, it helps to understand employer expectations and requirements for mileage reimbursement.

The Mileage Calculate Is Using The Input Table Tool That Displays The Mileage Usage In A Table Format.

Web irs mileage reimbursement form author: Web a mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Employees can simply download a mileage log template in any format that is preferred, that is, pdf, ms excel or ms word. Simply customize the form fields to fit the way you want to communicate with your insurance company, embed it in your website, or share it with a link.

Many Companies Use Mileage Reimbursement Programs To Repay Employees For Driving Their Own Vehicle For Business Purposes.

Companies usually require each individual employee to maintain a log for computation at the end of the year. Rate free mileage log form. Reimbursements based on the federal mileage rate aren't considered income, making them nontaxable to your employees. Related to form for mileage mileage logs for 2012 form date odometer.

The Template Will Also Help You To.

Some companies may reimburse you for travel costs or you may choose to list mileage for certain travel as a tax deduction. Page last reviewed or updated: This mileage reimbursement form asks for employee information, covered dates, mileage calculation, the rate per mile, and total reimbursements. Get started by downloading, customizing, and printing yours today.