Michigan Tax Form 5792

Michigan Tax Form 5792 - Web for the 2022 tax year dear taxpayer: This certiicate is invalid unless all four sections are. You will have to file form 5792 along with supporting documentation annually to ensure that you are using. Taxformfinder provides printable pdf copies of 98 current michigan income tax forms. The state income tax rate is displayed on. Web help with acrobat reader. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits, farmland and open space tax relief, and the home heating credit program. Web city of detroit business & fiduciary taxes search tips search by tax area: Keep in mind that some states will not update their tax forms for 2023 until. Web we last updated the additions and subtractions in february 2023, so this is the latest version of schedule 1, fully updated for tax year 2022.

Certiicate must be retained in the seller’s records. Mto provides taxpayers with free and secure 24/7 online access to their treasury. Local government forms and instructions. Resident tribal member income exempted under a state/tribal tax agreement or pursuant to. This form cannot be used to issue refunds of $10 million or more. Digital signatures are required on form 5792. Web help with acrobat reader. The michigan income tax rate for tax year 2022 is 4.25%. Web download or print the 2022 michigan form 4892 (cit amended annual return) for free from the michigan department of treasury. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms.

This form cannot be used to issue refunds of $10 million or more. Other michigan corporate income tax forms: This certiicate is invalid unless all four sections are. Most commonly used forms & instructions tax credits payments miscellaneous forms & instructions additional resources need a different form? This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits, farmland and open space tax relief, and the home heating credit program. When a form 5792 is submitted to. A page number of 1 indicates that the page number is soon to come. Taxformfinder provides printable pdf copies of 98 current michigan income tax forms. The current tax year is 2022, and most states will. Mto provides taxpayers with free and secure 24/7 online access to their treasury.

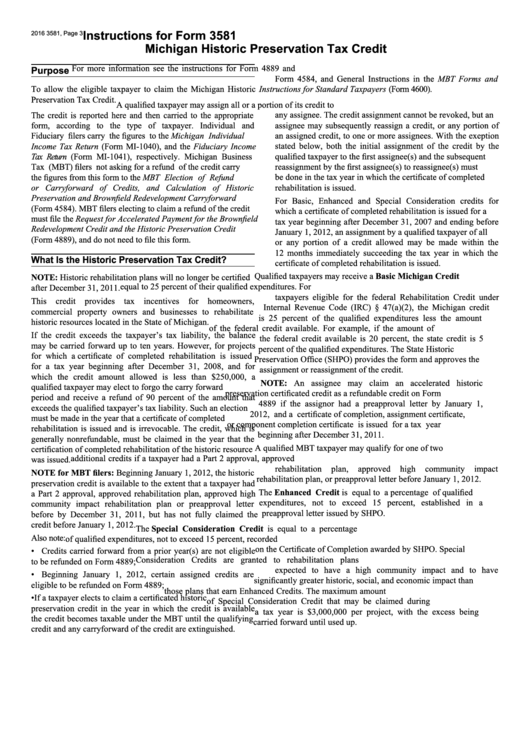

Instructions For Michigan Historic Preservation Tax Credit Form 3581

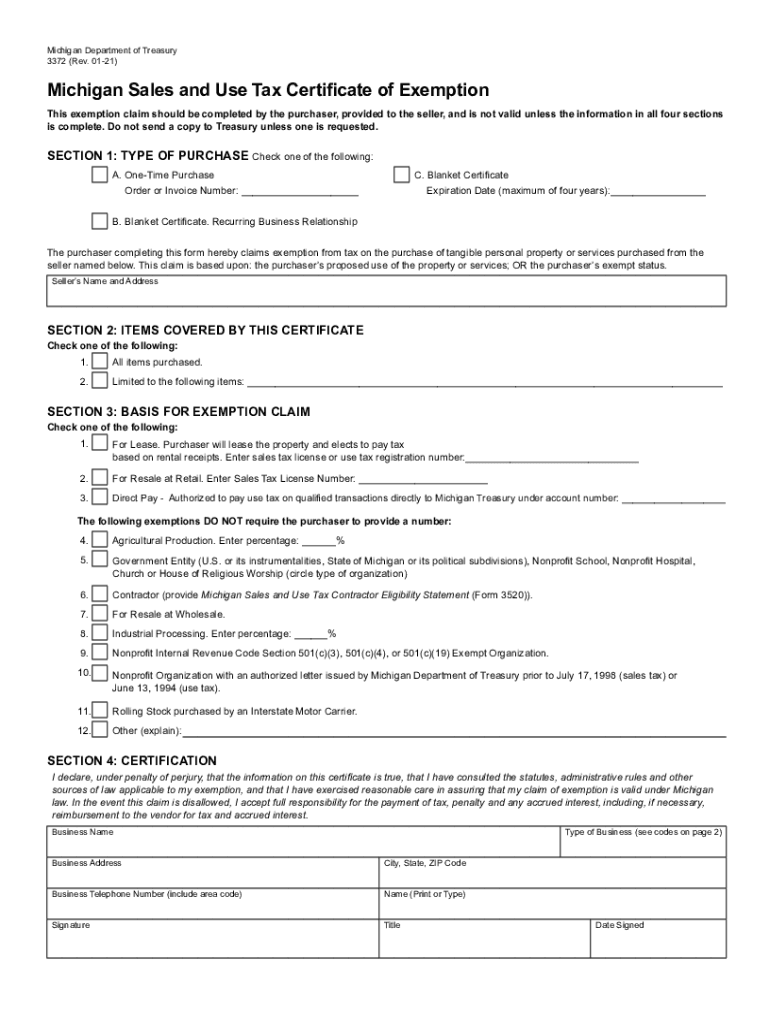

Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption.

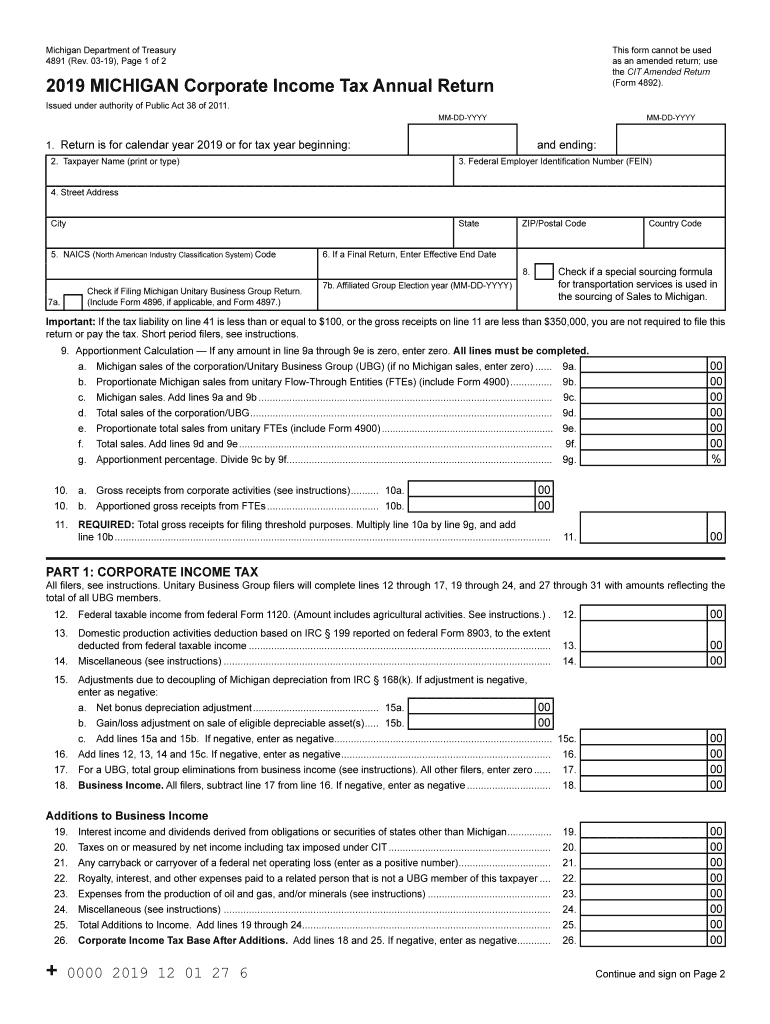

4892, Michigan Corporate Tax Amended Return Fill Out and Sign

Corporation or a partnership under the internal revenue code for. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. Taxformfinder provides printable pdf copies of 98 current michigan income tax forms. Web disclosure forms and information. Web form.

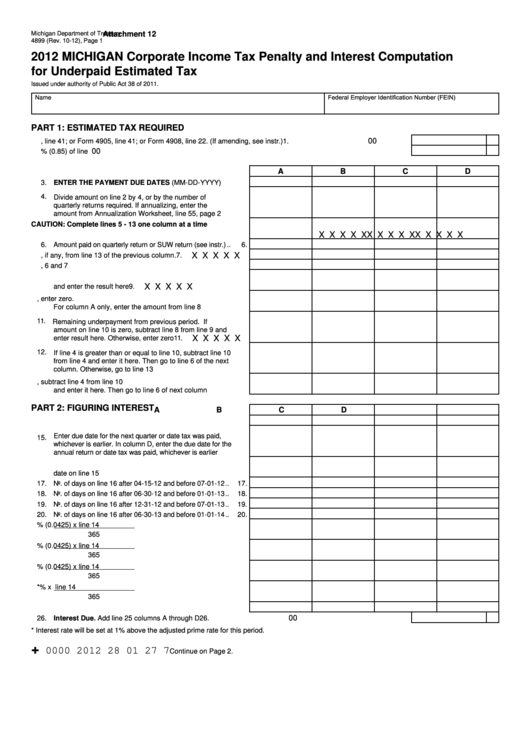

Form 4899 Michigan Corporate Tax Penalty And Interest

You will have to file form 5792 along with supporting documentation annually to ensure that you are using. Web michigan department of treasury form 3372 (rev. Web 69 rows michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Web printable michigan state tax forms for the 2022 tax year will.

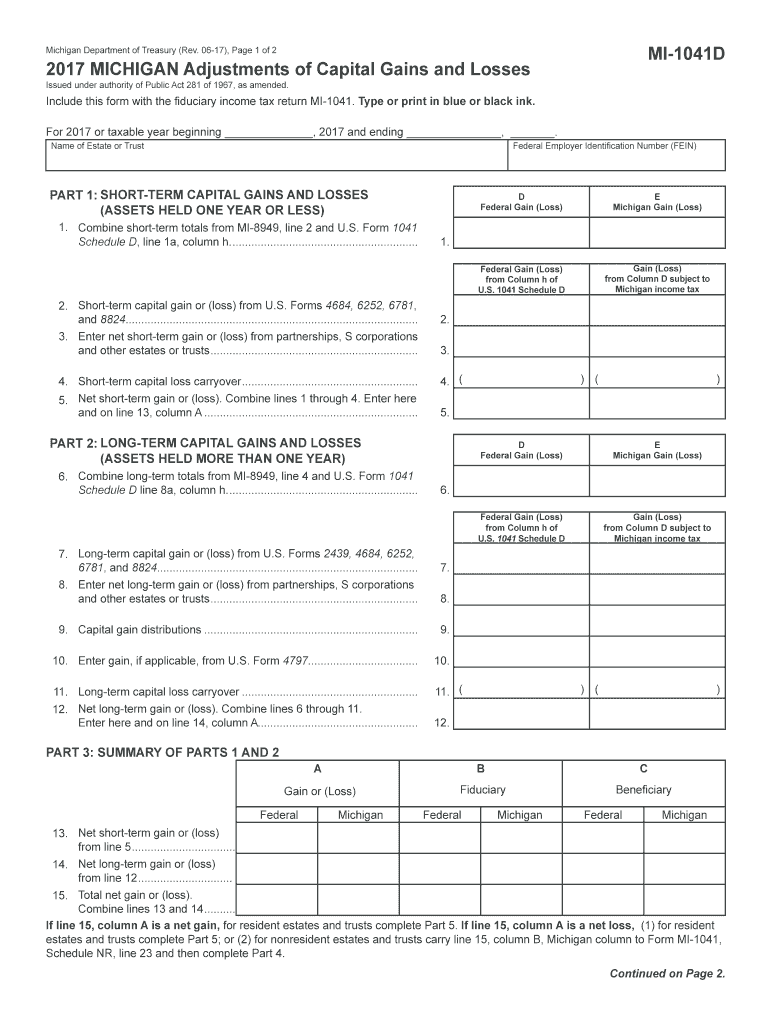

20182021 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

Taxformfinder provides printable pdf copies of 98 current michigan income tax forms. When a form 5792 is submitted to. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. This form cannot be used to issue refunds of $10.

8,090 Michigan tax returns reported at least 1M in and 7 more

A page number of 1 indicates that the page number is soon to come. Web city of detroit business & fiduciary taxes search tips search by tax area: The michigan income tax rate for tax year 2022 is 4.25%. Web we last updated the additions and subtractions in february 2023, so this is the latest version of schedule 1, fully.

Michigan Tax Withholding 2021 2022 W4 Form

This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits, farmland and open space tax relief, and the home heating credit program. Hb5792 history (house actions in lowercase, senate actions in uppercase) note: Use the latest revision of form 5792. Use this option to browse a list of forms by tax.

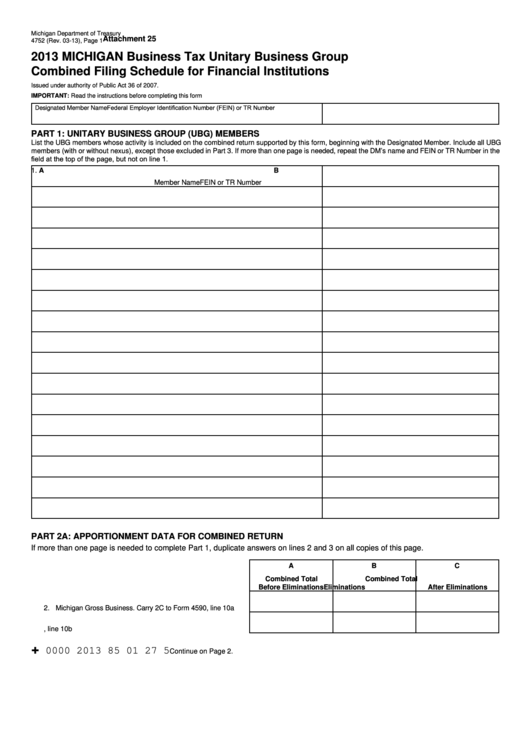

Form 4752 Michigan Business Tax Unitary Business Group Combined

The current tax year is 2022, and most states will. Other michigan corporate income tax forms: Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form.

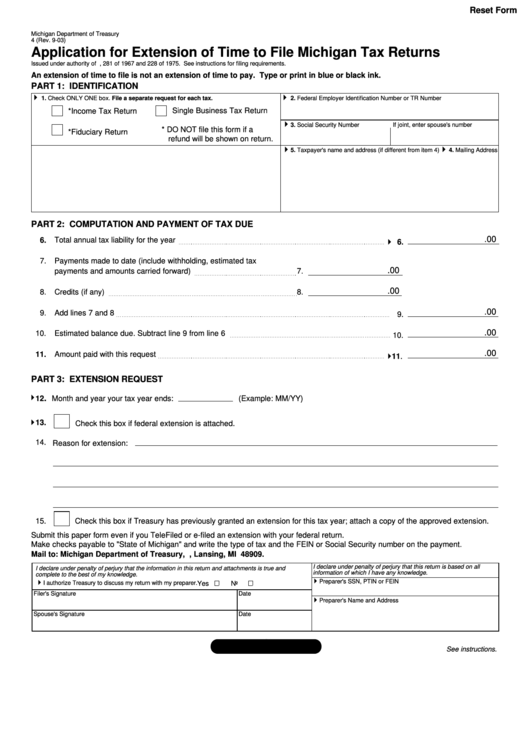

Fillable Form 4 Application For Extension Of Time To File Michigan

Taxformfinder provides printable pdf copies of 98 current michigan income tax forms. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms. The state income tax rate is displayed on. This form.

Form 3372 Fill Out and Sign Printable PDF Template signNow

Keep in mind that some states will not update their tax forms for 2023 until. Web city of detroit business & fiduciary taxes search tips search by tax area: Use the latest revision of form 5792. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits, farmland and open space tax.

3.11.23 Excise Tax Returns Internal Revenue Service

Digital signatures are required on form 5792. The michigan income tax rate for tax year 2022 is 4.25%. Health insurance claims assessment (hica) ifta / motor carrier. It is the purchaser’s responsibility to ensure the eligibility of the. Web disclosure forms and information.

Hb5792 History (House Actions In Lowercase, Senate Actions In Uppercase) Note:

Mto provides taxpayers with free and secure 24/7 online access to their treasury. Web help with acrobat reader. Local government forms and instructions. Other michigan corporate income tax forms:

Keep In Mind That Some States Will Not Update Their Tax Forms For 2023 Until.

Web download or print the 2022 michigan form 4892 (cit amended annual return) for free from the michigan department of treasury. When a form 5792 is submitted to. A page number of 1 indicates that the page number is soon to come. It is the purchaser’s responsibility to ensure the eligibility of the.

Taxformfinder Provides Printable Pdf Copies Of 98 Current Michigan Income Tax Forms.

Digital signatures are required on form 5792. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms 2018 fiduciary tax forms 2017 fiduciary tax forms 2016 fiduciary tax forms. Be sure to verify that the form you are downloading is for the correct year. Hb5792 analysis as passed by the house (5/9/2022) this document analyzes:

Web Michigan Department Of Treasury Form 3372 (Rev.

Look for forms using our forms search or view a list of income tax forms by year. The state income tax rate is displayed on. Most commonly used forms & instructions tax credits payments miscellaneous forms & instructions additional resources need a different form? You will have to file form 5792 along with supporting documentation annually to ensure that you are using.