Merrill Lynch 1099 Form Online

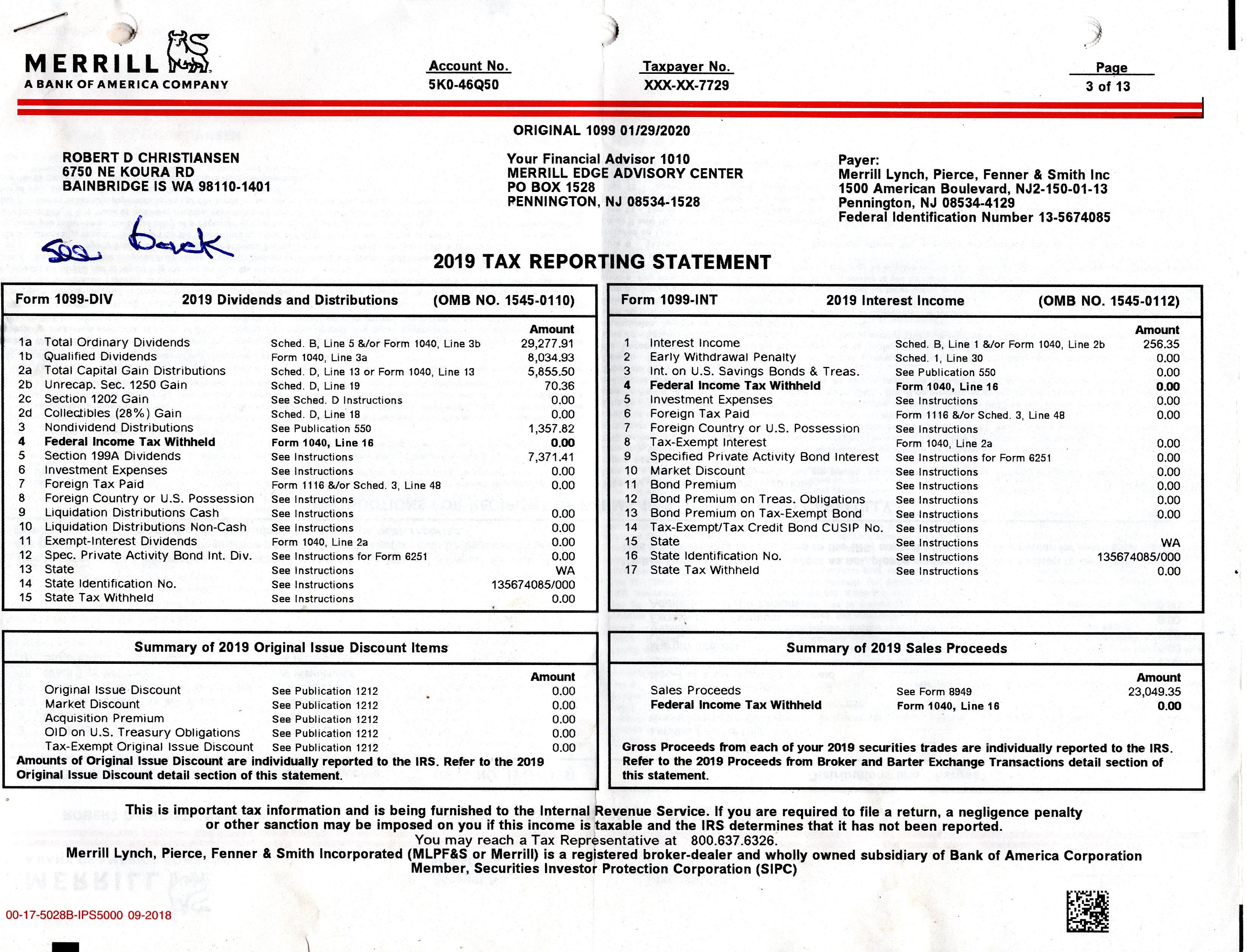

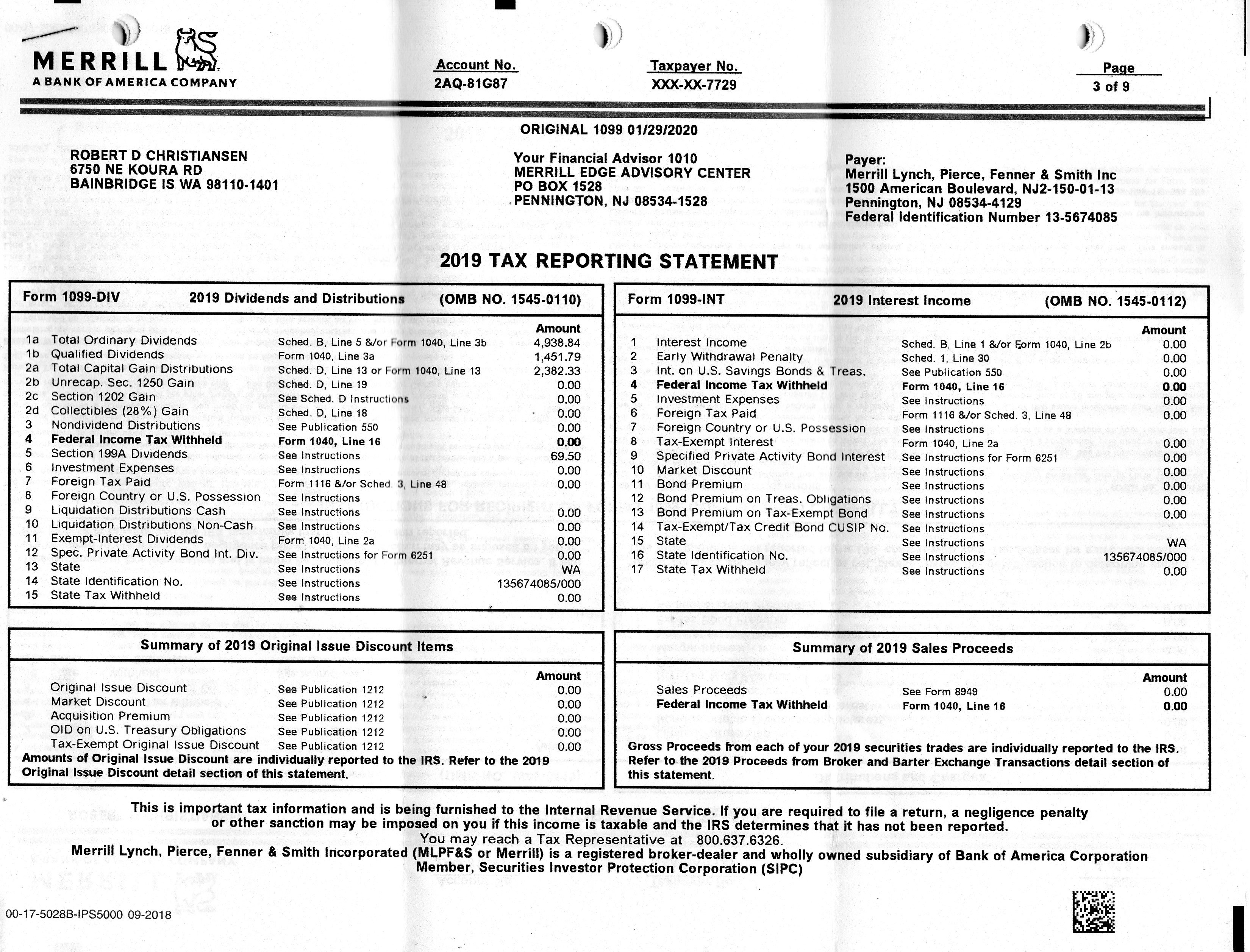

Merrill Lynch 1099 Form Online - Please check with merrill lynch to see if the forms are available. Web go paperless check on your statements, tax documents and other notices online without risking exposure to the mail system learn more about paperless transfer funds or. Once registered, you will be notified via email when your tax. Learn more about our firm's background on finra's brokercheck layer. Online access guides for 401(k). Web what is the merrill lynch tax reporting statement? United states (english) united states (spanish) canada (english) canada (french) tax bracket. Web your merrill 2019 tax reporting statement (form 1099) is designed to make it easier for you or your tax advisor to prepare your tax return. Web benefits online® retirement and benefit services provided by merrill. Web if your account is through merrill lynch, charles schwab, fidelity, etc.), you will need to contact that firm for information on the delivery of any materials.

I pulled from my 401k for an emergency in oct 2020 and trying to file my taxes. Web today is feb. I keep getting asked for this form and. Web online delivery register via mymerrill® or merrill edge® websites to receive your tax statements online. Web your merrill 2019 tax reporting statement (form 1099) is designed to make it easier for you or your tax advisor to prepare your tax return. Web forms 1099 from anyone for whom you performed work on a contract basis investment income1 documentation of your contribution to an individual retirement account (ira) —. As a merrill lynch client, you may receive a consolidated 1099 tax reporting statement that summarizes your account. United states (english) united states (spanish) canada (english) canada (french) tax bracket. Online access guides for 401(k). Web go paperless check on your statements, tax documents and other notices online without risking exposure to the mail system learn more about paperless transfer funds or.

Web go paperless check on your statements, tax documents and other notices online without risking exposure to the mail system learn more about paperless transfer funds or. United states (english) united states (spanish) canada (english) canada (french) tax bracket. Simply answer a few question to instantly download, print & share your form. Web benefits online® retirement and benefit services provided by merrill. Web if your account is through merrill lynch, charles schwab, fidelity, etc.), you will need to contact that firm for information on the delivery of any materials. Online access guides for 401(k). Web as a merrill client, there are a few ways to get in touch with us. Web anyone know how to find a 1099 r form from merrill lynch? Please check with merrill lynch to see if the forms are available. Web this form enables you to begin the process of initiating distributions from your merrill lynch individual retirement account (ira), rollover ira (irra ® ), roth ira, simplified.

Florida 1099 Form Online Universal Network

Web anyone know how to find a 1099 r form from merrill lynch? Learn more about our firm's background on finra's brokercheck layer. Contact us by phone or log in to your mymerrill or benefits online account to get answers to your questions and. Web today is feb. Online access guides for 401(k).

America's 1 Residual System American Bill Money 1099s from

As a merrill lynch client, you may receive a consolidated 1099 tax reporting statement that summarizes your account. Web what is the merrill lynch tax reporting statement? Online access guides for 401(k). Web online delivery register via mymerrill® or merrill edge® websites to receive your tax statements online. Click the “help” tab at the top of the screen once you.

Free Printable 1099 Misc Forms Free Printable

Web anyone know how to find a 1099 r form from merrill lynch? Please check with merrill lynch to see if the forms are available. Web merrill lynch 1099's are available on line; Click the “help” tab at the top of the screen once you log in. Simply answer a few question to instantly download, print & share your form.

tax 2019

Web forms 1099 from anyone for whom you performed work on a contract basis investment income1 documentation of your contribution to an individual retirement account (ira) —. Web your merrill 2019 tax reporting statement (form 1099) is designed to make it easier for you or your tax advisor to prepare your tax return. Simply answer a few question to instantly.

I Got Two 1099 R Forms Which Do I Use

Web this form enables you to begin the process of initiating distributions from your merrill lynch individual retirement account (ira), rollover ira (irra ® ), roth ira, simplified. United states (english) united states (spanish) canada (english) canada (french) tax bracket. Click the “help” tab at the top of the screen once you log in. Web go paperless check on your.

tax 2019

Includes cash/margin debit balances and. Please check with merrill lynch to see if the forms are available. Web what is the merrill lynch tax reporting statement? Web as a merrill client, there are a few ways to get in touch with us. Web your merrill 2019 tax reporting statement (form 1099) is designed to make it easier for you or.

Form1099NEC

If you are not sure, we. As a merrill lynch client, you may receive a consolidated 1099 tax reporting statement that summarizes your account. Contact us by phone or log in to your mymerrill or benefits online account to get answers to your questions and. Web anyone know how to find a 1099 r form from merrill lynch? Web your.

Efile 2022 Form 1099R Report the Distributions from Pensions

Please check with merrill lynch to see if the forms are available. Web merrill lynch 1099's are available on line; Web benefits online® retirement and benefit services provided by merrill. Takes 5 minutes or less to complete. Web as a merrill client, there are a few ways to get in touch with us.

1099 Form Independent Contractor Pdf 1099 Tax Form Fill Online

I pulled from my 401k for an emergency in oct 2020 and trying to file my taxes. I keep getting asked for this form and. Simply answer a few question to instantly download, print & share your form. Web online delivery register via mymerrill® or merrill edge® websites to receive your tax statements online. Once registered, you will be notified.

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

United states (english) united states (spanish) canada (english) canada (french) tax bracket. Web as a merrill client, there are a few ways to get in touch with us. If you are not sure, we. Please check with merrill lynch to see if the forms are available. Web go paperless check on your statements, tax documents and other notices online without.

Web As A Merrill Client, There Are A Few Ways To Get In Touch With Us.

Once registered, you will be notified via email when your tax. Web forms 1099 from anyone for whom you performed work on a contract basis investment income1 documentation of your contribution to an individual retirement account (ira) —. Web today is feb. Web benefits online® retirement and benefit services provided by merrill.

Includes Cash/Margin Debit Balances And.

I pulled from my 401k for an emergency in oct 2020 and trying to file my taxes. Web questions about mymerril.com? Please check with merrill lynch to see if the forms are available. Learn more about our firm's background on finra's brokercheck layer.

If You Are Not Sure, We.

Web what is the merrill lynch tax reporting statement? Takes 5 minutes or less to complete. Contact us by phone or log in to your mymerrill or benefits online account to get answers to your questions and. Web go paperless check on your statements, tax documents and other notices online without risking exposure to the mail system learn more about paperless transfer funds or.

I Keep Getting Asked For This Form And.

As a merrill lynch client, you may receive a consolidated 1099 tax reporting statement that summarizes your account. Online access guides for 401(k). Click the “help” tab at the top of the screen once you log in. Web your merrill 2019 tax reporting statement (form 1099) is designed to make it easier for you or your tax advisor to prepare your tax return.