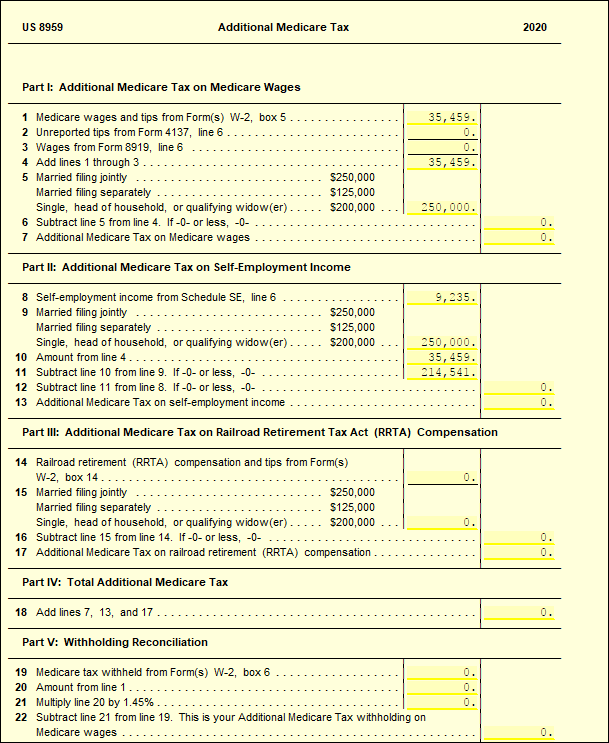

Medicare Tax Form 8959

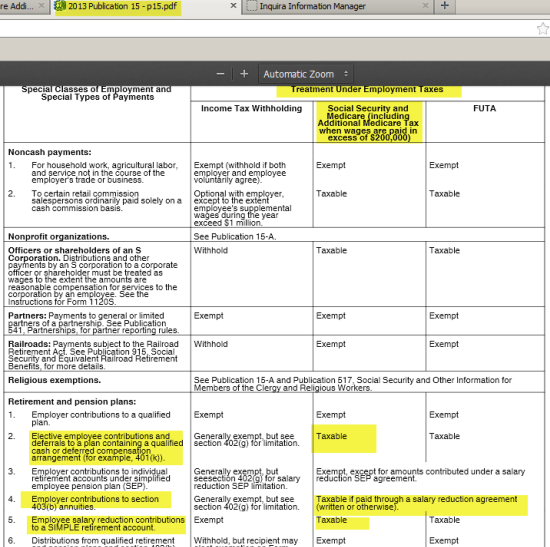

Medicare Tax Form 8959 - Form 8959, additional medicare tax, is used to figure the additional 0.9% percent. Web employer's quarterly federal tax return. This document(s) is required and must. Web file your taxes for free. Web form 8959 calculates additional medicare tax on earned income that exceeds certain thresholds, based on filing status. Starting in tax year 2022 the qualified widow (er) filing status has been renamed to. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Threshold amounts for additional medicare tax.

Register and subscribe now to work on your irs form 8959 & more fillable forms. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Threshold amounts for additional medicare tax. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web what is form 8959? Web form 8959 calculates additional medicare tax on earned income that exceeds certain thresholds, based on filing status. Web file your taxes for free. Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. The additional tax of.9% flows to 1040, page 2 as an. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.

Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web form 8959 calculates additional medicare tax on earned income that exceeds certain thresholds, based on filing status. Web what is irs form 8959? Who must pay the additional medicare tax? Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web what is form 8959? Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Complete, edit or print tax forms instantly. Ask your provider for an itemized receipt, which provides proof of the care received.

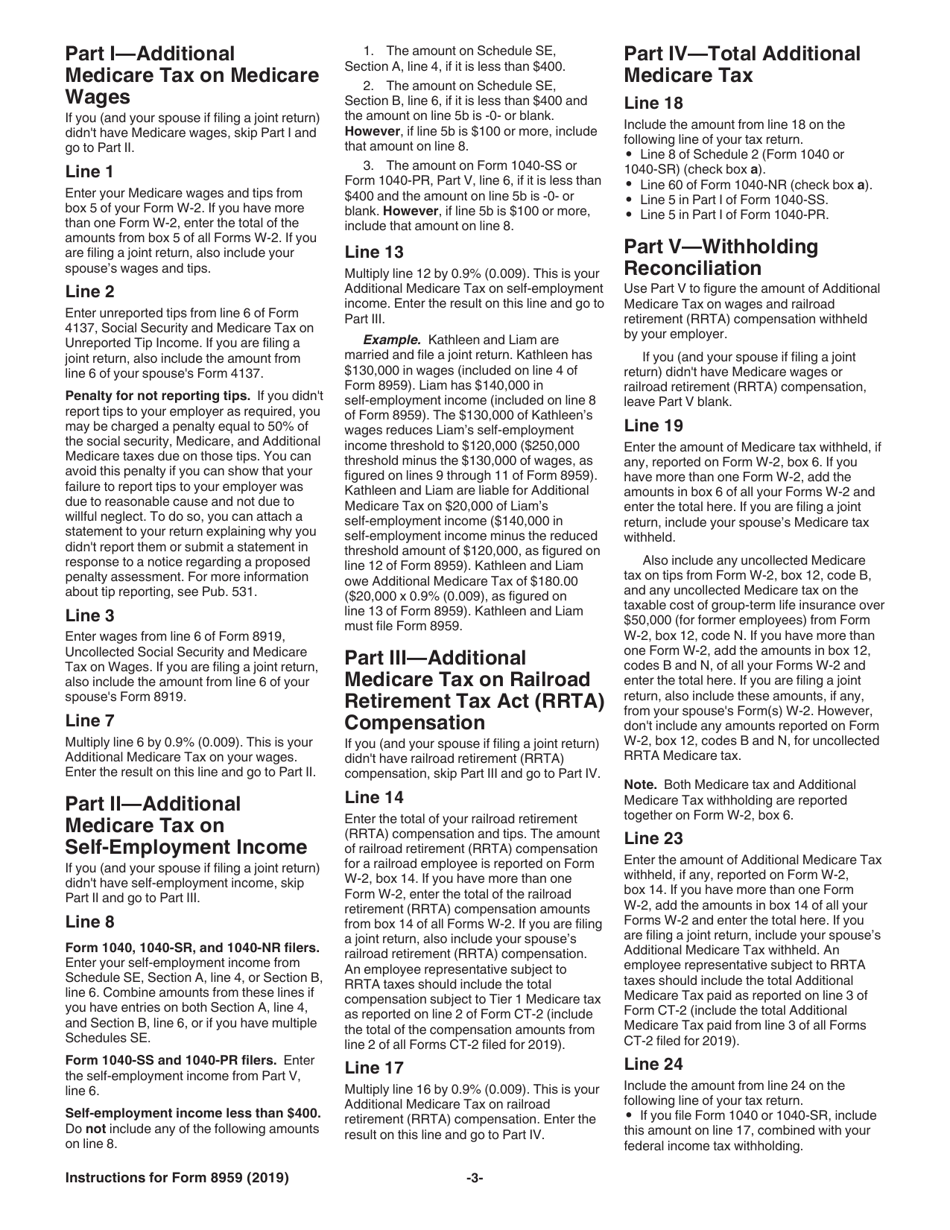

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Who must file irs form. You will carry the amounts to. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web what is form 8959? Form 8959, additional medicare tax, is used to figure the additional 0.9% percent.

8959 Additional Medicare Tax UltimateTax Solution Center

Web what is irs form 8959? Web form 8959 is used to calculate the amount of additional medicare tax owed and the amount of additional medicare tax withheld by a taxpayer’s employer, if any. Web form 8959 calculates additional medicare tax on earned income that exceeds certain thresholds, based on filing status. Web employer's quarterly federal tax return. Web what.

Form 8959 Additional Medicare Tax (2014) Free Download

You will carry the amounts to. What is the earnings threshold for the additional medicare tax? Web if you qualify for medicare, but didn’t sign up when you first became eligible, you have a limited time to sign up after losing medicaid without paying a late enrollment penalty. Starting in tax year 2022 the qualified widow (er) filing status has.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Who must pay the additional medicare tax? Web department of the treasury internal revenue service additional medicare tax if any line does not apply to you, leave it blank. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web what is irs.

How to Complete IRS Form 8959 Additional Medicare Tax YouTube

Web what is form 8959? Web download this form print this form more about the federal form 8959 other ty 2022 we last updated the additional medicare tax in december 2022, so this is the latest. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Solved•by turbotax•869•updated january 13, 2023. Web form 8959.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Complete, edit or print tax forms instantly. Register and subscribe now to work on your irs form 8959 & more fillable forms. This document(s) is required and must. Web download this form print this form more about the federal form 8959 other ty 2022 we last updated the additional medicare tax in december 2022, so this is the latest. Solved•by.

1099 Misc Fillable Form Free amulette

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Complete, edit or print tax forms instantly. What is the earnings threshold for the additional medicare tax? You will carry the amounts to. Complete, edit or print tax forms instantly.

Additional Medicare Tax for 200000 and Ab... Intuit

Complete, edit or print tax forms instantly. Web employer's quarterly federal tax return. The additional tax of.9% flows to 1040, page 2 as an. Ask your provider for an itemized receipt, which provides proof of the care received. Web attach itemized receipt(s) from your healthcare provider.

Form 8959 Additional Medicare Tax (2014) Free Download

The additional tax of.9% flows to 1040, page 2 as an. Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Web attach itemized receipt(s) from your healthcare provider. Web use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer,.

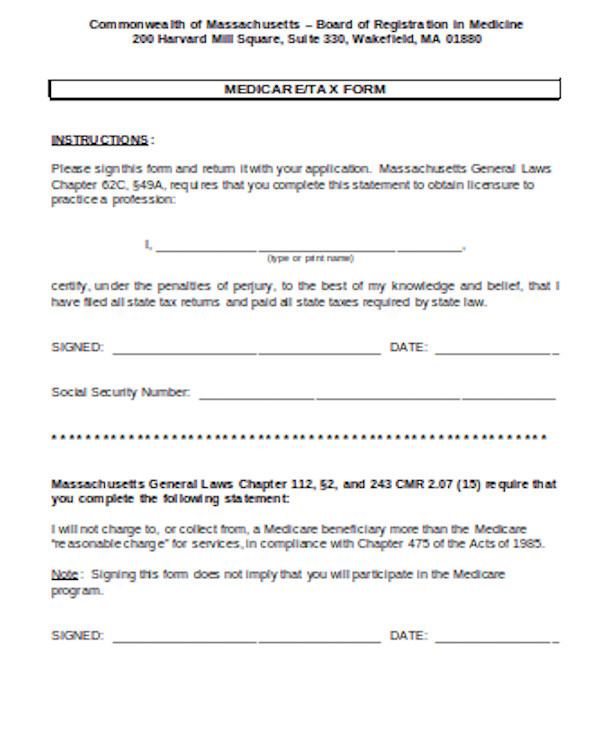

FREE 22+ Sample Tax Forms in PDF Excel MS Word

Web download this form print this form more about the federal form 8959 other ty 2022 we last updated the additional medicare tax in december 2022, so this is the latest. Web what is irs form 8959? Web instructions for form 8959: Web file your taxes for free. Ad register and subscribe now to work on your irs form 8959.

Web Employer's Quarterly Federal Tax Return.

Web file your taxes for free. Solved•by turbotax•869•updated january 13, 2023. Web form 8959 calculates additional medicare tax on earned income that exceeds certain thresholds, based on filing status. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.

Complete, Edit Or Print Tax Forms Instantly.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web attach itemized receipt(s) from your healthcare provider. What is the earnings threshold for the additional medicare tax? The additional tax of.9% flows to 1040, page 2 as an.

Web Form 8959 Department Of The Treasury Internal Revenue Service Additional Medicare Tax A If Any Line Does Not Apply To You, Leave It Blank.

Web if you qualify for medicare, but didn’t sign up when you first became eligible, you have a limited time to sign up after losing medicaid without paying a late enrollment penalty. Register and subscribe now to work on your irs form 8959 & more fillable forms. This document(s) is required and must. Ask your provider for an itemized receipt, which provides proof of the care received.

Web Form 8959 Is Used To Calculate The Amount Of Additional Medicare Tax Owed And The Amount Of Additional Medicare Tax Withheld By A Taxpayer’s Employer, If Any.

Ad register and subscribe now to work on your irs form 8959 & more fillable forms. Starting in tax year 2022 the qualified widow (er) filing status has been renamed to. Web what is form 8959? You will carry the amounts to.