Md State Withholding Form

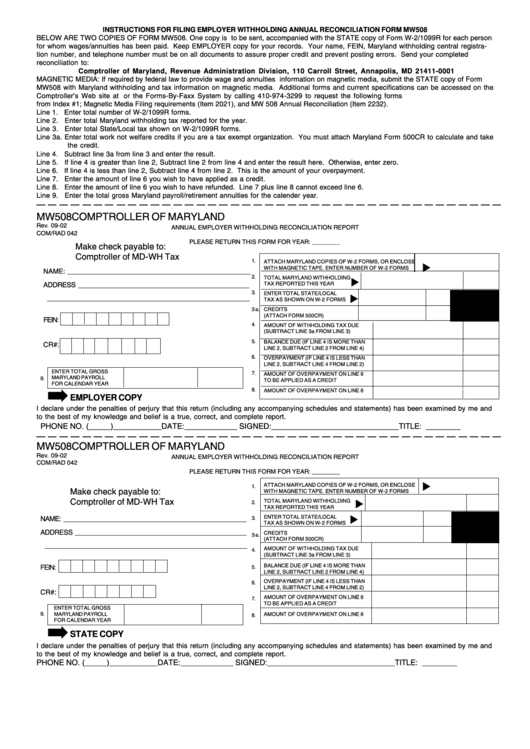

Md State Withholding Form - Web maryland return of income tax withholding for nonresident sale of real property: Withholding exemption certificate/employee address update. For maryland state government employees only. Web form used by employers to amend their employer withholding reports. Retirement use only form 766 (rev. Payees may request that federal and maryland state taxes be withheld from their retirement allowance. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. If you have previously filed as “exempt”. The retirement agency does not withhold. You can log into your account here:

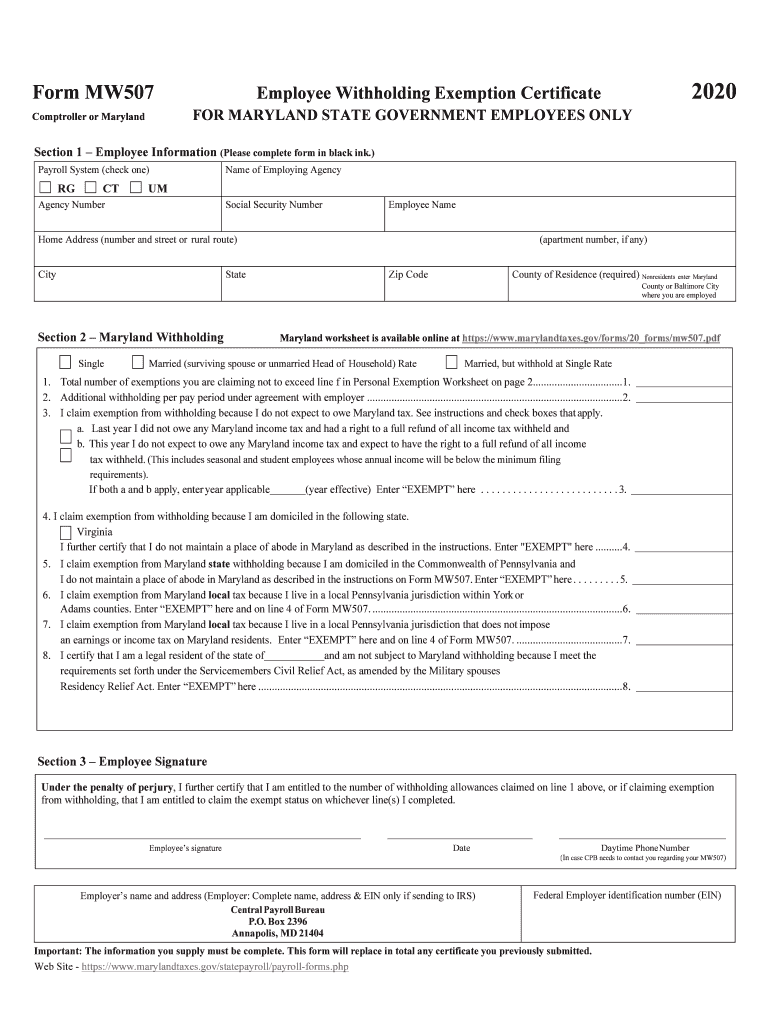

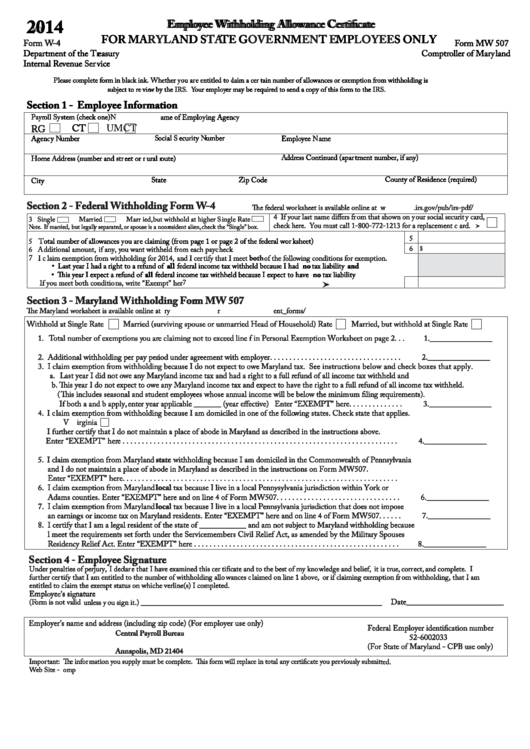

Web an employee who is required to file a withholding exemption certificate shall file with the employer a form mw 507 or other approved form. For maryland state government employees only. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Government of the district of. Web of maryland, can withhold federal and state income tax from your pay. Web this is the fastest and most secure method to update your maryland state tax withholding. Web 7 rows employee's maryland withholding exemption certificate. Web federal and maryland state tax withholding request. If you have previously filed as “exempt”. Payees may request that federal and maryland state taxes be withheld from their retirement allowance.

Your current certificate remains in effect until you change it. Web 7 rows employee's maryland withholding exemption certificate. Payees may request that federal and maryland state taxes be withheld from their retirement allowance. If you have previously filed as “exempt”. Web form used by employers to amend their employer withholding reports. The retirement agency does not withhold. Form used to determine the amount of income tax withholding due on the sale of property. Government of the district of. Web an employee who is required to file a withholding exemption certificate shall file with the employer a form mw 507 or other approved form. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil.

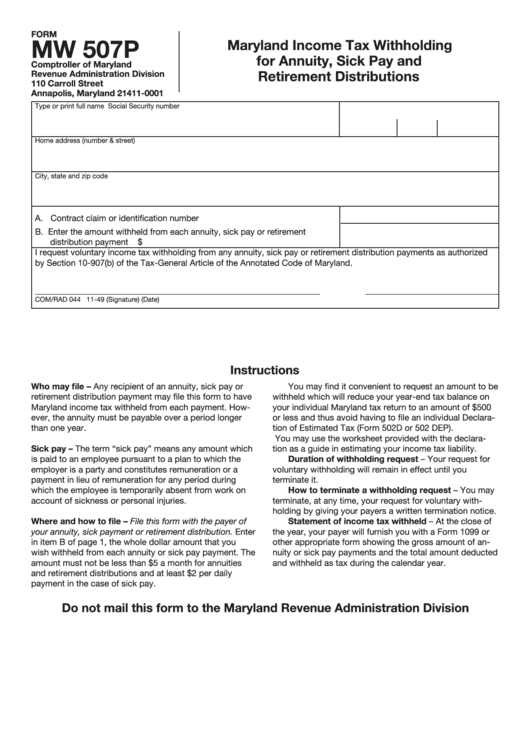

Fillable Form Mw 507p Maryland Tax Withholding For Annuity

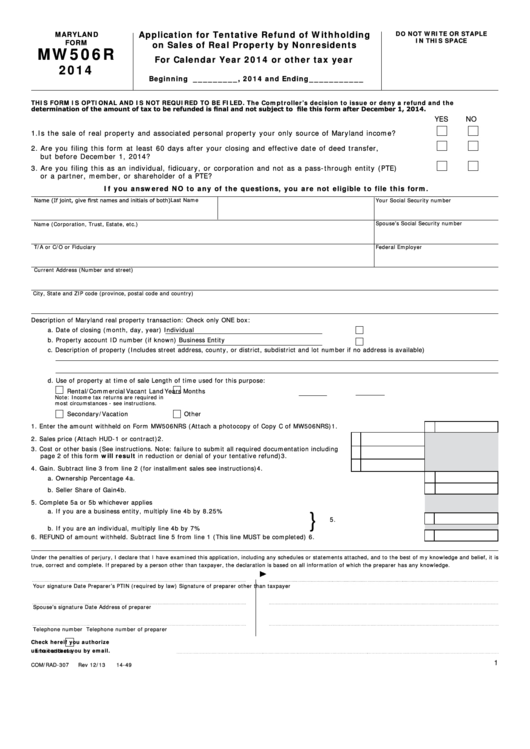

Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Web federal and maryland state tax withholding request. Government of the district of. Form used to determine the amount of income tax withholding due on the sale of property. For maryland state government employees only.

Md State Tax Withholding Form

I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Your current certificate remains in effect until you change it. If you have previously filed as “exempt”. Web 7 rows employee's maryland withholding exemption certificate. Withholding exemption certificate/employee address update.

20202022 Form MD BCPS Employee Combined Withholding Allowance

Retirement use only form 766 (rev. Web 11 rows federal withholding/employee address update. Government of the district of. 1/15) you must file one combined form covering both your. Web 7 rows employee's maryland withholding exemption certificate.

Fillable Maryland Form Mw506r Application For Tentative Refund Of

For maryland state government employees only. Retirement use only form 766 (rev. Md mw507 (2023) md mw507 (2023) instructions. You can log into your account here: Web 7 rows employee's maryland withholding exemption certificate.

Maryland Withholding

Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. Retirement use only form 766 (rev. The request for mail order forms may be used to order one copy or. Md mw507 (2023) md mw507 (2023) instructions. Web 11 rows federal withholding/employee address update.

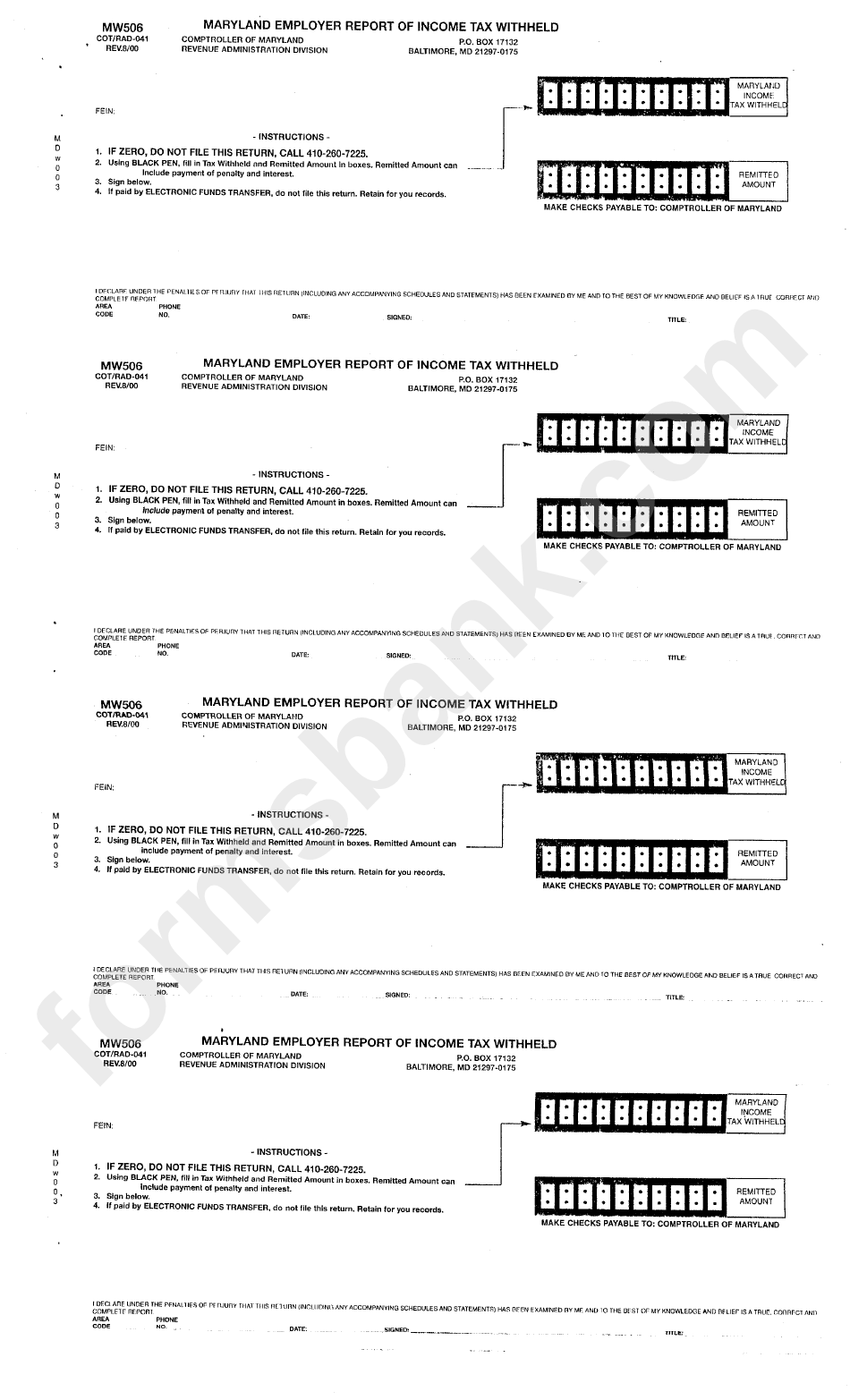

Form Mw506 Maryland Employer Report Of Tax Withheld printable

I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web 11 rows federal withholding/employee address update. The retirement agency does not withhold. Web federal and maryland state tax withholding request. Web the law requires that you complete an employee’s withholding.

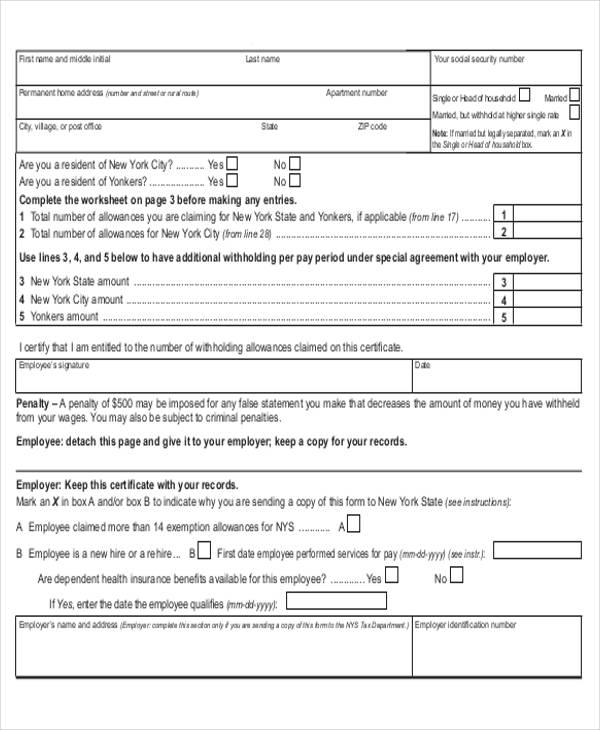

Fillable Form W4 (Form Mw 507) Employee Withholding Allowance

The request for mail order forms may be used to order one copy or. Payees may request that federal and maryland state taxes be withheld from their retirement allowance. The retirement agency does not withhold. 1/15) you must file one combined form covering both your. Web maryland's withholding requirements for sales or transfers of real property and associated personal property.

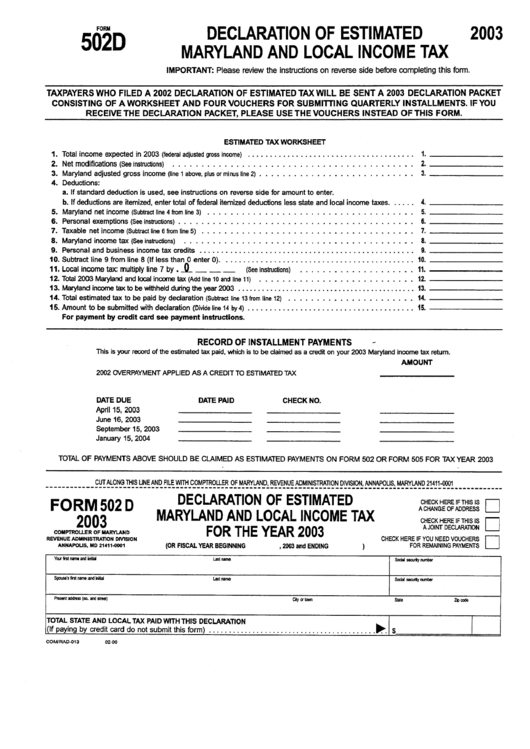

Form 502d Declaration Of Estimated Maryland And Lockal Tax

Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold federal and state income tax. Md mw507 (2023) md mw507 (2023) instructions. You can log into your account here: Withholding exemption certificate/employee address update. I certify that i am a legal resident of thestate of and am not.

Employee's Maryland Withholding Exemption Certificate

Web 7 rows employee's maryland withholding exemption certificate. Payees may request that federal and maryland state taxes be withheld from their retirement allowance. Web of maryland, can withhold federal and state income tax from your pay. Government of the district of. Web the law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of.

Maryland Employer Tax Withholding 2021 Federal Withholding Tables 2021

If you have previously filed as “exempt”. Web maryland's withholding requirements for sales or transfers of real property and associated personal property by nonresidents instructions for nonresidents who are. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web 7.

Web Federal And Maryland State Tax Withholding Request.

Web maryland return of income tax withholding for nonresident sale of real property: Government of the district of. Md mw507 (2023) md mw507 (2023) instructions. Withholding exemption certificate/employee address update.

Web Maryland's Withholding Requirements For Sales Or Transfers Of Real Property And Associated Personal Property By Nonresidents Instructions For Nonresidents Who Are.

For maryland state government employees only. Web 7 rows employee's maryland withholding exemption certificate. Web click here for a complete list of current city and local counties' tax rate. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil.

Web An Employee Who Is Required To File A Withholding Exemption Certificate Shall File With The Employer A Form Mw 507 Or Other Approved Form.

You can log into your account here: Web 11 rows federal withholding/employee address update. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Form used to determine the amount of income tax withholding due on the sale of property.

The Request For Mail Order Forms May Be Used To Order One Copy Or.

Payees may request that federal and maryland state taxes be withheld from their retirement allowance. Your current certificate remains in effect until you change it. ) bill pay ( make. Web this is the fastest and most secure method to update your maryland state tax withholding.