Md Form 505 Instructions 2022

Md Form 505 Instructions 2022 - Multiply line 13 by.0125 (1.25%). Return taxpayer who moved into or out. Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return. From to check here for maryland taxes withheld in error. Web more about the maryland form pv individual income tax estimated ty 2022 the form pv is a payment voucher you will send with your check or money order for any balance due. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web download or print the 2022 maryland form 505nr (nonresident income tax computation) for free from the maryland comptroller of maryland. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web use a maryland form 505 2022 template to make your document workflow more streamlined.

Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Sign it in a few clicks draw your signature, type. Return taxpayer who moved into or out. For returns filed without payments, mail your completed return to: Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web multiply line 14 by line 15 to arrive at your maryland tax. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Multiply line 13 by.0125 (1.25%). Web more about the maryland form pv individual income tax estimated ty 2022 the form pv is a payment voucher you will send with your check or money order for any balance due. Web use a maryland form 505 2022 template to make your document workflow more streamlined.

Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web resident dates you resided in maryland for 2021. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. Web more about the maryland form 505x individual income tax nonresident ty 2022 generally, form 505x must be filed within three years from the date the original return. Web download or print the 2022 maryland form 505nr (nonresident income tax computation) for free from the maryland comptroller of maryland. Edit your 505 maryland form online type text, add images, blackout confidential details, add comments, highlights and more. From to check here for maryland taxes withheld in error. Show details we are not affiliated with any brand or entity on this form. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return. From to check here for maryland taxes withheld in error. Web more about the maryland form 505x individual income tax nonresident ty 2022 generally, form 505x.

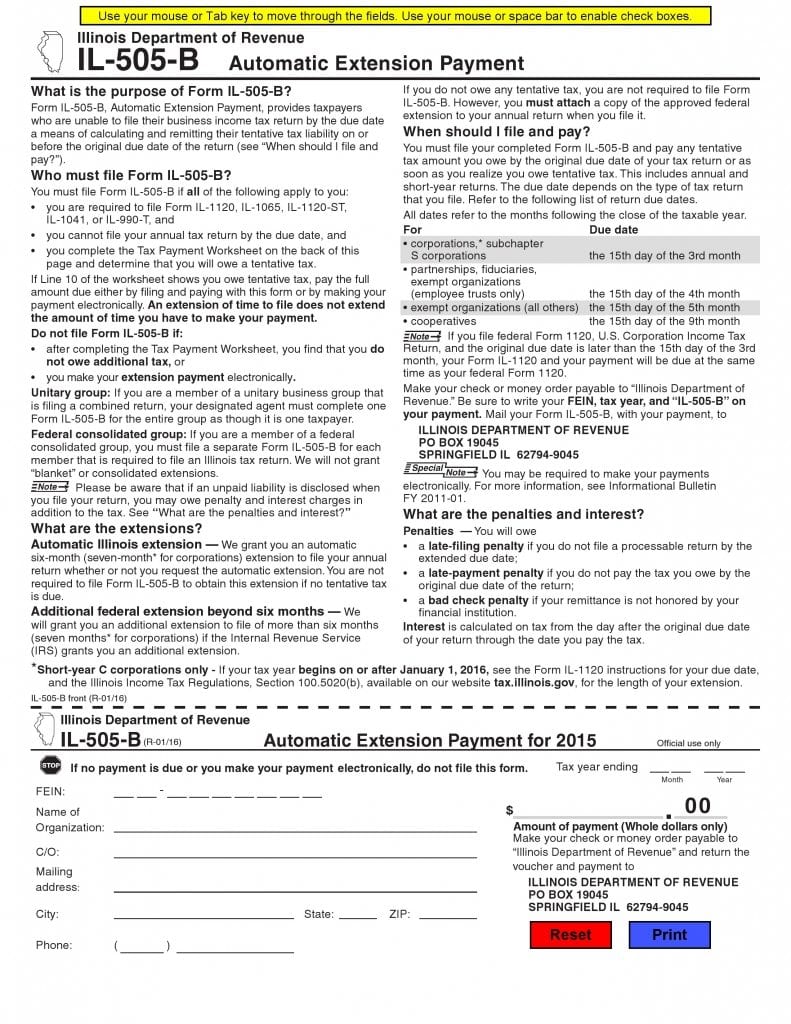

Free Automatic Extension Payment Form IL505B PDF Template Form

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. This form is for income earned in tax year 2022, with tax returns due in april. 2022 business income tax forms popular. Web maryland tax, you must also file form 505..

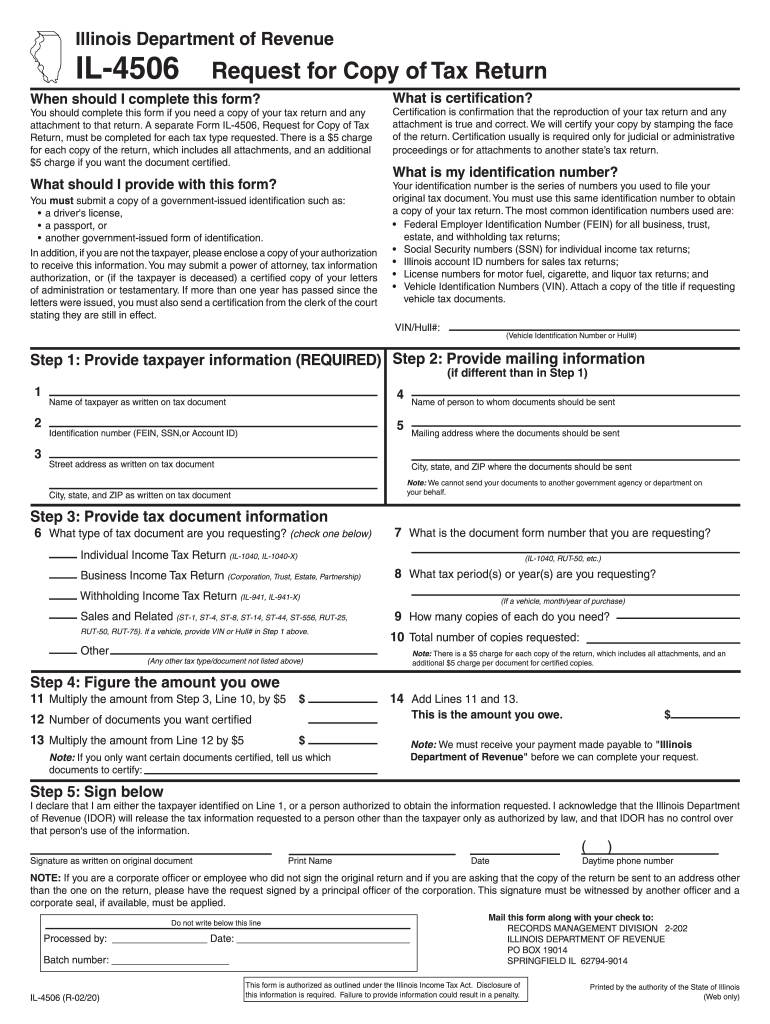

Illinois Dept Of Revenue Forms Fill Out and Sign Printable PDF

Enter this amount on line 16 and on form 505, line 32a. Web opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Web form 505nr maryland 2022 form 505nr nonresident.

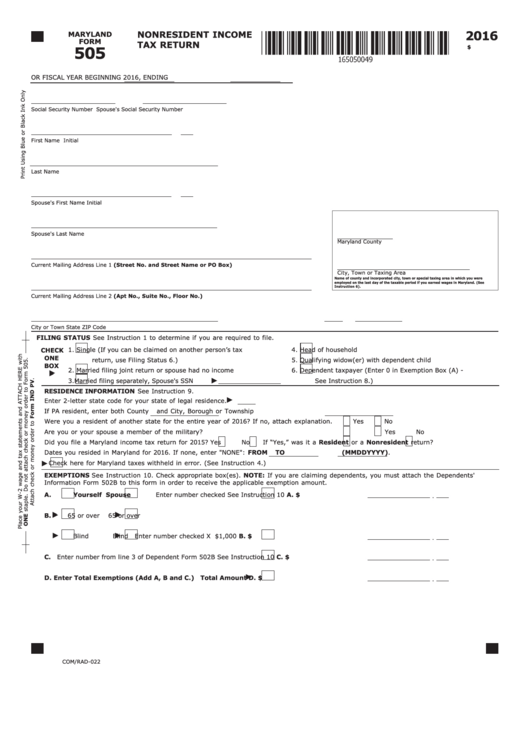

Fillable Maryland Form 505 Nonresident Tax Return 2016

Web use a maryland form 505 2022 template to make your document workflow more streamlined. Sign it in a few clicks draw your signature, type. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web maryland tax, you must also file form 505. Web use this screen to enter residency information.

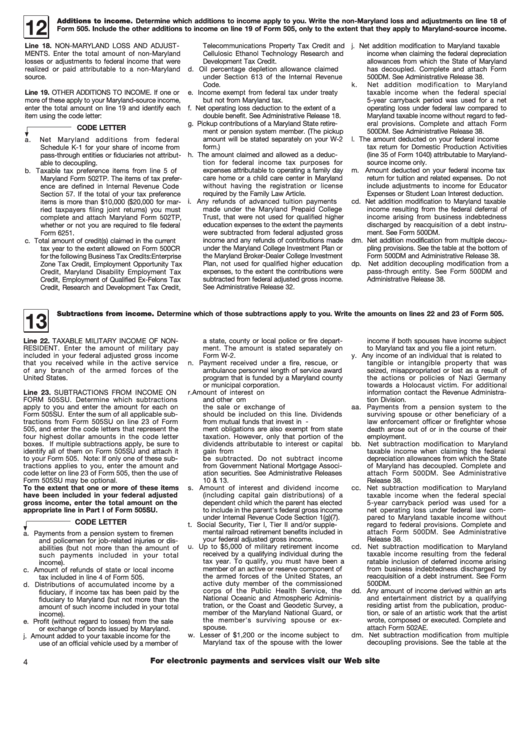

Instruction For Form 505 Maryland Nonresident Tax Return

Web we last updated maryland form 505nr in january 2023 from the maryland comptroller of maryland. Web more about the maryland form pv individual income tax estimated ty 2022 the form pv is a payment voucher you will send with your check or money order for any balance due. Web we last updated maryland form 505 in january 2023 from.

Fill Free fillable forms Comptroller of Maryland

Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return. Web resident dates you resided in maryland for 2021. Enter this amount on line. For returns filed without payments, mail your completed return to: Web more.

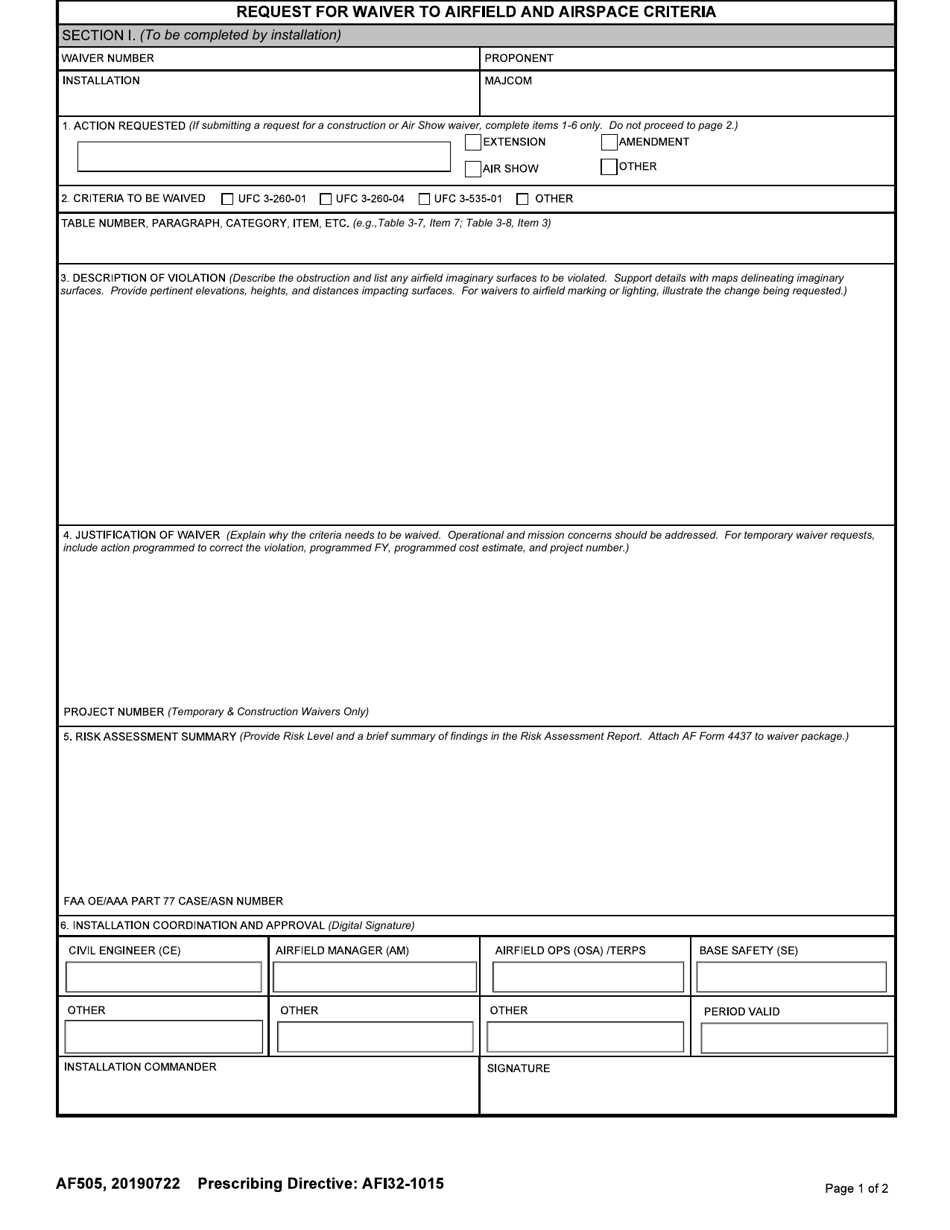

AF Form 505 Download Fillable PDF or Fill Online Request for Waiver to

When we resume our normal. For returns filed without payments, mail your completed return to: Multiply line 13 by.0125 (1.25%). Web maryland tax, you must also file form 505. Enter this amount on line 16 and on form 505, line 32a.

If you are a nonresident, you must file Form 505 and Form 505NR.

Web more about the maryland form 505x individual income tax nonresident ty 2022 generally, form 505x must be filed within three years from the date the original return. Enter this amount on line 16 and on form 505, line 32a. Web resident dates you resided in maryland for 2021. Web payment voucher with instructions and worksheet for individuals sending check.

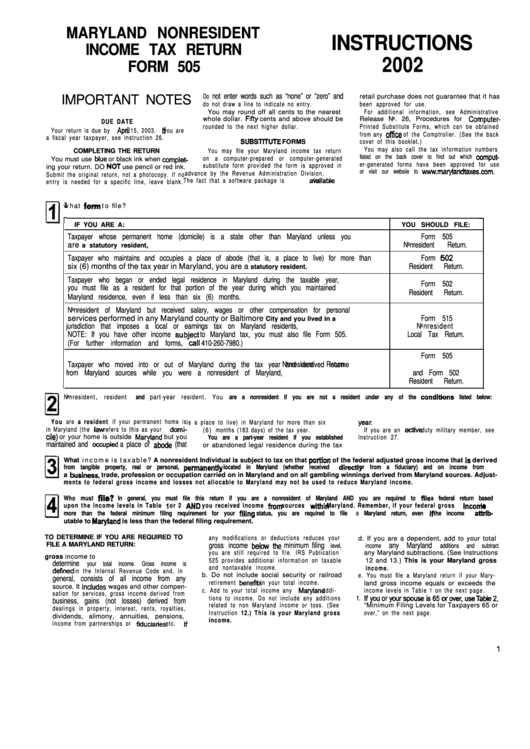

Instructions For Maryland Nonresident Tax Return Form 505 2002

Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april. Web multiply line 14 by line 15 to arrive at your maryland tax. Web use this screen to enter residency information for maryland forms 502 and 505, and.

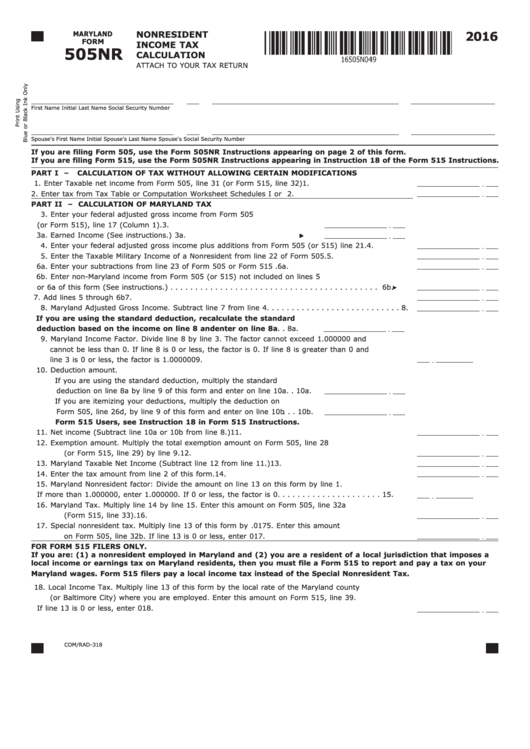

Fillable Nonresident Tax Calculation Maryland Form 505nr

Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Show details we are not affiliated with any brand or entity on this form. Web multiply line 14 by line 15 to arrive at your maryland tax. Edit your 505 maryland form online type text, add.

Enter This Amount On Line 16 And On Form 505, Line 32A.

Web opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. Enter this amount on line. Web we last updated maryland form 505 in january 2023 from the maryland comptroller of maryland. For returns filed without payments, mail your completed return to:

When We Resume Our Normal.

From to check here for maryland taxes withheld in error. This form is for income earned in tax year 2022, with tax returns due in. Edit your 505 maryland form online type text, add images, blackout confidential details, add comments, highlights and more. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or.

Web We Last Updated The Maryland Nonresident Income Tax Return In January 2023, So This Is The Latest Version Of Form 505, Fully Updated For Tax Year 2022.

This form is for income earned in tax year 2022, with tax returns due in april. Web use this screen to enter residency information for maryland forms 502 and 505, and also enter nonresident additions and subtractions for form 505su. Web more about the maryland form 505x individual income tax nonresident ty 2022 generally, form 505x must be filed within three years from the date the original return. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax.

Show Details We Are Not Affiliated With Any Brand Or Entity On This Form.

Sign it in a few clicks draw your signature, type. Web more about the maryland form pv individual income tax estimated ty 2022 the form pv is a payment voucher you will send with your check or money order for any balance due. Web form 505nr maryland 2022 form 505nr nonresident income tax calculation instructions using form 505nr, nonresident income tax. Web ing to maryland instructions for form 502, you are required to file a maryland income tax return if you are or were a maryland resident, you are required to file a federal return.