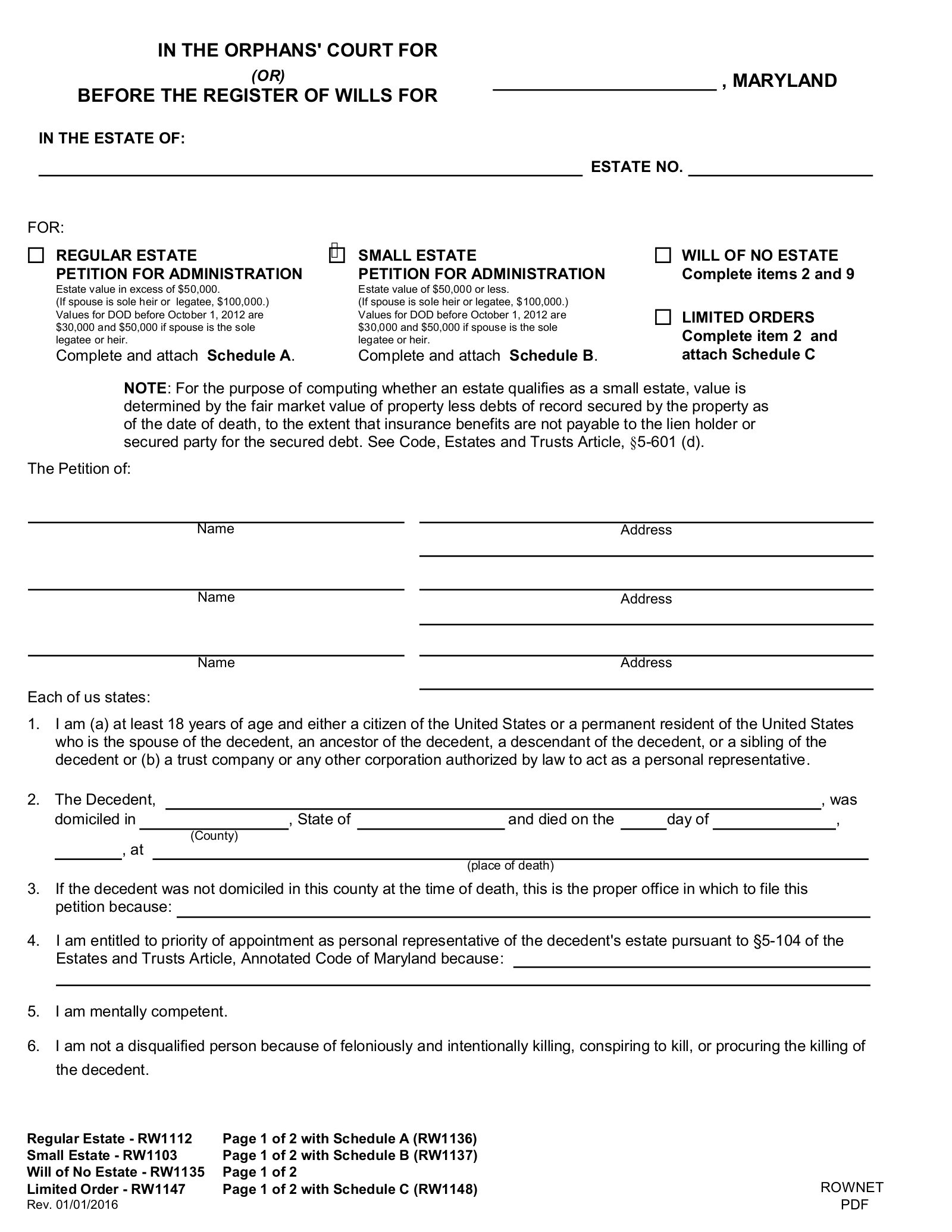

Maryland Executor Of Estate Form

Maryland Executor Of Estate Form - Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Probate fees, costs and inheritance taxes. File the return within nine (9) months after the decedent's date of death, or by the approved extension date. Web you can administer an estate even if the deceased died without a will or failed to specify an executor. Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. Web the register of wills serves as the clerk to the orphans cour t, which has jurisdiction over judicial probate, administration of estates and conduct of personal representatives. If your relationship to the deceased doesn't make you the probate court's. (p) “net estate” means the property of the decedent exclusive of the family allowance and enforceable. Web an executor, called personal representative in maryland, has an important role in the estate administration process. Web 15th september 2021 estate planning faq comments off in maryland, an executor (also known as a personal representative) plays a crucial role when it is time to.

Web an executor, called personal representative in maryland, has an important role in the estate administration process. Web of maryland under the authority of the constitution and laws of maryland. If your relationship to the deceased doesn't make you the probate court's. Web if you are the estate executor or administrator this is what you need to do: File the return within nine (9) months after the decedent's date of death, or by the approved extension date. The old rw1138 form will be accepted for a short time after july 1, 2023, when register of wills offices will begin requiring the new form. Web this form, which lists the necessary requirements for filing, may be obtained from any register of wills office in maryland. Web 15th september 2021 estate planning faq comments off in maryland, an executor (also known as a personal representative) plays a crucial role when it is time to. (p) “net estate” means the property of the decedent exclusive of the family allowance and enforceable. Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more.

If the vehicle is being sold by the executor or the administrator, the assignment of ownership section on. Web if you are the estate executor or administrator this is what you need to do: Web fiduciaries who are personal representatives of estates are subject to the maryland income tax and may have to file maryland form 504 and pay maryland fiduciary income tax. If your relationship to the deceased doesn't make you the probate court's. Web an executor, called personal representative in maryland, has an important role in the estate administration process. (p) “net estate” means the property of the decedent exclusive of the family allowance and enforceable. Locate estate planning documents if you find a will, maryland law requires that you file it with the register of wills promptly after the. Create a free legal form in minutes. Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Web funeral contract/bill approximate value of assets in the decedent's name alone title to decedent's automobiles and/or other motor vehicles names and addresses of persons.

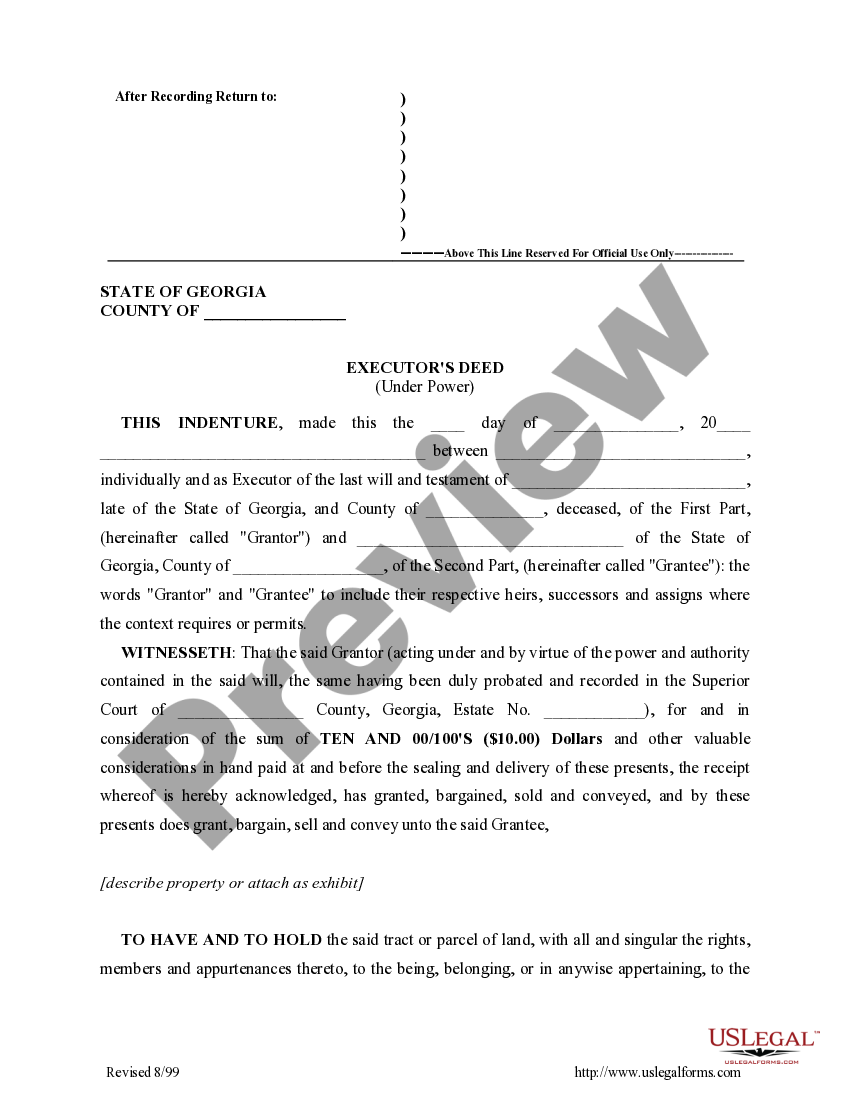

Executor's Deed Executors US Legal Forms

Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Web rw1138 will be available july 1, 2023. The old rw1138 form will be accepted for a short time after july 1, 2023, when.

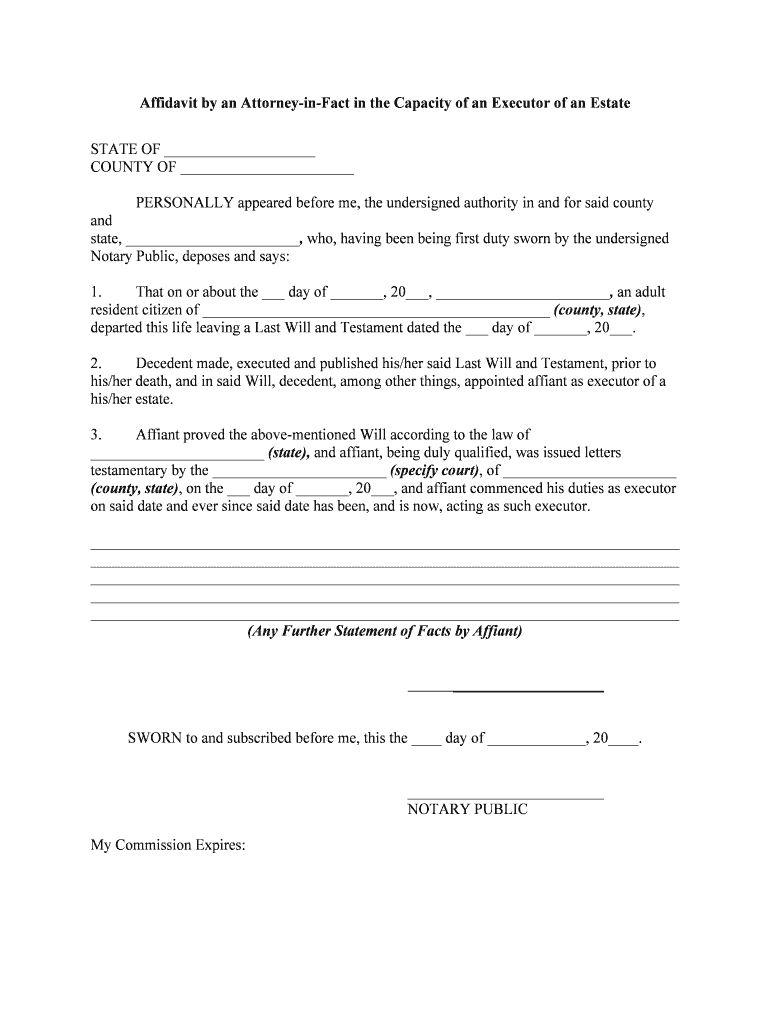

Executor Of Estate Form Fill Online, Printable, Fillable, Blank

Ad instant download and complete your probate forms, start now! Probate fees, costs and inheritance taxes. Select popular legal forms & packages of any category. Web rw1138 will be available july 1, 2023. Web if you are the estate executor or administrator this is what you need to do:

Letter Of Testamentary Form Oregon

Web if you are the estate executor or administrator this is what you need to do: Create a free legal form in minutes. Web 15th september 2021 estate planning faq comments off in maryland, an executor (also known as a personal representative) plays a crucial role when it is time to. Web an executor, called personal representative in maryland, has.

Calculating Executor Fees In Maryland

Web fiduciaries who are personal representatives of estates are subject to the maryland income tax and may have to file maryland form 504 and pay maryland fiduciary income tax. The old rw1138 form will be accepted for a short time after july 1, 2023, when register of wills offices will begin requiring the new form. Web this form, which lists.

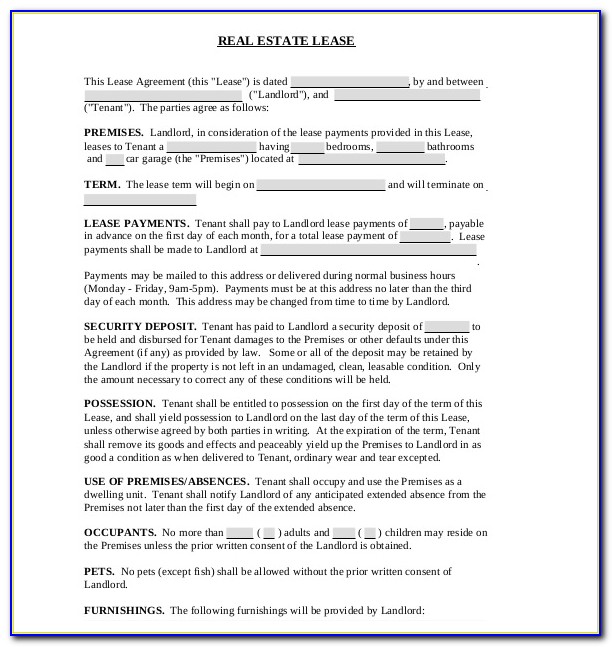

Free Printable Executor Of Estate Form Printable Form, Templates and

Create a free legal form in minutes. If the vehicle is being sold by the executor or the administrator, the assignment of ownership section on. Web of maryland under the authority of the constitution and laws of maryland. Web the executor is most often times the person responsible for making the funeral arrangements and obtaining the important documents, such as:.

Free Executor Of Estate Form Pdf Form Resume Examples R35xPPV51n

Web you can administer an estate even if the deceased died without a will or failed to specify an executor. Web this form, which lists the necessary requirements for filing, may be obtained from any register of wills office in maryland. Select popular legal forms & packages of any category. Locate estate planning documents if you find a will, maryland.

Free Maryland Small Estate Affidavit Form RW1103 PDF eForms

Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary. Ad instant download and complete your probate forms, start now! Locate estate planning documents if you find a will, maryland law requires that you.

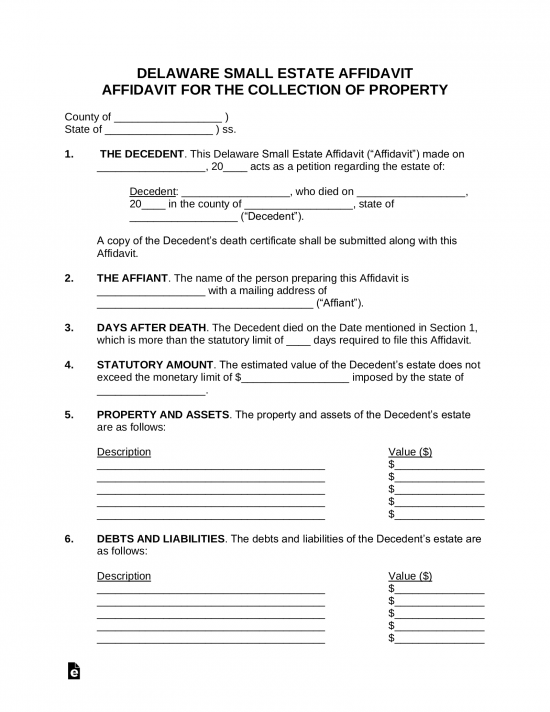

Free Delaware Small Estate Affidavit Form PDF Word eForms

Ad instant download and complete your probate forms, start now! Web the register of wills serves as the clerk to the orphans cour t, which has jurisdiction over judicial probate, administration of estates and conduct of personal representatives. If your relationship to the deceased doesn't make you the probate court's. Web the executor is most often times the person responsible.

Executor Of Estate Form Pdf Form Resume Examples EpDLGGEkxR

If your relationship to the deceased doesn't make you the probate court's. Web if you are the estate executor or administrator this is what you need to do: Web 15th september 2021 estate planning faq comments off in maryland, an executor (also known as a personal representative) plays a crucial role when it is time to. File the return within.

Executor Of Estate Template Master of Documents

Select popular legal forms & packages of any category. The old rw1138 form will be accepted for a short time after july 1, 2023, when register of wills offices will begin requiring the new form. (p) “net estate” means the property of the decedent exclusive of the family allowance and enforceable. File the return within nine (9) months after the.

Web Fiduciaries Who Are Personal Representatives Of Estates Are Subject To The Maryland Income Tax And May Have To File Maryland Form 504 And Pay Maryland Fiduciary Income Tax.

Select popular legal forms & packages of any category. If your relationship to the deceased doesn't make you the probate court's. File the return within nine (9) months after the decedent's date of death, or by the approved extension date. Web of maryland under the authority of the constitution and laws of maryland.

The Old Rw1138 Form Will Be Accepted For A Short Time After July 1, 2023, When Register Of Wills Offices Will Begin Requiring The New Form.

Web rw1138 will be available july 1, 2023. Web if you are the estate executor or administrator this is what you need to do: Web you may need to file a number of forms with the probate court, including a petition for probate and a notice of petition to administer estate, and more. Web the register of wills serves as the clerk to the orphans cour t, which has jurisdiction over judicial probate, administration of estates and conduct of personal representatives.

Web Funeral Contract/Bill Approximate Value Of Assets In The Decedent's Name Alone Title To Decedent's Automobiles And/Or Other Motor Vehicles Names And Addresses Of Persons.

Web the executor is most often times the person responsible for making the funeral arrangements and obtaining the important documents, such as: Web you can administer an estate even if the deceased died without a will or failed to specify an executor. Web 15th september 2021 estate planning faq comments off in maryland, an executor (also known as a personal representative) plays a crucial role when it is time to. Web if a person dies with a will, a petition to probate the will is filed with the probate court in the county where the deceased resided at the time of death, asking for letters testamentary.

If The Vehicle Is Being Sold By The Executor Or The Administrator, The Assignment Of Ownership Section On.

Create a free legal form in minutes. Ad instant download and complete your probate forms, start now! Probate fees, costs and inheritance taxes. (p) “net estate” means the property of the decedent exclusive of the family allowance and enforceable.