Maryland Chapter 7 Exemptions

Maryland Chapter 7 Exemptions - Web chapter 7 exemptions in maryland allow a debtor to protect separate kinds of property in bankruptcy. Pms are 1807c sorted out. Web maryland bankruptcy exemptions. The maryland bankruptcy exemptions chart, see below, details the. Web chapter 7 exemptions in maryland allow a liable to protect different kinds starting property in bankruptcy. Web chapter 7 bankruptcy is a federal court process designed to eliminate most of your debts. Web exemption, a bankruptcy attorney will be able to help you determine if other maryland exemption laws can protect the rest of your property. However, filing bankruptcy may not stop an eviction by your landlord, if the landlord has a judgment against you. Below is a list of common exemptions, but you should refer to the law for a complete list of exemptions. Chapter 7 freedoms with maryland allow a debtor to protect dissimilar kinds of.

Web in maryland, you'll use maryland's state exemptions—the federal bankruptcy exemptions aren't available (some states allow residents to choose between the two sets). Eligibility for chapter 7 bankruptcy depends on your income, family size, and the “means test.” the means test compares your income to the median income for a household of your size in maryland… (7) a notarized affidavit, sworn to under penalty of perjury, signed by all owners of the asset, and attesting to the distribution of ownership; In maryland, you can keep certain property even if you file for bankruptcy. When you file for chapter 7 bankruptcy, maryland bankruptcy law allows you to exempt certain assets from liquidation. Web maryland bankruptcy law provides exemptions in the chapter 7 process to protect some of your property. Chapter 7 freedoms with maryland allow a debtor to protect dissimilar kinds of. Maryland bankruptcy exemptions include properties and personal assets that cannot be seized or sold by. This means that you can keep. Web in chapter 7 bankruptcy, the asset which you exempt cannot be sold by bankruptcy trustee to pay off the creditors.

When you file for chapter 7 bankruptcy, maryland bankruptcy law allows you to exempt certain assets from liquidation. However, you can supplement maryland's state exemptions with the federal nonbankruptcy exemptions. Web chapter 7 exemptions in maryland allow a liable to protect different kinds starting property in bankruptcy. Maryland bankruptcy exemptions include properties and personal assets that cannot be seized or sold by. Web exemption, a bankruptcy attorney will be able to help you determine if other maryland exemption laws can protect the rest of your property. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Many families struggle with medical bills, credit cards, and other kinds of unsecured debt. Web maryland has a “cash” exemption of up to $6,000 that applies to many different kinds of property, as well as a wildcard exemption of up to $5,000. In most cases bankruptcy filers can keep their home if they’re regular on their mortgage. However, filing bankruptcy may not stop an eviction by your landlord, if the landlord has a judgment against you.

Federal, District of Columbia and Maryland Estate Tax Exemptions Incre

Web exemption, a bankruptcy attorney will be able to help you determine if other maryland exemption laws can protect the rest of your property. Chapter 7 freedoms with maryland allow a debtor to protect dissimilar kinds of. When you file for chapter 7 bankruptcy, maryland bankruptcy law allows you to exempt certain assets from liquidation. Under § 522 (b) (3).

What are the Federal Bankruptcy Exemptions? Bankruptcy Track Law Firm

Web chapter 7 bankruptcy is a federal court process designed to eliminate most of your debts. Web in maryland, you'll use maryland's state exemptions—the federal bankruptcy exemptions aren't available (some states allow residents to choose between the two sets). If you are filing for chapter 7 bankruptcy in maryland, you must use the state exemptions. Below is a list of.

Chapter 7 University of Maryland

Introduction to general financial requirements. Web maryland bankruptcy law provides exemptions in the chapter 7 process to protect some of your property. Web in maryland, you'll use maryland's state exemptions—the federal bankruptcy exemptions aren't available (some states allow residents to choose between the two sets). Eligibility for chapter 7 bankruptcy depends on your income, family size, and the “means test.”.

More About Chapter 7 Exemptions in Maryland Steiner Law Group, LLC

Below is a list of common exemptions, but you should refer to the law for a complete list of exemptions. Web in maryland, you'll use maryland's state exemptions—the federal bankruptcy exemptions aren't available (some states allow residents to choose between the two sets). Web there are two common consumer bankruptcy options and one informal bankruptcy option in maryland: (7) a.

New York Bankruptcy Exemption Michael H. Schwartz, P.C.

Web chapter 7 exemptions in maryland allow a debtor to protect separate kinds of property in bankruptcy. However, filing bankruptcy may not stop an eviction by your landlord, if the landlord has a judgment against you. Maryland bankruptcy exemptions include properties and personal assets that cannot be seized or sold by. Web chapter 7 exemptions in maryland allow a liable.

Chapter 7 Bankruptcy Exemptions The Needleman Law Office

However, you can supplement maryland's state exemptions with the federal nonbankruptcy exemptions. Chapter 7, chapter 13, and chapter 20 bankruptcy. Web in chapter 7 bankruptcy, the asset which you exempt cannot be sold by bankruptcy trustee to pay off the creditors. At the end of this article is a list of maryland exemptions. Web there are two common consumer bankruptcy.

Chapter 7 Bankruptcy Exemptions Steiner Law Group, LLC

Web people worry if they’re going to keep their property after filing for chapter 7 bankruptcy. In maryland, you can keep certain property even if you file for bankruptcy. Web what are the maryland bankruptcy exemptions? Introduction to general financial requirements. Web chapter 7 exemptions in maryland allow a debtor to protect separate kinds of property in bankruptcy.

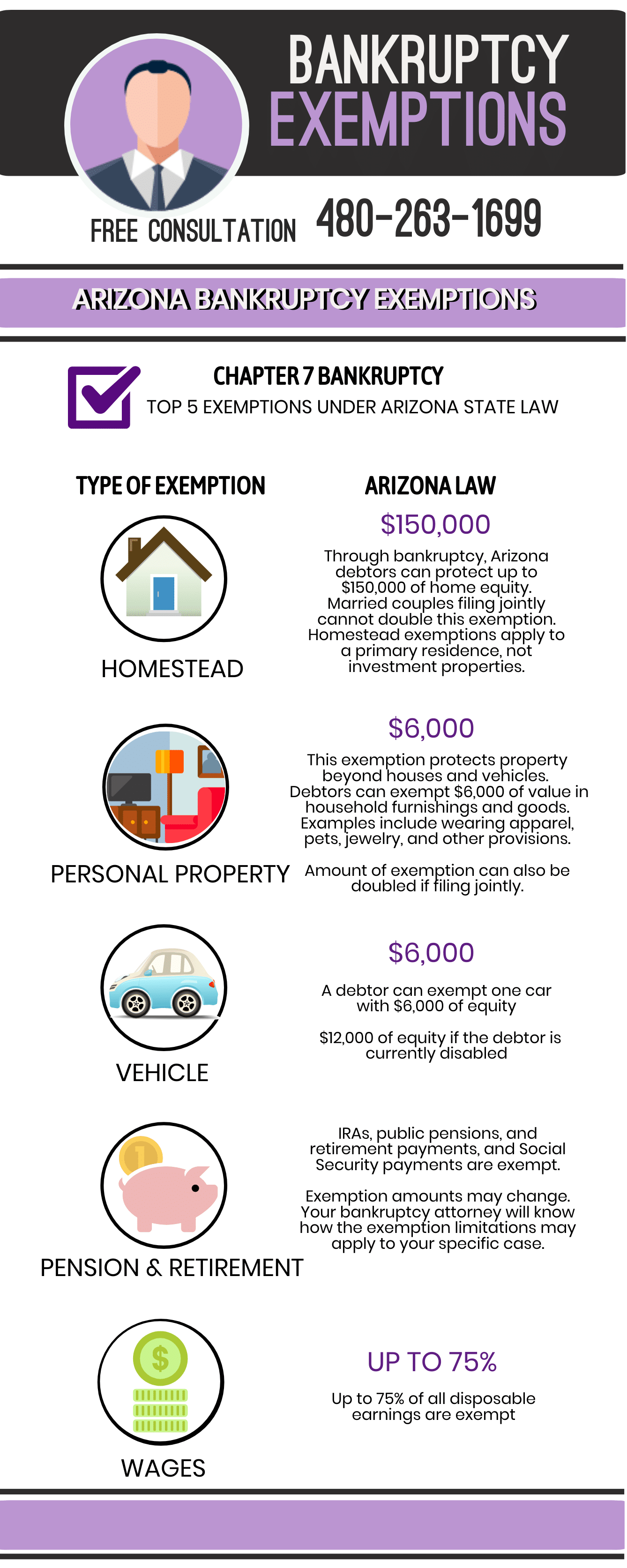

Chapter 7 Bankruptcy Exemptions in Arizona Judge Law Firm

However, filing bankruptcy may not stop an eviction by your landlord, if the landlord has a judgment against you. When you file for chapter 7 bankruptcy, maryland bankruptcy law allows you to exempt certain assets from liquidation. Web exemption, a bankruptcy attorney will be able to help you determine if other maryland exemption laws can protect the rest of your.

What Can Be Exempted in Bankruptcy Phoenix Bankruptcy Attorney

(7) a notarized affidavit, sworn to under penalty of perjury, signed by all owners of the asset, and attesting to the distribution of ownership; Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Web chapter 7 bankruptcy is a federal court process designed to eliminate most.

What Are Maryland's Bankruptcy Exemptions? Southern Maryland Law

Many families struggle with medical bills, credit cards, and other kinds of unsecured debt. Web there are two common consumer bankruptcy options and one informal bankruptcy option in maryland: The court will appoint a trustee who will arrange to liquidate all your assets, except for certain exempt… However, you can supplement maryland's state exemptions with the federal nonbankruptcy exemptions. Web.

Under § 522 (B) (3) (A) Of The Bankruptcy Code, In Order To Claim Maryland Exemptions…

However, filing bankruptcy may not stop an eviction by your landlord, if the landlord has a judgment against you. Web in chapter 7 bankruptcy, the asset which you exempt cannot be sold by bankruptcy trustee to pay off the creditors. Web there are two common consumer bankruptcy options and one informal bankruptcy option in maryland: Web chapter 7 bankruptcy is a federal court process designed to eliminate most of your debts.

Below Is A List Of Common Exemptions, But You Should Refer To The Law For A Complete List Of Exemptions.

In maryland, you can keep certain property even if you file for bankruptcy. When you file for chapter 7 bankruptcy, maryland bankruptcy law allows you to exempt certain assets from liquidation. Web people worry if they’re going to keep their property after filing for chapter 7 bankruptcy. Web what are the maryland bankruptcy exemptions?

Web In Maryland, You'll Use Maryland's State Exemptions—The Federal Bankruptcy Exemptions Aren't Available (Some States Allow Residents To Choose Between The Two Sets).

Chapter 7, chapter 13, and chapter 20 bankruptcy. At the end of this article is a list of maryland exemptions. (see maryland exemptions) the trustee sells the assets and pays you, the debtor, any. Eligibility for chapter 7 bankruptcy depends on your income, family size, and the “means test.” the means test compares your income to the median income for a household of your size in maryland…

This Property Is Called Exempt.

If you are facing an eviction, you should talk. Web maryland bankruptcy law provides exemptions in the chapter 7 process to protect some of your property. Most people who file chapter 7 in maryland can protect all their belongings with the state exemptions. Web exemption, a bankruptcy attorney will be able to help you determine if other maryland exemption laws can protect the rest of your property.