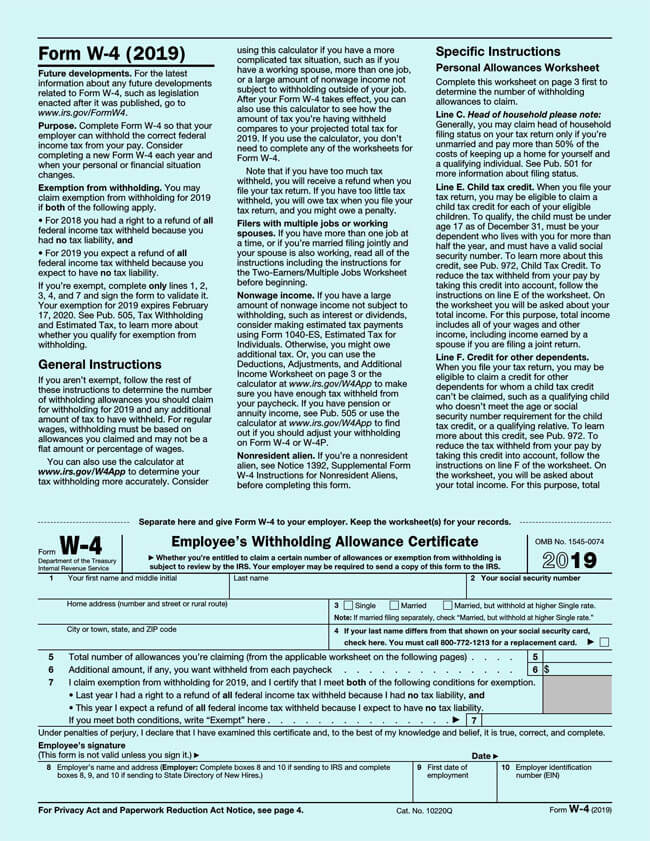

Ma W4 Form

Ma W4 Form - Web file an extension for massachusetts personal income or fiduciary tax. Irs forms, instructions and publications. Keep this certificate with your records. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Keep this certificate with your records. If too much is withheld, you will generally be due a refund. If the em ployee is believed to have claimed excessive exemp tions, the. Reconciliation of massachusetts income taxes withheld for employers. The number of exemptions claimed;

Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. The number of exemptions claimed; Reconciliation of massachusetts income taxes withheld for employers. If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised. If too much is withheld, you will generally be due a refund. Calculate withholding either by using the withholding tax tables or by using the percentage method. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Keep this certificate with your records. Keep this certificate with your records. If too much is withheld, you will generally be due a refund.

The number of exemptions claimed; Your withholding is subject to review by the irs. Irs forms, instructions and publications. Keep this certificate with your records. If too much is withheld, you will generally be due a refund. If too much is withheld, you will generally be due a refund. Web file an extension for massachusetts personal income or fiduciary tax. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

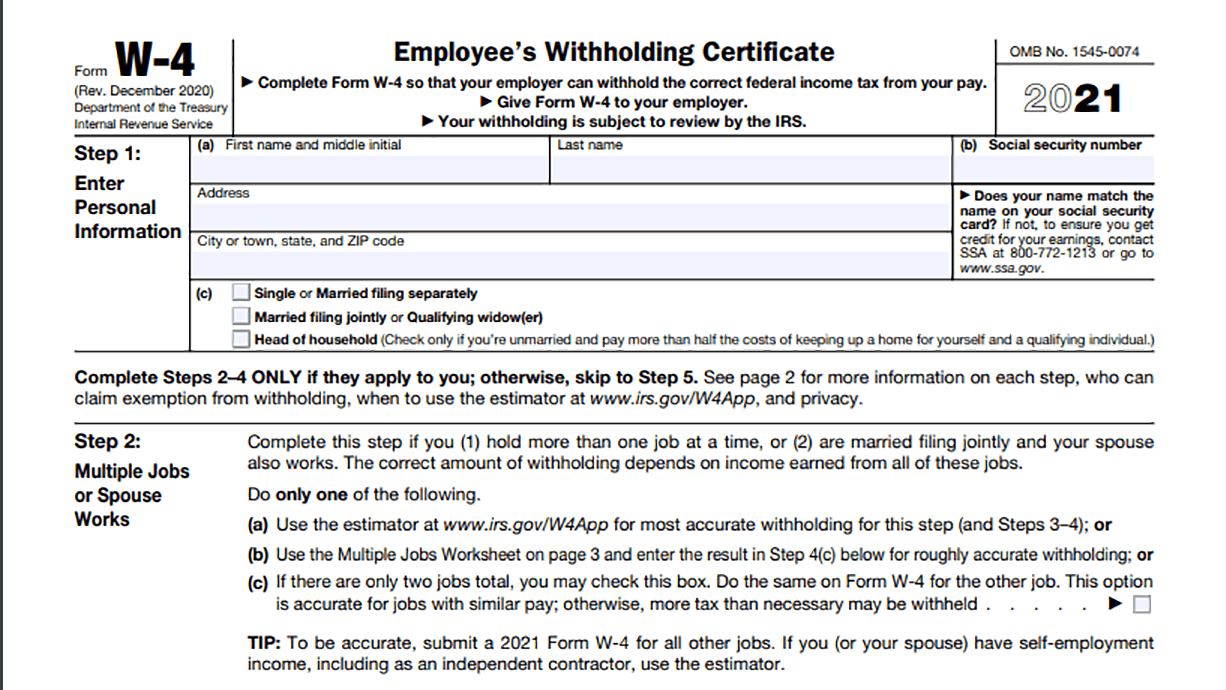

Form W4 Complete Guide How to Fill (with Examples)

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund. The number of exemptions claimed; Calculate withholding either by using the withholding tax tables or by using the percentage method. Otherwise, massachusetts income taxes will be withheld.

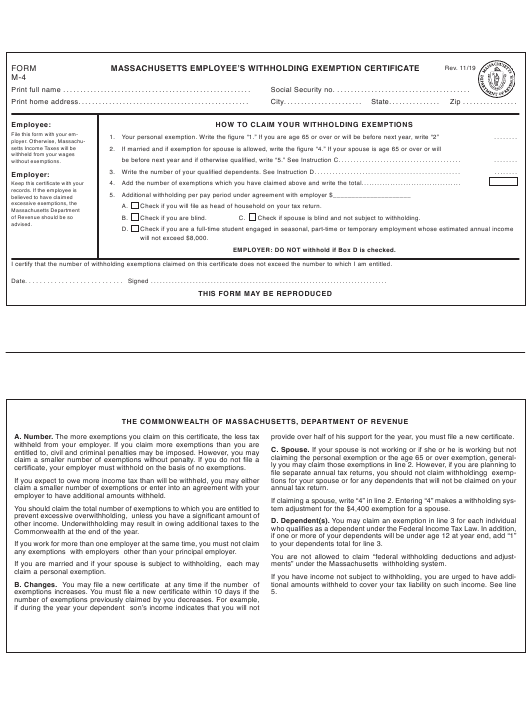

Massachusetts Employee Withholding Form 2022 W4 Form

Web file an extension for massachusetts personal income or fiduciary tax. Web the employee's taxable wages; Keep this certificate with your records. Calculate withholding either by using the withholding tax tables or by using the percentage method. If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised.

Form W4 2021 2022 W4 Form

The number of exemptions claimed; Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Mailing addresses for massachusetts tax forms. Keep this certificate with your records. Amend a massachusetts individual or business tax return.

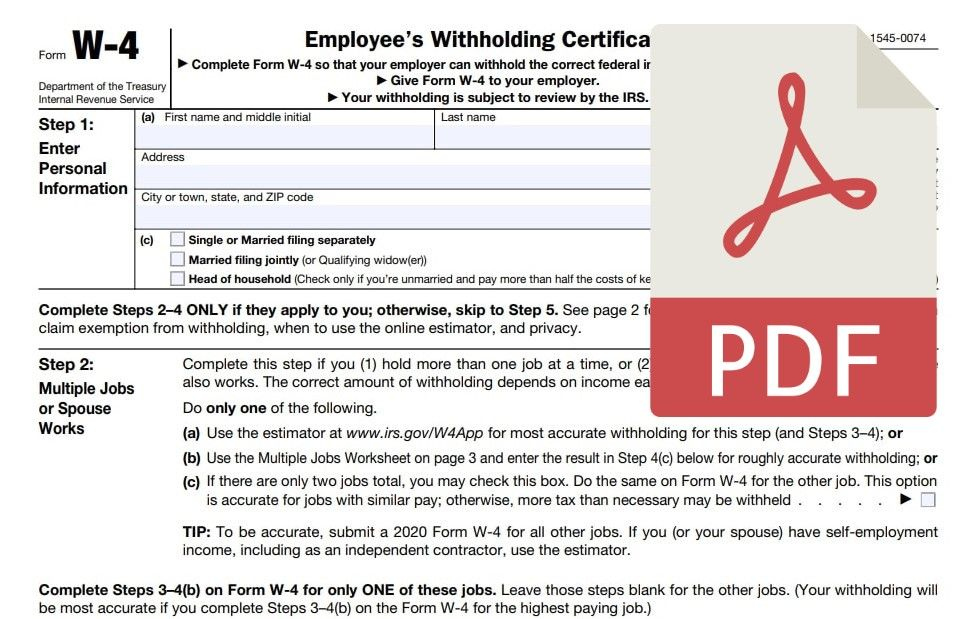

W4 Form 2021 PDF Fillable 2022 W4 Form

Reconciliation of massachusetts income taxes withheld for employers. Keep this certificate with your records. If too much is withheld, you will generally be due a refund. Mailing addresses for massachusetts tax forms. If the em ployee is believed to have claimed excessive exemp tions, the.

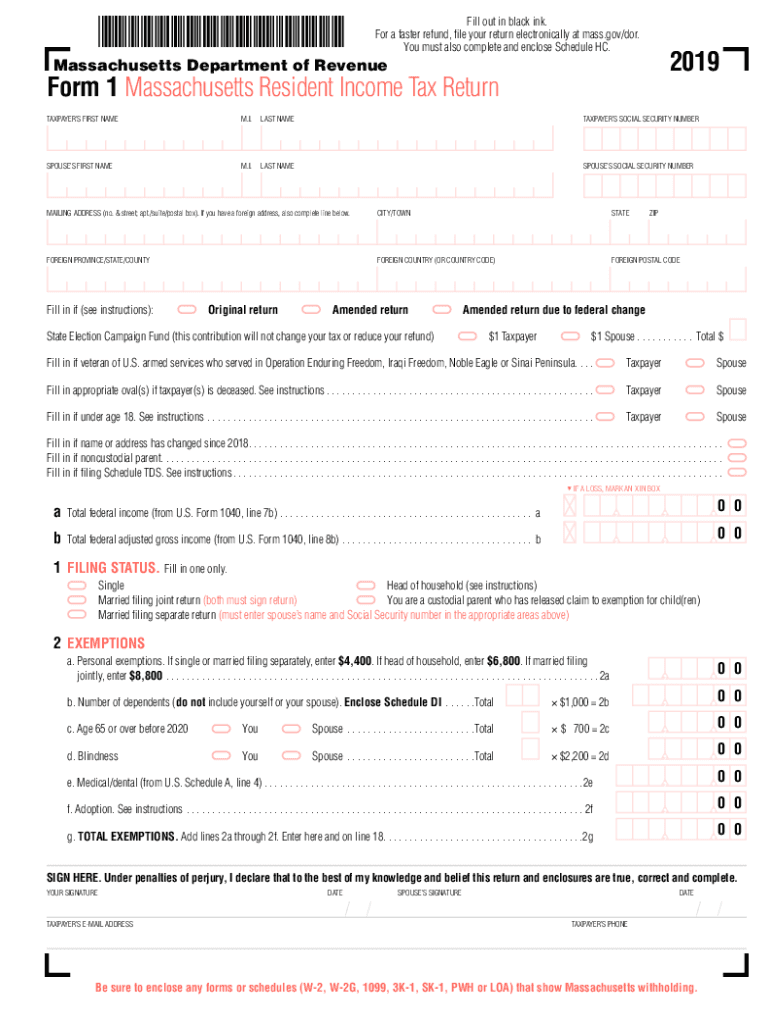

MA DoR 1 2019 Fill out Tax Template Online US Legal Forms

If the em ployee is believed to have claimed excessive exemp tions, the. Your withholding is subject to review by the irs. If too much is withheld, you will generally be due a refund. Calculate withholding either by using the withholding tax tables or by using the percentage method. Keep this certificate with your records.

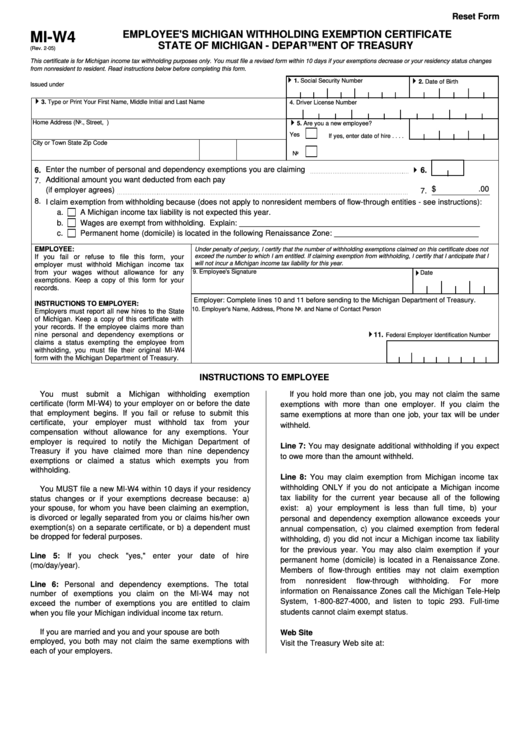

Fillable Form MiW4 Employee'S Michigan Withholding Exemption

Irs forms, instructions and publications. The number of exemptions claimed; If too much is withheld, you will generally be due a refund. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Mailing addresses for massachusetts tax forms.

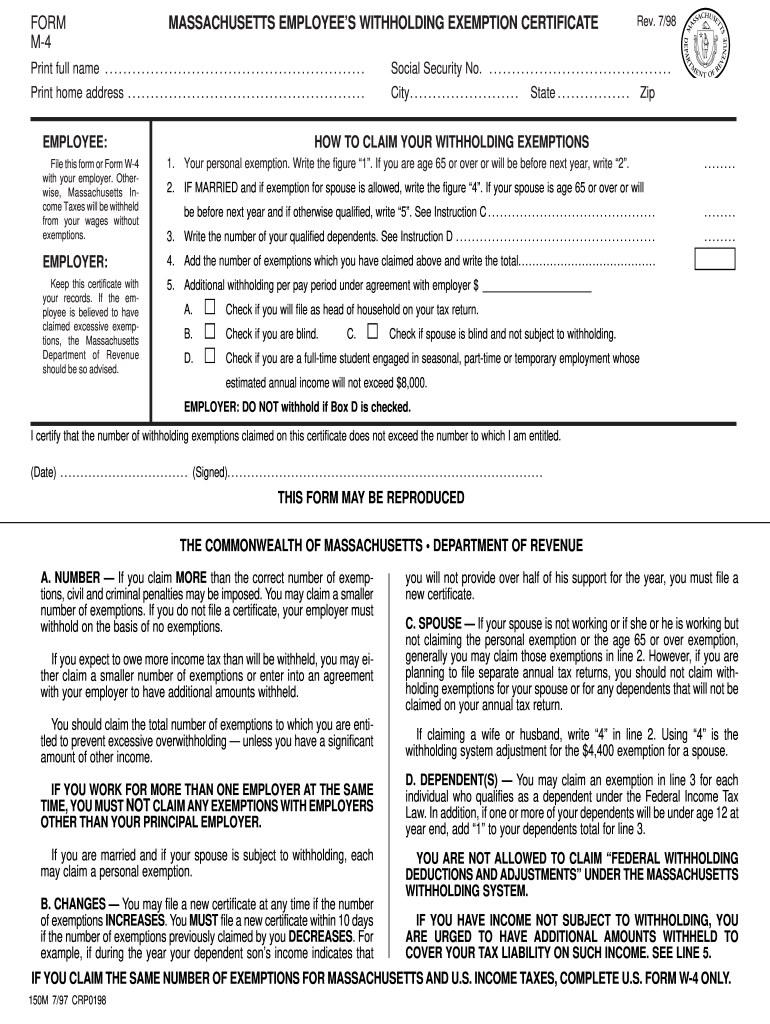

M 4 Form Fill Out and Sign Printable PDF Template signNow

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Reconciliation of massachusetts income taxes withheld for employers. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Web the employee's taxable wages; Keep this certificate with your records.

Did the W4 Form Just Get More Complicated? GoCo.io

If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised. If too much is withheld, you will generally be due a refund. Keep this certificate with your records. Keep this certificate with your records. If the em ployee is believed to have claimed excessive exemp tions, the.

CPA Strategic MA W4 Service Dept Cost Allocation Example 2 YouTube

File an appeal or abatement. Irs forms, instructions and publications. If too much is withheld, you will generally be due a refund. Mailing addresses for massachusetts tax forms. Calculate withholding either by using the withholding tax tables or by using the percentage method.

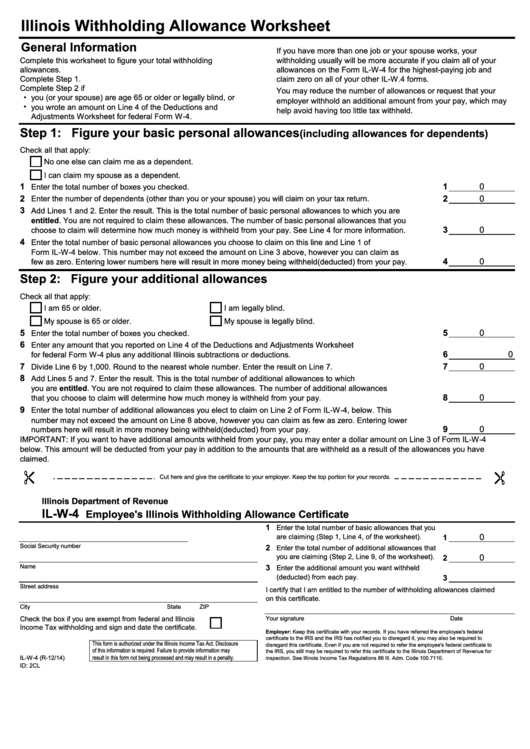

Illinois W 4 Form Printable 2022 W4 Form

Calculate withholding either by using the withholding tax tables or by using the percentage method. Mailing addresses for massachusetts tax forms. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. The number of exemptions claimed; Irs forms, instructions and publications.

If Too Much Is Withheld, You Will Generally Be Due A Refund.

Mailing addresses for massachusetts tax forms. Your withholding is subject to review by the irs. File an appeal or abatement. The number of exemptions claimed;

Web Here You Will Find An Alphabetical Listing Of Withholding Tax Forms Administered By The Massachusetts Department Of Revenue (Dor).

Reconciliation of massachusetts income taxes withheld for employers. Keep this certificate with your records. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Web File An Extension For Massachusetts Personal Income Or Fiduciary Tax.

If the em ployee is believed to have claimed excessive exemp tions, the. Irs forms, instructions and publications. Calculate withholding either by using the withholding tax tables or by using the percentage method. Web the employee's taxable wages;

Keep This Certificate With Your Records.

Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised. Amend a massachusetts individual or business tax return. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.